Cost Control Measures for Food Service Operations

advertisement

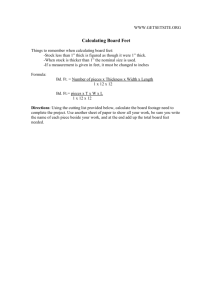

Cost Control Measures for Food Service Operations Chapter 9 Objectives • Define the Siamese twins of management • Summarize the importance of control systems • Clarify the use of financial statements • Define fixed, variable, conversion, and common costs Objectives (cont’d.) • Outline the purpose of production reports • Relate the concept of food cost and the Forty Thieves • Summarize inventory management • Explain how to calculate food and labor costs Objectives (cont’d.) • Describe how to make payroll calculations • Perform break-even analysis and illustrate the method used for graphing Using Other People’s Money • Food service operators can improve profitability with efficient purchasing, stock management, and cost controls – Purchase stock using free credit from suppliers – Maintain minimal yet sufficient stock – Quick turns allow goods to be sold before the bills are due The Importance of Control Systems • Controls, or systems of measure – Gauge progress of business towards its goals • Planning and controls are the “Siamese Twins of Management” The Importance of Control Systems (cont’d.) • Control process consists of four steps: – Establish standards and procedures – Train employees to follow them – Monitor performance – Take appropriate action to correct deviations The Importance of Quality Standards • Quality can be measured using predetermined standards • Measurement should be made each time a meal is served Evaluating Performance Using Financial Statements • Four primary financial statements used to manage and control finances – Income statements – Balance sheets – Cash flow statements – Operating budgets Managing by Income Statements • Income statement (profit and loss statement) – Gives detailed listing of revenue and expenses over the accounting period • Basic formula for the income statement – Revenue – Expenses + Gains - Losses = Income Managing by Income Statements (cont’d.) • Three sections of the P&L statement – Gross profit section • Sales, cost of sales, and gross profit – Operating expense • Operating expenses and operating income – Nonoperating expense • Interest and income taxes Managing by Balance Sheets • Balance sheet shows a company’s assets and liabilities • Shareholder equity is calculated as: – Assets – Liabilities = Net worth • Balance sheets are prepared for shareholders or loan officers, to show the financial health of the business Managing by Cash Flow • Cash flow is the comparison of cash on hand to bills due in the near future • Accounts payable – Money due to the business • Accounts receivable – Money the business owes others Managing by Operating Budgets • Operating budgets forecast expenses a business must incur to achieve targeted sales revenues • Operating budgets are income statements prepared for a future date • Sales are a company’s revenue Managing by Operating Budgets (cont’d.) • Prime costs are food and labor expenses – Most restaurants like to keep their prime costs between 60-69 percent of sales • Fixed costs (overhead) – Remain the same no matter how many customers are served Managing by Operating Budgets (cont’d.) • Variable (controllable) costs – Change depending on the number of customers served • Conversion costs – Direct labor plus business overhead • Common costs – Shared costs that are not easily assigned Evaluating Performance by Other Management Tools • The food service industry uses management tools that are unique to the industry – In addition to traditional management tools Make-or-Buy Decisions • Operator must decide whether to make or buy • Ready-to-eat foods have a higher food cost but a lower labor cost • If costs are comparable, operator must decide which is better for his operation – Factors: space, uniqueness Production Reports • Serve three primary purposes – Control, communication, and calculation • Used to record activity surrounding all prepared menu items • “The Forty Thieves of Food Cost” lists ways in which money can be lost Menu Engineering • Menu analysis is recording sales history of all items sold – Evaluating item’s contribution to profit – Evaluating customer appeal • Menu engineering – Classifies each item according to popularity index and profitability index Controlling Inventory • Weekly inventory – May be necessary if food cost figures not in line with budgets • Another method of control: – Restricting purchases to a certain percentage of sales Calculating Inventory Turnover • The rate of inventory turnover is a sign of efficiency and effective purchasing • Relevant equations: Calculating Food and Beverage Costs • Food cost percentage – Ratio of food costs to sales • Methods to help lower food costs – Adjust pricing strategies – Provide proper training; minimize waste – Reduce product quality; update inventory values; organize storage room Calculating Food and Beverage Costs (cont’d.) • Methods to help lower food costs (cont’d.) – Control portion sizes; monitor weights – Link chef pay to food cost percentage – Set up purchase order system and budget – Use trade-outs – Look for discounts Calculating Food and Beverage Costs (cont’d.) • Standardized recipe and portion costs – Standardized recipes are critical to achieving consistent profit – There are 12 steps that can help in developing a standardized recipe – Recipe costs should be calculated prior to menu pricing Calculating Labor Costs • Labor costs are all monies paid to employees to run the business • Labor cost percentage is relationship between labor costs and sales Calculating Labor Costs (cont’d.) • Calculating payroll – Hourly wage plus overtime, or salary – Deductions must be withheld • Federal and state income taxes • Social security • Voluntary deductions Break-Even Analysis • Used to evaluate how much sales revenue is needed to cover the costs of the establishment – Often employed when considering a capital investment or business expansion Calculating the Break-Even Point • Break-even point – Volume of sales needed to cover the total costs 9.13 Break-even graph Summary • Food service operators can improve profitability with efficient purchasing, stock management, and cost controls • Control systems are used to evaluate progress toward profitability goals • Four primary financial statements are used to manage and control finances Summary (cont’d.) • Important tools to achieving profitability – Production reports – Menu engineering – Controlling inventory – Calculating inventory turnover – Calculating food, beverage and labor costs – Break-even analysis