medical expense reimbursement accounts

advertisement

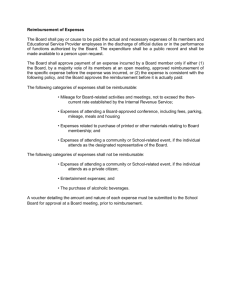

EXPENSE REIMBURSEMENT ACCOUNTS If available as a plan benefit option, expense reimbursement accounts allow you to establish an account to reimburse certain types of expenses on a tax exempt basis. There are two types of reimbursement accounts which may be elected. The first is the Medical Expense Reimbursement Account to reimburse uninsured out-of-pocket medical expenses, and the second is the Dependent Care Expense Reimbursement Account to reimburse dependent day care expenses. HOW DO THE REIMBURSEMENT ACCOUNTS WORK? Each month, pre-tax payments are made to an account set up in your name. As one of your Section 125 Flexible Benefit Plan elections, you can specify the payment amount to be set aside on a tax-free basis for one or both of the reimbursement accounts. As you incur qualified medical expenses or dependent day care expenses, you can submit a voucher form for reimbursement from the proper account. HOW DO I GET REIMBURSED FOR MY QUALIFIED EXPENSES? Each month in which you incur an expense, you may submit a voucher form for reimbursement. This voucher form must be accompanied by your original receipts or, in the case of a dependent day care expense, a dependent care provider acknowledgment form. These forms will be provided to you. The voucher will be processed and you will be sent a reimbursement check for your expense(s). The medical expense reimbursement check will be for the expenses claimed up to the maximum benefit amount you elected for the year less expenses previously reimbursed. The dependent care expense check will be for the expense you claimed up to the amount you have in your account. WHAT HAPPENS IF MY EXPENSES ARE LESS THAN THE AMOUNT SET ASIDE? “USE IT OR LOSE IT” Any expense dollars not used for expenses are forfeited. It is very important that you be conservative and accurate when estimating your expenses for the plan year. IMPORTANT GUIDELINES FOR ENROLLMENT IN REIMBURSEMENT ACCOUNTS 1. Be sure that the amount set aside is conservative – amounts not used for qualified expenses cannot be carried over or returned to you. 2. You cannot be reimbursed for these expenses from any other source. 3. All expenses to be reimbursed must be incurred in the plan year in which your contributions are made. 4. Expenses reimbursed under the Plan may not be used when calculating your medical expense deduction or the dependent care tax credit. 5. You have a 90-day grace period at the end of the plan year to request reimbursement of expenses you incurred during the plan year. 6. You should consult with your tax advisor concerning participation in the reimbursement accounts. MEDICAL EXPENSE REIMBURSEMENT ACCOUNTS The Medical Expense Reimbursement Account can benefit you if you have any predictable out-ofpocket medical, dental or vision care expenses. Only expenses incurred for you or your dependents during the plan year may be reimbursed. For the Medical Expense Reimbursement Account, you will only be allowed to change your benefit election due to termination of your employment. HOW MUCH IS AVAILABLE FOR REIMBURSEMENT? The total amount of a qualified expense is available for reimbursement upon receipt of a voucher and original bill or receipt. The amount of the reimbursement, however, will not exceed the total contribution for the plan year less any reimbursements paid to date. Total reimbursements for the plan year will not exceed the contribution amount for the plan year. IS THERE A CONTRIBUTION LIMIT? Maximum amount available under the Medical Expense Reimbursement Account is $3000 per plan year. MEDICAL EXPENSE REIMBURSEMENT WHAT TYPES OF EXPENSES ARE ELIGIBLE? Examples of eligible medical expenses may include, but are not limited to: Acupuncture Alcohol and Drug Rehabilitation Expenses (inpatient treatment only) Ambulance Anesthetist Artificial limbs and teeth Blood pressure monitor Certain corrective surgery Contraceptives Chiropractor Dental treatment Diabetic supplies Eye exam, prescription eyeglasses, and contact lenses, contact lens solution and enzyme cleaners Gynecologist Hearing aids and batteries Hospital and skilled nursing facility Laboratory fees Laser eye surgery Massage for medical reasons Medical examinations Medical monitoring and testing devices (ex. blood pressure and glucose monitors) Obstetrics Orthodontia expenses as treatment is provided* Over the counter drugs and medications for treatment of a medical condition (see next page) Over the counter items for smoking cessation Physical therapy provided by licensed therapist Physician Prescription drugs Rental or purchase of portable medical equipment Stop smoking program Support or corrective devices Transportation expenses relative to medical care, including medical mileage at the rate allowed by the tax code Weight Loss Program for obesity** (excludes food, exercise equipment and exercise classes) X-rays * Orthodontia claims cannot be accepted for the entire contracted amount. Claims will be accepted for the initial down payment usually associated with the appliances. Monthly payments will also be accepted as the charge for the medical services rendered for that month. ** You will be required to submit a Dr’s Prescription outlining the diagnosis and medical necessity in order to claim these types of expenses. Examples of ineligible over the counter medications may include, but are not limited to: ALL OVER THE COUNTER MEDICATIONS ARE INELIGIBLE EFFECTIVE JANUARY 1, 2011( see memo) DEPENDENT CARE EXPENSE REIMBURSEMENT If you incur dependent day care expenses so that you and your spouse can work, the dependent day care expense reimbursement portion of the plan will allow you to submit dependent day care expenses reimbursement for a qualifying dependent. Remember that to be eligible for this program, your spouse (if you are married) must work, go to school full time, or must be incapable of self-care. WHO IS A QUALIFIED DEPENDENT? A qualifying dependent lives in your home and is: 1. Your dependent under age 13 for whom you may claim an exemption deduction, or for whom you are the custodial parent, if separated or