Employee

advertisement

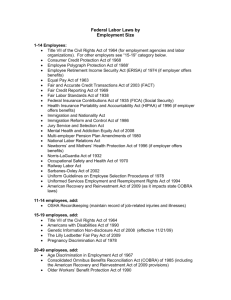

A Primer and Legal Update on Employment Claims and Strategy for General Litigators October 1, 2015 Steve Shardonofsky Seyfarth Shaw LLP sshardonofsky@seyfarth.com (713) 225-1001 Nitin Sud Sud Law P.C. nsud@sudemploymentlaw.com (832) 623-6420 EMPLOYMENT AT-WILL • Employment is presumed to be at-will in Texas Employment can be terminated for good cause, bad cause, or no cause at all (as long as it’s not an unlawful reason) • To rebut the at-will presumption, an employment contract must directly limit in a meaningful and special way the employer’s right to terminate the employee without cause – There must be an express agreement to modify the at-will status (no implied agreement) – The express agreement must be “clear and specific” – An employee cannot construct an agreement out of “indefinite comments, encouragements, or assurances.” – A statement that an employee may be fired for cause is not a specific agreement that the employee may be dismissed only for cause – An employment contract for a specific term may still be at-will if the agreement allows for termination for any reason Discrimination / Retaliation / Harassment / Rsnbl. Accommodation • Disparate Treatment – Treating someone differently because of that individual’s protected status • Disparate Impact – An employer’s neutral policy/practice that adversely affects a protected class • Harassment – Conduct that interferes with an employee’s work and creates a hostile or abusive work environment • Retaliation – Affecting the employee because he or she complained of discrimination or harassment, or exercised his/her rights in some way • Reasonable Accommodation (Disability/Religion) Major Federal EEO Laws • Title VII of the Civil Rights Act of 1964 • Pregnancy Discrimination Act • Americans with Disabilities Act (ADA) • Age Discrimination in Employment Act (ADEA) • Older Workers Benefits Protection Act (OWBPA) • Section 1981 of the Civil Rights Act of 1866 • Family and Medical Leave Act (FMLA) • Equal Pay Act (EPA) • Uniformed Services Employment & Reemployment Rights Act (USERRA) • Rehabilitation Act of 1973 • Genetic Information Nondiscrimination Act of 2008 (GINA) A Note About State Employment Laws This presentation covers only Federal Employment Laws. State Employment Laws can vary between states. For example, Title VII (federal) prohibits discrimination based on race, color, sex, national origin and religion. – The Texas Labor Code generally tracks Title VII, the ADA, and the ADEA – California discrimination laws also include political affiliations as a protected class. – New York discrimination laws also include domestic violence victim status as a protected class. What are the Protected Categories Under Federal Law? • Race • Citizenship status • Age • Veteran Status • Religion • Color • Gender • Ancestry • Pregnancy • Other characteristics protected by law • Disability • Sexual Orientation • National Origin • Genetic Information Discrimination is Illegal in These Areas: • Anything that is a term, condition or privilege of employment: – – – – – – – – – Interviewing and hiring Assignment or classification of employees Performance reviews and disciplinary actions Promotions, transfers, demotions, terminations Compensation and bonuses Benefits Training Testing Social events Who is Protected from Discrimination? Employees Applicants Former Employees Title VII – Religious Accommodation • Under Title VII, an employer has a duty to reasonably accommodate sincerely held religious beliefs and practices unless to do so would cause an undue hardship – Time off for religious observance – Eating restrictions • Definition of Religion: – Moral or ethical beliefs about right and wrong that are sincerely held with the strength of traditional religious views – Includes discrimination against someone because s/he is an atheist • The US Supreme Court recently lowered the standard of notice required to trigger the interactive process during the hiring process. (EEOC v. Abercrombie & Fitch Stores, Inc. ) Harassment - Overview of the Law •Elements •Unwelcome/Patently offensive •Conduct (verbal, non-verbal, physical) •Because of Protected Class •Results in a tangible employment action or is sufficiently severe or pervasive to alter the conditions of the complainant’s employment and create a hostile work environment •Employer liability (co-worker vs. supervisor harassment) Employer Liability For Harassment • Co-worker harassment: – Negligence standard – ER liable if it knew or should have known of the harassment and failed to take prompt, effective remedial action • Supervisor harassment: – Strict liability if there is a tangible employment action – ER directly liable if supervisor imposes a tangible employment action (replaced concept of quid pro quo harassment) • TEA Definition: “a significant change in employment status, often but not always resulting in economic injury” – Where no tangible employment action is taken an employer may raise Faraher/Ellerth affirmative defense Affirmative Defense Supervisor Harassment • Did the employer act reasonably to prevent and correct harassment? • • • • • Training Policy (especially with multiple reporting channels) No retaliation