Garrison Lect-1. 4 Hayek and Friedman

advertisement

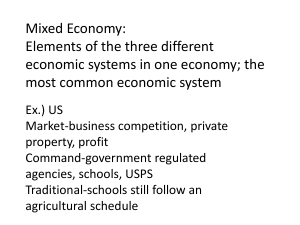

Hayek and Friedman: Head to Head How Methods Shape Substance Adapted from “Hayek and Friedman” Edward Elgar Companion to Hayekian Economics Edited by R. Garrison and N. Barry Published by Edward Elgar (forthcoming) July 26, 2013 Hayek and Friedman: Head to Head How Methods Shape Substance The Level of Aggregation Keynes, Friedman, and Hayek on Aggregation: M = quantity of money V = velocity of money P = price level Q = real GDP Capital-based is Milton Friedman’s Theorizing at amacroeconomics high monetarism level of was distinguished byhigher itsMaynard propitious based on a still aggregation, John level of Keynes disaggregation, brings aggregation. argued that market Thewhich equation economies of into view bothperversely—especially the problem of interexchange perform MV=PQ made use of the an temporal resource and the all-inclusive market mechanisms output allocation variable that are(Q), potential for abring market putting into supposed toeclipse saving thesolution. issue andof the F. A. Hayek showed that allocation investment ofinto resources balancebetween withaone coordination of savingand andinvestment current consumption another. investment decisions couldand be for Seeing the future. unemployment achieved by resource Seeingidleness nomarket-governed problems as theemerging norm, movements in interest rates. He also from thecalled Keynes market foritself, countercyclical Friedman recognized that this aspect the focused fiscal andonmonetary the relationship policiesof between and market economy is especially the government-controlled ultimately for a “comprehensive money vulnerable the manipulation of supply andto socialization the of overall investment.” price level. interest rates by the central bank. Hayek and Friedman: Head to Head How Methods Shape Substance Contrasting Methods Keynes, Friedman, and Hayek on Method John Maynard Keynes “Keynes was the type of theorist who developed his theory after he had developed a sense of relative magnitudes and of the size and frequency of changes in these magnitudes.” “He concentrated on those magnitudes that changed most, often assuming that others remained fixed for the relevant period.” Allan Meltzer, Keynes’s Monetary Theory: A Different Interpretation (1988) Keynes, Friedman, and Hayek on Method Milton Friedman “I believe Keynes’s theory "We're all that Keynesians now ….” is the right kind of theory in its simplicity, its concentration on a few key “We all use the language and apparatus….” magnitudes, andKeynesian its potential fruitfulness.” Milton Friedman, “Keynes’s Political Legacy,” in John Burton, ed., Keynes’s General Theory:inFifty On (1986 ) Milton Friedman as quoted TimeYears Magazine (1968) Keynes, Friedman, and Hayek on Method Friedrich Hayek For “There The Hayek, rolemay of the then, welleconomist, exist the cause-and-effect betterHayek ‘scientific’ points evidence relationship out [in between [i.e.,Pure his empirically Theory central-bank demonstrated of Capital, policy1941], during regularities isthe precisely boom among and to the ‘key’subsequent identify macroeconomic the features economic ofmagnitudes] the downturn market process forhave a false athat firstorder theory, are “hidden claim which on from will ourthe be attention, accepted untrained despite because eye.” theitmore is more salient ‘scientific,’ co-movements than for a valid in macroeconomic explanation, which is magnitudes rejected because that characterize there is no significant the post-crisis quantitative spiraling evidenceof forthe it.”economy into deep depression. Paraphrased Friedrich Hayek, from“The R. Garrison, Pretence“Hayek of Knowledge,” and Friedman: Nobel Head Lecture, to Head,” 1974 in The Elgar Companion to Hayekian Economics (forthcoming) Hayek and Friedman: Head to Head How Methods Shape Substance A Difference in Focus Keynes, Friedman, and Hayek on Focus John Maynard Keynes Keynes attributes the downturn to psychological factors affecting the investment community (rather than to movements in interest rates). “I suggest that a more typical, and often predominant, explanation of the crisis is … a sudden collapse in the marginal efficiency of capital” (G.T., 1936, p. 315) Keynes main focus, however, is on the dynamics of the subsequent downward spiral---and on policies aimed at reversing the spiral’s direction. Keynes, Friedman, and Hayek on Focus Milton Friedman