MID-TES/UTS (40%) - Departemen Ekonomi FEM IPB

advertisement

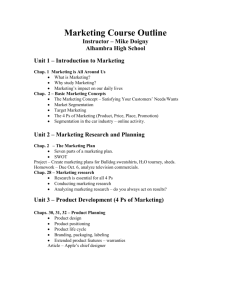

COMPETENCY AND INDONESIAN QUALIFICATION FRAMEWORK BASED SYLLABUS Course Title Coordinator Course Code Credit Semester Prerequisite Course Short Description Learning Outcome Session 1 Expected Learning Outcome (Basic Competency) Students can explain the importance of international finance, the development and indicators of international finance : International Financial Economics : Dr. Dedi Budiman Hakim, M.Ec : EKO 326 : 3 (3-0) : Even/6 : EKO 203, EKO 226 : This course is designed to provide knowledge on the importance of international finance and the development of international finance at the present. : After completing this course, students are expected to be able to explain the importance and development of international finance Teaching Material - Course Contract - The importance of international finance - International business companies - Interdependency of international finance - Micro and macro aspects of international finance - The role of financial managers, the impacts of exchange rate fluctuation - Indicators of international finance Assessment Indicator Students understand the factors behind the excellence of international finance, explain the role of financial managers, financial internationalization, and identify the development at the present Time 3 x 50 minutes Learning Method Lecture and Discussion, Assignment Assessment Criteria Assessmen t Weight Essay written test Mid-Test (UTS) : 50% ; Reference M : Chap 1 Final Test (UAS) : 1 Session Expected Learning Outcome (Basic Competency) 2 Students can explain the definition, participants, mechanism, and technology of foreign exchange market 3 Students can explain balance of payment (BOP) and effective exchange rate (definition, structure, and its determining Teaching Material - The development of international finance post-war - The definition and characteristics of foreign exchange market - Market’s participants, size, composition, and geographic distribution - Currency composition - Transaction components of foreign exchange - Spot transaction of foreign exchange - The change in exchange rate and currency conversion - Forward exchange rate - Outright transaction and swap forward - Forward distribution - Premium and discount - Explain the definition and structure of BOP - Components of current account - Financial account Assessment Indicator Time Learning Method Assessment Criteria Assessmen t Weight Reference Students can explain foreign exchange market and identify the participants and currency, explain the mechanism and technology of foreign exchange trade, know the concept of exchange rate, and describe maintained foreign exchange position 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 2 Students can understand the structure of BOP, the relationship between foreign exchange 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 3 2 Session Expected Learning Outcome (Basic Competency) factors) 4 Students can explain factors that determine foreign exchange supply and demand and issues related to foreign exchange market 5 Students can explain international monetary system (IMS) Teaching Material Assessment Indicator - BOP and foreign exchange market - factors that influence current account - effective exchange rate, real exchange rate, real effective exchange rate - Explain several types of fact - exchange rate equilibrium - the determinants of foreign exchange supply and demand - arbitrage in foreign exchange market - arbitrage multipoint - foreign exchange market speculation - the determinants of arbitrage bid-offer spread and speculation with bidoffer spread - forward determinant - forward spread - Explain the definition and components of IMS - Monetary system market and effective exchange rate concept. Time Learning Method Assessment Criteria Assessmen t Weight Reference Students understand the factors behind the change of exchange rate, the impacts of arbitrage and speculation, explain bid-offer spread and forward spread, explain the influence of bid-offer spread and forward spread on exchange rate. 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 4 Students understand the classification of international monetary system, the outlines of 3 x 50 minutes Lecture and Discussion M : Chap 5 3 Session Expected Learning Outcome (Basic Competency) 6 Students can explain the difference between forward, futures, and swap markets 7 Students can explain the basic concept of currency preference contract Teaching Material Assessment Indicator classification - Fixed and flexible exchange rates - The development of international finance system - Financial crisis - One-currency world? - Explain the definition of futures contract - The comparison between forward, futures, and swap markets - Swap exchange rate - Swap interest rate - Explain the definition of currency preference - Europe or United States call and put preferences - Currency preference specification - Price preference determinants - Sensitivity measurement - Exotic preferences exchange rate arrangement, the pro and contra of fixed and flexible exchange rates. Time Learning Method Assessment Criteria Assessmen