Marketing Plan - kimberly doctorial portfolio

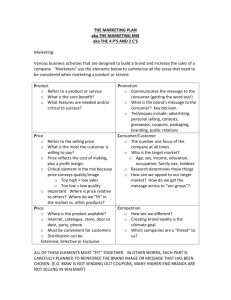

advertisement

0 Kimberly Tucker, Deo Sanders, Ray Walsh Marketing Plan 11/01/2010 Marketing Management 6800 Section 004 1 I. Review of financial & market performance: A) Market Position: Powers Incorporated is a computer company that is currently competing in two segmented markets, with two major brands. The target markets in which we are competing are the Work Horse and the Cost Cutter. The Stallion II brand targets the Workhorse segment while our Golden Saddle targets the Cost Cutter segment. In terms of salespeople, we currently have nine employees in London (5 Workhorse, 2 Cost Cutter, 1 Mercedes, and 1 Support), four in Berlin (2 Workhorse, 1 Cost Cutter, 1 Support), six in Toronto (3 Workhorse, 2 Cost Cutter, 1 Support), and four in Rio de Janiero (2 Cost Cutter, 1 Workhorse, 1 Support). Our rationale for entering into these geographic markets centers on the line of thinking that the other competitors, such as Refined IT, i3, and NGC Next Generation Computers, would pursue the low hanging fruits of the geographic market area of The United States. For example, every computer company, except for Powers Inc., initially entered the U.S.A. based on the market research concerning the 12-month potential demand (market size) and the price people are willing to pay. The United States had the highest potential demand for Cost Cutter and Work Horse. Also, the price people are willing to pay in the Cost Cutter Segment are highest in three areas: New York, LA, and Chicago. Atlanta is Fifth. Additionally, the Work Horse Segment has four of the top seven cities in the U.S.A market in terms of price willing to pay. Conversely, the European market, in terms of price willing to pay, was less in the Cost Cutter and the Work Horse segments than the United States market. Also, the 12-month potential demand for Cost Cutter was higher in the United States. However, for Work Horse, the 12-month potential demand was higher in London than any other U.S.A city. Based on these findings in the international business environment and the information found in the available 2 market segments (figure 1.1), we have chosen Work Horse and Cost Cutter to gain a strategic advantage grounded on unconventional thinking. Figure 1.1: Available Market Segments Available Market Segments (Market Structure) Mercedes Traveler Innovator Performance Work Horse Cost Cutter Price Copyright 2006 Ernest R. Cadotte Out of the five potential segments, Cost Cutter and Work Horse present a balance of price and performance, which allows for the greatest opportunity. Additionally, an initial consultation with the C.E.O., Dr. Bobbitt, supported our decision to pursue the target segments of Work Horse and Cost Cutter. We rationalized this decision based on underdeveloped technology and initially low market demand at the beginning stages of the simulation process. More specifically, research and development were unavailable to pursue the higher end clientele, such as the Mercedes segment. 3 Figure 1.2: Geographic Markets In Quarters 3 & 4, Powers Inc. geared their geographic markets, Europe, Canada, and Brazil, toward two target market segments: the Work Horse and Cost Cutter. We focused on the European market, specifically London, because they had the highest demand for Work Horse. We have since expanded our geographic market and brand to Berlin. The 12-month potential demand was forth for Cost Cutter and fifth for Work Horse in the Canadian market, i.e. Toronto. Both the Work Horse and Cost Cutter segments are in the top ten for potential demand in the Brazilian geographic market. Essentially, consistent with our unconventional strategies, we targeted substantial markets that were less appealing based on initial research. B) Market Performance: In the Cost Cutter segment, at the end of Quarter 3, we commanded a 72% market share with a demand of 63 out of a total of 87. At the end of Quarter 4, we commanded a 78% market share with a demand of 410 out of 524. There was a positive change in demand from quarter to 4 quarter of 367. There was also an increase in market share of about 6%. We held the lead for both the market share and market demand in the Cost Cutter segment for both Quarters 3 and 4. Please refer to Figures 1.3 and 1.4. Figure 1.3: Market Share Figure 1.4: Market Demand In the Work Horse segment, at the end of Quarter 3, we commanded nearly 57% of the market with a demand of 75 out of 132. Similarly at the end of Quarter 4, we commanded almost 59% of the market with a demand of 991 out of a total demand of 1684. The change in demand between the two quarters was a positive 916 with an increase in market share of about 5 2%. We held the lead for both market share and market demand in the Work Horse segment for these two quarters Figure 1.5: Market Share Figure 1.6: Market Demand In terms of total market share and market demand for every segment, we lag behind NGC because of their superior brand judgments, strategic locations, and target segment (Traveler). Powers Inc.’s brand judgments are three to twelve points away from reaching a grade of 70 in Europe and Canada for both the Cost Cutter and Work Horse segments. However, in terms of the top eight brands, Powers Inc. holds the top two brand judgments. According to price 6 judgments in Canada and Europe, the Cost Cutter and Work Horse brands are doing exceedingly well in all five target segments. However, the Stallion II brand is underperforming in the Cost Cutter segment. Still, this discrepancy is due to the fact that this brand is not geared toward the Cost Cutter clientele. These brand and price judgments suggest an average to below average performance. To make up for this loss, we should improve both of our Work Horse and Cost Cutter brand judgments to above 70%. To date, only NGC has been able to complete this minimal requirement. Accordingly, we should augment all of our brands in an effort to achieve this threshold. Figure 1.7: Total Market Share Figure 1.8: Total Market Demand 7 C) Financial Performance: According to our 4th Quarter sales performance, we sold a total of 1,428 units for both the Work Horse (Stallion II - 656) and the Cost Cutter (Golden Saddle - 772) brands. Our Stallion II brand brought in 1,930,878 in sales revenue and our Golden Saddle brought in 1,461,829. This equaled a total of 3,392,707 in sales revenue. Additionally, we allotted a total of 22,200 in rebates. The total cost of goods sold was 2,373,487. When you take the cost of goods sold, plus the rebates, and subtract them from