property i - Phi Delta Phi

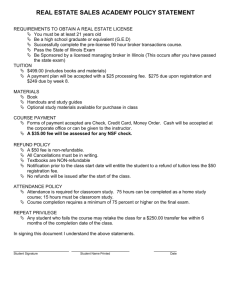

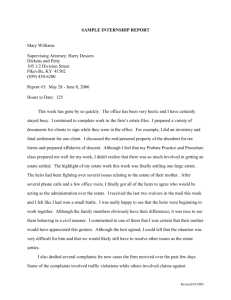

advertisement