Friedman is dismissive of the whole issue of the cause of the initial downturn in 1929, referring to it as an “ordinary,” “run-of-the mill,” “routine,” “gardenvariety” recession. His focus is on policy blunders that occurred on the The correlation between movements in the money heels ofand themovements downturn and on the correlation supply in total output leaves no between decrease the money supply and the doubt as the to the central in issue. decrease in real GDP. Keynes, Friedman, and Hayek on Focus Friedrich Hayek Friedrich Hayek focuses on the policy-infected aspects of the boom and their implications of the boom’s sustainability. The post-bust reallocation of labor and capital takes time, butwe thejustifiably particularsay dimensions e.g., QUERY: Can that “The of, bigger Great Depression (itsbust”? length and depth) are to the boom; the bigger the be explained largely in terms of the policy perversities that hampered the recovery. Hayek and Friedman: Head to Head How Methods Shape Substance: A Summary For Hayek, the ABCT is fundamentally a theory of the unsustainable boom. Accounting for the actual depth and length of the depression that ensues requires an economic and historical account of each particular episode. For Friedman, the analysis of a business cycle consists almost wholly of an empirical accounting of the depression’s depth and length. THE CASE OF THE CABBAGE-EATING MISSISSIPPI MONSTER Austrian and Chicago Methodology in Action Suppose that in late October of 1929, a thousandpound monster descended on Mississippi soil. It spent the next three-and-a-half years eating all the cabbages (and quite a few rabbits) between Tupelo and Pascagoula. By early March of 1933, the monster weighed four-thousand pounds. Two investigators are sent to Mississippi to get a handle on the situation. One is from Vienna, the other is from Chicago. THE CASE OF THE CABBAGE-EATING MISSISSIPPI MONSTER Austrian and Chicago Methodology in Action The Viennese investigator asks, “Where in the world did this hideous thing come from?” It turns out, on further investigation, that the monster was the unintended consequence of some ill-conceived government-sponsored bionics project. THE CASE OF THE CABBAGE-EATING MISSISSIPPI MONSTER Austrian and Chicago Methodology in Action The Chicagoan shows up, shoves the Austrian aside, and says, “Never mind how this thing got here, the REAL question is: How did it grow from 1000 pounds to 4000 thousand pounds? How did an ordinary, run-of-the-mill, garden-variety monster quadruple its weight in 40 months? The Chicagoan’s answer, of course, is: it was all those cabbages. (He couldn’t get good data on the rabbits.) The correlation between cabbage consumption and weight gain of the Mississippi monster leaves no doubt as to the central issue. THE CASE OF THE CABBAGE-EATING MISSISSIPPI MONSTER Austrian and Chicago Methodology in Action QUERY: Do we suspect that data availability is what led the Chicagoan to his conclusion? And that the lack of hard data pertaining to the monster’s origins caused him to be dismissive of questions about where the thing came from? These and related suspicions are what underlie the message in Hayek’s Nobel address on “The Pretense of Knowledge.” . Friedman’s Monetarism: MV=PQ with a lag of 18-30 months. With a nearly constant velocity of money and Output (Q) growing slowly, the price level (P) moves with the money supply (M). Friedman’s Monetarism: MV=PQ with a lag of 18-30 months. “Inflation is always and everywhere a monetary phenomenon.” Friedman’s Monetarism: MV=PQ with a lag of 18-30 months. Friedman’s Monetary Rule: Increase the money supply at a slow and steady rate to achieve long-run price-level constancy. Friedman’s Monetarism: MV=PQ But what happens within the Q aggregate as a result of the monetary injection? RATE OF INTEREST with a lag of 18-30 months. S +ΔM D SAVIING (S) INVESTMENT (D) Friedman’s Monetarism: MV=PQ But what happens within the Q aggregate as a result of the monetary injection? with a lag of 18-30 months. Friedman declares the 1920s as the Golden Years of the Federal Reserve. He ignores interest rates during the 1920s because they didn’t change much. That is, they didn’t pass the Keynes criterion. Friedman’s Monetarism: MV=PQ But what happens within the Q aggregate as a result of the monetary injection? with a lag of 18-30 months. But what if they should have changed---but weren’t allowed to? Friedman’s Monetarism: MV=PQ But what happens