Lesson 12 - Rental Income and Expense

advertisement

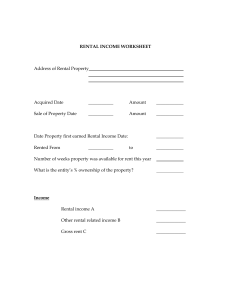

VITA: Winter 2011 Lesson 12: Rental Income and K-1s Winter 2011 Kristina Shroyer © Kristina Shroyer 2011 Lesson 12 – K-1's Some K-1's are in scope for VITA Certain entities: for example partnerships, S-Corporations, Trusts do not themselves pay taxes Instead taxes are passed through the shareholders or beneficiaries of these entities ♦ ♦ For example in a 50/50 partnership the income and expenses of the partnership would be reported 50/50 to each partner and each partner would report that income on their individual tax returns – This type of income is reported on Schedule K-1 Income reported to a shareholder or beneficiary on Schedule K-1 is included in various places on the shareholder's individual tax return depending on the type of income Partners/Members/Beneficiaries of these entities are taxed on their share of the entity's income regardless of whether or not that income was distributed to them The only K-1 type income in scope for VITA is: Interest Income (goes to Schedule B) Dividend Income (goes to Schedule B) Net short term capital gains and losses (goes to Schedule D – line 5) Net long term capital gains and losses (goes to Schedule D – line 12) Tax Exempt Interest Income (Form 1040 line 8b) New this year – Royalty Income (goes to Schedule E – line 4) ♦ Royalty income is only in the scope of VITA if it's reported on a Schedule K-1 Any other income on K-1 is out of scope of VITA so the taxpayer with anything else on their K-1 should be referred to a professional tax preparer © Kristina Shroyer 2011 Lesson 12 – K-1's If you enter the K-1 correctly in Taxwise the amounts should transfer to the correct places on the tax return that I indicated above, YOU SHOULD DOUBLE CHECK THOUGH K-1's are slightly different depending on what type of entity they come from but the main idea is the same…let's look at a K-1 from each type of entity Taxwise does NOT know if you entered something incorrectly and can have errors If you do the return by hand (we don't do that) you would have to put the items in the correct places yourself K-1 (Form 1041 – Trust) K-1 (Form 1065 – Partnership) K-1 (Form 1120S – S Corporation) The general information on the K-1 goes on page 2 of Schedule E and the rest of the items in scope go to the places on the return listed on the previous page © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses Introduction This lesson is going to show you how to report rental income and expenses for US Citizens and resident aliens ♦ ♦ There are some parts in this lesson that are difficult and outside the VITA scope except in certain situations, I'll point them out as we go Let's look at the Schedule E for a second and line 17 of Form 1040 A lot of this is out of scope for VITA EXCEPT in the situation This is for taxpayers that rent out their home or other property but renting is not their actual business This is not for taxpayers in the business of renting properties of assisting military and other government employees living abroad with limited access to professional taxpayers and other resources Where are rental income and expenses reported? Part I of Schedule E © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses What is rental income? A taxpayer who rents out a home, a room or some other property is engaged in an income producing activity ♦ Gross rental income includes: ♦ ♦ ♦ ♦ ♦ ♦ Rental income is reported when received and expenses when paid Accrual Method of accounting ♦ Ordinary rent payments Advance rent Payments for breaking a lease Security deposits (in some cases – see the tip on page 12-3) Expenses paid by the tenant FMV for services received instead of rent payments Cash Method of accounting (MOST INDIVIDUAL TAXPAYERS) ♦ This type of income received by US citizens and resident aliens must be reported for property located in the US or a foreign property Rental income is reported when earned and expenses when incurred Read CAUTION on page 12-3 regarding Fair Rental Value Basically this is talking about the situation of renting to friends or relatives for less than fair rental value (this situation would be out of scope for VITA) © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses What qualifies as a Rental Expense Mortgage Interest and Property Taxes When a taxpayer rents out a home instead of living in it these are no longer itemized deductions (we'll talk about itemized deductions in Chapter 20) but rental expenses If the taxpayer rents the home out part of the year and lives in it part of the year ♦ Mortgage Interest and Property taxes must be allocated between the Schedule E and the Schedule A It also could be that the taxpayer only rents out part of the home ♦ In this case also mortgage interest and Property taxes must be allocated between the Sch E and Sch A The allocation can be based on time (say the property was a rental 5 months and a home 7 months) This could be based on area (sq feet of rental vs sq feet of home part) Mortgage Interest is still reported on Form 1098 (just like it is for mortgage interest deductible as an itemized deduction) Form 1098 may include property taxes or the taxpayer may need to provide other documentation (such as a property tax statement and canceled check) Example at the bottom of page 12-4, Exercise on page 12-5 © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses What qualifies as a Rental Expense (continued) Property Insurance This is a deductible rental expenses for the time the property is considered a rental property If the property is only rented for a portion of the year only the property insurance allocable to that portion of the year is deductible If only a portion of the residence is rented an allocation must also be done Insurance premiums paid more than a year in advance cannot be deducted all in one year ♦ Other deductible rental expenses The only deductible portion in the current year is the amount that covers that year See list on page 12-4 The expenses may only be deducted in full if they are solely for the rental property (so