Mock Trial Script: Actuarial Negligence Case

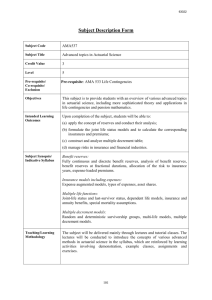

advertisement

[Mock Trial Script Outline, page 1]

Mock Trial Script Outline

CASUALTY ACTUARIAL SOCIETY

Course on Professionalism

Parts.

1. Bailiff

2. Judge

3. Plaintiff's Attorney (DOI)

4. James T. Waffle, CFO, Rehabilitated Ins. Co.

5. Defendant's Attorney (Actuarial Firm)

6. L.G. "Log" Normal, Vice President, Universal Actuaries Unlimited

Note: Items in Judge’s remarks that are italicized and underlined may optionally be deleted

and/or edited for time and clarity.

CALL TO ORDER

Bailiff: [If the judge makes an entrance:] ALL RISE.

Oyez Oyez. This Honorable Court, the District Court of Big City, in the State of Turmoil, is now

in session. All persons having business before this Honorable Court draw nye and be heard.

JUDGE'S INTRODUCTORY INSTRUCTIONS TO JURORS REGARDING THEIR DUTIES

Judge:

1.

Welcome and Explanation of Nature of Case

Good Morning, members of the jury. I am Judge _______________________________.

We are about to select a jury for the trial of a civil case.

This case arises out of circumstances that led to the State Insurance Department's takeover

of the Rehabilitated Insurance Company in September 2011. The Plaintiff is the liquidator, the

State Insurance Department. The Defendant is Universal Actuaries Unlimited. The Plaintiff

[Mock Trial Script Outline, page 2]

claims that negligence and breach of contract by the Defendant caused the Rehabilitated

Insurance Company's insolvency.

The Defendant denies that it caused this insolvency. Among other things, it claims that

the Insurance Company's own negligence was the primary cause and that such comparative

negligence should bar any recovery from the Defendant. To be clear, the State of Turmoil has a

Modified Comparative Negligence law that, unlike a Simple Comparative Negligence law, bars a

Plaintiff from recovery if the Plaintiff is determined to be 50% or more at fault.

The jury will

be asked to decide whether the Defendant should be held liable and, if so, in what amount.

2.

Duty of Citizens to Serve As Jurors

I recognize that serving as a juror is inconvenient, but jury service is an important duty of

citizenship. Having jurors available to decide the facts in lawsuits is fundamental to our entire

system of justice. The courts cannot function without members of the public offering their time to

serve as jurors.

3.

Introduction Of Parties, Counsel and Potential Witnesses

The parties to this lawsuit are as follows:

The Plaintiff is the Turmoil Insurance Department.

Counsel for the Plaintiff is _______________________________________. Please stand,

counsel.

The Chief Financial Officer for Rehabilitated Insurance Company, James T. Waffle, is

here today on behalf of the plaintiff for trial purposes and is a potential witness. Please stand Mr.

Waffle.

Counsel for the Defendant is ______________________________________. Please

stand.

L.G. Normal is here on behalf of the Defendant Universal Actuaries Unlimited and is a

potential witness. Please stand Mr. Normal.

[Mock Trial Script Outline, page 3]

VOIR DIRE

(1) Do you {{individual member or, when applicable, the rest of the prospective jurors}}

believe that you can impartially and objectively hear the evidence, that is to say, without any

preconceived bias against, or favoritism towards, any participant in the trial?

(2) Do you believe you can follow this court's instruction regarding law and

procedures, and decide this case objectively and fairly based solely on the facts presented

here, the law as described to you here, and your common sense? [If any potential juror

cannot, excuse that juror (for cause, but without saying in front of jurors that it is for cause).]

Bailiff: [Judge if there's no Bailiff:] "Do you swear or affirm that you will faithfully execute the

duties of juror in accordance with the lawful instructions of this Honorable Court?"]

Judge: Thank you for your service. Please remember my remarks earlier about the importance

of jury service to the Court system. Your presence here and your availability to serve as jurors

are greatly appreciated.

PRELIMINARY CHARGE

Judge: Members of the Jury:

Before we begin, I have a few preliminary instructions for you.

1.

Role of Jury, Court and Attorneys

As the jury in this case, you will be the judges of the facts and you will be the only judges

of the facts. You will have to decide what happened. I play no part in judging the facts. That is

[Mock Trial Script Outline, page 4]

your responsibility. My role is to be the judge of the law, that is to say, I make whatever legal

decisions have to be made during the course of the trial, and I will explain to you the legal

principles that must guide you in your decisions on the facts. You are to judge the facts in this

case based upon the evidence presented to you and based only on the evidence. This evidence

will consist of the testimony of witnesses, the exhibits marked into evidence and any material that

we read to you.

As the trier of fact, it will be your job to judge the believability of the witnesses. Size up

the witness. Is the witness telling the truth? Does the witness know what he/she is talking

about? How good is the witness's recollection? Is the witness accurate and correct in what he/she

is saying? You may also consider the demeanor of the witness, that is, how is the witness

behaving and responding to the questions asked. You may believe part of the witness's testimony

and not believe other parts of it.