t Weight Reference Students understand the futures contract and how to avoid it, compare forward and futures markets, explain swap design 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 6 Students understand the basic concept and contract of currency preference, premium preference determinants, and exotic currency preference 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 7 3 x 50 minutes Lecture and Discussion, M : Chap 8 MID-TES/UTS (40%) 8 Students can explain the money market of Europe - Explain the currency of Europe and the Students can explain the currency market of 4 Session Expected Learning Outcome (Basic Competency) - 9 Students can explain the Law of One Price - 10 Students can explain Covered Interest Arbitrage (CIA) - - Teaching Material Assessment Indicator currency market of Europe The currency central of Europe The evolution and growth of banking in Europe The causes of international banking International bank activities Explain the Law of One Price (LOP) The change from LOP to Purchasing Power Parity (PPP) The exchange rate of PPP The validity of PPP The actual and exchange rate of PPP Nominal and real exchange rate PPP as trading rules The monetary model of exchange rate Explain the definition of CIP (Covered Interest Parity) The reasons to choose CIP Europe, the currency central bank of Europe, the causes for currency growth in Europe, and explain international banking Students can explain the Law of One Price, the derivation of PPP from LOP, assess the empirical validity of PPP, the trading rules of PPP, and monetary model Time Learning Method Assessment Criteria Assessmen t Weight Reference Assignment 3 x 50 minutes Students understand 3 x 50 the reasons for CIP, minutes explain the condition of CIP, the mechanism of covered arbitrage, and M : Chap 9 Lecture and Discussion, Assignment M : Chap 10 5 Session Expected Learning Outcome (Basic Competency) 11 Students can explain the efficiency concept of foreign exchange market 12 Students can explain the importance of exchange rate forecasting and are able to evaluate and measure the accuracy of forecasting Teaching Material Assessment Indicator - CIP equilibrium condition - Investment profit and CIA - Arbitrage closing with bid-offer spread - CIP deviation and margin closing - Covered margin determinants - Explain market concept and efficiency - forward market efficiency - uncovered interest parity (UIP) - foreign and domestic investment returns - UIP condition and uncovered interest arbitrage (UIA) - UIA with bid-offer spread - real interest parity - Explain the importance of exchange rate forecasting - Econometric forecasting model - time series model explain the deviation of CIP Time Learning Method Assessment Criteria Assessmen t Weight Reference Students understand market efficiency concept, UIP condition, UIP empirical validation, explain real interest concept and the derivation of real interest parity. 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 11 Students understand the importance of exchange rate forecasting, forecasting technique, empirical evidence of forecasting model, explain the way 3 x 50 minutes Lecture and Discussion, Assignment M : Chap 12 6 Session Expected Learning Outcome (Basic Competency) - 13 Students can explain the concepts of risks and exposure and factors that determine them - 14 Students can explain the risk management of foreign exchange - - Teaching Material Assessment Indicator law of forecasting forecasting composite forecasting evaluation measure the accuracy of forecasting technical analysis market efficiency and trading rules empirical evidence Explain the definition of risks foreign exchange risks measure risks risk value pro and contra exposure of foreign exchange exposure line the relationship between foreign exchange risks and exposure factors that influence foreign exchange risks and exposure Explain the reasons to learn foreign exchange risks forward and futures hedging money market to evaluate forecasting, analysis technique using general buying and selling signal, rule selection and the average movement of work rules Students can explain risks and exposure and differentiate between transaction, economy and exposure Students understand the reasons to learn foreign exchange risks, how to manage transaction, economy and translation Time 3 x 50 minutes 3 x 50 minutes Learning Method Assessment Criteria Assessmen t Weight Reference Lecture and Discussion, Assignment M : Chap 13 Lecture and Discussion, Assignment M : Chap 14 7 Session Expected Learning Outcome (Basic Competency) - - Teaching Material Assessment Indicator protection (revenue and payment) hedging selection long-run management of exposure transaction economic exposure translation exposure exposure Time Learning Method Assessment Criteria Assessmen t Weight Reference FINAL TEST/UAS (40%) ASSIGNMENT (20%) Reference 1. Moosa, Imad. 2004. International Finance: An Analytical Approach. McGraw-Hill. Australia. (M) 2. Handout and journal provided by lecturers Lecturer Team: Dr. Dedi Budiman Hakim (Coordinator) Prof. Dr. Noer Azam Achsani ASSESSMENT FORMAT : Exam and Assignment Mid-Test (UTS) : 40 % Final Test (UAS) : 40 % Assignment (Paper) : 20 % 8