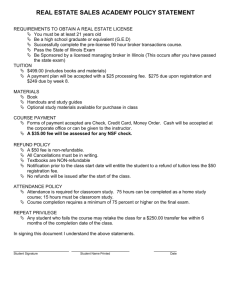

Transfer of Real Property

The Law of Property

Final Exam Review

1

Review – Looking back – looking forward

Final Exam Review

2

• In Review:

The Four Postulates of Property Law:

1. Property needs to be seen as a collection of “Rights” not a collection of “Things”;

2. Property Rights are those recognized by Law and the Law evolved from Property Rights;

3. Our Foundations of Law recognized that we are endowed with Property Rights; and

4. Property Rights can be summarized by E-PUT

3

• E-PUT – Just What are your property rights? They can be summarized by the initials EPUT. These initials stand for:

• E-PUT

1. The Right to Exclude;

2. The Right to Possess;

3. The Right to Use; and

4. The Right to Transfer.

4

And so, just what is the “Law”?

• The “Law” has been defined by Black’s Law Dictionary as follows:

• “That which is laid down, ordained, or established.

• A rule or method according to which a phenomena or actions co-exist or follow each other.

• Law, in its generic sense, is a body of rules of action or conduct proscribed by controlling authority, and having binding legal force. …

• Law is a solemn expression of the will of the supreme power of the state.”

• Perhaps the simplest description of the Law, however, is that:

“Law is the Rules by which civilization is ordered.”

5

Rome and Our Law

The concept of a body of law first emerged in Rome.

Although Rome developed a quasi legislative body known as the Senate as well as a system of Courts to arbitrate disputes, their concept of the Law , put down in Code , was largely the edicts of the emperor.

Rome was an empire based upon trade and its military. The law helped both these institutions promote civilization across the then known world by instilling both consumer and merchant confidence and providing a consistent template for the governance and operation of conquered lands and peoples.

The Law of Rome , often referred to as the Code due to its written history, helped to make the Empire the greatest of its time.

6

England and America – Bound by Heritage and Law

7

Henry, Eleanor, Richard and John

• After the reign of Stephen, in 1154 Henry the

Second , and his Wife Eleanor of Aquitaine took over England, Normandy, and Aquitaine (which belonged to Eleanor) thereby comprising not only England but also half of modern France as well.

• When Henry died, he left the throne to his son

Richard .

Richard , known popularly as Richard the Lionhearted , was a handsome, noble and brave.

Leading English forces for the 3 rd

Crusade, he left his younger brother John in charge during his absence.

8

The First Real Battle for Property Rights

On June 15, 1215, the forces of the landed nobles (the freemen) confronted John at

Runnymede , and forced him to sign and put his seal on the Magna Carta

(the Great Charter).

It was popularly known then as

“the Charter of Liberties”

9

The Magna Carta is Signed

• The Magna Carta was one of the forerunners of modern British law, the US

Constitution and its Amendments (the Bill of Rights) and the guiding documents of many other countries that have further expanded the rights and liberties of the people and limited the power of the government.

• Containing 63 clauses, this landmark document:

- Created a council to the King (a forerunner to parliament),

- Promised all freemen access to courts and a fair trial,

- Specified many property rights from infringement by the king and his agents,

- Eliminated unfair fines and punishments,

- Gave certain legal powers to the Catholic Church, and

- Addressed many lesser issues.

• One major right the Magna Carta did not recognize, was that it did not abolish the condition of involuntary servitude (serfdom), since the freemen who drafted the document, depended upon this feudal system for their wealth, power and life.

10

• Since the time of the Magna Carta the system of modern

Anglo-American Law evolved to flow from three sources.

1. Constitutional Law

2. Statutes

3. Case (or Common ) Law (Laws made by Judges).

11

• The law of early America was based largely upon the law of

England.

• We were, of course prior to the Revolution, English subjects .

• Our founders initially spoke of redressing their grievances under a format of the “Rights of Englishmen”

• There was very little statutory law , and even after the US and

State Constitutions, most law was still based upon English Court precedent.

This is best stated under the Doctrine of Stare

Decisis – Latin for “Let the Decision Stand”.

• Indeed statutes were looked upon with a skeptical eye . For it should be remembered that the Quartering Act, Stamp Act and the Townsend Acts were all statutes that ignited the Revolution to occur in the first place.

12

• Sir William Blackstone was an jurist and professor who produced the historical and analytic treatise on the law known as

Commentaries on the Law of England.

• First published in four volumes over 1765–

1769. It had an extraordinary success.

• A baseline “Bible of the law” of his time, these famous Commentaries still remain an important source on classical views of the common law and its principles.

• It was used not only through out England but through out the United States as well.

13

Pierson v. Post

Queens NY Case about Possession

Remember – chase that fox – get nothing!

Shoot that fox – and carry it away- get the prize for possession.

Mere pursuit is not possession!

14

Types of Property

• Property can be:

– Real (Rights in Land);

Real Estate – Ownership/Leaseholds/Easements/Life Estates

– Personal (Rights in Objects); and/or

Chattels – Tangible, visible “things”

– Intellectual (Rights in Ideas)

Patents

– Idea for Product or Process

Trademarks – Logo, Identification or Distinction

Copyrights

– Written or Performed Works

15

Tradition in the law

•

The Practice of Livery of Seizen

This was the practice before deeds when land transfers occurred in front of neighbors, where the seller would cut out a piece of sod of the property to be sold and physically hand it to the buyer in the presence and upon witness of others in exchange for gold (or other consideration).

Upon the conclusion of the transaction, a small male child would be beaten to have him remember the events (their version of recording).

16

REAL AND PERSONAL PROPERTY DISTINCTIONS

Common Law

• Real property means land, things fixed to land. and things incidental or appurtenant to land (basically immovable property).

• Personal property is movable property, but includes virtually every kind of physical property that is not real property.

• Real property may be converted to personalty by severance, and personal property may be converted to real property by an annexation intended to be permanent.

Leases

• Under the common law, a lease of land for a term of years constituted personal property.

• This was because the lease did not fall within the common law definition of land, tenements, or hereditaments; a lease was considered an interest in land less than a freehold and therefore a real chattel.

• Modern statutes changed the common law rule for leases, defining them as real property.

17

REAL AND PERSONAL PROPERTY DISTINCTIONS

Crops a. Fructus Naturales

Crops that grow spontaneously on land, e.g., trees, bushes, and grass, are described as fructus naturales and are considered to be a part of the land, and therefore real property.

Title to the land includes such crops.

b. Fructus Industriales

Crops that are the result of annual planting, labor, and cultivation, e.g., grains, vegetables, and other crops, are described as fructus industriales.

These crops are, as a general rule, regarded as personalty.

18

REAL AND PERSONAL PROPERTY DISTINCTIONS

Fixtures

Under the concept of fixtures, a chattel that has been annexed to real property is converted from personalty to realty.

The former chattel becomes an accessory to the land

(i.e., a fixture) and passes with ownership of the land.