During the trial, I may be required to rule on the admission or rejection of evidence. You

are to give no consideration to any evidence that I rule to be inadmissible and you are not to

speculate or guess about what that evidence might have been or what it might have meant.

Do not infer from any rulings I make in this case or anything I say what my feelings might

be about the outcome of this case. Even if you knew what my feeling were, you should disregard

them, because it is your decisions on the facts that control, not mine.

At the close of the entire case, I will explain to you the law which applies to this case.

You must accept the law as I explain it to you and apply it to the facts as you find them to be

based on the evidence.

During the course of the trial, you will hear from the attorneys on numerous occasions.

Always bear in mind that the attorneys are not witnesses and what they say is not evidence in the

[Mock Trial Script Outline, page 5]

case, whether they are arguing, objecting or asking questions. The attorneys are here as advocates

and spokespersons for their clients' positions.

2.

Outline of Order of Events

Let me now outline for you the order of events.

We will start with the attorneys' opening statements. Opening statements are not

evidence. The attorneys will explain to you the position of their clients in this litigation. They

will tell you what they think this case is about and what they believe the evidence will show.

Opening statements are designed to highlight for you the disagreements and factual differences

between the parties in order to help you judge the significance of the evidence when it is

presented.

Once the attorneys have made their opening statements, then each party is given an

opportunity to present its evidence. First, the plaintiff presents its evidence. Then the defense will

present its evidence. Each witness will undergo direct examination which means that the attorney

calling the witness will ask that witness questions. After that the other attorney is given an

opportunity to question the witness, which is referred to as cross-examination.

Once all the evidence has been presented, the attorneys will make their closing arguments.

Closing arguments are not evidence. The attorneys will give you their analysis of what the

evidence means and will attempt to highlight the significant evidence that is helpful to their

clients' positions.

Once the closing arguments are completed, I will instruct you on the legal principles to be

followed when deciding this case.

[Mock Trial Script Outline, page 6]

OPENING STATEMENTS BY EACH COUNSEL

Judge: The Plantiff's counsel will make the first opening statement.

Plaintiff's Attorney:

The evidence will show that:

Rehabilitated Insurance Company was a small Property-Casualty company operating in the state

of Turmoil, primarily writing workers' compensation insurance.

In late 2009, Rehabilitated Insurance Company engaged Universal Actuaries Unlimited to

perform actuarial services. Universal Actuaries Unlimited is an independent actuarial consulting

firm.

Through their training and experience, actuaries are professionals who use mathematics

(especially statistics and probabilities) as well as other information about market conditions to

help insurance companies project the aggregate costs of claims over time, the premium charges

that insurance companies should use, and the amounts that insurance companies should reserve to

pay claims.

Actuaries use insurance data regarding the number and amount of claims from the insured

population, compare numbers and trends in the insurance industry and the specific insurance

company's coverage, and tell the individual insurance company whether the company's reserves

appear adequate to cover the legitimate claims that will likely be made.

[Mock Trial Script Outline, page 7]

Insurance companies are required by law to obtain actuarial opinions regarding their reserves and

to file those opinions along with the annual financial statements that they submit to the state

insurance department.

Further, the evidence will show that:

Universal Actuaries was contracted to estimate the reserves that Rehabilitated Insurance

Company would need in connection with the annual financial statement that the company would

file regarding its December 31, 2009 status.

Universal Actuaries also contracted to provide a Statement of Actuarial Opinion regarding the

adequacy of Rehabilitated's reserves. This opinion would be used for filing with the state.

And Universal Actuaries acknowledged in its agreement with Rehabilitated Insurance Company

that its "reserve estimates [would] be a key factor in [Rehabilitated's feasibility study for]

determining whether Rehabilitated [had] the financial resources and the profitable base of

business on which to expand [beyond the State of Turmoil into other states]."

Universal Actuaries provided an actuarial opinion that said the reserves made a reasonable

provision for the unpaid loss and loss adjustment expense obligations of the company.

[Mock Trial Script Outline, page 8]

Neither that opinion nor the actuary representing the actuarial firm informed Rehabilitated

Insurance of the risks of premium growth in the prevailing market.

Neither the opinion nor the actuary informed Rehabilitated Insurance of significant changes in the

law in the State of Turmoil that would directly impact adversely on Rehabilitated's planned

market expansion. Specifically, legislatively mandated increase in workers compensation

benefits and reduction in premiums.

As a result, Universal Actuaries' breach of contract and professional negligence caused monetary

damages to the insurance company and the State, which is responsible through the Department of

Insurance for protecting the public's interest:

The evidence will show that the following monetary DAMAGES were caused by Universal

Actuaries:

1.

Fees the insurance company paid for actuarial services during the period in question:

$25,000.

2.

Fees the Insurance Department paid for a professional review of the services Universal

Actuaries negligently performed: $15,000.

3.

Damages the Department sustained for payment of estimated claims: $4,000,000.

[Mock Trial Script Outline, page 9]

4.

Damages for Rehabilitated's stockholders, representing their loss of equity: $1,000,000.

Judge: Counsel for the Defendant may make an opening statement.

Defendant's Attorney: Members of the Jury, we respectfully disagree. The evidence, when

viewed carefully and in detail, will show that:

Universal Actuaries Unlimited did not breach its arrangement with the insurance company or act

negligently.

