Real Estate - University of Montana

advertisement

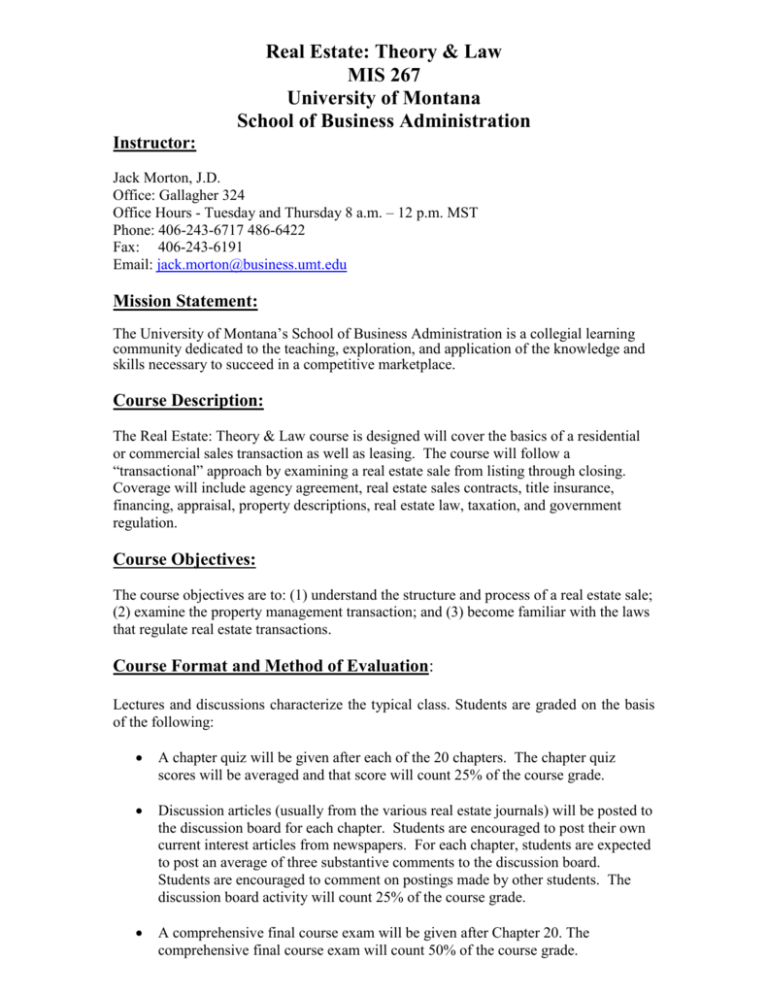

Real Estate: Theory & Law MIS 267 University of Montana School of Business Administration Instructor: Jack Morton, J.D. Office: Gallagher 324 Office Hours - Tuesday and Thursday 8 a.m. – 12 p.m. MST Phone: 406-243-6717 486-6422 Fax: 406-243-6191 Email: jack.morton@business.umt.edu Mission Statement: The University of Montana’s School of Business Administration is a collegial learning community dedicated to the teaching, exploration, and application of the knowledge and skills necessary to succeed in a competitive marketplace. Course Description: The Real Estate: Theory & Law course is designed will cover the basics of a residential or commercial sales transaction as well as leasing. The course will follow a “transactional” approach by examining a real estate sale from listing through closing. Coverage will include agency agreement, real estate sales contracts, title insurance, financing, appraisal, property descriptions, real estate law, taxation, and government regulation. Course Objectives: The course objectives are to: (1) understand the structure and process of a real estate sale; (2) examine the property management transaction; and (3) become familiar with the laws that regulate real estate transactions. Course Format and Method of Evaluation: Lectures and discussions characterize the typical class. Students are graded on the basis of the following: A chapter quiz will be given after each of the 20 chapters. The chapter quiz scores will be averaged and that score will count 25% of the course grade. Discussion articles (usually from the various real estate journals) will be posted to the discussion board for each chapter. Students are encouraged to post their own current interest articles from newspapers. For each chapter, students are expected to post an average of three substantive comments to the discussion board. Students are encouraged to comment on postings made by other students. The discussion board activity will count 25% of the course grade. A comprehensive final course exam will be given after Chapter 20. The comprehensive final course exam will count 50% of the course grade. Academic Integrity: Academic misconduct is subject to an academic penalty by the course instructor and/or a disciplinary sanction by the University. Any students found engaged in academic dishonesty will, at a minimum, receive an F for the course. Text: Real Estate: An Introduction by Harwood and Jacobus Readings: Current articles from various sources, such as the Wall Street Journal, Forbes, and Business Week will be posted on the web site. Students will be responsible for understanding those materials and the materials will be included in quizzes and exams. Course Coverage and Text Assignments: 1) 2) 3) 4) 5) 6) Introduction to Real Estate Brokerage Property management Nature and Description of Real Estate Land descriptions Water rights Mineral and hydrocarbon rights Rights and Interests in Land Fee simple Encumbrances Life Estates Leasehold Estates Forms of Ownership Severalty Joint tenancy Tenancy in common Tenancy by the entireties Transferring Title Deeds Dedication Adverse possession Accession Recording and Title Insurance Abstracts Title insurance Torrens system Quiet title actions 2 7) 8) 9) 10) 11) 12) 13) 14) 15) Contract Law Elements of a contract Statute of Limitations issues Dealing with a breach Real Estate Contracts Buy-sell agreements Binder Letter of intent Mortgage and Note Creating the lien Priorities Terminating the lien Foreclosure Trust Deeds Developmental history Reconveyance Social issues Lending Practices Loan-to-value ratios Amortized loans VA and FHA Sub-prime lending issues Sources of Financing Seller financing Primary market Secondary market Taxation of Real Estate Assessment process Exemptions Income tax issues Real Estate Leases Landlord-tenant laws Lease provisions Options and rights of first refusal Assignment and subletting Appraisal Market comparison approach Cost approach Income approach Reconciliation Appraisals and ethical issues 3 16) 17) 18) 19) 20) Licensing Brokers Salespersons Licensee regulation Agency Law Fiduciary obligations Disclosure of role to all parties Environmental Issues CERCLA, etc. Zoning and subdivision regulations Conservation easements Fair Housing State and local fair housing regulations Federal Fair Housing Act Condominiums and Cooperatives Condominiums Cooperatives Conversion Planned Unit Developments 4