If a fixture is detached from the real estate, it once again assumes its designation as personal property.

19

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

• Rights and title to personal property are acquired or lost by:

1. Transfer - Sale

2. Occupancy,

3. Adverse possession,

4. Accession,

5. Confusion,

6. Judgment,

7. When the chattel is lost, mislaid, or abandoned, or

8. Gift

20

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

The Finder of “Lost Property”

Property with Value Under Twenty Dollars

•

A finder of lost property of less than $20 in value must make a reasonable effort to find the owner and restore the property to them; if unable to do so after a reasonable effort, title vests in the finder one year after the finding. [N.Y. Pers.

Prop. Law §252( I )]

Property with Value of Twenty Dollars or More and Instruments

• A finder of lost property with a value of $20 or more, or an instrument as defined for purposes of the statute, who knows the property was lost, must within 10 days of finding it either return it to the owner or report such a finding and deposit the property with the local police. [N.Y. Pers. Prop. Law

§252(l)]

21

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

Abandoned Property

• Abandoned property is that which the owner has voluntarily relinquished all

ownership of without reference to any particular person or purpose.

•

The owner must intend to give up both title and possession.

Examples:

1) Allowing refrigerators to remain in a building that the owner of the refrigerators knew was to be destroyed would be deemed an act of abandonment.

2) A tenant's act of leaving her apartment for one week and becoming in arrears for one week's rent is not enough to constitute abandonment of the property in the apartment.

•

The landlord padlocked the tenant's door and attempted to charge an extra fee before allowing the tenant to reenter. It was held that the tenant had not abandoned her property and so the landlord had converted the property.

22

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

Escheat

• Where abandoned property is held by an intermediary with no property interest in the property (e.g., unclaimed funds held by banks or other depositories), the state may assume title to the property through a process called escheat.

• Property may be escheated only by the state in which the property is located.

• Intangible property is considered to be located at the domicile of the property owner.

23

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

Accession

• Accession is the addition of value to property by the expenditure of labor or the addition of new material.

• If the added article can be detached from the principal chattel, this will be ordered and each party will be put in status quo ante.

• If the added expenditure or thing cannot be detached from the principal chattel, the question arises as to who is the owner of the chattel in its enhanced state.

• The answer depends upon whether the trespasser acted in good faith or is a willful trespasser.

24

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

Accession

1) General Rule-Trespasser Cannot Recover

• The owner of a chattel does not lose her title merely because a trespasser has augmented or enhanced the value of that chattel.

• Generally, the authorities refuse to recognize any quasi-contractual claim to compensation by the innocent trespasser. Thus, the trespasser cannot recoup the value of his labor or materials added to the chattel.

2) Original Owner's Remedy

• The owner of the chattel may elect to sue the trespasser for damages for conversion

(value of the original material plus any consequential damages); or they may sue for replevin (i.e., sue for the return of the chattel).

3) Exceptions

• There are instances where the owner of the chattel will be restricted to a cause of action for damages (i;e., the value of the original chattel plus any consequential damages).

• In these instances, the former owner, by virtue of the act of accession, is divested of

title and may not elect to sue in replevin.

25

ACQUISITION AND LOSS OF RIGHT OR TITLE TO PERSONAL PROPERTY

Title by Judgment

a. Election of Remedies

• One who destroys, misuses, misdelivers, or otherwise wrongfully deprives the owner of chattel of his possessory rights, may be liable to the owner under various theories of recovery.

1) Replevin - Replevin is an action to recover the chattel itself.

2) Trespass - The action in trespass is to recover money damages incurred by reason of the dispossession.

3) Trover - The action in trover is to recover the value of the chattel along with damages for dispossession.

26

GIFTS

Types of Gifts

Gifts Inter Vivos (Gifts During Lifetime)

Gifts Causa Mortis (Gifts in Contemplation of Death)

The Three Factors that make a Gift

a. Donor's Intent b. Delivery c. Acceptance

27

GIFTS

When it comes to gifts remember your dear Aunt IDA

The Three Factors that make a valid Gift a. Donor's Intent b. Delivery c. Acceptance

28

GIFTS

Inter Vivos Gifts

Gifts in Contemplation of Marriage

• Engagement gifts (e.g., a diamond engagement ring) are made in contemplation of marriage and are conditioned upon the subsequent ceremonial marriage taking place.

• If the marriage does not occur, engagement gifts must be returned regardless of who is at fault for breaking off the engagement.

• The donor may recover gift even if donor is at fault.

29

GIFTS

Gifts Causa Mortis

a. Gifts of Personal Property Only

•

Only personal property may be transferred as a gift causa mortis.

b. Delivery and Acceptance

•

Delivery and acceptance must be sufficient to vest control and dominion in the donee.

•

Delivery to an agent does not complete the gift, since death is an event that terminates the agency.

c. Connection Between the Gift and the Donor's Fear of Death

•

At the time of the gift, the donor must have an immediate and present fear of death.

•

However, the actual cause of the death need not necessarily be the specific one the donor feared (i.e

.• donor hospitalized for cancer, but dies of stroke).

•

A gift causa mortis is revocable and is automatically revoked by the donor's recovery or by the donee's death.

30

Liens

So just what is a Lien?

Well lets go to Blacks Law Dictionary, and remember we need to think of property as a collection of

“Rights” and not a collection of “Things”;

Blacks Law Dictionary defines a “LIEN” as:

1.

A charge or security or encumbrance upon property

2.

A claim or charge on property for payment of some debt, obligation or duty

3.

A right to retain property for payment of debt or demand

31

Liens

Types of Liens

A.

Common Law Lien

A Common Law Lien is a common law, customary right to possess or retain personal property which has been improved or enhanced in value by the person who claims the lien until the person claiming the property pays in full all charges attaching to the property for such improvement.

Every lien requires that:

1. A debt has arisen from services performed on the thing;

2. Title to the thing is in the debtor; and

3. Possession of the thing is in the creditor.

B.

Statutory Lien

A Statutory Lien is an express right to enforce a lien pursuant to statute.

A lien is a security device to enforce payment

32

Liens

•

•

•

A Lien:

Gives the Lien holder the right to possess and retain certain property under certain circumstances

Can not be levied against an item not given by its owner; and

Can be deemed waived by contract, acceptance of other security, or by a demand for unlawful charges.

Classes of Liens

A.

General Lien

A general lien is the right to retain ALL OF THE PROPERTY of another person as security for a general balance due from such other person.

Certain creditors and universal agents can have a general lien.

B.

Special Lien

A special lien is the right to retain SPECIFIC PROPERTY of another to secure some particular claim or charge which has attached to the property retained.

A common or private carrier, a warehouser or ordinary bailee, a trustee, attorney, arbitrator, and a general or special agent may have a special lien.

33

Liens

Consequence of Classification

The question as to whether a lien is general or special becomes important only when the lienholder releases a portion of the chattels held as security. Where a doubt exists as to whether the lienholder has a general or special lien, the law presumes the lien to be special rather than general .

