NFP10-Sess111-Core-C..

advertisement

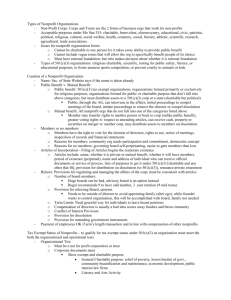

AICPA NFP10 Session 111 Tax Exemption: Core Concepts & Management Strategies Terry Miller Terry@TerryMiller.biz 415-333-6320 www.terrymiller.biz 1 Introductions Who’s here? Purpose Today / Framing Order of Concepts Conceptual: Legal / Public Policy Purposes Specific: Reporting on Form 990 Management: Planning Strategies Questions as we go: universal vs. fact specific Disclaimer 2 Objectives Objectives Issue spotting vs. memorize all nobody knows everything Know when to get help don’t be penny-wise & pound-foolish Context: the concept of “organized & operated” general legal compliance required “illegal” or in “contravention of public policy” ≠ exemption 3 Session Overview Context: organization types / regulators / a word on words Legal concepts: Tax Exemption (The “Big Four” + 2) 1. 2. 3. 4. Commerciality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . [earned income] Inurement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . [insiders] Public v. private benefit . . . . . . . . . . . . . . . . . . . . . . . . [insiders OR outsiders] Public policy advocacy . . . . . . . . . . . . . . . . . . . [1. lobbying, 2. electioneering] Public charity status / public support tests . . . . . . . . . . [for 501(c)(3) charities] Charitable deductions: substantiation & disclosure . . . . [for (c)(3) charities] Miscellaneous compliance issues Reporting: Form 990 – ‘the rubber hits the road’ Management strategies: Planning Opportunities Resources: Supplemental materials Related Sessions at NFP10 4 Context / Organization Types Types: Nonprofit Corps, Trusts, LLCs, L3Cs … [STATE law] Types of Nonprofit corporations (some states) Public Benefit, Mutual Benefit & Religious Authority: State Constitution & Statutes Articles of Incorporation Bylaws Corporate formalities – liability protection (“piercing the veil”) SOS: Registration IRS: Income Tax Exemption & Charitable Tax Deductions AG: Charitable Trust & Charitable Solicitation Registration Charitable Solicitation Registration cy pres ??: Sales & Property Tax Exemption, Charitable Gaming 5 “ Taxation? But we’re a nonprofit ?! ” Nonprofit = state corporation concept Tax law: levels of benefit by type of Exempt Organization, known by Internal Revenue Code Section 501(c)(1) Created by Congress; (c)(2) Title Holding 501(c)(3) Charities Public Charities Private Foundations 501(c)(4) Social Welfare / Civic Leagues 501(c)(5) Labor / Horticultural 501(c)(6) Biz League / Prof & Trade Assoc / Chamber Commerce 501(c)(7) Social Clubs ….up to 501(c)(27) and beyond…501(d,e,f,k,n), 527 6 More complicated than taxable for-profits The notion of “organized and operated” “exclusively” Form 990 is mind-numbing Measure whether sufficient exempt function activity is occurring to justify favorable tax treatment “Commensurate” test Tax Exempt (most net income not taxable) Tax Deductible (mostly 501(c)(3) organizations) Form 990 as a Public Communication tool Heightened public focus stoked by scandals 2008 Form 990 overhaul first in 30 years 7 A word on words “nonprofit”, “not-for-profit” “charity” “charitable trust” “EO” “exempt organization” “[income] tax-exempt” “tax deductible [as a charitable gift]” “tax deduction” “c3” “c4” … “PF” “PC” “new” 990 “income” = “support” + “revenue” “UBI” “UBTI” “UBIT” “exclusive” “substantial” “primary” “facts & circumstances” 8 Legal Concepts Legal Concepts: the Big Four (plus assorted details: “the fine print” ) 9 Internal Revenue Code 501(c) (3) (Complete! *) “(3) Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals, no part of the net earnings of which inures to the benefit of any private shareholder or individual, no substantial part of the activities of which is carrying on propaganda, or otherwise attempting, to influence legislation (except as otherwise provided in subsection (h)), and which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office.” * (color, bold & underlines added) 10 