the total revenues we have a total gross margin of 997,020. Please refer to figures 1.9, 1.10, and 1.11 for more details. Figure 1.9: Total Sales Sales - Total Brand Number of Units Sold Sales Revenue Rebates Cost of Goods Sold Gross Margin Stallion II 656 1,930,878 10,412 1,167,055 753,411 Golden Saddle 772 1,461,829 11,788 1,206,432 243,609 1,428 3,392,707 22,200 2,373,487 997,020 Total For an in depth analysis of our geographic market sales performances, see the following tables: Figure 1.10: Sales in Canada Sales - Canada Brand Number of Units Sold Sales Revenue Rebates Cost of Goods Sold Gross Margin Stallion II 122 378,078 6,100 217,044 154,934 Golden Saddle 196 362,404 4,900 306,296 51,208 Total 318 740,482 11,000 523,340 206,142 Figure 1.11: Sales in Brazil Sales - Brazil Brand Number of Units Sold Sales Revenue Rebates Cost of Goods Sold Gross Margin Stallion II 123 319,800 1,230 218,823 99,747 Golden Saddle 125 231,250 1,250 195,342 34,658 Total 248 551,050 2,480 414,165 134,405 8 Figure 1.12: Sales in Europe Sales - Europe Brand Number of Units Sold Sales Revenue Rebates Cost of Goods Sold Gross Margin Stallion II 411 1,233,000 3,082 731,188 498,730 Golden Saddle 451 868,175 5,638 704,794 157,743 Total 862 2,101,175 8,720 1,435,982 656,473 According to the 3rd and 4th Quarters’ marketing division of profitability, our operating profits are trending in a positive direction. Although our operating profits are currently in the negative, a 50% reduction for our operating profit has been seen from Quarter 3 (-525,963) to Quarter 4 (-205,902). II. Assessment of current situation and the market: A) Competitor Profile: The companies competing in Quarter 5 are Powers Inc., Refined IT, NGC, and i3. Our primary competitors are Refined IT and NGC. Refined IT has recently entered the London market. Besides Powers Inc, they are the only other company competing in the European market. They have a sales force in Europe of five people who are already targeting the Cost Cutter and Traveler segments. One brand, Avalanche 1, is doing particularly well because of superior price judgments due to a lack of competition in the European Traveler segment (figure 1.13). Also, this brand holds the number one position for ad judgments in the Work Horse segment (figure 1.14). They seem to be targeting the Traveler market segment due to price judgments and market share research. Per 4th Quarter results, Refined IT’s Cost Cutter market share is 10.8%. For the Work Horse, it is 5.6%. Their market demand in Cost Cutter is 57 out of a possible 524. Their demand in Work Horse is 95 out of a possible 1684. One of Refined IT’s 9 strengths is their above average demand and market share in the traveler segment. Another strength of this company is that they have a brand judgment grade of 66 out of 70 in the United States and European markets for the traveler segment. Although their target area (traveler) is different from ours (Cost Cutter and Work Horse), we have strategically identified that if they improve their brand judgments in the Cost Cutter and Work Horse segments, they will prove to be more of a threat to us in this geographic market in Quarter 5. Their price and ad judgments already put them in the position of being a formidable foe. Please see figures 2.1 and 2.2 below for these judgments. Figure 2.1: European Price Judgments Price Judgment - Europe Company Brand CostCutter Refined IT World. Refined IT Avalanche.1 Powers Inc. Powers Inc. Innovators Mercedes Work Horse Traveler 58 100 100 88 100 100 100 100 100 100 Golden Saddle 95 100 100 100 100 Stallion II 60 100 100 91 100 Figure 2.2: Top Ad Judgments for Work Horse 10 Our second major competitor is NGC. NGC boasts an astounding total market share of 43%, compared to Powers Inc.’s 33% (see figure 2.3). They hold one of the top three positions in almost every segment in terms of market share, market demand, brand judgment, ad judgment, and price judgment. Further analysis illustrates that this company commands the leading market share position in several target market segments. These market share leads are Mercedes (82.8%), Innovators (68.8%), and the Traveler (57.2%). NGC also has the highest market demand for the Traveler segment (1,026 out of 1,792), Innovators segment (126 out of 183), and Mercedes segment (29 out of 35). They are even the second major competitor in the Work Horse segment for market demand. Figure 2.3: Total Market Share According to brand judgments, two of NGC’s brands, TC 22X and AWC 22, are the top two brands for the Traveler segment with a grade of 75. Their WorkLoad XL brand is the top brand for the Innovators segment and the Mercedes segment. This brand is also the second 11 highest brand for the Work Horse segment and third highest for the Cost Cutter segment. In both the Work Horse and Cost Cutter segments NGC’s brand is in direct competition and second only to Powers Inc in brand judgments. Please see figures 2.4 and 2.5 for brand judgments in the Work Horse and Cost Cutter segments, the market segments pursued by Powers Inc. Figure 2.4: Top 8 Brand Judgments for Work Horse Figure 2.5: Top 8 Brand Judgments for Cost Cutter 12 NGC also has impressive price and advertising judgments. Their ad judgments place them in 2nd and 3rd place in the top eight advertisements for the Cost Cutter segment, right behind Powers Inc. They also closely follow Powers Inc. in the Work Horse segment for ad judgments because their ad judgment grade is a 55, compared to Powers Inc.’s 59. NGC has even achieved a grade of 100 in price judgments in the United States for the Work Horse and Cost Cutter segments. The following figure, figure 2.6, illustrates how Refined IT and NGC are Powers Inc.’s primary competitors. Figure 2.6: Competitor Highlights Competitor Tactical Highlights Total Demand Number of Sales Offices Total Sales Force Last Quarter Number of Brands for Sale Average Price Total Local Inserts Current Quarter Balanced Scorecard Powers Inc. Refined IT NGC Next Generation Computers 1428 606 1831 4 3 3 23 15 20 2 2 3 2387 2605 3000 32 4 35 0 0 5 13 B) SWOT: Internal External Strengths Opportunities Market Share (Workhorse, Costcutter) Market Demand Sales Office Locality European Market Dominance Travel Segment Europe Traveler Imitator position in the US Chicago More European Sales Offices STALLION II Price Judgments Weaknesses Threats Poor Brand Judgments Limited Brands Segmentation penetration United States penetration Ad Judgment NGC Brand crossover Refined IT market Entrance Economic Downturn An internal analysis of Powers Inc. reveals that the company’s