Prompt/thorough/objective investigation Prompt remedial action • Did the employee’s unreasonably fail to use available avenues provided by the employer to avoid harm? What is Retaliation? Basic Elements • Protected Activity (explained below) • Adverse Employment Action • Casual Connection – Employer Knowledge – Direct evidence – Circumstantial evidence • Temporal proximity • Inconsistent application of work rules What is “Protected Activity”? • Two types: – Protected “Opposition” – Protected “Participation” • Protected “Opposition” – – – – – Complaints Non-verbal conduct Requests for statutory rights Employee must have only a “good faith reasonable belief” What is not protected • General and vague complaints • Inappropriate workplace conduct What is “Protected Activity”? (Cont’d) • Protected “Participation” – Filing a complaint with State or Federal agency – Providing information – Assisting in investigations – Assisting in proceedings – Even if unreasonable or in bad faith Employer Cannot Take Adverse Employment Action • Adverse Employment Action: – Any adverse treatment reasonably likely to deter protected activity – Plaintiff experienced a “materially adverse action,” i.e., one that would “dissuade a reasonable worker from making or supporting a charge of discrimination;” (Burlington & Santa Fe Rwy v. White, 126 S. Ct. 2405 (2006)) • Still split in case authority: – – – – – Lateral transfer to similar position Low performance evaluation Reprimands / criticisms Cold shoulder / ostracism Change in work assignments “But-For” Causation Required in Title VII Retaliation Actions University of Texas Southwestern Medical Center v. Nassar • Employee must show that the adverse employment action would not have happened “but for” an unlawful motive to retaliate against the employee for protected activity • Contrast: in Title VII discrimination claims, an employee need only show that an unlawful discriminatory motive was a substantial motivating factor for the adverse employment action A Common Case Study -Workers’ Comp. Retaliation • Texas Labor Code Chapter 451 • Factors Courts Look At: – knowledge of the claim by the decision-maker; – a negative attitude toward the employee’s injured condition; – deviation from company policy when disciplining an employee who made a claim; – discriminatory treatment of the employee when compared to the treatment of other employees with the same disciplinary problem; and – (sometimes) timing of the termination in relation to the workers’ compensation claim. (But “timing alone” is insufficient to prove retaliation) The Summary Judgment Battle • Plaintiff Articulates A Prima Facie Case • Defendant Articulates A Legitimate, Nondiscriminatory Reason For Termination (e.g., “Performance Problems”) • *Pretext* --- Plaintiff Tries To Prove Defendant Is A Liar Ways Plaintiffs Show Pretext • Varying From Company Policies -- Seen as to “Get” The Plaintiff • Lack of Documentation to Support Decision • Treating Plaintiff Differently from Other Similarly Situated Employees • Evidence of Discriminatory or Negative Attitude Toward Condition • Flip-flopping • Other evidence of pretext, e.g., anecdotal, subsequent filling of the position, etc. Americans with Disabilities Act (ADAAA)-- Basic Requirements • Prohibits discrimination, retaliation, harassment against disabled applicants and employees • Requires employers to provide reasonable accommodations to disabled applicants and employees Almost Everyone Is “Disabled” Under The Law • “Disability” Defined: • A physical or mental impairment that substantially limits one or more of the major life activities of such an individual • A record of such an impairment • Being regarded as having such an impairment • (Those who have a relationship or association with someone who has a known disability are also protected) • Expanded List of Major Life Activities • MLAs include “[c]aring for oneself, performing manual tasks, seeing, hearing, eating, sleeping, walking, standing, sitting, reaching, lifting, bending, speaking, breathing, learning, reading, concentrating, thinking, communicating, interacting with others, and working.” • Operation of bodily functions including “the immune system, special sense organs and skin; normal cell growth.” Mitigating Measures Are Irrelevant • Regulations reject Supreme Court decisions, as did the Amendments Act • Mitigating measures include medication, medical supplies, equipment, prosthetics, and mobility devices, among other things • But not ordinary glasses and contact lenses • Surgery counts as a mitigating measure only if it “permanently eliminate[s] an impairment” 29 C.F.R. § 1630.2(j)(1)(vi) © 2015 Seyfarth Shaw LLP Reasonable Accommodation • Applies to those who have an actual disability or a record of a disability, not regarded as • Employer may choose accommodation as long as it is effective • Three categories of reasonable accommodation: – Modifications/adjustments to job application process – Modifications/adjustments to work environment or how/when job is performed – Modifications/adjustments that enable EE to enjoy equal benefits and privileges of employment • Must be provided absent undue hardship © 2015 Seyfarth Shaw LLP EEOC/TWC process • Employee must file a charge of