Internal Revenue Code 501(c) (4),(5) & (6) (Complete*) “(4) (A) Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare, or local associations of employees, the membership of which is limited to the employees of a designated person or persons in a particular municipality, and the net earnings of which are devoted exclusively to charitable, educational, or recreational purposes. (B) Subparagraph (A) shall not apply to an entity unless no part of the net earnings of such entity inures to the benefit of any private shareholder or individual. (5) Labor, agricultural, or horticultural organizations. (6) Business leagues, chambers of commerce, real-estate boards, boards of trade, or professional football leagues (whether or not administering a pension fund for football players), not organized for profit and no part of the net earnings of which inures to the benefit of any private shareholder or individual.” 11 * (color, bold & underlines added) Legal Concepts: The “Big Four” Commerciality How much can we operate like a business and still be tax exempt? Can we charge for services? Private Inurement - Insiders How much can we pay the boss? Can we rent from the Chairperson? Public vs. Private Benefit Who really benefits from our work, on balance? Politics & Lobbying Can we support candidates for office? Can we join a coalition to oppose legislation? 12 Commerciality -1 History destination test, until NYU / Mueller Macaroni, circa 1950 Pizza parlor example: “operated for” charitable (not commercial) purpose “Exempt function income” / program service revenue income as a by-product of program activity The concept of Unrelated Business Income (Tax) 1) trade or business 2) regularly carried on 3) unrelated to the exempt purpose 13 Commerciality -2 Common problem / error: technical assistance substantially below cost Useful exclusions from UBI follow from definition passive – not “carried on” at all interest, rents & royalties (watch out for debt-financed property) gains & losses not regularly carried on substantially by volunteers – not “trade or business” sale of donated merchandise – not “trade or business” convenience of patrons – “related” All revenues are one of these three: Related Exempt Function Income (a/k/a “program svc revenue”) UBTI UBI but for exclusion 14 Commerciality -3 Qualified Sponsorship Payments (v. advertising) no price & item, inducement to buy, comparative messaging watch out for web links! RESOURCE: Session 19 (qualified sponsorships) Dual types For-Profit & Nonprofit/EO: (e.g. hospitals) usually means there will be specific guidance frustrating issue: evolutionary enterprises (e.g. schools): poaching RESOURCE – Session 55 (hospitals & community benefit) Commercial sub-activities when UBI activity becomes jeopardizing: substantial (?) for-profit subsidiary 15 Private Inurement -1 about INSIDERS (power to exercise major influence) History: William Aramony (resigned 1992, convicted 1995, released 2001) Need for “Intermediate Sanctions” – IRC 4958 Continued concern driven by juicy scandals: Smithsonian, American University, Irvine Foundation, etc etc etc Excess compensation most common issue “Excess Benefit Transactions” includes loans & other (buy/sell/rent) T. Pattara says Grassley on a tear about this (recent news about Grassley & Boys & Girls Clubs) – Congress as a wild card 16 Private Inurement -2 Conflicts of Interest / Conflict of Interest Policies Definition? Who covered? IRS: close family & business Domestic partners? Best friends? How declared? IRS: directors & officers (they define officer to include CEO & CFO) All employees? Volunteers? What relationships to report? IRS: concerned about self-dealing Confidential information? “Settling scores”? IRS: at least annually – report all relationships that could give rise Duty of loyalty – develop sensitivities to disclosure & openness How monitored & enforced? Disclosure & recusal is usually enough 17 Private Inurement -3 Section 4958 Overview: (c)(3) pub charities & (c)(4) orgs Penalties doubled by Pension Protection Act Severe – on individuals notion of “intermediate sanctions” scrambled up by Caracci case 4958 “rebuttable presumption” basics – re: “disqualified persons” 1. 