strengths are founded on their command of the market share and market demand in the Work Horse and Cost Cutter segments. We have also dominated the European, Canadian, and Brazilian markets. This gives us a strategic advantage in the location of our sales offices. On the other hand, below average brand judgments and ad judgments (judgments that have not received a grade of 70 or above) and a limited number of brands and advertisements constitute the weaknesses of Powers Inc. Our other weakness revolved around the fact that we have not yet penetrated the geographic market of the United States. An external analysis of Powers Inc. brings to light our opportunities and threats. Our opportunities center on us being in a position to pursue the Traveler segment in Europe and expand our geographic market to the United States, where we can also focus on the Traveler segment. The other opportunities for our company are our ability to expand our sales offices in the European market and improve our Stallion II price judgments. However, we have several 14 critical threats that include NGC’s possible brand crossover, Refined IT’s entrance into our European market, and the downturn in the economy. C) Goals of the Firm: Powers Inc.’s mission statement states that “Powers Incorporated is a European computer company who is devoted to being the computer industry’s leading innovator, supplier, and profitable consumer - oriented company. We believe in delivering the highest quality and most reliable computing products and customer services.” We initially laid out certain strategies and goals in order to stay ahead of the competition. Powers Inc.’s focus is on large markets with highly competitive segments, even if they are more expensive. We pride ourselves on controlling the geographic markets that are in the middle of the cost/size continuum. Our competitive posture centers on building a market position and defending it, taking the lead and keeping it, and being a fast follower by imitating smart, competitive moves. Two distinctive competencies that have separated us from our competition are being one of the lowest providers in the market and being the market share leader. Currently, our goal to focus on large geographic markets has been achieved, although competitors in these markets are lagging behind what is seen in the United States. The markets we have chosen to compete in, Europe, Canada, and Brazil, are optimal in terms of the cost/size continuum, and we have been able to control these geographic markets so far. For example, in the Work Horse segment, Toronto is fifth in the 12-month potential demand and eighth in the price customers are willing to pay. Consistent with our initial goals, this moderate cost and demand has been realized. We have been able to build up a strong market position in each of our geographic locations in terms of our target segments. Based on market research and strategic 15 improvements, we are poised to defend our market dominance. As you will see in our Quarter 5 marketing strategy roadmap, we will be heavily targeting the Traveler segment, as well as having a small vested interest in the Mercedes segment. Based on NGC’s success with the Traveler segment, the creation of a similar brand geared toward this segment will springboard Powers Inc. in the direction of being a fast follower. While we are currently the market share leader in the both the Cost Cutter and Work Horse segments, we have not been efficient in terms of offering the lowest prices. In an effort to reverse this, we will be altering our pricing strategy for the next Quarter. III. Marketing Strategy Road Map: A) Customer Profile: In Quarter 5 we will continue to target the Work Horse and Cost Cutter segments. We will also begin to target the Traveler and Innovators segments. The customers who purchase our Work Horse brand are typically financial managers, office administrators, and corporate managers. The functions they usually look for in a computer product are bookkeeping and budgeting, word processing, and communication with other computers. The justification for demanding these applications lies in their desire to streamline the business process in terms of document creation and preservation. In order to achieve this streamlining process, the Work Horse clientele has to have a product that is secure and gives them peace of mind, is easy to use, is a low price, easy on the eyes, and available in all local markets. Please refer to figure 3.1 for a list of the wants and needs for the Work Horse segment. 16 Figure 3.1: Work Horse Customer Wants and Needs Customer Needs And Wants . Work Horse 'Peace of mind-safe,secure,no hassle 125 'Easy to use 122 'Computers are lowest priced 120 'Easy on eyes 120 'Available in all local markets 119 'Fast service response time 119 'Fast computer to computer links 119 'Established brand name 118 Our Stallion II brand targets the Work Horse segment. Based on the market research of what our Work Horse clientele demands, this brand focuses on offering a wide variety of office and bookkeeping software. The Stallion II provides peace of mind and security through antivirus software. This brand also delivers a product that is easy on the eyes by offering a 17” monitor and an expanded keyboard with hot keys. For a complete review of the Stallion II brand, please refer to figure 3.2. Figure 3.2: Stallion II brand Stallion II Base components X Standard desktop design X Digital video disk (DVD) read/write drive X High capacity hard drive X Office software-word, spreadsheets X Accounting/bookkeeping software X Business graphics software X Presentation software X Database software X 17" monitor for desktop X High performance processor X Expanded keyboard with hot keys X Antivirus software X 17 Expansion slots for adding new devices X Standard network/Internet connection X Windows for professionals X Even though this brand offers some key customer wants and needs, there is still room for improvement. Since we have a brand judgment of 67, this suggests only small alterations in our brand design need to be considered. In Quarter 5 we plan to make these adjustments by offering windows for professionals with high security protection and web design software to provide more security and diversify our product’s functionality and meet the threshold of 70. This modified brand will be entitled the Stallion III. In Quarter 5, we will also create a new Work Horse brand called the Thoroughbred because the success of the Work Horse segment in terms of market share and 12-month potential demand has lead us to create a similar