General Lien

If the lienholder has a general lien and releases part of the chattels, he releases no portion of the lien and he may hold the unreleased portion until the entire lien charge is paid.

Special Lien

If the lien is a special lienand the lienholder releases a portion of the chattels held, he thereby waives the lien to the extent of the chattels released.

34

BAILMENTS

A. DEFINITION

• A bailment is the relationship created by the transfer of possession of an item of personal property by one called the bailor to another called the bailee for the accomplishment of a certain purpose.

• Blacks defines Bailment as: “A delivery of goods or personal property, by one person to another, in trust for the execution of a special object upon or in relation to such goods, beneficial to the bailor or the bailee or both, and upon a contract, express or implied, to perform the trust and carry out such object, and thereupon redeliver the goods to the bailor or otherwise dispose of the same in conformity with the purpose of the trust.

”

35

BAILMENTS

A. DEFINITION

1. Elements of a Bailment

DAPPER

• * Delivery

• * Agreement

• * Personal Property

• * Purpose

• * Entered into for the Benefit of one or both parties; and

• * ended with Redelivery

36

BAILMENTS

A. Valid Bailments – For a Bailment to be Valid, there must be:

• A transfer of possession; and

• A demonstrated intent for the bailee to take control of the bailed item.

B. Care – The Legal Level of the Duty of Care for a Bailee depends on:

• Sole Benefit of the Bailor (Gratuitous) - the bailee must exercise only slight care with respect to the goods bailed and is liable only for gross negligence with respect to the bailed goods.

• Mutual Benefit Bailment (Commercial) – where the bailment is for hire and pledges are for the mutual benefit of the bailor and bailee, in such instances, the bailee must exercise a duty of ordinary care, and the bailee will be liable for her ordinary negligence.

• Sole Benefit of the Bailee – the bailee must exercise the highest level of care with respect to the bailed goods and is liable for negligence in the slightest degree.

C. Redelivery

• A Bailee must always redeliver the bailed item and is only entitled to use it if it must be used for the item’s protection (i.e. to milk a cow).

37

The Case of Regulation vs. Statute

The order of priority of laws in the United States is:

•

Constitution

•

Statute

•

Regulation

•

Executive Order

38

Intellectual Property

• Copyrights – Rights in Writings, Arts or Expression

• Patents – Rights in Inventions or Discoveries

• Trademarks – Rights in a Word, Name or Symbol

• These rights were not widely recognized in common law

• Are not enforceable world wide

• Are recognized in modern law pursuant to federal statutes

39

Common Law Felonies:

Remember - Mr & Mrs Lamb

M

urder

R

ape

M

anslaughter

R

obbery

S

odomy

L

arceny

A

rson

M

ayhem

B

urglary

40

Murder

A person is guilty of murder when:

1. With intent to cause the death of another person, he causes the death of such person or of a third person;

2. Under circumstances evincing a depraved indifference to human life, he recklessly engages in conduct which creates a grave risk of death to another person, and thereby causes the death of another person; or

3. Acting either alone or with one or more other persons, he commits or attempts to a felony, and, in the course of and in furtherance of such crime or of immediate flight therefrom, he, or another participant, if there be any, causes the death of a person other than one of the participants.

41

Rape

A person is guilty of rape when:

He or she engages in sexual intercourse with another person:

1. By forcible compulsion; or

2. Who is incapable of consent by reason of being physically helpless; or

3. Who is less than eleven years old; or

4. Who is less than thirteen years old and the actor is eighteen years old or more.

42

Manslaughter

A person is guilty of manslaughter when:

1. With intent to cause serious physical injury to another person, he causes the death of such person or of a third person; or

2. With intent to cause the death of another person, he causes the death of such person or of a third person under circumstances which do not constitute murder because he acts under the influence of extreme emotional disturbance.

43

Robbery

Robbery is forcible stealing.

A person forcibly steals property and commits robbery when:

In the course of committing a larceny, he uses or threatens the immediate use of physical force upon another person for the purpose of:

1. Preventing or overcoming resistance to the taking of the property or to the retention thereof immediately after the taking; or

2. Compelling the owner of such property or another person to deliver up the property or to engage in other conduct which aids in the commission of the larceny.

44

Sodomy

(No long referred to in New York’s Penal Law)

Under common law, a person was guilty of Sodomy when:

He or she engages in deviate sexual intercourse with another person:

1. By forcible compulsion; or

2. Who is incapable of consent by reason of being physically helpless; or

3. Who is less than eleven years old; or

4. Who is less than thirteen years old and the actor is eighteen years old or more.

45

Larceny

A person steals property and commits larceny when:

With intent to deprive another of property, or to appropriate the same to himself or to a third person, he wrongfully takes, obtains or withholds such property from an owner thereof.

Larceny includes a wrongful taking, obtaining or withholding of another's property, committed in any of the following ways:

(a) By conduct known as larceny by trespassory taking, larceny by trick, embezzlement, or by obtaining property by false pretenses; or

(b) By acquiring lost property, when during such acquisition he exercises control over property of another which he knows to have been lost or mislaid, or to have been delivered under a mistake as to the identity of the recipient or the nature or amount of the property, without taking reasonable measures to return such property to the owner; or

(c) By committing the crime of issuing a bad check; or

(d) By false promise, when, pursuant to a scheme to defraud, he obtains property of another by means of a representation, express or implied, that he or a third person will in the future engage in particular conduct, and when he or the third person does not intend to do so; or

(e) By extortion, when he compels or induces another person to deliver such property to himself or to a third person by means of instilling in him a fear that, if the property is not so delivered, the actor or another will:

(i) Cause physical injury to some person in the future; or

(ii) Cause damage to property; or

(iii) Engage in other conduct constituting a crime; or

(iv) Accuse some person of a crime or cause criminal charges to be instituted against him; or

(v) Expose a secret or publicize an asserted fact, whether true or false, tending to subject some person to hatred, contempt or ridicule; or

(vi) Cause a strike, boycott or other collective labor group action injurious to some person's business; except that such a threat shall not be deemed extortion when the property is demanded or received for the benefit of the group in whose interest the actor purports to act; or

(vii) Testify or provide information or withhold testimony or information with respect to another's legal claim or defense; or

(viii) Use or abuse his position as a public servant by performing some act within or related to his official duties, or by failing or refusing to perform an official duty, in such manner as to affect some person adversely; or

(ix) Perform any other act which would not in itself materially benefit the actor but which is calculated to harm another person materially with respect to his health, safety, business, calling, career, financial condition, reputation or personal relationships.

