Comparations with STATA, RATS and PC-Give

advertisement

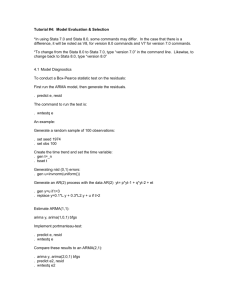

SVAR Modeling in STATA Armando Sánchez Vargas Economics Research Institute UNAM I.- Motivation Stata is a powerful and flexible statistical package for modeling time series. Prospective and advanced users would want to know: I. SVAR modeling facilities the package offers. II. The main advantages of Stata compared with other time series packages. III. What is still needed and what might be refined to implement the whole SVAR methodology in Stata. II.- Objectives The main purpose of this presentation is to discuss STATA´s capability to implement the entire SVAR methodology with non-stationary series. A second objective is to discuss what is needed to improve the implementation of SVAR models in STATA. III.- SVAR Methodology The main objective of SVAR models is to find out the dynamic responses of economic variables to disturbances by combining time series analysis and economic theory. III.- SVAR Methodology In the presence of unit roots the structuralisation of a VAR model can take place at three distinct stages: III.- SVAR Methodology I. The first step consists of specifying an appropriate VAR representation for the set of variables.* * Which implies to choose the lag order, the cointegration rank and the kind of associated deterministic polynomial and a sensible identification of the space spanned by the cointegrating vectors (Johansen, 1995). III.- SVAR Methodology II. In the second step, the “structuralisation” stage, we use the VAR model in its error correction form to identify the short run associations between the variables and their determinants, which are hidden in the covariance matrix of the residuals of such multivariate model. In order to recover the short run model coefficients we can use the variance covariance matrix of the VAR in its error correction form (*) and impose theoretical restrictions. (*) ( L)zt zt 1 t ' III.- SVAR Methodology Then, we start with an exactly-identified structure given by the lower triangular decomposition of the variancecovariance matrix of the estimated VAR disturbances and restrict the non-significant parameters to zero moving to a situation of over-identification (i.e). 1 0 0 0 a12 a13 a14 et b11 1 0 0 ( mm* )t 0 0 1 0 ( y y*)t 0 0 0 1 (ii*)t 0 0 uet u b22 0 0 ( mm* )t 0 b33 0 u( y y*)t 0 0 b44 u(ii*)t 0 0 III.- SVAR Methodology III. Finally, the short and medium run validity of the model can also be verified by plausible modeling of the instantaneous correlations via impulse response functions. The model selection strategy IV.- SVAR Estimation First, we must do misspecification test over VAR, this guarantee a good model; because is very important to have the correctly VAR then to have a good SVAR. After the reduced from VAR representation has been aptly estimated, the researcher is allowed to specify a set of constraints on the A and B matrices. IV.- SVAR Estimation The SVAR procedure verifies whether the restrictions comply with the rank condition for local identification. This check is carried out numerically by randomly drawing A and B matrices satisfying the restrictions being imposed. At this stage, of the identification condition is met, the procedure SVAR carries out maximum likelihood estimation of the structural VAR parameters by using the score algorithm. In the case of over-identification, the LR test for checking the validity of the over-indentifying restrictions is computed. IV.- SVAR Estimation Starting from the estimate of the SVAR representation, the procedure VMA estimates the structural VMA and the FEVD parameters, together with their respective asymptotic standard errors. The results of this analysis are then available for being displayed, saved and graphed. Stata’s capabilities: Univariate Analysis Capabilities PcGive STATA RATS Graphics yes yes yes Autocorrelation Functions yes yes yes yes yes yes ADF ADF ADF PP PP KPSS SCP Unit Root Test DF-GLS Note: ADF=Augmented Dickey-Fuller Test. PP=Phillips Perron. KPSS=Kwiatkowski-Phillips-Schmidt-Shin. SCP=Schmidt Phillips. DFGLS=Dickey-Fuller GLS. Stata’s capabilities: Model Specification and Estimation Capabilities Automatic Seasonal Dummies Maximum lag Trend polynomial Cointegration ranks Exogenous variables VAR estimation RATS PcGive STATA Malcom yes yes yes yes yes yes no yes yes yes yes yes yes yes yes yes yes yes Stata’s capabilities: Misspecificacion Tests Capabilities PcGive STATA RATS Single Test Joint Test Single Test Joint Test Single Test Joint Test Normality yes yes yes no yes yes Homoskedasticity yes yes no no no no No Autocorrelation Parameters Stability yes yes yes yes no no yes no yes no no yes Linearity no no no no no no Stata’s capabilities: Statistial Inferences based on the model Capabilities Maximum lag Tests for trend polynomial Test for joint determination of cointegration rank and deterministic polynomial Trace Test in the I(1) model Tests for r, s in the I(2) model Parameters stability:rank and cointegrating space Roots the Model PcGive yes no STATA yes no RATS yes yes no no yes yes yes yes no no yes no yes no yes yes yes Stata’s capabilities: Automatic test Capabilities PcGive STATA RATS Weak exogeneity test no no yes Indentification no no yes Granger causality no yes yes Tests on α y β yes yes yes Stata’s capabilities: Structural VAR analysis whit stationary and non stationary variables Capabilities PcGive Non Stationary stationary STATA RATS Stationary Non stationary Stationary Non stationary Estimation no no yes no yes yes Simulation no no yes no yes yes Graphics no no yes no yes yes Conclusions Commands are appropiate for basic use. Improvements in routines for advanced users. Conclusions What is needed: I. Addition of some other Unit Roots Tests. II. The VAR capabilities could benefit by the addition of single and joint misspecification tests. III. Adding a few tests and graphs as automatic output: Tests for trend polynomial, Test for joint determination of cointegration rank and deterministic polynomial, Tests for r, s in the I(2) model, Parameters stability:rank and cointegrating space. IV. Considered the cointegrated SVAR model Conclusions What might be refined: I. It should automatically include seasonals. II. It should automatic include tests in the I(1) model. Conclusions The VAR, SVAR and VECM commands deal with non stationarity through the prior differencing or the incorporation of deterministic trend or cointegration. Stata needs more flexibility for dealing with non stationary series. In general, Stata is powerful, versatile and well designed program which maybe improved by adding some features and refinements. Bibliography Alan Yaffe, Robert (2007): Stata 10 (Time series and Forecasting), Journal of Statistical Software, December 2007, volume 23, software review 1, New York. Gottschalk, J. (2001): An Introduction into the SVAR Methodology: Identification, Interpretation and Limitations of SVAR Models, Kiel Institute of World Economics. Amisano & C Gianni (1997): Topics in Structural VAR Econometrics, New York. Dwyer, M. (1998): Impulse Response Priors for Discriminating Structural Vector Autoregressions, UCLA Department of Economics. Krolzig, H. (2003): General to Specific Model Selection Procedures for Structural Vector Auto Regressions. Department of Economics and Nuffield College. No 2003W15. Sarte, P.D. (1997): On the Identification of Structural Vector Auto Regressions. Federal Reserve Bank of Richmond, Canada, Sum: 45-68.