The insurance company's Chief Financial Officer, James T. Waffle, was responsible for providing

accurate data to Mr. Normal and Universal Actuaries Unlimited.

Mr. Waffle's transmittal letter stated that he had made a diligent inquiry regarding data before he

sent his data to the actuarial firm.

His transmittal letter specifically stated that, based on his personal knowledge and diligent

inquiry, the data was prepared under his direction and the data was accurate and complete.

The evidence, when viewed carefully, will reveal that Mr. Waffle was not so diligent and that his

supervision was lax.

[Mock Trial Script Outline, page 10]

As it turns out, the data that he provided was not accurate and complete. Under the lax controls of

Mr. Waffle, a clerk stuffed information in a desk drawer, and Waffle not only failed to pass that

data on, but made a convincing affirmation that the data was complete and accurate.

My client diligently worked with what they received and carefully prepared an actuarial opinion

based on that information. They did not breach their arrangement with Rehabilitated Insurance

Company and did not act negligently.

We acknowledge that losses to policy holders, investors, and the pubic are unfortunate. But the

evidence will show that those losses were not caused by my clients.

The evidence will show you that an insurance company employee and the insurance company

CFO caused the problems in this case, NOT Universal Actuaries Unlimited. Therefore, no

liability whatsoever should be imposed upon the actuarial firm.

Judge: ________________________ [Insurance Department's Counsel], please proceed with

your case.

PLAINTIFF INSURANCE DEPARTMENT'S CASE IN CHIEF

Plaintiff's Attorney: The Turmoil Insurance Department calls James T. Waffle.

Plaintiff's Witness: Insurance Co. CFO James T. Waffle's Direct Examination

[Mock Trial Script Outline, page 11]

Bailiff: [Oath.] Do you swear or affirm that the testimony that you will give in this hearing will

be the truth, the whole truth, and nothing but the truth?

Plaintiff's Attorney Direct Examination:

1.

Please state your name, job title, and company name.

I am James T. Waffle, CFO of Rehabilitated Ins. Co.

2.

What, if any, was the relationship between your insurance company and the defendant

actuarial firm that led to this suit?

Rehabilitated Ins. Co. contracted the services of Universal Actuaries Unlimited.

3.

What was the format of that agreement?

It was initially oral and, thereafter, formalized in writing.

4.

Please describe the written agreement.

It was a December 14, 2009 retainer letter from L.G. Normal, the Vice President of UAU.

5.

I show you Exhibit 2. Please tell the jury what that is.

The retainer letter—Mr. Normal's agreement to provide actuarial services that we agreed

to.

6.

According to the retainer letter, what did the actuaries agree to?

UAU agreed to [quote] "estimate the required December 31, 2009 loss reserves to

be utilized by the [Rehabilitated Insurance Company] in its statutory Annual Statement."

UAU agreed to [quote] "also provide a Statement of Actuarial Opinion regarding

the adequacy of those reserves."

[Mock Trial Script Outline, page 12]

UAU's retainer letter acknowledged that [quote] "Rehabilitated writes primarily

Workers' Compensation insurance in the State of Turmoil. Rehabilitated is in the

process of studying the feasibility of expansion into other states so as to achieve a

greater spread of risk. Our reserve estimates will be a key factor in determining whether

Rehabilitated has the financial resources and the profitable base of business on which to

expand."

7.

What, if any, obligation did the company have under this agreement?

To provide data and pay for the actuarial services.

8.

What, if anything, did you do pursuant to the contract?

I provided data, and the company paid UAU for actuarial services.

9.

What, if anything, did the actuaries do pursuant to the contract? Did the actuaries provide

an estimate of the December 31, 2009 loss reserves for Rehabilitated?

They provided a draft opinion with an estimate of the December 31, 2009 loss reserves

for Rehabilitated Ins. Co.

10.

Please explain that.

Mr. Normal, UAU's representative, met in person with me {Mr. Waffle} on

February 10, 2010, when he visited Rehabilitated to discuss UAU's final reserve

conclusions.

During the meeting, Mr. Normal discussed his final reserve conclusions and

provided a draft.

11.

What else, if anything, did the actuaries do?

Mr. Normal provided a report and provided a final opinion for filing with the state

Department of Insurance.

[Mock Trial Script Outline, page 13]

12.

What were the dates and specifics?

UAU completed a written report dated February 23, 2010.

UAU provided an actuarial opinion dated February 27, 2010 on the adequacy of

held reserves (which were equal to the recommended level).

The actuarial opinion stated that the amount the company reserved, based on

what they had recommended that we reserve, made [quote] "a reasonable provision, in

the aggregate, for all unpaid loss and loss expense obligations."

13.

I show you Exhibit 3. Please tell the jury what this is.

Exhibit 3. The opinion we contracted the actuaries to provide.

14.

Did the actuarial opinion warn of any data problems?

No.

15.

Did the actuarial opinion address the feasibility of Rehabilitated Insurance Company

expanding into states?

No.

16.

Did the actuarial opinion or any other documents from the actuaries at that time warn that

a state statute, effective February 15, 2010, increased workers' compensation benefits and

also mandated a 10% rate decrease?

No.

17.