they must be allocated if they are for a property where only a part of it is rented out or for a property not rented the entire year) Read tip on page 12-4 at the top © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses What qualifies as a Rental Expense (continued) Auto and Travel Expenses These expenses can be deducted on Schedule E as long as they are attributable to the production of rental income Taxpayer must separate personal and business portions of the travel and be able to substantiate it with records (taxpayers MUST keep mileage records, total and business) If the taxpayers personal auto is used for the travel the rental-related portion of the expenses may be deducted using ♦ ♦ Repairs vs. Improvements Repairs keep the property in good working condition and is a current year deduction as a rental expense Improvements add to the life or material value of the property and the cost must be recorded as an asset and depreciated over the asset's useful life ♦ The total cost of an improvement includes labor, material and installation Look at the table on page 12-6 for a list of common repairs and improvements ♦ Standard Mileage method (same rules as with business travel – 50 cents per mile) Actual Expense method (out of VITA scope) It's important NOT to deduct improvements as a current year expense Question 3 of the Exercises on page 12-6 © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle depreciation of rental property A property or improvement has a useful life of more than one year Depreciable property includes: buildings, equipment, machinery, furniture vehicles, improvements Land is NOT depreciable property, the taxpayer gets no expense deduction for land When a property is depreciated each year (a year of expense is deducted), the taxpayer's basis in that property is reduced by the depreciation It is important that taxpayers claim the correct amount of depreciation each year This means the cost of a property or improvement cannot be deducted as an expense all in one year Instead the cost of the property is expensed (depreciated) over the useful life of the asset (property or improvement) Even if they don't claim all depreciation they are entitled to they must reduce their property's basis by the correct amount of depreciation What factors affect depreciation In calculating depreciation for an asset, three factors affect the calculation ♦ ♦ ♦ Depreciation Method (usually MACRS for tax) Basis of the property (usually purchase price plus any improvements or costs to bring the property to operating condition) Recovery Period for the property (What is its useful life…how long to depreciate) © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle depreciation of rental property (continued) Depreciation Methods used in Tax (We focus only on MACRS) Exercises 12-7 (Question 4 and 5) Basis and Adjusted Basis of a Rental Property Basis is generally ♦ The purchase price of the property + any improvements but NOT including the value of the land on which the property sits When a property is converted from personal use to a rental property the basis is: ♦ ♦ The lesser of the adjusted basis or FMV at the time of the conversion Read Example on page 12-8 Total Depreciation Expense taken of all the years can NEVER exceed the property's basis, stop taking depreciation when the property's basis is reduced to zero What is a Recovery Period? So the purchase price needs allocated between land and building, this is usually done with a property tax assessment This is the number of years over which the taxpayer recovers (deducts as an expense) the cost or other basis of the property The MACRS method assigns specific recovery periods to different classes of property Exercise (Question 7) Page 12-9 © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle depreciation of rental property (continued) How to Figure out the MACRS Depreciation Deduction You need to know three things ♦ ♦ ♦ Placed in Service Date ♦ ♦ Placed in Service Date Recovery Period Depreciable Basis - We just went over how to calculate this When the asset (property or improvement) is a condition of readiness and used in the rental for the production of income Read the example at the bottom of page 12-9 Recovery Periods Under MACRS ♦ ♦ ♦ Depends on the class the property is in – basically classes of assets (such as "Machinery", "Residential Rental Property" etc) are assigned recovery periods by MACRS Publication 527 Page 12 has a table of MACRS recovery periods (the software may also have the information) Recovery Periods Under MACRS you'll likely use (see page 12-10) 27.5 years for a residential rental property converted to such in 1986 or later 5 years for a Stove or appliance used in a residential rental Property located outside the US has different rules and recovery periods © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses When the Rental Property is a Portion of the Taxpayer's Residence Expenses must be allocated between the rental and the taxpayer's personal residence Expenses that apply only to the rental property are reported in full on the Schedule E ♦ Installing a second phone line in the rental ♦ ♦ Repairing an appliance in the rental Painting the rental unit only Expenses that benefit the ENTIRE property (both the rental and the personal residence) ♦ Must be divided up and only the rental portion deducted on the Schedule E ♦ Taxpayer cannot deduct any part of the cost of the first phone line in a partially rented property Mortgage interest and property taxes may be split up between the Sch E and the Sch A, so if the rental is 10% of the property 10% of Mortgage Interest and Prop taxes go on Sch E and 90% on Sch A The taxpayer can use any reasonable method to divide up the expenses – square footage and number of rooms are the most common methods Read the example at the bottom of page 12-11 © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses Reporting Rental Expenses that Exceed Income How rental expenses are reported depends on how much the taxpayer uses the rental property personally How taxpayers report rental expenses that exceed