divorced; 2. Your dependent who is physically or mentally not able to care for himself or herself, and spends at least 8 hours daily in your home; or 3. Your spouse who is physically or mentally not able to care for himself or herself, and spends at least 8 hours daily in your home. WHAT ARE ELIGIBLE EXPENSES? You may be reimbursed for dependent care for a qualified dependent provided either inside or outside of your home. If provided outside the home, the dependent care center or provider must comply with all federal, state and local regulations, if applicable. In addition, the center or provider must be willing to complete the dependent care provider acknowledgment form and to provide the name, address and social security number or tax identification number of the care provider. Expenses may not be reimbursed if care is provided by one of the following: 1. Someone you may claim as a dependent for federal income tax purposes; 2. Your child unless the child is age 19 or older by the end of the year. WHAT IS THE MAXIMUM I CAN CONTRIBUTE? In most cases, you may contribute up to $5,000 per year; however, that amount may be reduced if: 1. You are married and file a separate tax return, the maximum contribution is $2,500. 2. You or your spouse earns less than $5,000 a year, the maximum contribution is equal to the lesser income amount. WHAT IS AVAILABLE FOR REIMBURSEMENT? Upon receipt of the voucher and acknowledgement form, you will be reimbursed for the expense you claimed up to the amount you have in your account. If your voucher is for an amount in excess of the amount in your account, the balance of the expense will be carried forward to future months as additional payments are received for your account. TAX CREDIT ALTERNATIVE You should be aware that you may be able to take a federal tax credit on the amount you pay for dependent care expenses instead of participating in the dependent care expense reimbursement account. You cannot claim the tax credit for expenses that have been reimbursed through the plan. Please consult you tax advisor to determine which plan may be most advantageous to you. IMPORTANT TAX INFORMATION Regardless of whether you participate in the dependent day care plan under Section 125 or claim the credit on you income tax, you must provide the IRS with the name, address and taxpayer identification number (TIN) of your dependent day care provider(s) by completing Schedule 2 of Form 1040A or Form 2441 and attaching it to you annual income tax return. Failure to provide this information to the IRS could result in loss of the pre-tax exemption for your dependent day care expenses. Wellington Benefits EMPLOYEE EXPENSE WORKSHEET EMPLOYER: NAME OF EMPLOYEE: SOCIAL SECURITY #:_____________________________DATE OF BIRTH:_____________ MARITAL STATUS: ________________ NUMBER OF DEPENDENTS:________________ ESTIMATED USE ONLY I.OUT-OF-POCKET MEDICAL EXPENSES: Type of Expense Health insurance Deductibles Doctor Office Visits Physicals Prescription Drugs Dental Costs (check-ups, cleaning, fillings) Orthodontia Costs (braces, exams, etc.) Vision & Eye Care (glasses, contacts) Surgery Other Health Related Expenses Specify ANNUAL COST ELECTION $ TOTAL AVERAGE MONTHLY EXPENSE (divide total by 12 or number of months being paid if less than 12) II. DEPENDENT OR CHILD CARE EXPENSES: Child Care Expenses $ Other Employment Related DDC Costs TOTAL: _______ AVERAGE MONTHLY EXPENSE (divide total by 12 or number of months being paid if less than 12) This is a worksheet only and does not obligate you in any way. If you decide to participate in either of the expense reimbursement accounts or in both of them, there may be a monthly administration fee to be payroll deducted. Remember that you should review you tax situation carefully as to the tax advantage of the dependent care tax credit compared with participation in the dependent care expense reimbursement portion of the Section 125 Flexible Benefit Plan. Newton-Conover City Schools FLEX NUMBER: 75028 The Metavante Debit Card is now available for Medical Reimbursement Flexible Spending Accounts. Cards can also be issued to dependents for no additional fee. If the card is lost or stolen, replacement cost is $10.00 and will be deducted from account balance. Claims can also be submitted directly for reimbursement. If funds remain in your account after the end of the plan year, you may also use the debit card during the 2½ month grace period. The system will deduct all remaining funds from your old plan year and then deduct any balance from the new plan year, if you continue to participate. The IRS requires validation of most transactions – you must submit receipts for verification of expenses, when requested. Claim forms can be found on our website, www.ffga.com. Copies can either be mailed to First Financial Administrators, Inc. (P.O. Box 670329 Houston, TX 77267-0329) or faxed to (800) 298-7785. Because of innovative coding of eligible medical items, receipts from Walgreens, WalMart, Target, and Drugstore.com - for example - do not need to be submitted; however, you must pay for non-eligible items separately. Where to use your debit card for eligible unreimbursed medical expenses: Pharmacies, always use your debit card at the pharmacy counter only! In-Store Pharmacies – If “merchant code” is programmed “pharmacy,” the expense will be authorized. However, if the MasterCard transaction code is programmed “grocery/retail,” THE TRANSACTION MAY BE DENIED! THE DEBIT CARD MAY NOT WORK AND THE EXPENSE MAY BE DECLINED IN SOME GROCERY/DISCOUNT STORES Physician Offices Specialist Physician Offices Dental Offices Vision Care Providers Medical Facilities Medical Clinics Hospitals, including Emergency Rooms First Financial Administrators, Inc. can provide you with a list of eligible expenses associated with your Medical Reimbursement Flexible Spending Account. This card is a signature debit card and does not require a PIN for use. Transactions must always be submitted as “credit.” Participants may always review Flexible Spending www.ffga.com. Call (866) 853-FLEX for more information. **Card will deactivate upon termination of employment Account balances online at