What expenses did Rehabilitated incur as a direct result of negligence on the part of

Universal Actuaries?

$25,000 paid to Universal Actuaries for actuarial services;

$15,000 paid by the Insurance Department for a professional review of the

services that Universal Actuaries negligently performed;

[Mock Trial Script Outline, page 14]

The Department sustained damages of $4,000,000 for payment of estimated

claims;

Rehabilitated's stockholders sustained damages of $1,000,000, representing their

loss of equity.

[Mock Trial Script Outline, page 15]

Plaintiff's Attorney: YOUR WITNESS.

[POINTS that WAFFLE might address when cross examined:

Mr. Waffle supplied most of the relevant data UAU requested.

Mr. Waffle "has no recollection of any oral discussion with Mr. Normal regarding

the risks of premium growth, and UAU's workpapers do not contain any written

record that such a conversation occurred." {Materials, page 4}

Neither the actuarial opinion nor the allied documents warned of any problems

with the market expansion that we were considering. They did not mention the

state legislation that became effective February 15, 2010, which increased

workers' compensation benefits and also mandated a 10% rate decrease. And

their documents did not tell us of any adverse effects this would have on our plans

to expand our markets into other states.

In July 2010, Mr. Waffle discovered that the claims data that he had provided to

Mr. Normal for the 12/31/09 study was incorrect.

o An overworked claims employee had been stuffing claims into his desk.

o This claims information was not coded into the data base.

o Waffle's review of the data supplied to him did not result in the need for him

to independently test any data elements.

o In July 2010, Mr. Waffle discovered there were errors in the data

summaries.

o The employee who had been stuffing claims in his desk was fired.

o The company immediately created internal controls in an effort to prevent

the problem from recurring.

[Mock Trial Script Outline, page 16]

o In November 2010, the corrected figures became available. He notified

UAU of the error.]

[Mock Trial Script Outline, page 17]

Cross-Examination of CFO James Waffle

Attorney for the Defendant:

1.

You’re Rehabilitated’s CFO, are you not?

2.

So you have primary responsibility for overseeing Rehabilitated’s finances, don’t you?

3.

And of all Rehabilitated’s executive, you’re most likely to know how the company is

doing financially, aren’t you?

4.

You’re not an actuary, are you?

5.

You don’t know how actuaries make their calculations, do you?

6.

But you do know that, in many instances, more than one actuarial technique can be used?

7.

Are you aware that, in many instances, the method selected by the actuary depends upon

the data the actuary is given?

8.

And are you aware that UAU claims it would have used a 30% unreported assumption if

you had provided accurate data, and that the revised assumption would have resulted in an

$800,000 deficit? [instead of a surplus]

[Mock Trial Script Outline, page 18]

9.

You were the person responsible for providing accurate data to UAU, correct?

10.

And although Mr. Normal asked for all claim counts for the past five years, you didn’t

provide them, did you?

11.

In fact, isn’t it true that the 2009 claim counts were inaccurate because an overworked

Rehabilitated employee was stuffing claims in a drawer?

12.

Even though you’ve rectified that situation, the controls weren’t in place when you

forwarded the counts to UAU, were they?

13.

Let me refer you to Exhibit 1. This was the letter that you submitted to UAU with the

data. Would you please read it aloud?

14.

You told UAU that you had made a "diligent inquiry," didn’t you?

15.

Did you ever check the accuracy of the data?

16.

Mr. Waffle, you’re a very busy man, correct?

17.

You routinely delegate work to junior staff, don’t you?

18.

And that’s all right, so long as the staff is adequately supervised, isn’t it?

[Mock Trial Script Outline, page 19]

19.

Wouldn’t you call two and one-half days of direct oversight and half a day of peer review

pretty substantial?

20.

You knew that an actuarial student at UAU, a Mr. Willie Makeit, was working on your

reserve account, didn’t you?

21.

And you didn’t notice any deficiencies in Mr. Makeit's work at the time, did you?

22.

Certainly, you never reported any deficiencies in his work to Mr. Normal, did you?

23.

Rehabilitated has legal staff, does it not?

24.

And you certainly don’t expect your attorneys to function as actuaries, do you?

25.

Your counsel could have notified you of changes in the workers compensation law,

correct?

26.

You could have asked UAU to review the reserves in light of any legal or regulatory

changes, couldn’t you?

27.

But you didn’t, did you?

[Mock Trial Script Outline, page 20]

28.

When you met with Mr. Normal, you allegedly said that Rehabilitated was considering

"expanding its business." That’s not very specific, is it?

29.

You didn’t ask him to re-evaluate the reserves in light of a possible expansion, did you?

30.

You don’t usually expect consultants to do work they haven’t been asked to do, do you?

31.

And you certainly wouldn’t want to pay for work you hadn’t requested, would you?

32.

UAU’s opinion said the reserves appeared to be adequate, based on historical data. That

isn’t a guarantee that the reserves will be adequate under all circumstances, is it?

33.

And nothing in the report said the reserves would be adequate if Rehabilitated’s business

significantly expanded, right?

No further questions.

[Mock Trial Script Outline, page 21]

Judge: The Court is limiting each side to one direct examination or one cross examination.

Accordingly, the plaintiff rests.