discrimination prior to filing a lawsuit – EEOC: Within 300 days after the adverse action – TWC: Within 180 days after the adverse action • The EEOC/TWC will issue a right-to-sue notice (usually upon request) – Employee has 90 days to file a lawsuit under federal law after EEOC issues right-to-sue notice – Employee has 60 days to file a lawsuit under state law after TWC issues right-to-sue notice (no later than 2 years after filing charge with TWC) • Statements may be admissible in later proceedings – Nasti v. CIBA Specialty Chemicals Corp., 492 F.3d 589, 594 (5th Cir. 2007) (“A court may infer pretext where a defendant has provided inconsistent or conflicting explanations for its conduct.”) • Employee/Plaintiff – Opportunity to conduct your own investigation and obtain statements from witnesses • Employer/Defendant – Opportunity to gather information and documents – Opportunity to dissuade a plaintiff’s attorney – If high potential for liability, take advantage of mediation TWC Unemployment – Impact on Discrimination Claims • Statements made under oath (by EE or ER) will likely be admissible in later proceedings • Employee/Plaintiff • Can quickly and efficiently evaluate potential wrongful termination claim and cross examine Employer’s representative • Can better evaluate (and set up) wrongful termination / discrimination case • Develop evidence to present to the EEOC • Employer/Defendant • Just ignore the unemployment claim • Prepare your witness • If responding, make sure you are consistent at the EEOC stage and litigation • Obtain TWC files at start of litigation Family Medical Leave Act (FMLA) -- Basic Rights • An absolute entitlement to a certain amount of job protected leave (in most case up to 12 weeks) in a defined period of time (leave may be intermittent or on a reduced leave schedule) • The right to reinstatement to the same job • The right to have health benefits continued as if still working the same regular schedule Eligibility • To be eligible for FMLA leave an employee must: – Have worked for employer for at least 12 months (need not be consecutive) – Have worked at least 1,250 hours in the 12 months prior to the leave •This is actual hours worked and does not include paid or unpaid time off (vacation, holidays, sick/personal days do not count) •Except . . . time the employee would have worked but for military service counts as hours worked for purposes of determining FMLA eligibility • Employee must be eligible for each different leave request (e.g., different condition or reason for leave). Reasons for Leave • Employee Medical: • Family Care: • Birth/Placement: • Qualifying Exigency in connection with a covered family Employee’s own serious health condition that makes employee unable to perform one or more of the employee’s essential job functions Care for a family member (parent, spouse or child) with a serious health condition Birth of employee’s child or placement of a child with the employee for adoption or foster care member’s (parent, spouse or child) military service • Injured Servicemember: Care for injured servicemember with serious illness or injury who is employee’s parent, spouse, child, or for whom employee is next of kin (26 weeks) Intermittent and Reduced Schedule Leave • Intermittent leave: Leave taken in separate blocks of time for same (or related) serious health condition, for a qualifying exigency, or to care for injured service member. • Reduced Work Schedule Leave: Leave taken by reducing the usual number of hours EE works (workweek or day). • Must be certified by a health care provider. • Employee must make reasonable effort to schedule leave so as not to unduly disrupt operations (subject to the approval of the HCP). Military Leave (USERRA) • • • Available for employees who are called to active duty, voluntarily enlist or are in the reserves or training. Length: Up to 5 years, possibly more (there are many exceptions). Reinstatement Rights: Employees returning from a military LOA are entitled to reinstatement rights, including: • • • • • • • Must return to the same position as if had not taken leave. Original hire date is intact The rate of pay is where pay would have been if employee never left No waiting period for benefits Vacation accrual is at the same rate, as if employee never left Employees may be entitled to 401(k) contributions Bonus eligibility will be retained or may be gained Employment Torts (Texas) • Negligent hiring or retention – Employer may be liable to the public and other employees if it knows or should have known that an employee was “incompetent or unfit.” – Employer can be liable for employees’ acts committed outside scope of employment if the injury was foreseeable – Common issues – criminal convictions, driving accidents, drug/alcohol abuse • Waffle House, Inc. v. Williams, 313 S.W. 3d 796 (Tex. 2010) – Sexual harassment case brought under Texas Labor Code and as negligent hiring claim – Jury found in favor of employee under both claims, and she elected common law claim – Supreme Court held that because the claim was premised on the same conduct that the statute finds unlawful, Chapter 21 controls and employee cannot recover under negligence theory • No claim for a “negligent investigation” • Limits on