brand with upgraded features. In addition to having the same features as the Stallion II, the Thoroughbred will offer a rugged portable design with standard battery because business professionals seem to prefer the freedom a laptop provides. This rationale is based on the fact that NGC has two brands that offer this feature and subsequently have a brand judgment of 75. We will also offer an eye-popping 19” monitor to make it easier on the eyes. In addition to these changes, we will supply a product with a very high capacity hard drive for more storage and windows for professionals with high security protection for added peace of mind. These new features are consistent with the Work Horse clientele’s wants and needs. To cover the costs of these additions, we will slightly raise the price to 3,099 in the European Market with no rebate and 3,199 in the Canadian market with a 100 rebate. This employs an odd pricing strategy in which our product is priced just below whole dollar amounts. The rationale for this strategy is that costumers will feel as if they are getting a bargain. Please see figure 3.3 for a table of this new brand. 18 Figure 3.3: Work Horse Thoroughbred brand Thoroughbred Base components X Rugged portable design X Digital video disk (DVD) read/write drive X Very high capacity hard drive X Office software-word, spreadsheets X Accounting/bookkeeping software X Business graphics software X Presentation software X Database software X Web design software X 19" high resolution monitor for desktop X High performance processor X Expanded keyboard with hot keys X Antivirus software X Expansion slots for adding new devices X Standard network/Internet connection X Standard battery for portable X Windows for professionals with high security protection X In addition to the Work Horse segment, we also targeted the Cost Cutter segment. Similar to the Work Horse brand, the Cost Cutter brand focuses on office administrators and corporate managers. However, data processors are key clientele for this segment. In terms of application, they favor word processing, bookkeeping and budgeting, and data managementaccounts for inventory. The justification for demanding these applications lies in their desire to streamline the business process in terms of document creation and preservation. These functions also allow them to efficiently manage data accounts and inventory. Thus, the Cost Cutter clientele has to have a product that is secure and gives them peace of mind, is easy to use, is easy to setup, is a low price, and has minimal complexity for its operators. 19 The Golden Saddle brand targets the Cost Cutter segment. Based on the market research of what our Cost Cutter clientele demands, this brand focuses on offering a wide variety of office, bookkeeping, and database software. Because this brand is not doing well in terms of brand judgments and profitability, we will modify the Golden Saddle brand. It has a brand judgment of 61 and only has a brand profitability of 127 dollars, which signify a need for improvement. In order to modify this brand accordingly, we will offer windows for professionals with high security protection for peace of mind, a rugged portable design with a standard portable battery for more freedom. This modified brand will be named the Golden Saddle I. Prices will remain the same (on average 1,875) because of superior price judgments. Figure 3.4: Cost Cutter modified brand Golden Saddle I Base components X Rugged portable design X Compact disk (CD) read/write drive X High capacity hard drive X Office software-word, spreadsheets X Accounting/bookkeeping software X Presentation software X Database software X 17" monitor for desktop X Mid-range processor X Expanded keyboard with hot keys X Antivirus software X Standard network/Internet connection X Standard battery for portable X Windows for professionals with high security protection X Consistent with our goals to be a fast follower that imitates smart, competitive moves, Powers Inc. will create two new brands targeting the Traveler and Innovators segments. NGC has been the most successful company in terms of brand, ad, and price judgments for the 20 Traveler segment. However, there reluctance to enter the European market provides us with an opportunity to create a similar brand that capitalizes on the untapped traveler segment. The Traveler clientele, which is composed of sales people, corporate managers, and engineers, demand presentation, word processing, and business software, portability. They also need a product that is easy on the eyes and can communicate with other computers. In order to comply with these demands, our Traveler brand, Pegasus, will offer the following features listed in figure 3.5: Figure 3.5: Pegasus brand Pegasus Base components X Rugged portable design X Digital video disk (DVD) read/write drive X High capacity hard drive X Office software-word, spreadsheets X Accounting/bookkeeping software X Business graphics software X Presentation software X Database software X Web design software X 15" monitor for desktop X High performance processor X Standard keyboard X Antivirus software X Standard network/Internet connection X Standard battery for portable X Windows for professionals with high security protection X Based on the price Travelers are willing to pay in the European market, our brand will be priced at 3,299. In terms of market share, market demand, and brand judgment, NGC and i3 command the Innovators segment. NGC dominates the Innovators market demand with 126 out of 183. I3 is 21 second with a demand of 43. NGC also holds 68.8% of the Innovator market share. In the United States, these two companies hold the top two positions in terms of brand judgments for the Innovators segment, with NGC achieving a grade of 44 out of a minimum of 70 and i3 achieving a grade of 38. However, Powers Inc. is a close third with a grade of 32. This is due to the fact that neither NGC nor i3 have entered the European or Canadian markets. Yet, according to the 12-month potential demand, London and Berlin are the third and fourth most important geographic locations for the Innovators clientele. Still, no other company has entered this market except for Powers Inc. Given this information, Powers Inc. has a great opportunity to target the Innovators segment in the European market. The Innovators clientele consists of engineers, managers, and data processors. In order to streamline their business and be more efficient managers and engineers, they demand a product that has web design and management applications, technical graphics, and