_______________________________ [Defendant's Counsel], you may present your case.

DEFENDANT'S CASE IN CHIEF

Attorney for the Defendant: The defense calls Mr. L.G. Normal.

Defendant's Witness: L.G. (Log) Normal's Direct Examination

Bailiff: [Oath. Do you swear or affirm that the testimony that you will give in this hearing will

be the truth, the whole truth, and nothing but the truth?]

Defendant's Attorney's Direct Examination:

1.

Mr. Normal, please state your full name, job title, and firm's name.

L.G. (Log) Normal. Actuary, Partner, and Vice President at Universal Actuaries

Unlimited.

2.

Which business contacted the other in establishing the relationship between the insurance

company and Universal Actuaries Unlimited?

Rehabilitated Ins. Co. contacted Universal Actuaries Unlimited.

3.

Was there anything unusual about this?

It was already December 2009.

[Mock Trial Script Outline, page 22]

4.

What kind of services did Universal Actuaries agree to provide to this insurance

company?

Estimate of the company's loss reserves for workers' compensation coverage and

provide an actuarial opinion regarding those reserves.

5.

What specifically did the CFO ask Universal Actuaries to provide?

Waffle, the insurance company CFO, asked UAU to provide an estimate of the

company's loss reserves for workers' compensation coverage as of December 31, 2009

and an actuarial opinion on the adequacy of loss reserves.

6.

What service did you agree to provide?

As my December 14, 2009 retainer letter states, we agreed to [quote] "estimate the

required December 31, 2009 loss reserves to be utilized by the Rehabilitated Insurance

Company...in its statutory Annual Statement." Additionally, we agreed to "also provide a

Statement of Actuarial Opinion regarding the adequacy of those reserves."

7.

Did you agree to provide advice on the feasibility of the insurance company trying to

expand into other states?

No.

8.

Did you agree to provide any advice on changes in state statutes that insurance companies

need to study and follow?

No.

9.

Did the insurance company have any obligations in this contractual arrangement besides

payment for your services?

Yes.

[Mock Trial Script Outline, page 23]

10.

What were those obligations?

To provide data. UAU asked Rehabilitated for data indicating "earned premiums

for the last ten calendar years, paid and incurred losses and reported claim counts for

the last ten accident years, with evaluations at each year end 2005 - 2009."

11.

Did the CFO provide all the data you requested?

No.

12.

Did the CFO provide accurate data for the December 31, 2009 reserves?

No. In November 2010, almost a year after he sent us the original data, the CFO

informed us of errors that he discovered in July 2010. He said that in July 2010, he had

discovered that the claims data that he had provided to me for the 12/31/09 study was

incorrect. An overworked claims employee had been stuffing claims into his desk. This

claims information was not coded into the data base.

13.

When the CFO provided data to you for the December 31, 2009 reserves, did he indicate

there were any problems with it?

When providing data, the CFO affirmed his belief that he had provided "all

information which would materially affect the loss reserves". He affirmed that he directed

preparation of the data and that it was accurate and complete. He stated that his

affirmations were "based on [his] personal knowledge and diligent inquiry made prior to

making [his] affirmation."

14.

I show you Exhibit 1. What is that?

Transmittal letter in which the CFO affirmed the accuracy and completeness of the data.

15.

Yes.

Did you rely on his affirmations regarding the completeness and accuracy of the data?

[Mock Trial Script Outline, page 24]

16.

How so?

We performed the analysis in January and February 2010. A bright actuarial

student named Willie Makeit performed much of the work determining the reserves.

I supervised and reviewed the work and made sure that it was peer reviewed.

I personally visited the CFO on February 10, 2010 and discussed my final reserve

conclusions.

We concluded the assignment with a written report dated February 23, 2010.

We completed the Statement of Actuarial Opinion regarding the adequacy of held

reserves...February 27, 2010.

Defendant's Attorney: YOUR WITNESS.

Cross-Examination of L.G. (Log) Normal

Plaintiff's Attorney:

1.

You were the account executive for Rehabilitated Insurance, correct?

2.

So you were the person at your firm with primary responsibility for the annual statement

opinion on the 2009 reserves?

3.

You are a member of the American Academy of Actuaries and the Casualty Actuarial

Society, correct?

[Mock Trial Script Outline, page 25]

4.

So you are required to comply with their Code of Professional Conduct, are you not?

5.

The Code states that an actuary “may choose” to consult with the prior actuary before

taking on a new assignment, correct? [Annotation 10-4.]

6.

But you didn’t consult with Higher & Higher, the firm that issued the 2008 reserve

opinion for Rehabilitated, before issuing your annual statement opinion, did you?

7.

So you were "imprudent" under the terms of your Code of Conduct, were you not?

8.

Most of the work on this opinion was performed by an associate in your firm, Willie

Makeit, is that right? [This is a word-play. He's not yet an associate in the eyes of the

profession.]

9.

Mr. Makeit is not an actuary yet, in terms of Casualty Actuarial Society qualifications, is

he?

10.

To become an Associate of the Casualty Actuarial Society, an actuary must have passed a

series of exams, isn’t that right?

11.

And the purpose of those exams is to test an actuary’s competence in the subject of the

exam, correct?

[Mock Trial Script Outline, page 26]

12.

The CAS offers exams in loss reserving including workers compensation reserving,

correct?

