course schedule - Stevens Institute of Technology

advertisement

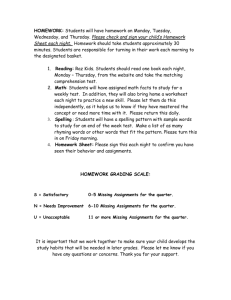

Stevens Institute of Technology Howe School of Technology Management Syllabus BT 200 Financial Accounting Spring 2015 Desi Arisandi Babbio Building Tel: 201-702-0405 Desi.arisandi@stevens.edu Monday 03.00-03.50PM P120 Thursday 11.00-12.40PM P120 Office Hours: Monday 4:00 pm Also by appointment Course & Web Address: BT200 https://sit.instructure.com/courses/1210 Overview This course covers the principles of financial accounting. It is focuses on the use of accounting data by individuals to enhance decision-making. It is designed to enable you to understand and be conversant in basic accounting language Topics covered include the accounting cycle, and the major financial statements. Reporting for assets, liabilities and equity accounts using generally accepted accounting principles will be also explored. Prerequisites: None. Learning Goals After successfully completing this course, the student will be able to: 1. 2. 3. 4. 5. 6. Analyze and record transactions Identify adjustments necessary for accrual financial statements Account for receivables and inventory Account for long-term assets and liabilities Account for stock transactions and retained earnings Prepare and analyze balance sheets, income statements and cash flow statements Pedagogy The course will employ lectures, class discussion, in-class individual assignments, and review of homework assignments. There will be three exams and quizzes (there are no makeups for missed quizzes). The third exam will be a comprehensive final. Required Text(s) Horngren’s Accounting, 10th edition,Ch 1- 16, Nobles, Mattison and Matsumura, 2014 and MyAccounting Lab. 1 (Student can select e-book version of this book via MyAccounting Lab) MyAccounting Lab MyAccountingLab is a supplemental resource for students. Selected homework assignments are to be submitted through MyAccountingLab. It is web-based tutorial software. The software makes submitting homework easy. You get immediate feedback and assistance in completing the assignments as well. To register MyAccountingLab please follow the instructions on the registration guideline (Files-Canvas). Use the following course code to begin registration: arisandi52103. If you purchased the text at the bookstore, an access code to MyAccountingLab is included with the text. The access code can be purchased separately when you go the above web site). Assignments The course will emphasize class discussion and the analysis of the assigned readings. Your first and most important assignment is to come to class prepared to discuss the readings and cases each week. All assignments must be submitted to the MyAccounting Lab. All assignments are due as noted in the course schedule below. In fairness to others, late work will be penalized 10% per week overdue. HOMEWORK (Individual) To help reinforce the material covered in the lectures, short answer take-home tests will be given during the course. These will be based on the lecture material and should take approximately one or two hours to complete. The dateline of the homework is before the Monday class started. Timely submission is important to reinforce what is learned in class and to minimize falling behind. There will be multiple-choice or short answer questions for the homework (MyAccounting Lab). QUIZZES (Individual) There will be eight in-class quizzes for this class. Each quiz will be covering one chapter material. The schedule of these Quizzes is listed on the following schedule. CLASS PARTICIPATION To enhance the learning experience, all students are expected to participate in class discussion and the in-class team exercises. Attendance in class sessions is an important component of this grade. The assignments and their weights are as follows: Homework assignments, in-class participation and attendance 15% Quizzes 15% Exam 1 20% Exam 2 20% Final Exam 30% Ethical Conduct The following statement is printed in the Stevens Graduate Catalog and applies to all students taking Stevens courses, on and off campus. 2 “Cheating during in-class tests or take-home examinations or homework is, of course, illegal and immoral. A Graduate Academic Evaluation Board exists to investigate academic improprieties, conduct hearings, and determine any necessary actions. The term ‘academic impropriety’ is meant to include, but is not limited to, cheating on homework, during in-class or take home examinations and plagiarism.