statistical analysis software. This clientele also insists on having a computer product that has fast access to graphical images, is ultra fast and can handle large tasks, is quick to response to commands, and has fast computer to computer links. Please see figure 3.6 for a complete list. Figure 3.6: Innovator wants and needs Customer Needs And Wants . Innovators Fast access to graphical images 129 Ultra fast, handle large tasks 125 Quick response to commands 124 Fast computer to computer links 124 Can see, work on multiple programs 123 Fast processing and output 123 Want high performance over price 121 Able to tailor to individual needs 121 Easy to tie into local area network 120 22 In order to meet these customer demands, we will create a new Innovators brand that will target the European market, as well as the Canadian and Brazilian markets. This new brand, the Mustang, will offer several key features demanded by the Innovators clientele. Some of the features included in this brand are graphic, statistical analysis, engineering, and web design software. All of the components in the Mustang brand can be found in figure 3.7. Also, since the price the Innovators clientele are willing to pay in the European market ranges between 3,500 and 3,780, we will price our Mustang brand at 3,619. Figure 3.7: The Innovator brand - Mustang Mustang Base components X Rugged portable design X Digital video disk (DVD) read/write drive X Very high capacity hard drive X Office software-word, spreadsheets X Accounting/bookkeeping software X Business graphics software X Presentation software X Database software X Statistical analysis software X Engineering graphics software X Web design software X 19" high resolution monitor for desktop X High performance processor X Expanded keyboard with hot keys X Antivirus software X Expansion slots for adding new devices X Standard network/Internet connection X Standard battery for portable X Windows for professionals with high security protection X Current market research has shown that, although NGC has their product priority emphasizing the Travel segment and then the Work House, they have been successful in other 23 segments, such as the Innovators, Cost Cutter, and the Mercedes segments. This is mainly due to product feature spillover. For example, both the Mercedes and the Innovators segments value fast access to graphical images, as well as computers that are ultra fast and can handle large tasks. Due to these feature similarities, when customers from different segments view each product’s components, they will often choose products not necessarily consistent with their segmentation. Our Work Horse, Traveler, and Innovator brands do just that. The consistency of our product offerings across all segments allows each of our brands to reach consumers in different target segments. For instance, when customers seek peace of mind, our Thoroughbred, Mustang, Stallion III, and Pegasus brands offer both Antivirus software and Windows for professionals with high security protection. Similar the Thoroughbred and the Mustang boast standard network and Internet connections. This overlap between the Work Horse and Innovator segments offer the clientele exactly what they demand, specifically fast computer to computer links. Powers Inc. also seeks to have key advantages over both external competition and internal cannibalization. In order to minimize internal cannibalization we have instituted key differences in our brands that allow for differentiation amongst our segments. The Stallion III for example is the only standard desktop design that we will be featuring in Quarter 5. This key difference will allow our immobile customers albeit for business or personal reasons, the availability of a stationary setup. Another key difference among our segments is the absence of a Digital Video Disk (DVD) drive for the Cost Cutter segment. Since this clientele wanted the lowest price and minimal complexity for their operators, the Compact Disk (CD) was more suitable. 24 A) Marketing Mix Elements: In the Customer Profile section, we outlined our rationale for product development in terms of the target segment, brand design and augmentation, and the rationale for these decisions. We identified the Work Horse as our primary segment. In doing so, we first created the brand Stallion II. However, the brand judgment for this product was lower than the required grade of 70. Thus, we decided to modify the Stallion II by offering more security and software. This modified brand is called the Stallion III. In order to provide the Work Horse segment with more features and benefits, we created the Thoroughbred brand. This will be our first rugged portable design computer product, with Traveler segment crossover potential. The Cost Cutter segment has been our secondary target. We first created the Golden Saddle brand to focus on the needs of this clientele. This brand offered a lower cost and peace of mind through high security protection because this segment valued inexpensive products and security without hassle. We decided to modify this brand due to the fact that the Golden Saddle had a brand judgment of 61, which is below the minimum of 70. The augmented brand, Golden Saddle I, offered more security and freedom through a portable product. Besides this modified brand, we did not create a new Cost Cutter brand because we have decided to shift our secondary focus from the Cost Cutter segment to the Traveler segment. Based on market research, in Quarter 5 we have decided to pursue the Traveler segment. The rationale for doing so is due to low market product realization for the brands of the Refined IT Company. Additionally, the current market leader in the United States, NGC, has been reluctant to provide the Traveler clientele with a product in the European market. Thus, we designed a Traveler brand that would focus on the European Traveler segment. Based on the wants and needs of this segment, we created the Pegasus brand. This brand offers presentation, 25 word processing, and business software, as well as portability, because the Traveler clientele is primarily composed of sales people, corporate managers, and engineers. The last brand we developed for Quarter 5 was the Mustang, which is aimed at the Innovators segment. The rationale behind this move is identical to our decision to pursue the Traveler segment in that the product demand for the Innovators segment in European market has been ignored by other companies. In order to fulfill the needs and wants of the Innovators segment, the Mustang offers web design and