within the Q aggregate as a result of the monetary injection? with a lag of 18-30 months. During But thethe Federal 1920sReserve, breakthroughs guided by in technology the “real-bills increase doctrine”the metdemand each increase for loanable in demand funds for andcredit put upward with an pressure increase in onsupply---thus interest rates.keeping the interest rate from rising. Friedman’s Monetarism: MV=PQ But what happens within the Q aggregate as a result of the monetary injection? with a lag of 18-30 months. Seeing QUERY:no Which change view, in interest Friedman’s rates, rates or when Hayek’s, Friedman theyis should dismissed more risen have firmlyinterest (because anchored rates ofinthe as theatechnological empirical potential (historical) independent advances), variable Hayek was circumstances in his ableeconometric oftothe identify 1920s? some equations. critical “market forces hidden from the untrained eye.” Does Keynes recognize the significance of the loanable funds market in the For him,ofsaving is dependent context business cycles? only on income, and investment expenditures are No. Hepredominantly denies that saving depends on based on psychological the interest rate on and“animal he (all spirits.” but) denies considerations, that investment depends on the interest rate. He jettisons the loanable-funds Does theory.Friedman recognize the significance of the loanable funds market in the For him,ofthe focus iscycles? on total output (Q, context business as in MV=PQ), which includes the No. Heof assumes this marketgoods is working output both consumption and well and so goods. he ignores it in dealing with investment the key issue of the relationship between the money supply and the price level. S = -a + (1-b)Y. I = I0 MV = PQ THE GREAT RECESSION Consequences of the Housing Boom A Critical Comparison: The Dot-Com Boom and Bust (1990s) cushioned with underlying real growth The Housing Boom and Bust (2000s) compounded by mortgage market distortions. In a typical cyclical episode, the boom begins as a genuine boom that reflects technological breakthroughs. RATE OF INTEREST Boom and Bust: The Dot-Com Episode S +ΔM D SAVING (S) INVESTMENT (D) increased expansion demand fordrives creditsaving puts upward The monetary back topressure its initial on interest rates. for a still-greater level of borrowing. level while allowing An Theartificial Fed counters boom rides the upward piggyback pressure on a genuine on interest boom. rates by “accommodating” the increase in demand for funds with an increase in supply. This boom began with increasingly aggressive housing policy that increased the supply of mortgage loans. RATE OF INTEREST Boom and Bust: The Housing Episode S +Subsidy S+Subsidy+ΔM D SAVING (S) INVESTMENT (D) double shift in theofsupply loanable funds The increased supply creditof put downward compounded both the downward pressure on interest pressure on interest rates. ratesFed andfurther the excessive borrowing. The increased the supply of loanable funds to avoid reduced in other markets The artificial boom rodelending piggyback on the distortion of (and to stimulate recovery from the dot-com bust). mortgage markets. “too low for too long” Friedman’s View of a Monetary Contraction MV=PQ A sharp monetary contraction puts downward pressure on P and Q. If P is sticky downward, Q will fall dramatically. Evidence showsbetween that between October The correlation movements in of the1929 money and March of 1933 decreasing M was leaves the essential supply and movements in total output no (primary, cause of the decrease in Q. doubt as todominant) the central issue. Friedman’s Monetarism: MV=PQ with a lag of 18-30 months. The Irony of Monetarism: Greenspan: The monetary rule that allows the economy to “We don’t what money is,presupposes anymore.” a perform atknow its laissez-faire best critical of intervention (Regulation Q)switched that …whichpiece explains why the Federal Reserve makes the money supply operationally definable. from money-supply targeting to interest-rate targeting in the early 1980’s Friedman’s Monetarism: MV=PQ with a lag of 18-30 months. Also, consider: The velocity of money The bank operating ratios (excess reserves) The geographical distribution of US dollars Friedman’s “Plucking Model” of Cyclical Movements Vienna vs. Chicago on Monetary Issues Why was Milton Friedman so unreceptive to the Austrians’ capital-based theory? Friedman’s Monetarism: MV=PQ with a lag of 18-30 months. Inflation