false imprisonment claims – Employer is entitled to question an employee on its premises regarding a violation of company policy • Limits on defamation claims – Qualified privilege applies in employment situations • Allows for investigations into employees’ potential wrongdoings – Texas Defamation Mitigation Act (effective 2014) • Sabine Pilot Service, Inc. v. Hauck, 687 S.W.2d 733 (Tex. 1985) – The only common law exception to the employment-at-will doctrine – An employee cannot be fired for refusing to perform an illegal act • • • • Must be the sole reason of the termination The “illegal act” must carry criminal penalties The employee must refuse to perform the illegal act The employee must be terminated – Very narrow exception • Employer asking the employee not to report a criminal act is not protected EEOC’s Criminal History Guidance (2012) • Use of criminal history has “disparate impact” on certain minority groups based on race and national origin. • “We don’t hire felons” policy per se unlawful • Criminal History Question – ERs should not consider expunged or sealed convictions – Recommends not asking about crim. history on applications – Recommends only asking about convictions relevant to a specific job • Use of arrests has a per se disparate impact – But – employers may base a hiring decision on underlying conduct if the conduct makes the individual unfit for a position 38 | Employers May Consider Convictions • Excluding candidates based on convictions: – Nature and gravity of the offense – Time since the conviction and/or complete of the sentence – Nature of the job held or sought • All convictions or only specific types? – Timing? (7 years or some other or all?) • EEOC recommends an “individualized assessment” of applicants 39 | FCRA Adverse Action Requirements • Before adverse action is taken employer must provide: – A copy of the consumer report – A summary of the consumer’s rights under the FCRA – Any state law right disclosures/information • Waiting period: – Between pre-adverse and adverse action an employer must WAIT – FTC has opined that 5 business days is reasonable – To allow consumer to dispute accuracy of report BEFORE adverse action • Adverse Action: – Notice of the adverse action – Name, address, and toll-free number of the CRA that furnished the consumer report – Various other statutory disclosures 40 “Ban the Box” Laws • Laws requiring removal of criminal history questions from employment applications and/or interviews. Generally prohibit employers from inquiring into an applicant’s criminal history until after a first interview or conditional offer of employment is made. • While most of these laws apply only to state and local governments, the laws in seven of these states (Hawaii, Illinois, Massachusetts, Minnesota, New Mexico, Oregon, and Rhode Island) apply to private employers as well. (Many cities and counties have also enacted some form of “Ban the Box” legislation for private employers, including Philadelphia, San Francisco, and Seattle). Wage & Hour Laws 101: Substantive Rights of Employees • Federal Law: Fair Labor Standards Act (“FLSA”) – Applies in all 50 states – Sets the floor for wage and hour law and starts with the assumption that everyone is entitled to minimum wage and overtime for hours over 40 – Incudes limited “exemptions” to overtime based on (1) salary level; (2) salary basis; and (3) job duties • State Wage & Hour Law: – Great amount of overlap with federal law • Some states simply adopt the FLSA as the state law standard or mirror FLSA with respect to overtime eligibility • Most differences between federal and state laws are in procedures and remedies available in a lawsuit • Texas has OT statute, but it doesn’t apply if you are covered by FLSA 42 Wage & Hour Federal Court Lawsuits* 9000 8160 8,125 8000 7,500 7,310 6,825 7000 6,336 6,073 6000 5,393 5000 4000 4,207 3,617 3000 2000 4,039 3,904 2,751 1,717 1,580 1,558 1,633 1,562 1,457 1,545 1,935 1,960 1000 0 * Fiscal year ending September 30th per the Annual Report of the Director, Administrative Office of the United States Courts Wage & Hour Laws 101: Procedures – “Opt in” versus “Opt out” – under federal law, the class is made up of individuals who affirmatively sign up – Collective-Action Certification • Conditional • De-certification? • Certification – Statute of limitations (i.e., the number of years the Court looks back from the date of the lawsuit) • FLSA – 2 years or 3 years if violation is deemed “willful” • States vary – NY has a 6 year statute of limitations; Kentucky possibly up to 5 44 Wage & Hour Laws 101: Remedies Under the FLSA, successful plaintiffs receive: – Back wages for the overtime owed during the statute of limitations period; – Double the overtime owed (“liquidated damages”) unless employer can show good faith – Plaintiffs’ receive reimbursement for their attorneys’ fees and costs Under some state laws, additional remedies are allowed, e.g., in Massachusetts, the damages are tripled (not doubled) automatically, even if the employer shows good faith 45 Three Requirements For Exemptions • Salary level ($455 /wk) • Salary basis – Regularly receives a predetermined amount of compensation each pay period (on a weekly or less frequent basis) – Cannot be