46

Arson

A person is guilty of arson when:

He intentionally damages a building or motor vehicle by causing an explosion or a fire;

1. When:

A. Such explosion or fire is caused by an incendiary device propelled, thrown or placed inside or near such building or motor vehicle; or

B. Such explosion or fire is caused by an explosive; or

C. Such explosion or fire either:

(i) causes serious physical injury to another person other than a participant, or

(ii) the explosion or fire was caused with the expectation or receipt of financial advantage or pecuniary profit by the actor; and

2. When another person who is not a participant in the crime is present in such building or motor vehicle at the time; and

3. When the defendant knows that fact or the circumstances are such as to render the presence of such person therein a reasonable possibility.

47

Mayhem

(Merged under Crime of First Degree Assault in Present Day NY Law)

At Common Law, Mayhem Was defined as:

The intentional disfigurement of any part of the male body useful in time of war.

48

Burglary

A person is guilty of burglary when:

1. He knowingly enters or remains unlawfully in a dwelling with intent to commit a crime therein, and

2. In effecting entry or while in the dwelling or in immediate flight therefrom, he or another participant in the crime:

A. Is armed with explosives or a deadly weapon; or

B. Causes physical injury to any person who is not a participant in the crime; or

C. Uses or threatens the immediate use of a dangerous instrument; or

D. Displays what appears to be a pistol, revolver, rifle, shotgun, machine gun or other firearm.

49

Review of Real Property

Looking Back to See our Way Forward

50

In Review:

The Four Postulates of Property Law:

1. Property needs to be seen as a collection of “Rights” not a collection of “Things”;

2. Property Rights are those recognized by Law and the Law evolved from Property Rights;

3. Our Foundations of Law recognized that we are endowed with Property Rights; and

4. Property Rights can be summarized by E-PUT

51

Real Property Basics

• Historically, Real Property has meant wealth, power and life.

• To truly understand Real Property and its legal concepts, one must think in terms of possession and time.

• Complex legal rules and holdings of Real Property have developed because of the inherent value and uniqueness of real property.

52

Real Property Taxes

• There are two types of taxes, and really only two types of taxes, which tax you on what you own or have, not upon what you earn or acquire. These two types of taxes are Real Property Taxes and Estate (or Death) Taxes .

• In New York State, Real Property Taxes are used to finance local governments and schools .

• The STAR Program in New York Shifts school tax revenue from real property taxes to State income taxes .

• The TAX CAP seeks to limit the growth in real property taxes by requiring a 60% vote before a local government or school district can raise real property taxes 2 percent above the tax levy

• Governments us the Real Property Tax , to generate revenue because its is a more dependable, less fluctuating, source of revenue .

53

Words of Purchase vs. Words of Limitation

To determine what rights exist in an Interest in Land, there are two factors which tell the story and they appear in the deed as follows:

• Words of purchase:

Describe

who

takes the real property by grant, gift, inheritance or bequest.

• Words of limitation:

Describe the

type

and

duration

of the estate taken by the transferee.

54

Interests in Land

• A Two Step Dance: Possession and Time

Step One: Form of Possession

• Possessory Interests in Land (Either presently or in the future)

• Non - Possessory Interests in Land (Either presently or in the future)

Step Two: When the Interest Vests

• Present interests (When the RIGHT to possess is NOW)

• Future interests (When the RIGHT to possess is in the future)

55

Interests in Land

• Possessory Interests in Land (Either presently or in the future)

1. Fee Simple Absolute

2. Defeasible Estates

- Fee Simple Determinable with Possibility of Reverter

- Fee Simple Subject to a Condition Precedent

- Fee Simple Subject to an Executory Interest

3. Fee Tail

4. Life Estate

• Non possessory interests in land: (An Interest with a right that can be executed but is not presently possessed)

1. Easements

2. Profits,

3. Covenants, and

4. Servitudes

56

Interests in Land – Possessory Interests

• Possessory Interests in Land

(Either presently or in the future)

1. Fee Simple Absolute

2. Defeasible Estates

- Fee Simple Determinable with Possibility of Reverter

- Fee Simple Subject to a Condition Precedent

- Fee Simple Subject to an Executory Interest

3. Fee Tail

4. Life Estate

57

Interests in Land – Possessory Interests

Present, possessory interests.

• Highest Level Estate in Land:

FEE SIMPLE ABSOLUTE

1. Invests the owner with all possible rights (E-PUT) now and in the future.

2. It is the presumed form of ownership grant, unless a lesser estate grant was expressly intended.

3. Is of perpetual and infinite duration (lasts forever).

4. Is the form of ownership from which all lesser forms are derived.

Magic Language: “To Grantee and their heirs”

58

Fee Simple Absolute

“To A and his heirs”

• What are the words of purchase?

• What are the words of limitation?

To A

Words of purchase and his heirs

Words of limitation

Infinity

59

What are the critical attributes of

Fee Simple Absolute?

When a transfer is made to A and his heirs:

Alienable

(Able to be sold/gifted),

Reducible

(Able to be reduced to a lesser estate)

Devisable

(Able to be given by will or intestate), and

Lasts for Perpetuity

(Forever – No Limitation of Time).

60

Interests in Land – Possessory Interests

• Defeasible Estates

These are possessory fee estates of infinite duration that can be terminated by the happening of a specified event.

These are a lesser estate than fee simple absolute.

FEE SIMPLE DETERMINABLE (Possibility of Reverter)

1. An Estate that AUTOMATICALLY terminates upon the happening of a stated event.

2. Stated event must be for a lawful purpose.

Magic Language: “To Grantee and their heirs for so long as” or “while” or “during” or

“until” (the occurrence of an event).

61

Fee Simple Determinable

“To A and his heirs for so long as …”

• What are the words of purchase?

• What are the words of limitation?

To A

Words of purchase and his heirs for so long as …

Words of limitation

Infinity

62

What are the critical attributes of

Fee Simple Determinable?

When a transfer is made to A and his heirs for so long as … :

All Subject to the Possibility of Reveter

Alienable

(Able to be sold/gifted),

Reducible

(Able to be reduced to a lesser estate)

Devisable

(Able to be given by will or intestate), and

Lasts for “So Long As”

(The Limitation of The Reverter).

63

Interests in Land – Possessory Interests

• Defeasible Estates Continued

These are possessory fee estates of infinite duration that can be terminated by the happening of a specified event.

These are a lesser estate than fee simple absolute.

FEE SIMPLE SUBJECT TO A CONDITION SUBSEQUENT

1.

An Estate that can terminate upon the happening of a stated event and the taking of an action by the party granted such rights by the transferring owner.

2.

Known as a RIGHT OF RE-ENTRY , this termination is

NOT AUTOMATIC and needs the grantor to take action

Magic Language: “To Grantee and their heirs upon the condition that” or “provided that” or “but if” or “if it happens that” (the occurrence of an event).

64

Interests in Land – Possessory Interests

• Defeasible Estates Continued

FEE SIMPLE SUBJECT TO A CONDITION SUBSEQUENT

- A RIGHT of RE-ENTRY CAN be waived

(unlike Fee Simple Determinable which is automatic) by express agreement or by conduct.

- Although inaction by itself is NOT a waiver, where there is inaction, and detrimental reliance, courts have held a waiver by the grantor pursuant to the doctrine of estoppel.

