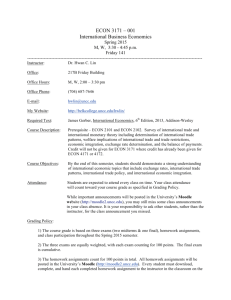

University of North Carolina at Charlotte

advertisement