reduced because of variations in the quality or quantity of the work performed – Must be paid the full salary for any week in which the employee performs any work (limited exceptions to “no pay docking rule”) – Need not be paid for any workweek when no work is performed • Job duties Seven Exceptions To The “No Pay-Docking” Rule • Absence for 1+ full days for personal reasons (not sickness/disability) • Absence 1+ full days due to sickness or disability if deductions made under a bona fide plan, policy or practice of providing wage replacement benefits for these types of absences (STD/LTD) • To offset any amounts received as payment for jury fees, witness fees, or military pay • Penalties imposed in good faith for violating safety rules of “major significance” • Unpaid disciplinary suspension of one or more full days imposed in good faith for violations of workplace conduct rules • Proportionate part of an employee’s full salary may be paid for time actually worked in the first and last weeks of employment • Unpaid leave taken pursuant to the Family and Medical Leave Act The “White Collar” Exemptions The FLSA exempts executive, administrative, professional and outside sales employees from its overtime and minimum wage requirements* BUT, the FLSA does not define what these terms mean. Instead, the FLSA directs the Secretary of Labor to define these terms. *Note: there are other less common exemptions Executive Duties • Primary duty is management of the enterprise or of a customarily recognized department or subdivision; • Customarily and regularly directs the work of two or more other employees; and • Authority to hire or fire other employees or whose suggestions and recommendations as to hiring, firing, advancement, promotion or other change of status of other employees are given particular weight. Administrative Duties • Whose primary duty is the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers; and • Whose primary duty includes the exercise of discretion and independent judgment with respect to matters of significance. Management or General Business Operations • • • • • • • • • • • Tax Finance Accounting Budgeting Auditing Insurance Quality Control Purchasing Procurement Advertising Marketing • • • • • • Research Safety and Health Human Resources Employee Benefits Labor Relations Public and Government Relations • Legal and Regulatory Compliance • Computer Network, Internet and Database Administration Overtime • Generally, non-exempt employees who have more than 40 hours of compensable work time in any workweek are entitled to time and one-half for all hours over 40. • Standard is “suffer or permit” to work – Need not be requested • This requirement cannot be waived, even if: – “off-the-clock” – forbidden by employer – volunteered by employee Calculating Overtime Rate of Pay • Not simply “time-and-a-half” • Requires the payment of 1.5 times the “regular rate of pay” for all hours worked in excess of 40 hours in a workweek • Every workweek stands alone • All remuneration for employment paid to, or on behalf of, the employee – with certain limited exceptions – divided by the number of hours worked. Payments That May Be Excluded From Regular Rate 1. contributions to profit-sharing or savings plan 2. contributions to benefit plans 3. gifts 4. expense reimbursement (e.g. per diem) 5. pay for vacation, PTO, sick leave 6. premium pay for work in excess of daily or weekly standard 7. premium pay for work on Saturdays, Sundays, or holidays 8. discretionary bonuses Hours of Work • General areas of interest – Waiting time – Rest and meal periods – Sleeping time – Preparatory and concluding activities – Lectures, meetings, and training programs – Travel time – Civic and charitable work Waiting Time • Whether waiting time is hours worked depends upon the particular circumstances. – Generally, the facts may show that the employee was engaged to wait (which is work time) or the facts may show that the employee was waiting to be engaged (which is not work time). – For example, a secretary who reads a book while waiting for dictation or a fireman who plays checkers while waiting for an alarm is working during such periods of inactivity. These employees have been "engaged to wait." On-Call Time • An employee who is required to remain on call on the employer's premises is working while "on call." • An employee who is required to remain on call at home, or who is allowed to leave a message where he/she can be reached, is not working (in most cases) while on call. – Additional constraints on the employee's freedom could require this time to be compensated. Meal and Rest Periods • Federal Law: – Rest periods of short duration, usually 20 minutes or less, must be counted as hours worked. – Bona fide meal periods (typically 30 minutes or more) generally need not be compensated as work time. • The employee must be completely relieved from duty for the purpose of eating regular meals. • The employee is not relieved if he/she is required to perform any duties, whether active or inactive, while eating. Preparatory and Concluding Activities • Donning and doffing of “nonunique” gear such as hairnets, goggles, hardhats, smocks, sterilized clothing • Typically must take place at work • Focus is