2. 3. 4. Written comparables, saved with minutes Disinterested majority of board, with interested party/parties out of room Good faith determination best interest of the organization Prior to transaction Some in Congress want safe harbor steps required IRS considers it best practice; pressure to report IRS concerned about quality of “comparables” Risks: notion of “Automatic” Excess Benefit Transactions / Listed Property RESOURCES: Session 48 (intermediate sanctions) Session 53 (comparability audits) 18 Public v. Private Benefit -1 501(c)(3)’s & 501(c)(4)’s Subtle / requires step back & ask: “who really benefits?” NOT about insiders, necessarily avoid: “more than incidental private benefit” “the presence of private benefit, if substantial in nature, will destroy taxexempt status regardless of an organization’s other charitable purposes or activities” – Marcus Owens on Better Business Bureau case (Resources) Charitable class – how big? Public? Private Benefit: IRS’ new all-purpose hammer? “commensurate” test “efficiency & effectiveness” dovetails with public skepticism 19 Public v. Private Benefit -2 Famous cases American Campaign Academy Consumer Credit Counseling current: Seller-financed Down Payment Assistance Governance as indicator of risk: audit flag v. denial of exemption application unpredictable good governance policies & controls; Owens’ paper (Pg 111-64), e.g.: broad Board clear records on achievements conflict of interest & whistleblower policies commitment to proper arm’s length outside auditor & if big enough, internal auditor greater disclosure than required accountable plan for reimbursements compensation process use rebuttable presumption 20 Public Policy Advocacy: Lobbying v. Politics Key distinction: Lobbying v. Candidate Electioneering big danger in jumbling them !! [C3 Public Charity] Lobbying = legislation including work on referenda even though elections involved [C456] Lobbying = legislation plus certain executive branch decision making Electioneering = candidates for elected office some targeted lobbying IS electioneering 21 Public Policy Advocacy: Lobbying -1 501(c)(3) Public Charities History: 1930, 1934, 1955, 1970, 1990 Expenditure Test v. Substantial Part Test Expenditure Test: more objective (IRC 501(h), Regs 4911) Direct v. Grassroots lobbying “Specific legislative proposal” Substantial Part Test: “facts & circumstances” 501(c)(3) Private Foundations No explicit lobbying (earmarked / restricted) Some wiggle room (general support, or project support less than the non-lobbying portion of the project) mostly they just don’t want to hear about it 22 Public Policy Advocacy: Lobbying -2 501(c)(non-3) Exempt Organizations Unlimited if related to exempt purpose 501(c)(4)’s (NRA, Sierra Club, etc) lobby a LOT 501(c)(5) (Labor unions, Farm Bureau) lobby a LOT 501(c)(6) (Trade associations, chambers of commerce, professional associations) lobby a LOT 501(c)(7) social & recreational: not so much Different definitions: legislation (other than local), plus certain executive branch policies Business dues non-deductible as biz expense if used for lobbying, & must apply dues income first to Lobbying Notify members of non-deductible portion, or Pay 35% proxy tax 23 Public Policy Advocacy: Lobbying -3 Remember: this has been about TAX law Fed / State / (Local?) ethics & registration rules such as Congressional “Lobbying Disclosure Act” (LDA) Trigger points ($ level) Different definitions Wining & dining & gifts & travel, money in politics, including by individuals from organization (!) LDA allows public charities that have elected the expenditure test to use some of the tax definitions Ballot measures may involve State election commissions and “PAC” regulation / registration / reporting RESOURCE: Session 43 (elect & lobbying reporting: beyond tax) 24 Public Policy Advocacy: Candidate Electioneering -1 IRC Section 527 & “527 Activities” = political = “electioneering” True meaning: influence the election of candidates “527” As used in the press: issue advocacy targeted at influencing election of candidates which escapes election commission jurisdiction by not being explicit will Citizens United kill off such “issue 527’s” of this sort? 501(c)(3) Charities (both PC & PF) CANDIDATE ELECTIONEERING PROHIBITED Revocation and/or penalties on charity AND on individuals (Board) Non-partisan voter registration, voter education & get out the vote are all OK if done just right (think: League of Women Voters) 25 Public Policy Advocacy: Candidate Electioneering -2 501(c)(4,5,6 …) organizations Must be not primary purpose, conducted legally, and consistent with overall exempt purpose Primary: 51/49%? No clear standard EACH year, no rolling periods Legal: jurisdiction of FEC or State/Local equivalents Usually means hiring election law coun$el Notion of Separate Segregated Fund 527 Organizations Not just “soft PACs / issue 527’s” – includes parties, candidate cttees Risk if not political enough (more than insubstantial “non-exempt purposes”) 26 Recap: The Big Four 1. Commerciality Exempt Function Income Unrelated Business Income UBI but for Exclusion(s) 2. Inurement – insiders 3. Public v. Private Benefit – insiders or outsiders 4. Public Policy Advocacy Lobbying v. Candidate Electioneering Next: Private Foundation v. Public Charity & the public support tests Charitable Deduction Rules Misc Compliance Issues 27 501(c)(3): Public Charity or Private Foundation? 501(c)(3) charities are private foundations (PF) by default, unless can qualify as a public charity (PC) status tests (e.g. school) or public support tests “Grandma’s Foundation” vs. Publicly-Supported Charity PC is better; much less regulated than PF better donor deductibility (% of AGI, FMV v. Basis) more transactions with insiders allowed + safe harbor avail (for now) no tax on investment income, fewer “excise tax” penalties may MAKE grants to any entity (including foreign) for specific charitable purposes (if entity not a c3) only practical way to get many PF grants is to be a PC may lobby 28 PC or PF? Types of Public Charity Qualify as Public Charity under IRC 509(a)(1)-(4) 509(a)(1) says: 1. 170(b)(1)(A)(i) 2. 170(b)(1)(A)(ii) 3. 170(b)(1)(A)(iii) 4. 170(b)(1)(A)(iv) 5. 170(b)(1)(A)(v) 6. 170(b)(1)(A)(vi) 170(b)(1)(A)(i) - (vi) Church School Hospital / medical research org Support org to public college or univ Governmental unit Publicly supported charity – gifts status status status status status test 7. 509(a)(2) Publicly supported charity – fees test 8. 509(a)(3) Supporting Org (four sub-types ) mix RESOURCE: Session 47 (supporting organizations) 9. 509(a)(4) Product Safety Testing Org 29 status PC or PF? Public Support Test(s) Two Public Support Tests: Both are complex – dynamic formula (mix of donors & revenues by size) 5 year measurement period Advance period for startup – don’t prove until Year 6 (2-3-4-5-6) 509(a)(1) & 170(b)(1)(A)(vi): broad gift support more forgiving and flexible than (a)(2) some changes with New 990 509(a)(2): broad base of earned revenue from program services, plus very small gifts extraordinarily complex math – 1 yr, 5 yr & data from inception unforgiving, inflexible test switching between is OK 30 Donor Deductibility -1 Donor Substantiation (Receipting) Publication 1771 & Deeper: Pub 526 Cash (& Un-reimbursed Volunteer Participation) Gifts >= $250 donor must have receipt with required language if audited Cash v. Non-Cash gifts valuation: internal estimate (books) v. donor receipt (no value estimate!) for charitable use vs. for resale: key issue Quid pro Quo gifts > $75 FMV, not cost, stated in Solicitation or Receipt TIP: fundraising events need TWO income lines each exception: low cost logo items (“coffee mug”) for certain gifts Common Errors Donated services (+ whole concept of confusion about “a write-off”) Earmarked for individual beneficiaries Non-cash valuations estimated on receipt (donor pressure!) 