Internal Environment

Internal

Environment

3rd Lecture

MSc Agricultural

Economics and

Management

External and Internal Analyses

Environment

Sociocultural

Industry

Environment

By studying the external environment, firms identify what they might choose to do

Opportunities and threats

Competitor

Environment

Technological

General

External and Internal

Analyses

By studying the internal environment, firms identify what they can do

Unique resources, capabilities, and core competencies

(sustainable competitive advantage)

Challenge of Internal Analysis

How do we effectively manage current core competencies while simultaneously developing new ones?

How do we assemble bundles of resources, capabilities and core competencies to create value for customers?

How do we learn to change rapidly?

Conditions Affecting Managerial Decisions

About Resources, Capabilities, and Core

Competencies

Uncertainty

regarding characteristics of the general and the industry environments, competitors’ actions, and customers’ preferences

Complexity

regarding the interrelated causes shaping a firm’s environments and perceptions of the environments

Intraorganizational Conflicts

among people making managerial decisions and those affected by them

Choosing the right tools for internal analysis

Start with simple techniques

Consider all tools and identify those likely to be useful

Define the competitive capabilities the enterprise needs

Identify the subsystems which support these capabilities

Identify core competence relative to competitive capabilities

Determine changes to enhance/improve core competence

Take a systemic view

Adjust the methods of analysis in the light of what is found

Some commonly used techniques for internal analysis

Single Businesses

Resource Audit

Analysis of cost and profit

Benchmarking

Value Chain Analysis

Supply Chain Analysis

Multiple Businesses

Portfolio Analysis

Both Single and Multiple Businesses

Core Competencies

Shareholder Value Analysis

Resource Audit

Resources

Physical

Human

Financial

Other

Quality and Quantity

Unique resources

A good initial analysis

Internal Audit

Parallels process of external audit

Information from:

Management

Marketing

Finance/accounting

Production/operations

Research & Development

Management information Systems

Marketing

Marketing Functions

Customer analysis

Selling products/services

Product & service planning

Pricing

Distribution

Marketing research

Opportunity analysis

Finance/Accounting

Finance/Accounting Functions

Investment decision (Capital budgeting)

Financing decision

Dividend decision

Production/Operations

Production/Operations Functions

Process

Capacity

Inventory

Workforce

Quality

Research & Development

Research & Development Functions

Development of new products before competitors

Improving product quality

Improving manufacturing processes to reduce costs

Management Information

Systems

Information Systems

Security

User-friendly

E-commerce

Analysis of Costs and Profit

Current sources of profits and trends

Recast standard reporting to give new insights

Pragmatic approach to get value from time and effort spent

A good initial analysis

Single Businesses

Resource Audit

Analysis of cost and profit

Benchmarking

Value Chain Analysis

Supply Chain Analysis

Benchmarking

Objective comparison with best in class

Simple in theory - Hard in practice

Observed differences in performance may be due to differences in parameters

Qualitative observations may be more valuable than quantitative

Benchmarking - at three levels

Level of benchmarking

Resources

Competences in separate activities

Through

Resource audit

Analysing activities

Competences through managing linkages

Analysing overall performance

Examples of measures

Quantity of resources, e.g.

· revenue/employee

· capital intensity

Quality of resources, e.g.

· qualifications of employees

·

· age of machinery uniqueness (e.g.

patents)

Sales calls/sales person

Output/ employee

Materials wastage

Market share

Profitability

Productivity

Value Chain Analysis

Basic Value chain

Elegant in theory

Time-consuming in practice

Revised value chain to reflect power of people and knowledge

Value Creation

The Basic

Value Chain

Service

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Primary Activities

To capitalize on the usefulness of the

Value Chain concept...

it is important to recognize that...