on “integral and indispensable” • If deemed “first principal activity,” may make subsequent transportation time compensable – concepts have been used in other contexts (e.g., checking assignments from home, blackberry usage) • Computer start-up/shut-down time • Card swipes/clock punches Lectures, Meetings, and Training Time • Attendance at lectures, meetings, training programs and similar activities need not be counted as working hours if: – Attendance is outside of the employee’s regular working hours – Attendance is in fact voluntary – The course, lecture, or meeting is not directly related to the employee’s job – The employee does not perform any productive work during such attendance Travel Time • The principles which apply in determining whether time spent in travel is compensable time depends upon the kind of travel involved. – Home to Work Travel – Home to Work on a Special One Day Assignment in Another City – Travel That is All in a Day's Work – Travel Away from Home Community Home-to-Work Travel • An employee who travels from home before the regular workday and returns to his/her home at the end of the workday is engaged in ordinary home to work travel, which is not work time. Home to Work on a Special One Day Assignment in Another City • An employee who regularly works at a fixed location in one city is given a special one day assignment in another city and returns home the same day. The time spent in traveling to and returning from the other city is work time, except that the employer may deduct/not count that time the employee would normally spend commuting to the regular work site. Travel That is All in a Day's Work • Time spent by an employee in travel as part of their principal activity, such as travel from job site to job site during the workday, is work time and must be counted as hours worked. Travel Away from Home Community • Travel that keeps an employee away from home overnight is travel away from home. – Travel away from home is clearly work time when it cuts across the employee's workday. – The time is not only hours worked on regular working days during normal working hours but also during corresponding hours on nonworking days. – As an enforcement policy the Wage and Hour Division will not consider as work time that time spent in travel away from home outside of regular working hours as a passenger on an airplane, train, boat, bus, or automobile. Upcoming Changes… What the DOL Proposal Contains DOL issued its Notice of Proposed Rulemaking on July 6, 2015: • DOL estimates that there are currently 4.6 million employees classified as exempt “white collar” employees who are paid $455 to $921 per week • Increase in salary level for standard exemption $50,400 in 2016 ($970 per week) with automatic increases • Requests for comments on: – Duties tests • Time-based test like California is the better approach? • How to deal with “concurrent duties” – Use of nondiscretionary bonuses to satisfy salary level Misclassification of Independent Contractors Independent contractor status is determined based on various legal tests, not choice of the parties • An independent contractor relationship cannot be created simply by calling a worker an independent contractor • Issuing a 1099 rather than a W-2 is not determinative • Employee status can not be waived by an employee’s choice or desire to have different taxes • Written contracts are not controlling Determining Contractor Status • Different agencies use different tests – – – – National Labor Relations Act: Common Law Agency Test Fair Labor Standards Act: Economic Realities Test Internal Revenue Service: Right to Control Test Employment Retirement Income Security Act: Common Law Agency Test – Title VII of the Civil Rights Act of 1964: Combined Test – Unemployment Insurance Acts: ABC Test • Most tests focus on the right of control and entrepreneurial nature of contractor’s business • Tests often applied in an outcome-determinative way – factors weighted differently • All tests focus on reality, rather than writing How Liability Arises • “Contractor” files unemployment claim upon contract termination – Likely to trigger review and audit – IDES almost always finds employee status – IDES is required to notify IRS, which may choose to audit • IRS random audit • Contractor gets injured and files workers compensation claim • Contractor is disgruntled or wishes to challenge termination of contract and: – makes claim for severance benefit or other retirement, welfare benefits – claims entitled to past overtime compensation – files charge or lawsuit and gets attorney involved on other issues Determining Contractor Status Independent Contractor Inquiry Employer – Employee Contractor tasked with results only – works out details Who Controls Details of Work? Employer dictates and monitors details; requires regular reporting Independent business; risk of profit/loss; provides services to others; may subcontract Entrepreneurial Nature? Exclusive to employer; may not subcontract; reimbursed for expenses; paid hourly Services provided incidental to core business of client Are Services Core to Business? Services are the employer’s core business; employees performing same work Provides own tools, instruments and place of work Who