13.

Mr. Makeit hadn’t passed that exam when he worked on the Rehabilitated annual

statement, had he?

14.

So you had no objective yardstick to measure his competence to do workers comp loss

reserving work, had you?

15.

And isn’t it true that you had never worked with Mr. Makeit before, and had no personal

knowledge of his capabilities? [Normal deposition , page 6.]

16.

And, in fact, Mr. Makeit had never done workers compensation loss reserving before, had

he?

17.

UAU billing records reflect that Mr. Makeit worked 150 hours on this project, while you

only worked twenty -- so you really let him do most of the work, didn’t you?

18.

Did you carefully review Mr. Makeit's work?

19.

You noticed a handwritten notation to "check with the company as to why claim counts

are down." Isn’t that right?

[Mock Trial Script Outline, page 27]

20.

You didn’t personally follow up on that notation, did you?

21.

And you have no personal knowledge as to whether Mr. Makeit followed up on that

notation, have you?

22.

But Mr. Makeit’s note does indicate a visible anomaly in the data underlying your

opinion, doesn’t it?

23.

In fact, it was an anomaly that was significant enough for a relatively inexperienced

actuarial student to notice, wasn’t it?

24.

Certainly an experienced, fully-qualified actuary like you should have recognized a

significant change in the claim counts, correct?

25.

That change could have had a substantial effect on your opinion, couldn’t it?

26.

And, in fact, with correct data, you opinion would not have shown a $2 million surplus,

but an $800,000 deficit, correct?

27.

You testified earlier that you must comply with the Code of Professional Conduct,

correct?

[Mock Trial Script Outline, page 28]

28.

Precept 1 of the code requires you to perform professional services with "integrity, skill

and care," does it not?

29.

And Precept 3 of the code requires you to comply with applicable Actuarial Standards of

Practice when you provide professional services, does it not?

30.

In the United States, those standards are the Actuarial Standards of Practice promulgated

by the Actuarial Standards Board ("ASB"), correct?

31.

Would you agree that the ASB’s Standards reflect appropriate actuarial practice in the

United States?

32.

Are you familiar with Actuarial Standard of Practice Number 23, which covers Data

Quality?

I would like to enter Actuarial Standard of Practice Number 23 into evidence. Here is a copy of

the document. <Attorney hands ASOP 23 to L.G. Normal.>

33.

Section 3.5(b) of the Data Quality Standard requires you to consider whether known

imperfections in data will produce material biases in your opinion, does it not?

34.

And Section 3.5 of the standard, while permitting reliance on representations of others,

requires you to review data for reasonableness and consistency, correct?

[Mock Trial Script Outline, page 29]

35.

And where material defects in data are noted, Section 3.7(d) of the standard requires the

actuary to at least try to verify if and how the data was reviewed, correct?

36.

Section 4.1(f) requires the actuarial report to contain disclosures concerning "unresolved

concerns" regarding data, correct?

37.

ASOP No. 23 wasn’t followed here, was it?

38.

This, of course, constituted a breach of Precepts 3 & 4 of the Code, correct?

PAUSE

39.

And there is nothing in your opinion, report or work papers to indicate that you or Mr.

Makeit ever followed up on that significant drop in claim counts, is there?

40.

And there’s nothing in your opinion or report to call Rehabilitated’s attention to potential

data problems, is there?

41.

UAU has a standard boilerplate paragraph on data problems that you usually use in

situations like this, hasn’t it?

42.

But you didn’t use that paragraph here, did you?

43.

Just how long is your opinion? [1 p w/an atch.] What did you charge for it? [$25,000.]

[Mock Trial Script Outline, page 30]

44.

How much does that work out to be per page?

45.

On February 27, 2010, you issued an unqualified opinion that Rehabilitated’s reserves

made a reasonable provision for its liabilities. There would be no reason for the reader of

your opinion to question the adequacy of the reserves, would there?

46.

Let me refer you to Exhibit 2 – would you please read aloud the last sentence of the third

paragraph?

47.

So you knew Rehabilitated was relying on your opinion to make a decision about market

expansion, didn’t you?

48.

On February 10, 2010, you met with Mr. Waffle to discuss your opinion, didn’t you?

49.

And at that meeting, Mr. Waffle asked you about expanding Rehabilitated’s business into

other states, didn’t he?

50.

You indicated that Rehabilitated could expand if it continued its current underwriting

practices, didn’t you?

51.

There are no references to risk of premium growth in you opinion or work papers, are

there?

[Mock Trial Script Outline, page 31]

52.

There is no mention of a legislative increase in workers compensation benefits or a 10%

reduction of premiums either, is there?

53.

In fact, you waited almost a year to mention that legislation to Rehabilitated, didn’t you?

54.

You’re familiar with a company called Greatmarket; it’s a big client for UAU, isn’t it?

55.

And in a recent reserve valuation for Greatmarket, the UAU account executive billed 50

hours, or two and one-half times as many hours as your billable time on Rehabilitated,

correct?

56.

And the UAU staff assistant on the Greatmarket account worked only half as many hours

as Mr. Makeit did for Rehabilitated, correct?

57.

And the Greatmarket staff assistant was an FCAS with 6 years’ workers compensation

experience, right?

58.