management applications, great graphics, and analysis software. Our pricing strategy in previous quarters has been the average of the price people are willing to pay in each geographic market. For example, in Europe, we determined the price people were willing to pay in both London and Berlin for a specific segment, Work Horse. We then took the average of those prices and as the cost for our product in that geographic market and for that particular target segment. Essentially, we tried to provide the lowest cost for each segment while still making a profit. In Canada, our Stallion II brand was priced at 3,099 with a rebate 100 dollars. In the same geographic location, our Golden Saddle brand was priced at 1,849 with a rebate of 50 dollars. In this market, the Stallion II was identified as the first priority because this geographic area had more of a demand for the Work Horse segment. In the Brazilian market, the Stallion II sold for 2,600 with a 20 dollar rebate. Additionally, the Golden Saddle sold for 1,850 with a 20 dollar rebate. We decided to have the Golden Saddle as the first priority in this geographic market because there was more of a demand for the Cost Cutter segment. In the European market, we priced our Stallion II brand at 3,000 with a rebate of 15 dollars. The Golden Saddle brand was priced at 1,925 with a rebate of 25 dollars. In this geographic market, the Work Horse brand, Stallion II, was identified as the first priority. 26 Figure 3.8: Pricing for Powers Inc. Competitors` Price and Priority - Canada Company Brand Price Rebate Priority Point of Purchase Display Bonus Gift Powers Inc. Stallion II 3,099 100 1 Yes 0 0 Powers Inc. Golden Saddle 1,849 50 2 Yes 0 0 Competitors` Price and Priority - Brazil Company Brand Price Rebate Priority Point of Purchase Display Bonus Gift Powers Inc. Stallion II 2,600 20 2 Yes 0 0 Powers Inc. Golden Saddle 1,850 20 1 Yes 0 0 Competitors` Price and Priority - Europe Company Brand Price Rebate Priority Point of Purchase Display Bonus Gift Powers Inc. Stallion II 3,000 15 1 Yes 0 0 Powers Inc. Golden Saddle 1,925 25 2 Yes 0 0 The price judgments of these two brands for our target segments have been excellent. For example, our European Stallion II brand received a judgment of 91 in the Work Horse segment and a 100 in the Traveler, Mercedes, and Innovators segments. This suggests crossover potential. While this brand received a grade of 60 for the Cost Cutter segment in the European market, it was not geared to this segment. In Canada, the Cost Cutter brand, Golden Saddle, received a judgment of 96 and a 100 for all remaining segments. While the Stallion II made a 57 in the Cost Cutter segment, it was geared toward the Work Horse segment of this geographic market, in which it received a price judgment of 84. Based on these findings, the prices for our modified Work Horse and Cost Cutter brands, Stallion III and Golden Saddle I, will remain the same. However, the price of the Stallion III brand will be reduced to 2,899 with a 50 dollar rebate because we had it overpriced for this geographic market. 27 Figure 3.9: Price Judgments Price Judgment – Canada Company Brand CostCutter Innovators Mercedes Work Horse Traveler Powers Inc. Golden Saddle 96 100 100 100 100 Powers Inc. Stallion II 57 100 100 84 97 Price Judgment – Europe Company Brand CostCutter Innovators Mercedes Work Horse Traveler Powers Inc. Golden Saddle 95 100 100 100 100 Powers Inc. Stallion II 60 100 100 91 100 However, both the new Work Horse, Traveler and Innovators brands will have new prices. In the Canadian market, the new Work Horse brand, the Thoroughbred, will have a retail price of 2,999 with a 50 dollar rebate. This brand will have first priority in this geographic market. This price was determined through research on the price people are willing to pay in this market and the cost of goods already sold for this segment in this market. Since the Work Horse is the first priority in the Canadian market, we only have point of purchase displays for these two brands. Again, based on market research, our Traveler brand for this market, the Pegasus, will be priced at 3,054 with no rebate and our Innovators brand, the Mustang, will have a price of 3,580 with a 50 dollar rebate. In the Brazilian market, the Thoroughbred brand will be priced at 2,585 with a 20 dollar rebate. The Traveler brand, Pegasus, will have a price of 3,058 with a 15 dollar rebate. The price of the Mustang brand will be 3,512 with a rebate of 50 dollars. These prices were determined based on a competitive analysis of what these segments were willing to pay in the Brazilian 28 market. Our top two priorities are focused on the Thoroughbred and Golden Saddle I brands. They also contain the point of purchase displays because the demand is higher for the Work Horse and Cost Cutter segments. Finally, in the European market, the new Work Horse brand, the Thoroughbred brand design will be priced at 3,099 with a 30 dollar rebate. The price of the Traveler brand, Pegasus, will be 3,449 with a rebate of 25 dollars. The Innovators brand, the Mustang, will have a price of 3,619 with a 50 dollar rebate for this geographic market. Again, these pricing decisions were based on a competitive analysis of what the Innovators, Traveler, and Work Horse segments were willing to pay in the European market. The Traveler and Work Horse brands were our top two priorities. The rationale for this priority decision is based on the 12-month potential demand. For this geographic market, we had three point of purchase display groups: the Thoroughbred, Pegasus, and the Mustang. The findings in the 12-month potential demand research are also the rationale behind our point of purchase decisions. Figure 3.10: New Quarter 5 Prices Canada Brand Available for Sale Retail Price Price Rebate Sales Priority Point of Purchase Display Stallion III X 2,899 50 2 Golden Saddle I X 1,849 50 4 Thoroughbred X 2,999 50 1 Pegasus X 3,054 0 3 Mustang X 3,580 50 5 X X Brazil Brand Available for Sale Retail Price Price Rebate Sales Priority Point of Purchase Display Stallion III X 2,600 20 3 Golden Saddle I X 1,850 20 2 X Thoroughbred X 2,585 20 1 X Pegasus X 3,058 15 4 Mustang X 3,512 50 5 29 Europe Brand Available for Sale Retail Price Price Rebate Sales Priority Point of Purchase Display Stallion III X 3,000 15 2 Golden Saddle I X 1,925 25 5 Thoroughbred X 3,099 30 1 X Pegasus X 3,449 25 3 X Mustang X 3,619 50 4 X In terms of promotional activities, Powers Inc. tried to design advertisements that persuaded each target segment to buy a particular brand of our product by creating