Provides Tools? Employer provides tools and instruments or reimburses; provides workplace Determining Contractor Status (cont.) Inquiry Employer – Employee Independent Contractor Services performed in one year or less; definite period Length of Service? Services performed for longer than one year or indefinite Highly skilled work requiring independent judgment Skill and Judgment? Unskilled work requiring little independent judgment Paid by the job, by the project, or by the piece Nature of Payment? Paid by the hour or fixed salary per pay period Provides own bid, negotiated contract, and invoices for services; waives benefits Parties’ Intent? Employer provides terms, or terms unclear, and pays regardless of invoices Work customarily performed by independent profession Industry Norm? Work typically performed by employees in industry Potential Liability for Misclassification • Overtime Liability – If contractor would be non-exempt as employee • Minimum Wage/Reimbursement/Tip Issues – Insufficient reimbursement for vehicle use; tip-sharing; minimum wage? • Workers’ Compensation – Percentage of wages plus fines; no immunity from tort • Federal Employment Laws – Joint employment liability • Employee Benefit Coverage – Contractor claims 401(k), severance, health/welfare coverage, ESPPs • Federal Taxes – Back taxes if tax unpaid, 1.5% penalty for failure to withhold • Social Security & FICA – 6.2% of wages for failure to withhold • State and Federal Unemployment Tax – State = 5%; Federal = 0.8% of wages, interest & penalties Worker Adjustment and Retraining Notification (WARN) Act • Applies to businesses employing: – 100 or more full-time employees; or – 100 or more employees, including part-time employees, who in the aggregate work at least 4,000 hours per week exclusive of overtime • Requires giving 60 days’ notice (or 60 days’ pay in lieu of notice) prior to a “plant closing” or “mass layoff.” WARN Act (continued) • Plant closing – Permanent or temporary shutdown of a single site of employment, or one or more operating units within the site, during a 30-day period that results in an employment loss for 50 or more employees, excluding part-time employees. • “Single site of employment” can include separate buildings/areas if they are in reasonable geographic proximity, used for the same purpose, and share the same staff and equipment WARN Act (continued) • Mass layoff – Employment loss at a single site of employment during any 30-day period involving: • 50 or more employees, other than part-time employees, provided those affected constitute at least 33% of the active workforce at the site, not counting part-time employees; or • At least 500 employees, other than part-time employees, regardless of the affected workforce percentage WARN Act (continued) • Allows for aggregation of separate reductions that occur within a rolling 90-day period, which by themselves are not of a sufficient size to trigger the Act • “Part-time” employee defined: Employed for – an average of fewer than 20 hour per week; or – fewer than 6 of the 12 months preceding the date on which the WARN notice would be required WARN Act (continued) • “Employment loss” defined: – An employment termination other than a discharge for cause, voluntary departure, or retirement; – A layoff exceeding six months; or – A reduction in work hours by more than 50% during each month in a six-month period. • No “employment loss” if an employee is discharged for cause, voluntarily leaves, or retires. WARN Act (continued) • Exceptions allow for no or reduced notice – Sale of business exception – Faltering company exception • Applies to businesses actively seeking capital or business at the time the 60-day notice would be required and if it had given notice, it would have been precluded from obtaining the needed capital or business – Unforeseeable business circumstances exception • Focus is on the employer’s reasonable business judgment, not hindsight – Natural disaster exception COBRA • Consolidated Omnibus Budget Reconciliation Act of 1985 • Applies to employers with 20 or more employees • Generally allows for continued coverage for employees and covered dependents up to 18 months (or longer in certain situations) COBRA (continued) • A “qualifying event” triggers COBRA obligation: – – – – – Death of covered employee Voluntary or involuntary termination of employment Reduction in hours of work of the covered employee Divorce or legal separation Covered employee becoming entitled to Medicare benefits – Dependent child of the covered employee ceases to be a dependent child under the terms of the plan COBRA (continued) • When a COBRA notice must be sent – A qualifying event occurs – A new employee becomes subject to group healthplan coverage – COBRA coverage is unavailable or denied – Continuation coverage will terminate before the end of the maximum coverage period • Sending notice is the responsibility of the plan administrator (unless the employer is also the plan administrator) COBRA (continued) • Employer must notify the plan administrator within 30 days • Plan administrator must then send the COBRA notice within 14 days of that notification • Notice should be sent to employee and dependents by first-class mail to their last known