- The rights of a Fee Simple Subject to a Condition Subsequent have been held to be devisable, but NON TRANSFERABLE.

65

Fee Simple Subject to Condition Subsequent

“To A and his heirs upon the condition that …”

• What are the words of purchase?

• What are the words of limitation?

To A

Words of purchase and his heirs upon the condition that …

Words of limitation

Infinity

66

What are the critical attributes of Fee Simple

Subject to a Condition Subsequent

?

When a transfer is made to A and his heirs upon the condition that … :

All Subject to the Right of Re-entry

Alienable

(Able to be sold/gifted),

Reducible

(Able to be reduced to a lesser estate)

Devisable

(Able to be given by will or intestate), and

Lasts until the condition arises

AND

the Right of Re-entry is exercised

.

67

Interests in Land – Possessory Interest s

• Defeasible Estates

FEE SIMPLE SUBJECT TO AN EXECUTORY INTEREST

-

A Defeasible Estate that AUTOMATICALLY divests in favor of a THIRD PERSON upon the happening of a stated event.

- Different from a

FEE SIMPLE DETERMINABLE in that this estate does not revert to the grantor but to a 3 rd PERSON.

- Subject to the Rule Against Perpetuities .

- Title passes to a third party in the event that the Condition is satisfied.

68

Interests in Land – Possessory Interests

• Defeasible Estates

LIMITATIONS

– Possibility of Reverters and Rights of Re-entry have been limited by most states to foster the marketability of title.

A free society needs the ability to freely transfer property, and not impair the title of the same from transactions which occurred years ago.

– DIRECT STATUTORY PRECLUSIONS (usually 30 years)

– RULE AGAINST PERPETUITIES (21 years plus lives in being)

– RULE IN SHELLEY’S CASE

(Remainder limited to heirs or heirs of the body)

– DOCTRINE OF WORTHIER TITLE (Remainder invalid, Grantor retains reversion) 69

Interests in Land – Possessory Interests

Present, Possessory Interests.

FEE TAIL

1. An Estate limited to the grantee and his or her family

2. Reverts to grantor if not owned by heir

3. No longer recognized in almost any state

Magic Language: “To Grantee and heirs of their body”

Now

FEE SIMPLE ABSOLUTE

70

Interests in Land – Possessory Interests

Present, Possessory interests.

LIFE ESTATE

1. By Marital Right (Dower and Curtsey)

2. For Life of Grantee

3. Pur Autre Vie (Life of Another)

Magic Language: “To Grantee for Life” or

“To Grantee for the Life of Tilda Spain”

71

Life Estate

“To A for Life…”

• What are the words of purchase?

• What are the words of limitation?

To A

Words of purchase for life…

Words of limitation

Infinity

72

Interests in Land – Non Possessory Interests

Until now we have discussed “Possessory Interests”, meaning interests in real property that either ARE, or WILL BE (pre-vested interests)

POSSESSED by the holder of the property.

Just as there are possessory interests in real property where possession is not effectuated yet because of time or condition, the law also recognizes interests in real property where the holder of such interest does NOT EVER actually POSSESS the property.

Such are interests are deemed “Non - Possessory Interests”

73

Joint Interests/Concurrent Estates

Tenancy in the Entirety

By Marital Right – only between husband and wife

- Right of Survivorship – by operation of law

- Severance Limited (Death, divorce, agreement, joint creditor execution)

- Joint Tenancy

Created by unity of time, title, interest and possession

- Right of Survivorship – by operation of law

- Severance Less Limited (Inter vivos conveyance or contract to convey, death, agreement, foreclosure on lien)

- Tenants in Common

- No Right of Survivorship.

- Freely alienable.

- Joint ownership based upon percentage.

- Share & responsible proportionally in all gains / liabilities.

74

Future Interests

75

Future Interests - Estates in Time

Life Estates

The remainder is the estate in time.

- Possibility of Reverters

The reversion is the estate in time.

- Rights of Re-Entry

The right of re-entry is the estate in time.

76

Future Interests – Estates in Time

• Like all property, interests in land are a collection of rights

• Interests in Land need to be seen through the prism of:

– Possession

– Time

Two Major Questions

• Possession – Does the interest allow possession of the realty?

• Time – What time will the interest in the property be executed?

This time factor is the critical question when dealing with “Future Interests”

77

Future Interests – Estates in Time

Remember – We need to think of possession & time

Black’s Law Dictionary – Definition

Future Interests: “Interests in land or other things in which the privilege of possession or of enjoyment is future or non present.”

The real property rights that are left over from the granting of an interest

78

As a result …

Possessory Interests in Land

Can be:

Present Possessory Interests or

Future Interests

79

Future Interests – Estates in Time

• A Two Step Dance: Posession and Time

• Possessory Interests in Land (Either presently or in the future)

1. Fee Simple Absolute

2. Defeasible Estates

- Fee Simple Determinable with Possibility of Reverter

- Fee Simple Subject to a Condition Precedent

- Fee Simple Subject to an Executory Interest

3. Fee Tail

4. Life Estate

• Present interests (When the RIGHT to possess is NOW)

• Future interests (When the RIGHT to possess is in the future)

80

Types of Future Interests

• Reversionary Interests

•

Reversions

• Possibility of Reverter

•

Right of Re-entry

• Remainders

• Indefeasibly vested remainder

• Vested remainder subject to open

• Vested remainder subject to complete divestment

•

Contingent remainder

• Executory Interests (Limitations)

• Shifting executory interest

• Springing executory interest

81

Explanations of Future Interests

• Reversionary Interests

–

Reversion

The residue (or future interest) of an estate left by operation of law in the grantor or his heirs.

Examples/Explanation:

When any lesser estate is created from the fee simple absolute, the reversion is legal rights in the estate that the grantor or his heirs are entitled to after such creation, including remainders or executory interests, vesting in the grantor of his heirs. The key is that such legal interest RETURNS to the grantor or his heirs.

82

Explanations of Future Interests

• Reversionary Interests

–

Possibility of Reverter

A specific type of reversion, pursuant to a fee simple determinable, whereby the estate

AUTOMATICALLY returns to grantor of his heirs upon the happening of a stated, legal, event.

Examples/Explanation:

When a grantor transfers an estate to the grantee for so long as the property remains an active, cultivated farm, if the grantee stops using such property for such legal purpose, the parcel automatically reverts back to the grantor or his heirs.

83

Explanations of Future Interests

• Reversionary Interests

–

Right of Re-entry

A specific type of reversion, pursuant to a fee simple subject to a condition subsequent, whereby the grantor or his heirs have a right to reclaim the estate upon the happening of a stated, legal, event.

Examples/Explanation:

When a grantor transfers an estate to the grantee upon the condition that the property remains an active, cultivated farm, if the grantee stops using such property for such legal purpose, then the grantor or his heirs can exercise a right to reclaim full title to the parcel.