income (losses) depends on how much the taxpayer uses the property personally 1. Taxpayers do NOT use their rental home has their residence ♦ ♦ 2. Taxpayers who rent out their personal residence 15 days or more during the year ♦ ♦ 3. Include the rent received as income Deduct all rental expenses even if those expenses exceed income (there are still other deductibility limitations that may apply though – Passive Activity Limitations and At Risk Limitations) Include all of the rent received as income Expenses that exceed rental income may not be deductible (we'll look at the rules) Taxpayers who rent out their personal residence fewer than 15 days during the year may NOT include the rent as income or deduct the rental expenses (LOOPHOLE!) ♦ Los Angeles Olympic Games~ © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses What is considered "personal use" of the rental property? The taxpayer is considered to be using the dwelling as a home if he or she meets any of the personal use test rules on pages 12-12 (let's take a look) There are also some exceptions to the personal use rules (see page 12-13) Read the example page 12-13 Limitations on deducting rental expenses (Vacation Home Rules) (situation 2 on the previous page) Deductibility limitations apply to rental expenses for a dwelling the taxpayer uses as a home (so if the dwelling is used for "personal use" as defined above) for the greater of ♦ ♦ See #2 on part 1 of Schedule E (these questions must be answered for each property) 1. 2. If the above limitations do NOT apply, "No" will be answered and the expenses are not limited by the vacation home rules (HOWEVER, the expenses may be limited by the At Risk Rules or Passive Activity Loss Rules) If the "Yes" box is checked and the property was rented out at least 15 days (remember less than 15 days means don't report income or losses) the amount of expenses the taxpayer may deduct are limited ♦ ♦ 14 days OR 10% of the number of days during the year the property is rented at FAIR MARKET VALUE Let's look at the rules for this situation at the bottom of page 12-13 General Idea: A LOSS cannot be taken on the property, any unused expenses are carried forward indefinitely Answer Question 10 (Exercise) at the bottom of page 12-14 © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle rental losses? Rental losses are not always fully deductible ♦ ♦ Two restrictions on how much a rental loss can offset other income ♦ ♦ Just because the last set of rules allowed the taxpayer to report all their rental expenses (even if they exceeded income) does NOT mean that the resulting loss will be deductible A deductible loss would be recorded on line 17 of Form 1040 and could be used to offset other income At-risk rule Passive Activity Rule (book says law) At-risk Rule Basically this says a taxpayer can only deduct a loss up to they amount they have at risk in an activity ♦ So how much has the taxpayer put into the rental that they could lose? They can only deduct losses up to this amount © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle rental losses? (continued) Passive Activity Rule (Law) Basically this says that passive losses can only be used to offset passive income ♦ ♦ ♦ Some common sources of active income are wages, dividends and investments…so passive losses can not be used to offset these types of income Rentals in most cases are passive activities and therefore there losses are considered passive Passive losses that exceed passive income are not deductible There are other sources of passive income than rental income though Passive vs. Active The limits on deducting rental losses have to do with ♦ ♦ How much of the rental activity is considered a passive activity If the activity involves active participation (then losses may be less limited) Passive Rental Activity ♦ One where income is received mainly from the use of the property rather than the services Most rentals are this Passive Rental Activity with Active Participation ♦ Active participation means making significant management decisions, such as approving tenants, approving rental terms, approving repairs and expenses…etc © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle rental losses? (continued) Passive Activity Rule (Law) (continued) Why do we care about active participation? ♦ Exception Remember we said rental income is usually passive and therefore losses are usually not deductible (can only be used to offset other passive income) However there is an Exception ♦ ♦ More non-passive income examples on page 12-13 (salary, dividends, interest, capital gains and losses are all NON-passive and can NOT be offset with passive rental income unless the exception is met and then only $25,000 of the rental expenses can be deducted) It is considered active participation when taxpayers own at least 10% of the rental property and make significant management decisions as defined earlier Phase out Taxpayers who actively participate in the rental company can use up to $25,000 of their rental expenses to offset non-passive income (up to $12,500 for MFS) This exception can be limited by AGI Active Participation Defined because there is an exception to the passive activity rule for this The $25,000 exception may be reduced or completely gone depending on the taxpayers AGI Example on page 12-15 © Kristina Shroyer 2011 Lesson 12: Rental Income & Expenses How to handle rental losses? (continued) How are Passive Rental Losses Reported Disallowed passive losses are carried forward to future years (in case future years have passive income that can be offset by them) Also once the rental is sold all passive losses for that property can be deducted Form 8582 is used to figure the amount of any passive losses for the current tax year as well as carry forwards ♦ See rules for when Form 8582 is not required on page 12-14 TaxWise will automatically generate and complete the Form 8582 for you if required However you should check the taxpayers prior year return for any passive loss carry forwards from prior years and enter them in the appropriate place © Kristina Shroyer 2011