“ Consequences of academic impropriety are severe, ranging from receiving an “F” in a course, to a warning from the Dean of the Graduate School, which becomes a part of the permanent student record, to expulsion. Reference: The Graduate Student Handbook, Academic Year 2003-2004 Stevens Institute of Technology, page 10. Consistent with the above statements, all homework exercises, tests and exams that are designated as individual assignments MUST contain the following signed statement before they can be accepted for grading. ____________________________________________________________________ I pledge on my honor that I have not given or received any unauthorized assistance on this assignment/examination. I further pledge that I have not copied any material from a book, article, the Internet or any other source except where I have expressly cited the source. Signature _________________________ Date: _____________ Please note that assignments in this class may be submitted to www.turnitin.com, a web-based anti-plagiarism system, for an evaluation of their originality. Course/Teacher Evaluation Continuous improvement can only occur with feedback based on comprehensive and appropriate surveys. Your feedback is an important contributor to decisions to modify course content/pedagogy, which is why we strive for 100% class participation in the survey. All course teacher evaluations are conducted on-line. You will receive an e-mail one week prior to the end of the course informing you that the survey site (https://www.stevens.edu/assess) is open along with instructions for accessing the site. Login using your campus username and password. All responses are strictly anonymous. We especially encourage you to clarify your position on any of the questions and give explicit feedbacks on your overall evaluations in the section at the end of the formal survey, which allows for written comments. We ask that you submit your survey prior to the close of the examination period. COURSE SCHEDULE 1. Accounting and the Business Environment: Thursday January 22, 2015 and Monday January 26, 2015 3 The chapter begins with an introduction to accounting, and a brief description on why accounting is important. The differences between financial and managerial accounting are discussed. Various financial report users, such as individuals, businesses, investors, creditors, government regulatory agencies, and taxing authorities are explained. The accounting profession and career paths available to accounting majors are briefly described. Book: Horngren’s Accounting, 10th edition,Ch 1, Nobles, Mattison and Matsumura 2. Recording Business Transactions: Thursday January 29, 2015 and Monday February 2, 2015 Introduces the account and the ledger, and then briefly describes specific asset, liability, and owner's equity accounts. The concept of double-entry bookkeeping and the rules of debit and credit for assets, liabilities, and owner's equity are described. The rules of debit and credit are then expanded to include specific types of owner’s equity accounts, and then expanded again to include revenues and expense accounts. The “T-account” is illustrated. The normal balances of accounts are explained. The accounting equation is tied to the rules of debit and credit. Book: Horngren’s Accounting, 10th edition,Ch 2, Nobles, Mattison and Matsumura 3. The Adjusting Process: Thursday, February 5, 2015 and Monday, February 9, 2015. Introduces the student to the adjusting process. Cash and accrual accounting are illustrated and differentiated. The time period concept, the revenue recognition principle, and the matching principle are explained. Adjusting entries are defined. Prepaid and accruals are compared. Book: Horngren’s Accounting, 10th edition,Ch 3, Nobles, Mattison and Matsumura 4. Completing the Accounting Cycle: Thursday, February 12, 2015 and Tuesday, February 17, 2015 A review of the financial statements and the relationship between the statements is emphasized. The classified balance sheet is explained, and assets and liabilities are classified as current or long-term. Assets are listed based on liquidity. Liabilities are listed in the order in which they must be paid. The report format and the account format of the balance sheet are illustrated. Book: Horngren’s Accounting, 10th edition,Ch 4, Nobles, Mattison and Matsumura 5. Exam 1 6. Merchandising Operations: Thursday, February 26, 2015 and Monday, March 2, 2015 Compares a service business with a merchandising business, and then discusses how to complete the accounting cycle for a merchandising company. Explains how a service entity’s