And the Greatmarket peer reviewer was an FCAS, whereas the Rehabilitated peer

reviewer was an FSA, correct?

59.

And isn’t it true that Greatmarket’s UAU team used much more conservative assumptions

than you and Mr. Makeit used for Rehabilitated?

[Mock Trial Script Outline, page 32]

60.

Isn’t it also true that Greatmarket is still active in the Turmoil insurance market, while

Rehabilitated has failed?

61.

Isn’t it also true that Greatmarket was in competition with Rehabilitated until

Rehabilitated failed?

62.

So it benefits Greatmarket to have Rehabilitated placed in receivership, doesn’t it?

No further questions.

Judge: Pursuant to the Court's rules, the defendant rests.

Counsel [Plaintiff's Attorney], you may present your closing argument.

PLAINTIFF'S CLOSING ARGUMENT

The actuaries' breached the contract they made with the Rehabilitated Insurance Company.

They contracted to provide certain professional services.

Through negligence and professional malpractice, they failed to deliver.

They were aware of a data problem. It was so apparent to them that even their actuarial student

saw the problem. He not only saw the problem, he made a note in the file.

[Mock Trial Script Outline, page 33]

However, the actuary in charge of the account was slipshod in his work; failed to devote the

necessary attention to the work; failed to have an appropriate, experienced, competent peer

reviewer review the work; failed to communicate the problem to Rehabilitated; and just plowed

right ahead.

He failed to follow the Actuarial Standards of Practice and the Code of Professional Conduct for

actuaries.

If the actuary had only exercised minimal due diligence Rehabilitated Insurance Company could

have corrected the problem.

All he had to do was follow up on an actuarial student's note and inquire into the reason claims

counts were down. All he had to do was perform up to minimal professional standards and fulfill

the duty of care he owed to his client, and we could have avoided the expenses that his sloppiness

caused.

Unfortunately, that did not happen.

And his failure to perform in a professional manner caused the liquidator certain expenses.

We ask you hold the actuaries responsible for their breach of contractual duties and their

professional malpractice.

We ask that you hold the actuaries liable for damages that the Insurance Department Liquidator

has incurred in attempting to protect the public's interest and the interest of appropriate parties:

1.

Fees the insurance company paid for actuarial services during the period in question:

$25,000.

[Mock Trial Script Outline, page 34]

2.

Fees the Insurance Department paid for a professional review of the services Universal

Actuaries negligently performed: $15,000.

3.

Damages the Department sustained for payment of estimated claims: $4,000,000.

4.

Damages for Rehabilitated's stockholders, representing their loss of equity: $1,000,000.

Judge: Counsel [Defendant's Attorney], your closing argument.

DEFENDANT'S CLOSING ARGUMENT

Members of the jury, Universal Actuaries Unlimited did not breach its contract with Rehabilitated

Insurance Company. Universal Actuaries promised to provide professional actuarial services and

did just that.

Neither the actuarial student Willie Makeit nor L.G. Normal nor Universal Actuaries Unlimited

was negligent. They received data from the insurance company CFO. The CFO said that he had

directed preparation of the data and that it was accurate and complete. He said that his

affirmations were "based on [his] personal knowledge and diligent inquiry made prior to making

[his] affirmation."

Universal Actuaries used that data and arrived at what the reserves should be. It fulfilled its duty

to provide professional services.

[Mock Trial Script Outline, page 35]

Even if you thought for a moment that Universal Actuaries was negligent, which it was not, then

you would need to agree that the CFO was negligent as well. His lax supervision of his employee

allowed the data summaries to be erroneous. He even glowingly assured Mr. Normal that he, the

CFO of Rehabilited, had personally made a diligent inquiry regarding the data; that he had

supervised preparation of the data; and that it was complete and accurate.

He was negligent, and his negligence was the primary cause of the insolvency. As you have been

instructed, the modified comparative negligence laws of this state bar the Plaintiff from any

recovery if the plaintiff is 50% or more at fault for the loss. Therefore, comparative negligence

bars the insurance department from recovery on grounds of alleged negligence by Universal

Actuaries.

There is no legitimate basis for holding Universal Actuaries liable. The losses and costs to the

Insurance Department are unfortunate, but there is no legitimate reason to pass those costs on to

Universal Actuaries.

[Mock Trial Script Outline, page 36]

Judge's Instructions to Jury:

GENERAL PROVISIONS AND OUTLINE FOR STANDARD CHARGE

A.

Purpose of Charge

I am now going to tell you about the principles of law governing this case. You are

required to accept my instruction as the law. You should consider these instructions as a whole,

and do not pick out any particular instruction and place undue emphasis upon it. Any ideas you

have of what the law is or what the law should be or any statements by the attorneys as to what

the law may be, must be disregarded by you, if they are in conflict with my charge.

B.

Role of the Attorneys

The lawyers are here as advocates for their clients. In their opening statements and in

their summations they have given you their views of the evidence and their arguments in favor of

their clients' position. While you may consider their comments, nothing that the attorneys say is

evidence and their comments are not binding upon you. In addition, you must not decide this case

based on the performance of the attorneys.

C.