Value Chains are part of a Total Value System

Supplier Value Chain Firm Value Chain Channel Value Chain Buyer Value Chain

Value Chains are part of a Total Value System

Firm Value Chain Channel Value Chain Buyer Value Chain

Supplier Value Chain

Upstream Value

Perform valuable activities that complement the firm’s activities

Value Chains are part of a Total Value System

Supplier Value Chain Firm Value Chain Buyer Value Chain

Upstream

Value

Perform valuable activities that complement the firm’s activities

Channel Value Chain

Each firm must eventually find a way to become a part of some buyer’s value chain

Value Chains are part of a Total Value System

Supplier Value Chain Firm Value Chain Channel Value Chain

Upstream Value

Perform valuable activities that complement the firm’s activities

Each firm must eventually find a way to become a part of some buyer’s value chain

Buyer Value Chain

Ultimate basis for differentiation is the ability to play a role in a buyer’s value chain

This creates VALUE!!

Value Chains are part of a Total Value System

Supplier Value Chain Firm Value Chain Channel Value Chain Buyer Value Chain

Upstream

Value

Perform valuable activities

that complement the firm’s activities

Each firm must eventually find a way to become a part of some buyer’s value chain

Ultimate basis for differentiation is the ability to play a role in a buyer’s value chain

This creates VALUE!!

Value chains vary for firms in an industry, reflecting each firm’s unique qualities:

• History

• Strategy

• Success at Implementation

Outsourcing

Outsourcing is the purchase of some or all of a valuecreating activity from an external supplier

Usually this is because the specialty supplier can provide these functions more efficiently

Service

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Primary Activities

Strategic Rationales for

Outsourcing

Improve Business Focus

lets company focus on broader business issues by having outside experts handle various operational details

Provide Access to World-Class Capabilities

the specialized resources of outsourcing providers makes world-class capabilities available to firms in a wide range of applications

Strategic Rationales for

Outsourcing

Accelerate Business Re-Engineering Benefits

achieves re-engineering benefits more quickly by having outsiders--who have already achieved world-class standards--take over process

Share Risks

reduces investment requirements and makes firm more flexible, dynamic and better able to adapt to changing opportunities

Strategic Rationales for

Outsourcing

Free Resources for Other Purposes

permits firm to redirect efforts from non-core activities toward those that serve customers more effectively

Outsourcing Issues

Greatest Value

outsource only to firms possessing a core competence in terms of performing the primary or support activity being outsourced

Evaluating Resources and Capabilities

don’t outsource activities in which the firm itself can create and capture value

Environmental Threats and Ongoing Tasks

do not outsource primary and support activities that are used to neutralize environmental threats or complete necessary ongoing organizational tasks

Outsourcing Issues

Nonstrategic Team of Resources

do not outsource capabilities that are critical to their success, even though the capabilities are not actual sources of competitive advantage

Firm’s Knowledge Base

do not outsource activities that stimulate the development of new capabilities and competencies

Revised Value Chain

SUPPORT

ACTIVITIES

Firm’s infrastructure

Technology trapping and commercialisation

Strategic Management

PRIMARY

ACTIVITIES

INFORMATION SYSTEMS & KNOWLEDGE MANAGEMENT basic skills, know-how, technologies strategic assets core competence technical, management, marketing, sales, production price, place, promotion product service customer satisfaction, loyalty

HUMAN RESOURCE MANAGEMENT

PROCUREMENT AND SUPPLIER MANAGEMENT revenue, profit, market share,

Product portfolio matrices

RELATIVE MARKET SHARE

High Low

MARKET

GROWTH

High

Low

Stars

Cash cows

Question marks

Dogs

High

INDUSTRY

ATTRACTIVENESS

Med

Low

COMPETITIVE POSITION

Strong Average Weak

(a) The original Boston Consulting

Group Matrix (BCG)

(b) Attractiveness matrix*

Product portfolio matrices

Development

STAGE OF

PRODUCT/

COMPETITIVE POSITION

Strong Average Weak

Growth

MARKET

EVOLUTION Shake-out

Maturity

High

PUBLIC NEED

AND

Publicsector star

SUPPORT +

FUNDING

ATTRACTIVENESS

Golden fleece

Low

High

Decline

Political hot box

Back drawer issue

Low

ABILITY TO SERVE

EFFECTIVELY

(c) Product/market evolution matrix (d) Public sector portfolio matrix

Portfolio Analyses

Over-coming some pitfalls:

Defining `high’ and `low’ (growth or share) can be difficult

`Plot’ SBU’s not products

Apply to market segments not whole markets

Assess the `role’ of each SBU

Consider wider resource implications - not just cash

Dogs may have a positive role

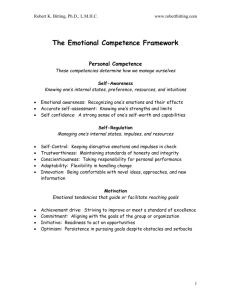

Components of

Internal Analysis

Discovering Core

Competencies

Core

Competencies

Capabilities

Resources

Tangible

Intangible

Four Criteria of Sustainable

Advantages

• Valuable

• Rare

• Costly to Imitate

• Nonsubstitutable

Value Creation

Competitive

Advantage

Value

Chain

Analysis

• Outsource

Resources, Capabilities and Core

Competencies

Capabilities

Are the firm’s capacity to deploy resources that have been purposely integrated to achieve a desired end state

Emerge over time through complex interactions among tangible and intangible resources

Often are based on developing, carrying and exchanging information and knowledge through the firm’s human capital

Resources, Capabilities and Core

Competencies

Capabilities

The foundation of many capabilities lies in:

The unique skills and knowledge of a firm’s employees

The functional expertise of those employees

Capabilities are often developed in specific functional areas or as part of a functional area

Resources, Capabilities and Core

Competencies

Core Competencies

Resources and capabilities that serve as a source of a firm’s competitive advantage:

Distinguish a company competitively and reflect its personality

Emerge over time through an organizational process of accumulating and learning how to deploy different resources and capabilities

Resources, Capabilities and Core

Competencies

Core Competencies

Activities that a firm performs especially well compared to competitors

Activities through which the firm adds unique value to its goods or services over a long period of time

Building Sustainable Competitive

Advantage

Four Criteria of

Sustainable Competitive

Advantage

Valuable

Rare

Costly to imitate

Nonsubstituable

Building Sustainable Competitive

Advantage

Valuable capabilities

Help a firm neutralize threats or exploit opportunities

Rare capabilities

Are not possessed by many others

Building Sustainable Competitive

Advantage

Costly-to-Imitate

Capabilities

Historical

A unique and a valuable organizational culture or brand name

Ambiguous cause

The causes and uses of a competence are unclear

Social complexity

Interpersonal relationships, trust, and friendship among managers, suppliers, and customers

Building Sustainable Competitive

Advantage

Nonsubstitutable Capabilities

No strategic equivalent

Core Competence as a Strategic

Capability

Resources

Inputs to a firm’s production process

Core Competence

A strategic capability

The source of

Capability

An integration of a team of resources

Does it satisfy the criteria of sustainable competitive advantage?

Yes

No

Capability

A nonstrategic team or resource

Sustainability of Competitive Advantage

Sustainability of competitive advantage is a function of:

the rate of core-competence obsolescence due to environmental changes

the availability of substitutes for the core competence

the imitability of the core competence

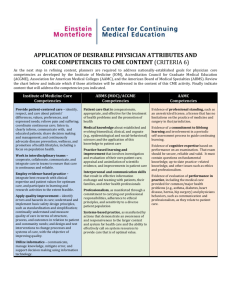

Performance Implications

No No No No

Yes No No

Yes/

No

Yes Yes No

Yes/

No

Yes Yes Yes Yes

Competitive

Consequences

Competitive

Disadvantage

Competitive

Parity

Performance

Implications

Below Average

Returns

Average Returns

Temporary Competitive Advantage

Above Average to

Average Returns

Sustainable Competitive Advantage

Above Average

Returns

Core Competencies:

Cautions and Reminders

Never take for granted that core competencies will continue to provide a source of competitive advantage

All core competencies have the potential to become core rigidities

Core rigidities are former core competencies that now generate inertia and stifle innovation

The SWOT diagram may summarise the results of analyses

Strengths Weaknesses

Internal

Analyses

Threats Opportunities

External

Analyses

Strategic Assessment of a business as a whole

Questions

What business are we really in?

What real customer needs do we satisfy?

What problem do we solve for our customers?