financial statements differ from a merchandiser’s financial statements. Following an illustration of the financial statements of a service company and a merchandising 4 company, both the periodic and perpetual inventory systems are defined; however, only the perpetual inventory system is emphasized in the chapter. Book: Horngren’s Accounting, 10th edition,Ch 5, Nobles, Mattison and Matsumura 7. Merchandise Inventory: Thursday, March 5, 2015 and Monday, March 9, 2015 Examines the accounting for merchandise inventory. The accounting principles and concepts that affect merchandise inventory—the consistency principle, the disclosure principle, the materiality concept, and accounting conservatism are explained. Controls over merchandise inventory are discussed. Accounting for merchandise inventory costs under a perpetual inventory system is described. Four different costing methods— specific identification, first-in, first-out (FIFO), last-in, first-out (LIFO), and weightedaverage, are explained. Book: Horngren’s Accounting, 10th edition,Ch 6, Nobles, Mattison and Matsumura 8. Internal Control and Cash: Thursday, March 12, 2015 and Monday, March 23, 2015 Discusses the purposes and characteristics of an effective system of internal control. The text describes four objectives that a company hopes to achieve with a good system of internal control. The five components of internal control are identified, including control procedures, risk assessment, information system, monitoring of controls, and environment. Basic characteristics of an effective system of internal control are listed, including competent, reliable, and ethical personnel; assignment of responsibilities; separation of duties; internal and external audits; documents; electronic devices; and other controls. Book: Horngren’s Accounting, 10th edition,Ch 8, Nobles, Mattison and Matsumura 9. Receivables: Friday, March 27, 2015 and Monday, March 30, 2015 Overview of various types of receivables—both accounts receivable and notes receivable. Internal controls over receivables, the duties of the credit department, recording sales on credit, and recording credit and debit card sales are presented. Two methods for recording uncollectible accounts are discussed: first the direct write-off method and, later in the chapter, the allowance method. Book: Horngren’s Accounting, 10th edition,Ch 9, Nobles, Mattison and Matsumura 10. Plant Assets, Natural Resources, and Intangibles: Thursday, April 2, 2015 and Monday, April 6, 2015 Explaining plant assets, the different categories of plant assets, and deprecation. Students learn how to determine the cost of various plant assets. The relative-market-value method is used for a lump-sum purchase. Capital and revenue expenditures are explained. Book: Horngren’s Accounting, 10th edition,Ch 10, Nobles, Mattison and Matsumura 11. Exam 2 12. Corporations: Thursday, April 16, 2015 and Monday, April 20, 2015 Introduces the student to the corporation, the dominant form of business organization in our country. The characteristics of the corporation, a brief description of how a 5 corporation is organized, and the definition of capital stock are presented. The two components of stockholders’ equity, paid-in capital and retained earnings are discussed. Book: Horngren’s Accounting, 10th edition,Ch 13, Nobles, Mattison and Matsumura 13. Long-Term Liabilities: Thursday, April 23, 2015 and Monday, April 27, 2015 Introduces the student to long-term liabilities, particularly bonds payable, as a way to finance operations. General background information is given as to bond terminology, types of bonds, interest rates, and bond quotations. The concept of how bond prices are related to present value is briefly explained. Entries are illustrated for issuing bonds at par, paying semi-annual interest, and paying bonds at maturity. Next, students learn about bonds issued at a discount. Straight-line amortization of the discount is presented. Book: Horngren’s Accounting, 10th edition,Ch 14, Nobles, Mattison and Matsumura 14. The Statement of Cash Flows: Thursday, April 30, 2015 and Monday, May 4, 2015 A discussion of the basic concepts and purposes of the Statement of Cash Flows. Operating, investing, and financing activities are defined. A brief comparison of the direct and indirect method for preparing cash flows from operating activities is given. The Statement of Cash Flows using the indirect method is explained. A five-step process is outlined. Book: Horngren’s Accounting, 10th edition,Ch 16, Nobles, Mattison and Matsumura 15. Exam 3 6