addresses – A single mailing should include separate notices for each qualified beneficiary COBRA (continued) • The failure to provide a COBRA notice results in liability against the employer and/or plan administrator of up to $110 per day per covered employee and beneficiary, plus costs and attorney’s fees. See 29 U.S.C. § 1166(a)(4); 29 C.F.R. 2590.606-4; 29 C.F.R. § 2575.502c-1; 29 U.S.C. § 1132(c)(1); 29 U.S.C. § 1132(g). • The amount of penalty to actually award is discretionary for a judge and depends on two factors: 1) the presence or absence of good faith on the part of the employer; and 2) the presence or absence of prejudice to the plaintiffs. See Slipchenko v. Brunel Energy, Inc., C.A. No. H-11-1465, 2013 U.S. Dist. LEXIS 124159, *53 – 54 (S.D. Tex. Aug. 30, 2013). Ethics for Labor and Employment Counsel • An employee has made an internal complaint of harassment and you are conducting an investigation. While meeting with a witness, the witness says he would like to tell you details about the allegations but wants to make sure you agree to keep it confidential. Do you agree? • No. You are not the witness’ attorney and cannot agree to keep his statements to you confidential. No ABA Model Rule Comments To Texas Rules 85 • A former employee sued the company for wrongful termination. During trial he leaked to the press allegations that the company hid known safety concerns from federal regulators. Can the company publically respond that it was the former employee who met with federal regulators and covered up the safety issues without the company’s knowledge or consent? • Yes, a lawyer may make a statement that a reasonable lawyer would believe is required to protect a client from the substantial undue prejudicial effect of recent publicity not initiated by the lawyer or the lawyer's client. ABA Model Rule 3.6 Texas Rule 3.07 86 • An employee’s husband lost his job and she starts stealing supplies like toilet paper from the company. Her manager catches her in the act and fires her. The manager wants to get back at the former employee for embarrassing him at a company event and wants you to file a lawsuit to recover damages for the stolen property. Should you file the lawsuit? • No, because the company is filing the lawsuit primarily for the purpose of harassing or maliciously injuring the former employee. ABA Model Rule 3.1 Texas Rule 3.01 87 • Your sales manager quits and starts working for your largest competitor. She never signed a non-compete but you are concerned she has confidential information, including information on her iPad/iPhone, she could use to unfairly compete. You seek a TRO, serve discovery, subpoena her iPad/iPhone, and notice several depositions. Can you do this? • Yes, because the company is not seeking the discovery to gain an advantage in resolving the matter unrelated to the merits of its claim. ABA Model Rule 3.2 Texas Rule 3.02 88 • You are representing the company at mediation. At the end of the day, the mediator asks you to disclose your authority so she can get the case settled. You tell her $50,000, when your actual authority is $80,000. Is this an ethical violation? • No, because in the context of mediation, this statement is viewed merely as a negotiating position rather than a representation of material fact. ABA Model Rule 4.1 Texas Rule 4.01 89 • The company terminates a 62 year old female employee for performance reasons. The company offers her a severance and release agreement. She comes to you (an attorney for the company) to ask questions about the agreement. Do you: (a) answer her questions as neutrally as possible; (b) refuse to discuss with her; or (c) advise her to obtain counsel? • (c) You advise her to obtain counsel. ABA Model Rule 4.3 Texas Rule 4.03 90 • A terminated employee sues the company for employment discrimination and retaliation. You learn during the course of discovery that the employee falsified her expense reports and over the course of five years stole $10,000 from the company. Can you threaten the former employee with criminal charges if she does not drop her lawsuit? • No, attorneys cannot use or threaten to use the criminal process solely to coerce a party in a private matter. ABA Model Rule 4.4(a) Texas Rule 4.04 91 • During the discovery phase of a case, Company’s lawyer suspects Plaintiff may have posted relevant pictures on her Facebook page. Plaintiff’s Facebook page is set on private and thus only her Facebook “friends” can see the pictures. What methods may the attorney use to obtain the pictures? A. Send a discovery request for production B. Hire private investigator to send a “friend” request to see if the plaintiff will accept it C. A & B • A -- A lawyer is forbidden from communicating with a person whom the lawyer knows to be represented by counsel without first obtaining consent from the represented person’s lawyer. This prohibition extends to any agents (secretaries, paralegals, private investigators, etc.) who may act on the lawyer’s behalf. ABA Model Rule 4.2, 8.4. Texas Rule 4.02, 8.04(a). 92 Questions?? 93 | © 2014 Seyfarth Shaw LLP THANK YOU!! Steve Shardonofsky Seyfarth Shaw LLP sshardonofsky@seyfarth.com (713) 225-1001 Nitin Sud Sud Law P.C. nsud@sudemploymentlaw.com (832) 623-6420