Note: Q = is always QC + QIand everywhere a monetary phenomenon. but the effect of interest-rate changes on relative movements of consumption and investment and But what goes on in the short-run---during on the pattern of investment is no part of the that critical 18-30 months? theory. Clark-Knight (Black Box) Capital Theory John Bates Clark 1847 — 1938 Frank H. Knight 1885 — 1972 Hayek and Friedman: Head to Head How Methods Shape Substance Does the interest rate play any role at all within the output aggregate? Milton Friedman (1969 [1961]), “The Lag Effect in Monetary Policy,” in Milton Friedman, The Optimum Quantity of Money and Other Essays, Chicago: Aldine. Friedman allows for a possible effect on interest rates: Holders of cash will…bid up the price of assets. If the extra demand is initially directed at a particular class of assets, say, government securities, or commercial paper, or the like, the result will be to pull the prices of such assets out of line with other assets and thus widen the area into which the extra cash spills. The increased demand will spread sooner or later affecting equities, houses, durable producer goods, durable consumer goods, and so on, though not necessarily in that order…. These effects can be described as operating on “interest rates” if a more cosmopolitan [i.e., Austrian] interpretation of “interest rates” is adopted than the usual one which refers to a small range of marketable securities. “The key feature of MAINTENANCE OF SOURCES this process [during SOURCES which interest rates are low] is that it SERVICES DO NOT OPEN tends to raise the prices of sources of both producer and consumer services relative to the prices of the services themselves…. It therefore encourages the production of such sources and, at the same time, the direct acquisition of the services rather than of the sources. But these reactions in their turn tend to raise the prices of services relative to the prices of sources, that is, to undo the initial effects on interest rates. MAINTENANCE OF SOURCES SOURCES SERVICES DO NOT OPEN The final result may be a rise in expenditures in all directions without any change in interest rates at all; interest rates and asset prices may simply be the conduit through which the effect of the monetary change is transmitted to expenditures without being altered at all….” Hayek and Friedman: Head to Head How Methods Shape Substance But how, then, does Friedman account for the lag between rising M and rising P? Friedman accounts for the 18-30 month lag: CONSUMPTION “It may be … that monetary expansion induces someone within two or three months to contemplate building a factory; within four or five, to draw up plans; within six or seven, to get constructions started. The actual construction may take another six months and much of the effect on the income stream may come still later, insofar as initial goods used in construction are withdrawn from inventories and only subsequently lead to increased expenditure by suppliers.” INVESTMENT GREG MANKIW’S BLOG Random Observations for Students of Economics September 16, 2006: Curious question from Mankiw: “How can you identify my car?” Gregory Mankiw Former Chairman Council of Economic Advisors George W. Bush Administration mvpy writes: You know, I hate to spoil things, but I must say, I think Milton Friedman has a better plate. This is from an article I came across: "Years ago, trying to find the Friedman’s apartment in San Francisco, I knew I was in the right location when I spotted a car with a license plate that read “MV = PT." A. Delaique writes: Milton Friedman's license plate was MV = PQ, not MV = PT. Picture here : http://gribeco.free.fr/article.php3?id_article=12 mvpy writes: You know, I hate to spoil things, but I must say, I think Milton Friedman has a better plate. This is from an article I came across: "Years ago, trying to find the Friedman’s apartment in San Francisco, I knew I was in the right location when I spotted a car with a license plate that read “MV = PT." A. Delaique writes: Milton Friedman's license plate was MV = PQ, not MV = PT. Picture here : http://gribeco.free.fr/article.php3?id_article=12 Anonymous writes: That's pretty ridiculous.. Canée writes: I love economists. Hayek and Friedman: Head to Head How Methods Shape Substance Adapted from “Hayek and Friedman” Edward Elgar Companion to Hayekian Economics Edited by R. Garrison and N. Barry Published by Edward Elgar (forthcoming) July 26, 2013