84

Explanations of Future Interests

• Remainders

–

Remainder

The remnant (or future interest) of an estate depending upon a particular prior estate created at the same time and by the same instrument, and limited to arise immediately on the determination of that estate, and not in abridgement of it. In other words, a remainder is a future interest limited in favor of a transferee, which may become possessory immediately upon the termination (upon the happening of a limitation) of a prior possessory estate

simultaneously created

Examples/Explanation:

Those rights in an estate which are left over (i.e. that remain) from the creation of a lesser estate.

85

Explanations of Future Interests

• Remainders

–

Remainders v. Reversions

Reversions are special remainders, whereby the remainder vests in the grantee or his heirs. As a result, all reversions are remainders, but NOT all remainders are reversions.

Examples/Explanation:

In the case of a reversion, the remainder is those rights in an estate which are left over (i.e. that remain) from the creation of a lesser estate and vest in the grantor of his heirs. In a remainder that is not a reversion, such is where such rights vest in another person who is NOT the grantor or his heirs.

86

Explanations of Future Interests

• Remainders

–

Vested Remainder

An indefeasibly vested remainder is a remainder that will, in all events, become possessory immediately upon the termination of the prior possessory estate

(either in the remainderman or his successor)-no “ifs, no

“ands”, no “buts”.

Examples/Explanation:

A vested remainder is a definite interest that will become possessory .

87

Explanations of Future Interests

• Remainders

–

Vested Remainder Subject to Open

A vested remainder subject to open (also known as a vested remainder subject to partial divestment) is a vested remainder limited in favor of a class of persons collectively described

(and typically related to each other though a common ancestor) of which there is at least one living member.

Examples/Explanation:

To Harold for life, then to such of my grandchildren who have graduated from college. Under this grant, the number of grantees can expand as more grandchildren are born and graduate.

88

Explanations of Future Interests

• Remainders

– Vested Remainder Subject to Complete

Divestment

A vested remainder subject to complete divestment is a remainder limited in favor either of a born or ascertained individual or in favor of a class of persons of which there is one living member which is subject to the happening of a condition subsequent and not a condition precedent.

If the condition subsequent occurs, the vested remainder could fail; if the vested remainder becomes possessory as a fee simple estate before the condition subsequent occurs, the fee simple will terminate.

In both cases, another estate (known as a shifting executory interest) will either vest in interest or possession.

Examples/Explanation

:

To Alice for life, then to Bob and his heirs, but if Bob does not survive Alice, then to Carol and her heirs. This is subject to a definite condition not a condition that might happen. Therefore, if the condition occurs then the property is held in fee simple.

89

Explanations of Future Interests

• Remainders

–

Contingent Remainder

A contingent remainder is a remainder that is subject to a condition precedent.

It also includes remainders limited in favor of unborn or unascertained persons for whom the condition precedent includes either being born or being ascertained.

Examples/Explanation

:

To Alice for life, then to Bob if he has graduated from college.

This is subject to a condition that might or might not happen.

Upon the satisfaction of the condition its held in fee simple.

If, however, the condition is not satisfied

(i.e. Alice dies before Bob graduates from college) then the grantor will get a reversion.

90

Explanations of Future Interests

• Executory Interests

–

Springing Executory Interest

The springing executory interest is a future interest limited in favor of a transferee which can become possessory only after some period of time during which there is no other transferee entitled to a freehold estate, and which, if it becomes possessory, divests the grantor of a retained interest in the property

Examples/Explanation

:

Bert conveys his estate to Alfred for the use of Bert, and upon the marriage of my daughter Carol to (prospective son in law) David, for the use of Carol.

By providing for this contingent use,

Bert can provide an incentive for his daughter to marry and in such event pass on the property for his daughter’s use without inheritance taxes.

91

Explanations of Future Interests

• Executory Interests

–

Shifting Executory Interest

A shifting executory interest is a future interest that is limited in favor of a transferee which can become possessory only by divesting the present possessory interest or a vested future interest limited in favor of another transferee.

A divesting occurs only upon the happening of a condition. Shifting executory interests divest other grantees, not grantors.

Note: The one exception to this rule was that a shifting executory interest is the future interest in a transferee following a fee simple determinable even though a fee simple determinable ends, if it ends at all, upon the happening of a limitation rather than a condition.

Examples/Explanation

:

Bert conveys his estate to Alfred for the use of his son Clark, but if his son David returns from his adventure climbing Mt. Everest, for the use of David as well.

By providing for this contingent of David’s return, Bert can provide for the use by both sons, As such, Bert can again pass on the property for both his sons’ use without inheritance taxes.

92

Review - Types of Future Interests

• Reversionary Interests

– Reversions

– Possibility of Reverter

– Right of Re-entry

• Remainders

– Vested

– Vested subject to partial divestment

– Vested subject to complete divestment

– Contingent

• Executory interests (limitations)

– Shifting

– Springing

93

Title Limitation Rules

•

Rule in Shelley’s Case

–

(To A for Life with remainder in A’s Heirs: Now to A in Fee Simple Absolute)

•

Doctrine of Worthier Title –

(To A for Life with remainder in O’s Heirs: Now to A with reversion in O)

•

Rule Against Perpetuities –

(No property interest is good unless it must vest, if at all, not later than 21 years plus lives in being)

•

Rule Against Restraints on Alienation –

(All disabling and absolute restraints are void, some equitable, promissory, temporary restraints can be upheld)

These Rules All Seek to Promote Marketable Title and

Ensure that Real Property is NOT Controlled for any significant time from Beyond the Grave

94

Fixtures

In General:

A “fixture” is a chattel that has been affixed to land and as such has ceased being personal property and has become part of the realty .

Common Fixtures:

Stoves, affixed flat screen TV’s, curtain rods, door keys.

Challenging Items:

• Flat Screen TV’s, In Room Air Conditioners

• Electrical Generators, Art Collections

• Screened Yard Houses, Satellite Dishes

• Basketball Units

95

Adverse Possession

Generally

At the core of adverse possession is a statute of limitations

Statutes of Limitation bar suits after some period of time after the cause of action accrues

Under New York State Law (Section 212 (a) of the CPLR) the statute of limitations (time period for adverse possession) for an action to recover real property is 10 years.

96

Adverse Possession

Basic Issues

* In context of actions to recover possession of real property the cause of action accrues at the time the wrongdoer enters and takes possession of the property.

* A Cause of action for wrongful possession differs from cause of action for trespass.

* In trespass, there is a wrongful entry, not wrongful possession

* If some one is purchases a building on top of property not owned or leased by them the owner of the land can sue the building owner for ejectment and make them take the building off the land.

97

Adverse Possession

Underlying Policies – Why the Law Recognizes It

• To reward productivity with the land

• To avoid continuing, unresolved, title disputes

• To penalize true owners for sitting on their rights and not protecting their land

98

Adverse Possession

Specific Requirements - COACHEN

C – O – A - C – H – E – N

99

Adverse Possession

Specific Requirements - COACHEN

•

Continuous

•

Open

•

Actual

•

Claim of Right

•

Hostile

•

Exclusive

•

Notorious

100

Adverse Possession

Tacking and Tolling

• Tacking

- Under New York State Law, an adverse possessor may tack (or add to) his time under the statute of limitations, the adverse possession time of the previous land owner.