the right message and placing it in the right geographic market. However, according to the International Advertising Federation, all advertisements across all segments have received a very poor rating. In previous quarters, our Cost Cutter ad (Stallion II) received a grade of 52, the highest in this segment. We held the second and third places in the Work Horse segment (Stallion II and Golden Saddle respectively), with a grade of 60 and 59. Figure 3.11: Ad Judgments Ad Judgment – Canada Company Ad CostCutter Innovators Mercedes Work Horse Traveler Powers Inc. Golden Saddle 43 48 44 59 39 Powers Inc. Stallion II 52 45 46 60 49 Ad Judgment – Europe Company Ad CostCutter Innovators Mercedes Work Horse Traveler Powers Inc. Golden Saddle 43 48 44 59 39 Powers Inc. Stallion II 52 45 46 60 49 30 Our advertisement decisions were based on the needs and wants of our target segments. Like the brands we created, the benefits we chose to stress and prioritize in our ads were determined by what needs, features, and components were most important to the particular segment our ad was targeting. Our Stallion II ad was geared toward the Work Horse segment. Because this segment valued a product that gave them peace of mind, was easy to use and easy on the eyes, and had bookkeeping and work processing software, we decided to emphasize these things in our advertisement. Please see figure 3.12 for the benefits and the prioritization of those benefits offered in our Work Horse, Stallion II ad. We geared our Golden Saddle ad toward the Cost Cutter segment. This target segment valued a computer product that gave them security, was easy to use, easy to setup, and gave the clientele minimum complexity. They also demanded a product that was priced at a lower cost but could still perform a variety of tasks and functions. We designed this Cost Cutter advertisement around these wants and needs. Figure 3.13 illustrates the benefits we chose to stress and prioritize in this Golden Saddle ad. In order to make our ads more visually appealing, we added a picture or two. Figure 3.12: Stallion II Advertisement Stallion II [Stallion II] Mention brand name 6 Manufacturer`s rebate 1 High speed/execution time 3 Easy to use, simple design 4 Easy on eyes with larger screen 5 Ready to use, bundled software 2 Picture people in travel setting 7 31 Figure 3.13: Golden Saddle Brand Golden Saddle [Golden Saddle] Mention brand name 1 Manufacturer`s rebate 5 High speed/execution time 4 Do variety of tasks 3 Easy to use, simple design 2 Easy on eyes with larger screen 6 Ready to use, bundled software 7 Picture business professionals 8 2 2 We justified the media placement of these two ads based on the 12-month potential demand. We ran both the Stallion II and Golden Saddle ads seven times in the Canadian market because the Work Horse and Cost Cutter segments both had a high potential demand in this geographic location. In Brazil, we only ran the Stallion II ad because the Work Horse had a higher potential demand. In Europe, we concentrated on running the Stallion II and Golden Saddle ads in the city of London because both the Work Horse and Cost Cutter segments had a high potential demand in this geographic location. Figure 3.14: Advertisement Placements Local Advertising – Canada City Company Ad Number of Inserts Toronto Powers Inc. Stallion II 7 Toronto Powers Inc. Golden Saddle 7 Local Advertising – Brazil City Rio de Janeiro Company Powers Inc. Ad Stallion II Number of Inserts 1 32 Local Advertising – Europe City Company Ad Number of Inserts Berlin Powers Inc. Stallion II 1 London Powers Inc. Stallion II 10 London Powers Inc. Golden Saddle 6 The placement of these advertisements and the number of times will largely remain the same for Quarter 5. However, the number of times they will run in their perspective geographic markets will increase. Please see figure 3.15 for the specific numbers. Figure 3.15: Quarter 5 Allotted Ads for Stallion II and Golden Saddle Canada Number of times ad should run in market City Cost Toronto Stallion II Golden Saddle 3,500 6 5 Brazil Number of times ad should run in market City Cost Rio de Janeiro Stallion II Golden Saddle 3,500 4 4 Europe Number of times ad should run in market City Cost Stallion II Golden Saddle Berlin 6,000 7 4 London 7,000 10 4 Besides increasing the numbers for the advertisements that have already been created and have already been running in the market, we will also modify the Work Horse and Cost Cutter ads because they have low ad judgments. We will also develop two new ads in Quarter 5. These new advertisements will be geared toward the Traveler and Innovators segments. Due to extremely low ad judgments, we modified our Work Horse ad. This Stallion III ad now 33 emphasizes that Powers Inc. is the highest rated Work Horse brand. It also emphasizes the software the Work Horse clientele has demanded. Please see figure 3.16 for a full description of our modified Work Horse advertisement. Besides the Stallion III, we have also modified the Golden Saddle ad in the hopes of raising our ad judgments. Based on market share research and the wants and needs of the Cost Cutter segment, which this ad is targeting, we have modified the Golden Saddle ad accordingly. In the modified ad, Golden Saddle I, we have emphasized that our company has the highest rated Cost Cutter brand. Like the Work Horse ad, this ad also emphasizes the software applications provided in our Cost Cutter brand. Please refer to figure 3.17 for a full description of our modified Cost Cutter advertisement. Figure 3.16: Modified Stallion III Ad Stallion II [Stallion III] Mention brand name 8 Manufacturer`s rebate 1 Do variety of tasks 4 Bookkeping/budgeting applications 5 Word processing application 6 Easy to use, simple design 3 Easy on eyes with larger screen 7 Ready to use, bundled software 9 Figure 3.17: Modified Golden Saddle I Ad Golden Saddle [Golden Saddle I] Mention brand name 1 Manufacturer`s rebate 6 Do variety of tasks 5 Bookkeping/budgeting applications 4 Word processing application 2 Data management application 7 34 Easy to use, simple design 8 Highest rated brand-Cost Cutter 3 In addition to modifying these two ads, we have also decided to develop two new advertisements for our newly created Traveler and Innovators brands. The rationale behind this move is so that we can get the word out for these two new products. Based on the feature demands and the wants and needs of the Traveler segment, we designed our Traveler ad, Pegasus, to emphasize that this product is easy on the eyes, has a rugged design, is ready to use, and has high speed and execution time. Please refer to figure 3.18 for our Pegasus advertisement. Figure 3.18: Traveler Ad, Pegasus Pegasus [Pegasus] Mention brand name 2 Manufacturer`s rebate 9 High speed/execution time 7 Presentation application 8 Easy on eyes with larger screen 4 Ready to use, bundled software 3 Rugged design for portability 5 Link PC to local network/Internet 6 Picture people in travel setting 1 In addition to creating a Traveler ad, we also designed an Innovator ad, entitled the Mustang. In order to determine the benefits and the prioritization of those benefits that this ad will emphasize, we researched the feature demands and product wants and needs of this segment. Based on these findings, our Mustang ad will emphasize engineering and business software, web design tools, and a product that can tackle really big problems. Please refer to figure 3.19 for a full description of this Innovator advertisement. 