Role of the Jury

You sit here as judges of the facts. You alone have the responsibility of deciding the

factual issues in this case. It is your recollection and evaluation of the evidence that controls. If

the attorneys or I say anything about the facts in this case that disagrees with your recollection of

the evidence, it is your recollection that you should rely on. Your decision in this case must be

based solely on the evidence presented and my instructions on the law.

[Mock Trial Script Outline, page 37]

D.

The Evidence

The evidence in this case consists of:

1.

the testimony that you heard from the witness (including any videotaped

testimony); and

2.

E.

the exhibits that have been marked into evidence.

Inferences

When deciding this case, you are permitted to draw inferences from the evidence. Inferences are

deductions or logical conclusions drawn from the evidence. Use logic, your collective common

knowledge and your common sense when determining what inferences can be made from the

evidence.

F.

Breach of Contract and Negligence

The plaintiff, The Turmoil Insurance Department, has charged negligence and breach of

contract against UAU.

To establish its contract claim against the defendant, plaintiff must prove that:

1.

The parties entered into a contract containing certain terms.

2.

The plaintiff did what the contract required the plaintiff to do.

3.

The defendant did not do what the contract required the defendant to do. This

failure is called a breach of the contract.

4.

The defendant's breach, or failure to do what the contract required, caused a loss to

the plaintiff.

[Mock Trial Script Outline, page 38]

If you find that the plaintiff proved these four elements, then your verdict must be for the

plaintiff. If you find that the plaintiff has not proved these elements, then your verdict

must be for the defendant.

Negligence is the failure to use that degree of care, precaution and vigilance which a reasonably

prudent person would use under the same or similar circumstances. It includes both affirmative

acts which a reasonably prudent person would not have done and the omission of acts or

precautions which a reasonably prudent person would have done or taken in the circumstances.

The concept of a "reasonably prudent person" does not mean the most cautious person nor

one who is unusually bold but rather one of reasonable vigilance, caution and prudence.

In order to establish negligence, it is not necessary that it be shown that the defendant had

an evil heart or an intent to do harm.

To summarize, every person is required to exercise the foresight, prudence and caution

which a reasonably prudent person would exercise under the same or similar circumstances.

Negligence then is a departure from that standard of care.

G.

Malpractice through Negligence

An action brought against a "professional" is referred to as a malpractice action. In this

action, the plaintiff contends that defendant did not comply with the standard of care which the

law imposes upon professionals while attending to professional services.

A person engaged in the practice of a learned profession represents that he/she has the

degree of knowledge and skill ordinarily possessed and used by others engaged in that practice.

The required knowledge and skill must be judged by the standard for that profession at the time

the professional provided services to the client. The law, therefore, imposes upon a professional

[Mock Trial Script Outline, page 39]

the duty or obligation to have and to use that degree of knowledge and skill which members of

that profession ordinarily possess and exercise in the performances of such services, though the

law does not require that a professional guarantee a favorable result. A practitioner who fails to

measure up to such standards and is negligent in the performance of services commits

malpractice.

H.

Comparative Negligence

The State of Turmoil is a "modified comparative negligence" state, as opposed to a

"simple comparative negligence" state. If you find that both the plaintiff and the defendant were

negligent and proximately caused the damage, then you must determine the relative negligence of

each party. Specifically, you may reach one the following conclusions:

If you believe that the defendant, UAU, is 50% or less at fault, then the plaintiff is barred

from any recovery as the plaintiff substantially contributed to the damages incurred.

If you believe that the defendant's relative negligence is 51% or greater, then you must

determine both the defendant's specific degree of negligence, as a percentage, and the total

monetary damages. The damages awarded to the plaintiff will then be calculated as the

degree of defendant negligence times the total monetary damages.

I.

Verdict

Since this is a civil case, any verdict in which 80% or more of the jurors agree is a legal

verdict. Therefore, it is not necessary that all jurors agree on each question. An agreement of

80% or more of the jurors is sufficient. All jurors must deliberate fully and fairly on each and

every question, and all jurors must determine and vote upon each question. It is not necessary

that the same set of jurors agree upon the answers to all questions. Whenever at least 80% of the

[Mock Trial Script Outline, page 40]

jurors have agreed to any answer, that question has been decided, and you may move on to

consider the remaining questions in the case if it is appropriate to do so. All jurors must

participate fully in deliberating on the remaining questions. A juror who has been outvoted on

any question shall continue to deliberate with the other jurors fairly, impartially, honestly and

conscientiously to decide the remaining questions. Each juror must consider each question with

an open mind.

J.

Jury Verdict Sheet

I have prepared a jury verdict sheet which I believe should make your task simpler. I will

be sending that sheet with you to the jury room. The sheet has questions that you must consider

and answer within the framework of the instructions that I have given you.

Your first task will

be to appoint a jury foreman who will be responsible for recording the answers to each item on

the jury verdict sheet and submitting the results to me.

Answering the questions on this sheet will be your verdict.

K.

Thanking the Jury

Let me take this opportunity to thank you for your service on this jury. We realize this

case has interfered with your daily lives and probably caused you some inconvenience. However,

our judicial system could not function without people like you willing to serve on juries. It is a

job that has to be done in order that people can resolve their differences by jury trial. We are

extremely grateful for the time you have spent here.

"Ladies and Gentlemen: You may now retire to the jury room for your deliberations.

Thank you."