• Tolling

- Under New York State Law, certain disabilities of the true land owner can toll (or stop the time running of) the statute of limitations. These include: Minority (under the age of 18); Mental incompetence; Imprisonment; and Soldiers and Sailors on active duty.

101

Non Possessory Interests

“Possessory Interests”, are interests in real property that either are, or will be (pre-vested interests) possessed by the holder of the property.

“Non Possessory Interests”, are interests in real property interests where the holder of such interest does not ever actually possess the property. It is the right to use land possessed by someone else.

102

Non Possessory Interests

•

Easements

•

Profits

•

Covenants

•

Servitudes

103

Non Possessory Interests: EASEMENTS

•

An Easement is defined as:

“The right to use a tract of land for a specific purpose”.

• Types of Easements:

- Affirmative (Allows a non possessor to use land)

- Negative (Prevents possessor from a specific use)

- Appurtenant (Permits adjoining landowner a use)

- In Gross (Permits use by non adjoining landowner)

104

Creation of Easements

The basic methods of creating an easement are:

•

Express grant

•

Express reservation

•

Implication, and

•

Prescription.

105

Transfer of Real Property

Conveyances - C

o

M

man

D

e

R

There are four major factors to a transfer of real property. They are:

Contract

Mortgage

Deed

Recording

106

Transfer of Real Property:

Conveyances

The Contract:

Because of the Statute of Frauds, all agreements for the sale of real property must be in writing and signed by the Party to be charged.

Because of Specific Performance – Both Parties sign a Contract to purchase Real Estate

Most contracts are provided by non lawyer realtors and contain a standard “attorney approval clause which allows the buyers to have an attorney examine the same within a specified period of time and cancel it if it is not in their best interest.

107

Transfer of Real Property: Conveyances

The Contract:

In the Contract, there is an implied warranty to transfer:

Marketable Title

- Title (ability to pass ownership) is free from doubt

- Free from Encumbrances (Mortgages, liens, easements, covenants, encroachments)

Although most contracts provide for the sale of the premises “as is”, a duty to disclose known defects has been upheld by the courts and is now standard form in nearly all real estate contracts. Active concealment by a seller is deemed fraud.

Sellers frequently now also add specific disclaimers of liability, particularly on expensive items like leaky foundations or roofs.

108

Transfer of Real Property: Conveyances

The Contract:

Most buyers find real estate through a Real Estate Agent:

The Real Estate Agent is an “Agent” for the Seller, and the Seller by means of a written listing agreement is liable for their commission, usually between 6 to 7 percent of the sale value.

Real Estate Agents are licensed by the State of New York .

They are sales people, who make their income from making sales of real estate. Although they work for and must represent the Seller, they have a vested interest in making the buyer happy and enthusiastic about the purchase of the property. Also because they may represent many buyers, they can offer one buyer several choices, especially through the multiple listing service.

109

Transfer of Real Property: Conveyances

The Mortgage:

The Mortgage is the Legal Instrument by which Real Estate can be Financed.

A mortgage is both a loan contract and a lien

Elements of a Mortgage:

Must be in writing –Statute of Frauds

Must Describe the Land and the Parties

Like all contracts, they can have different terms (duration, interest rates and payment structures) but most clauses are both federally and state regulated, causing them to be highly uniform so they can be sold on the secondary mortgage market (Fannie Mae and Freddie Mac – Federal

National Mortgage Association and Federal Home Mortgage Corporation).

Under Federal and State tax law, Home Mortgage interest is tax deductible.

Mortgage Interest Rates are front loaded so early payments are much more heavily interest than principal. As a result a 15 year mortgage is far less costly due to a shorter term of interest payment than a 30 year mortgage.

Mortgages are an exception to the Homestead exemption and can foreclose on tenants by the entirety because both owners would be required to sign mortgage.

110

Transfer of Real Property: Conveyances

The Mortgage:

Types of Mortgages:

First and Second Mortgages – A property may contain more than one mortgage. The first mortgage is the first in time (and usually the first in right). The second or secondary mortgage (often a home equity loan) is financing on whatever amount between the amount of the first mortgage and the amount of the value of the home (i.e. the equity).

Amortized Mortgage – A mortgage for a specified term of years – usually 15 or 30 years – where the principal and interest are amortized over the period of the loan in equal payments.

Balloon Payment Mortgage - A mortgage for a specified term of years where after a period of equal loan payments, a single, large balloon payment is due upon the conclusion of the loan.

Assumed Mortgage – A mortgage taken by a previous owner of the property that is assumed (i.e. taken over) by a subsequent owner.

Purchase Money Mortgage – A mortgage loan made by the owner of the property to the purchaser of the property for a portion of the purchase price.

111

Transfer of Real Property: Conveyances

The Mortgage:

Types of Mortgages:

Prime Rate Mortgages – A mortgage made at market interest rates.

Fixed Rate Mortgage – A mortgage made at a rate of interest consistent and unchanging during the course of the loan.

Variable Rate Mortgage – A mortgage made at a rate of interest that fluctuates during the course of the loan (most often tied to prime rates or treasury bills plus a fee amount).

Convertible Mortgage - A variable rate mortgage convertible for a time period during the term to a fixed rate upon the payment of a fee.

Sub Prime Mortgage – A mortgage with a variable rate that begins at an interest rate below the prime rate.

Due on Sale Clause – Most mortgages require the mortgage to be paid off in total upon the sale of the property. An assumable mortgage is not due on sale.

Foreclosure – The right of the Mortgagor to repossess and sell the property for the mortgagee’s failure to provide payment of the mortgage pursuant to its terms. Mortgagor is also entitled to collect a deficiency if one exists, or remit the balance if there is a surplus.

112

Transfer of Real Property: Conveyances

The Deed:

The Deed is the Legal Instrument by which the title to the Real

Property is passed.

(We no longer do livery of seizen)

Form and Content of the Deed:

Must be in writing –Statute of Frauds

Must Describe the Land and the Parties

Must provide “words of intent” – How the property is transferred and held – i.e. fee simple absolute or any terms of limitation.

Consideration is unnecessary, since the Deed merely represents the title and not the contract or agreement under which terms it is passed.

Seal and Attestation are also unnecessary, but can be required for recording.

A signature is required from the grantor. A grantee’s signature is not required even if it contains covenants as their acceptance of the deed is deemed acceptance of the covenants or limitations.

113

Transfer of Real Property: Conveyances

The Deed Continued:

A deed must be delivered and accepted to be effective

Title to property passes upon effective delivery, as a result returning it back to the grantor has no effect, since title has already passed.