31 earned donated Donor Deductibility -2 Intangible Membership & Religious Benefits best to read Pub 1771 rules are pretty common-sense Penalties Failure to disclose non-deductibility (attn C4s!) Failure to provide quid-pro-quo information Vehicles, Boats & Planes: Pub 526 general direction of law Other high-value non-cash items 8282 / 8283 RESOURCE: Session 24 (charitable contribution compliance) 32 Other Compliance Issues 990 Disclosure (Guidestar does not count) 1023/1024 Disclosure “Complete & Accurate” Return: statute of limitations, penalties if severe Late Filing: Penalties 3 years Non-Filing: Revocation Donor Advised Funds & certain “fiscal sponsorships” Abuses: 1) parking place, 2) self-serving grants, 3) self-serving investments RESOURCE: Session 59 (working with community fdns) Foreign Activity: PATRIOT Act / know your customer RESOURCE: Session 36 (foreign operations) 33 Reporting: Form 990 Reporting: Form 990 (the rubber hits the road) 34 Key Parts of the New 990: Core Form PART I Summary III Program Service Accomplishments IV Checklist of Required Schedules V Other Filings & Tax Compliance VI Governance, Mgt & Disclosure VII Compensation (dashboard for the public) Functional Expenses X Balance Sheet (trigger questions) (various compliance) (private benefit / inurement) (inurement) VIII Revenue IX (commensurate test) (commerciality; UBI analysis) (commensurate test) (inurement) 35 New 990: The 16 Schedules -1 (Which schedules to file? Based on “trigger question” – thresholds) SCHEDULE A Public Support Tests / Pub Char Status B Contributors (no change from “old” 990) C Campaign & Lobbying Activity D Supplemental Financial Statement Detail (various) E Private Schools [Education] (no substantive change) (special) F Foreign Activities & Grants G Gaming (& Fundraising) H Hospitals (public charity status) (deductibility) (public policy advocacy) (special: PATRIOT Act / terrorism) (commerciality; private benefit) (commensurate test; public benefit) 36 New 990: The 16 Schedules -2 I Grants (Domestic - Inside U.S.) (public benefit) J (Justify) Compensation K Bonds (public benefit; compliance) L Loans (inurement) M Non-Cash Contributions N Termination / Disposition of Assets O Open for Narrative Responses R Related Organizations 37 (inurement) (deductibility; excess benefit) (inurement / public benefit) (various) (various / public benefit) 990: Core Form Pg 1 see Full-Size Form in Supplemental Materials ! (Page 23) Core Form Page 1 Parts I and II Dashboard / Overview 38 990: Core Form Pg 2 Core Form Page 2 Part III Program Accomplishments Commensurate Test Key Communication Tool 39 990: Core Form Pg 3 Core Form Page 3 Part IV “Trigger Questions” threshold(s) where IRS has concern 40 990: Core Form Pg 4 Core Form Page 4 Part IV continued 41 990: Core Form Pg 5 Core Form Page 5 Part V Other Filings & Compliance 42 990: Core Form Pg 6 Core Form Page 6 Part VI “Governance, Management & Disclosure” IRS Theory: Public v. Private Benefit risk assessment: audit flags BIG emphasis 43 990: Core Form Pg 7 Core Form Page 7 Part VII Compensation of: Officers Directors (Trustees) Key employees Highest comped ees Former ODKE’s Inurement IRS Focus: audit flags: more BIG emphasis 44 990: Core Form Pg 8 Core Form Page 8 Part VII continued Trigger Questions 45 990: Core Form Pg 9 Core Form Page 9 Part VIII Income (“Revenue”) Support v. revenue Classify revenues Related UBTI UBI but for exclusion 46 990: Core Form Pg 10 Core Form Page 10 Part IX Functional expenses Program Mgt & Gen (Admin) Fundraising 47 990: Core Form Pg 11 Core Form Page 11 Part X Balance Sheet Inurement 48 990: Core Form Pg 12 Core Form Page 12 Part XI Accounting methods, auditors, etc 49 Schedule Highlights: Schedule J Pg 1 Schedule J Page 1 Inurement compensation setting basis & practices compensation-like reimbursements 50 Schedule Highlights: Schedule L Schedule L Inurement: Loans & other transactions with insiders 51 Schedule Highlights: Schedule M Pg 1 Schedule M, Page 1 Deductibility: non-cash gifts Private benefit / excess benefit: certain hard-tovalue noncash gifts Governance Type Questions 52 Planning Strategies Management: Planning Strategies 53 Planning Strategies -1 General Fads & fashions in tax law enforcement Unfortunate but true Australia: the “tall poppy” syndrome Read trade publications Congress – official & individual Sen. Grassley, but earlier was J.J. Pickle Subscribe to IRS’ free “EO Update” newsletter Read Chronicle of Philanthropy Retain counsel 54 Planning Strategies -2 Commerciality Broaden exempt purposes – amend articles, review 1023 Master exclusions Logo wear vs. message wear Sponsorship deals if UBTI: calculate expenses with consistent methodology if UBTI approaching substantial activity: for-profit subsidiary Inurement Benchmarking – not everyone is above average / 75th %ile Audit committees – value squeaky wheels – avoid groupthink Compensation committee – do regular review; document Learn to spot compensatory reasoning and handle it correctly watch out for listed property Managing [even the appearance of] Conflicts of Interest 55 Planning Strategies -3 Public v. Private Benefit Commensurate test – think critically Mission & (re)-evaluation regularly New blood Take governance seriously Public Policy Advocacy Master the lobbying rules Find one person or committee to really master it Train train train C3’s: Watch out for Election Years Consider tandem c3/c4 or triad c3/c4/527 56 Planning Strategies -4 Public Support the notion of “tipping” run a test at Year 3 don’t panic about 10% + facts & circumstances if tipping, consider alternates: 509(a)(3) 501(c)(4) private foundation private operating foundation sponsored project merger into / with another public charity 57 Resources: Supplemental Materials Supplemental Materials 1. Form 990 markups: Core Form, Schedules J (Pg 1), L, M (Pg 1) 33 2. Types of Tax Exempt Organizations (from IRS.gov) 48 3. “Nonprofit Governance, and Effectiveness and Efficiency of Operations,” speech by former IRS EO Commissioner Steven T. Miller, April 2008 50 4. “Current Climate for Charities,” speech by Miller, October 2007 58 5. “More Scrutiny of Charities Expected, Regulators Told,” article about IRS EO Director Lois Lerner speech to NASCO 63 6. UBTI exclusion codes – good short reference (from 2007 990 instructions) 66 7. “Private vs. Public Benefit,” Marcus Owens, 2007, AICPA NFP conference 67 8. IRS Pub 1771: “Charitable Contributions: Substantiation & Disclosure” 76 9. Bibliography: Public Policy Advocacy 84 10. Additional Resources 93 58 Resources: Directly Related Sessions at NFP10 19 22 24 36 42 43 47 48 49 53 55 58 59 Qualified Sponsorship Payments (commerciality) 2009-2010 Tax Year Update (repeats in 49) (general) Charitable Contribution Compliance (donor deductions) Foreign Operations / Schedule F (anti-terrorism) New 990: Lessons & Ambiguities (general) Election & Lobbying Reporting: Beyond Tax (policy advocacy) Supporting Organizations (public charity status) Compliance w/ Intermediate Sanctions Rules [4958] (inurement) (repeat) 2009-2010 Tax Year Update (general) Managing Comparability & Compensation Audits (inurement) Hospitals & Community Benefit (special) Ask the Experts Panel: Tax (varies) Working with Community Fdns – Planning Opptys (public support) 59 Resources: Other EO Tax Sessions at NFP10 202 205 6 13 18 25 30 35 54 60 Form 990-T: What’s New? (commerciality-UBIT / general) Reporting 403(b) Plans on Form 5500 (inurement) View from the IRS (general) Issues With Related & Affiliated Orgs (varies) Tax Exempt Bond Compliance (varies) Tax Ethics / Practitioners (varies) Private Foundations: Current Developments (PF / advanced) Form 990 Part IX / Functional Accounting (commensurate test) Alternative Investments (charitable trust) Advanced Non-Qualified Deferred Comp (inurement) 60 End Questions? 61