35 Figure 3.19: Innovator Ad, Mustang 4 Mustang [Mustang] Mention brand name 9 Manufacturer`s rebate 8 High speed/execution time 7 Tackle really big problems 6 Engineering design application 2 Business graphics application 3 Web design tools 4 Link PC to local network/Internet 5 Picture engineering setting 1 4 We justified the media placement of these two new ads in Quarter 5 based on the 12month potential demand. While we have every segment ad running in each of our geographic markets, these research findings prompted us to concentrate our Work Horse, Stallion II ad and our Traveler, Pegasus ad in the European Market. In Brazil, we concentrated on running our Stallion II and Golden Saddle advertisements. In the Canadian market, we focused on running our ads for the Work Horse, Cost Cutter, and Traveler segments. Again, the rationale in determining the prioritization of which geographic market would concentrate on running which ad and its corresponding target segment was based on the demand of each segment in each geographic location. Figure 3.20 provides the number of times the Pegasus and Mustang ads should run in a specified geographic market. Figure 3.20: Allotted Ads for Pegasus and Mustang Canada Number of times ad should run in market City Toronto Cost 3,500 Pegasus Mustang 6 3 36 Brazil Number of times ad should run in market City Cost Rio de Janeiro Pegasus Mustang 3,500 2 2 Europe Number of times ad should run in market City Cost Pegasus Mustang Berlin 6,000 11 4 London 7,000 14 4 Also, in figure 3.21 there is a full description of the number of times each ad should run in each geographic market and in which media outlet. We determined the media placement of each advertisement based on the consumer characterisctics of each target segment and the geographic placement of each ad based on the 12-month potential demand. For example, the Work Horse clientele is composed of financial managers, office administrators, and corporate managers. Thus, in the European market we placed our Work Horse ad in executive business magazines, daily newspapers, general news magazines, general business magazines, and business newspapers. However, the media placement of every ad is not the same due to the fact that Powers Inc. would like to cover all its bases. Essentially, we placed some of the same segment advertisements in different media outlets in order to figure out which combination is more appealing to our target segment and which one can reach our target segment more effectively. Figure 3.21: Media Placement of each Ad in each Geographic Market Canada Number of times ad should run in market Media Cost Stallion II Golden Saddle Pegasus Mustang Business newspapers 19,000 1 0 2 1 General business magazine 13,500 1 0 0 0 37 Computer magazines 4,300 1 1 0 0 General news magazines 6,900 1 1 0 0 Leading trade journals 6,300 1 1 1 0 New venture magazines 7,800 1 1 0 0 Sports magazines 21,500 0 0 0 0 Executive business magaz 25,000 0 0 2 0 Science & technology mag 13,300 0 0 0 0 7,000 0 1 1 2 16,600 0 0 0 0 Daily newspaper Leisure & entertain mag Brazil Number of times ad should run in market Media Business newspapers Cost Stallion II Golden Saddle Pegasus Mustang 12,000 1 1 1 1 General business magazine 8,500 1 0 0 0 Computer magazines 3,000 0 0 0 0 General news magazines 4,500 1 1 0 0 Leading trade journals 4,000 0 0 0 0 New venture magazines 4,300 0 0 0 0 Sports magazines 13,000 0 0 0 0 Executive business magaz 15,000 0 0 0 0 Science & technology mag 7,000 0 0 0 0 Daily newspaper 4,300 1 2 1 1 Leisure & entertain mag 7,500 0 0 0 0 Europe Number of times ad should run in market Media Cost Stallion II Golden Saddle Pegasus Mustang Business newspapers 20,000 3 0 4 0 General business magazine 14,000 3 0 0 0 Computer magazines 4,500 0 0 5 0 General news magazines 7,000 5 0 3 0 Leading trade journals 6,500 0 0 7 0 New venture magazines 8,000 0 0 0 0 Sports magazines 22,000 0 0 0 0 Executive business magaz 26,000 3 0 0 0 Science & technology mag 14,000 0 0 0 0 8,000 3 0 6 0 17,000 0 0 0 0 Daily newspaper Leisure & entertain mag 38 Finally, Powers Inc. will expand their sales operations in the European market place in Quarter 5. Based on the success in both London and Berlin, we have decided to open up additional sales offices in Paris and Rome. Our sales people will focus on three segments: Work Horse, Travel, and the Innovators. From the aforementioned market research both the 12-month potential demand and price willing to pay, these markets present a huge chance for success. For instance, in Paris the 12-month potential demand is 4578 compared to Berlin’s potential of 4928. This closeness and vacancy of this geographical market makes both Paris and Rome appealing. In terms of salespeople with the inclusion of our two new brands we will now extend to 5 new sales people in London, focusing on our Pegasus brand and 3 in Berlin focusing on this same segment. Additionally, to take advantage of our new Innovators brand, the Mustang, we will extend new salespeople in the same geographical markets, London and Berlin. In both these markets we will add 4 new salespeople for each segment, bring our new total to 16 in London and 12 in Berlin. In the Canadian marketplace we will be adding two new salespeople to each of our new segments, the Innovators and Travelers brand. This will bring our new total of Canadian salespeople to 10 total salespeople. In our Brazilian market we will also increase our salespeople to meet the demand and launch our two new brands. We will have 1 person selling the Innovators brand, Mustang and 2 selling our Travelers brand, the Pegasus. This will bring our new Brazilian total to 7 salespeople.