Physical or manual (through the mail or courier) delivery is required

Delivery is presumed if handed to grantee, if delivery is acknowledge before a notary by the person delivering the deed to the grantee, or if the deed is recorded.

114

•

•

•

Transfer of Real Property: Conveyances

The Deed Continued:

There are three types of deeds characteristically used to convey property interests:

To remember these think of Harry Potter ( G ryffindor is S tupendous at Q uidditch )

1.

The general warranty deed,

2.

The special warranty deed (usually statutory ), and

3.

The quit claim deed.

The major difference between these deeds is the scope of assurances

(covenants for title) they give to the grantee and the grantee's successors regarding the title being conveyed.

The general warranty deed normally contains five covenants for title as will be seen ahead

The special warranty deed contains fewer and more limited assurances.

The quitclaim deed usually contains no assurances; it releases to the grantee whatever interest the grantor happens to own.

115

Transfer of Real Property: Conveyances

Recording:

• At common law, in nearly all cases priority was given to the grantee first in time.

• First in Time was considered first in right

• Thus, if A conveyed Blackacre to B and then made an identical conveyance to C, B would prevail over C on the theory that after the first conveyance A had no interest left to convey.

116

Transfer of Real Property: Conveyances

Recording:

Statutes known as "recording acts" require a grantee to make some sort of recordation so as to give "notice to the world" that title to certain property has already been conveyed, and thus to put subsequent purchasers on guard. These statutes are in effect in some form in every state.

Basically, recording acts set up a system by which any instrument affecting title to property located in a certain county can be recorded in that county. These acts seek to protect all subsequent Bona Fide

Purchasers (BFP) from secret, unrecorded interests of others.

Purpose of Recordation-Notice - Recordation is not essential to the validity of a deed, as between the grantor and grantee.

However, if a grantee does not record her instrument, she may lose out against a subsequent BFP. By recording, the grantee gives constructive (or "record") notice to everyone. Hence, as stated earlier, proper recording prevents anyone from becoming a subsequent BFP.

117

Transfer of Real Property: Conveyances

Recording Continued:

•

•

Requirements for Recordation

1) What Can Be Recorded-Instrument Affecting an Interest in Land

Practically every kind of deed, mortgage, contract to convey, or other instrument creating or affecting an interest in land can be recorded. Note: A judgment or decree affecting title to property can also be recorded. And, even before judgment, where a lawsuit is pending that may affect title to property, any party to the action can record a lispendens (notice of pending action), which will effectively put third parties on notice of all claims pending in the lawsuit.

2) Grantor Must Acknowledge Deed

Most recording statutes provide that, in order to be recorded, a deed must be acknowledged by the grantor before a notary public. This requirement offers some protection against forgery. Problems may arise if the recorder records a deed that has not been acknowledged or has been improperly acknowledged.

Mechanics of Recording

1) Filing Copy

The grantee or her agent normally presents the deed to the county recorder, who photographs it and files the copy in the official records. These records are kept chronologically.

2) Indexing

The recorder also indexes the deed to permit title searches. The usual indexes are the grantorgrantee and grantee-grantor indexes, which are arranged by reference.

118

The Law of Land Use

•

Nuisance

•

Trespass

•

Zoning and Planning

•

Governmental Taking (Eminent domain)

119

Nuisance

• The law has long recognized the concept that one must not use one’s property to injure another’s property. When this type of conduct occurs it can legally be classified as Nuisance.

• Private Nuisance – A private nuisance is the substantial interference with private rights to use and enjoy land, produced by either intentional and unreasonable conduct, or by unintentional conduct that is either negligent, reckless, or so inherently dangerous that strict liability is applied.

• Public Nuisance – A Nuisance that affects the rights held in common by many landowners, i.e. the public, rather than the specific rights of an individual, targeted landowner can be classified as a public nuisance.

120

Nuisance

• Remedies for nuisance include remedies at law and equity or both. As a result, a party who has suffered a nuisance can bring an action for:

* Money Damages;

* Injunction (to have the person creating the nuisance cease creating it); or

* Both

121

•

•

•

•

•

Trespass

The law has also long recognized the concept that a property owner is entitled to use one’s property with out interference from others, and that property owners have an inherent right to exclude those who may so wish to so interfere. When this type of physical interference occurs, it can legally be classified as Trespass.

Trespass Defined

–

At common law, any intentional and unprivileged entry onto land owned or occupied by another constituted a trespass. Although recent developments in the law have focused on carving out special exceptions to liability, the basic liability standards have not changed.

Intent The element of intent has a special meaning in trespass law. A trespasser is strictly liable; good faith, knowledge, and fault are irrelevant. A person commits trespass, even if they merely walk across a property owner’s land, mistakenly believing it to be their own. The trespass doctrine requires only that the trespasser intended to enter onto the land as a matter of free choice, not that he had a subjective intent to trespass or even knew he was trespassing.

Entry - Although trespass always involves a physical invasion, a trespass may occur without any personal entry by the trespasser. For a trespasser will also be liable in trespass, if they cause a thing or a third person to enter the property owner’s land. This doctrine also applies to entries below the land surface (e.g., through tunnels or caves) as well as-at least partially to entries in the air space over the land.

Remedies A trespasser is liable even if the entry causes no actual damage. A court can hold a trespasser liable for nominal damages and, upon the property owner’s request, can enjoin any further trespass.

122

Trespass

General Exceptions to Trespass Liability

An entry under a legally recognized privilege does not constitute a trespass.

A privileged entry is one made with the landowner's consent.

If an owner invites a repairman onto their land to fix a leaky pipe, then the workman’s entry is privileged.

Privilege may also be found of necessity.

A firefighter may enter private property to save an adjacent house from fire.

A police officer may enter to arrest a suspect.

Private persons can also be found to have a privilege to enter another's land in an emergency situation (e.g., while fleeing from an attacking bear).

123

Trespass

•

Remedies for trespass also include remedies at law and equity or both. As a result, a party who has suffered a nuisance can bring an action for:

* Money Damages; (can be nominal)

* Injunction (called ejectment, to have the trespasser removed from the property and/or enjoined from re-entering it); or

* Both

124

Zoning

• Zoning is the use of governmental power to regulate land use.

• Zoning laws divide a political jurisdiction into specific separate geographic areas and impose limits on the permissible uses of land within each area.

• Zoning has several legitimate objectives:

(1) To prevent incompatible uses from occurring (thus reducing the need for nuisance law),

(2) to increase property values generally by minimizing use conflicts (thus increasing the property tax base). and

(3) to channel development into patterns that may serve larger

social goals (e.g., reduce urban sprawl to conserve resources and reduce air pollution from automobiles).

• Zoning is the use of public power to impose uniform results that might otherwise be accomplished in more piecemeal and selective fashion by private bargains.

125

Eminent Domain

TAKINGS: THE POWER OF EMINENT DOMAIN AND REGULATORY TAKINGS

The power of eminent domain is the power of a governmental body to take private property for public purposes.

The law places the particular focus upon the regulator. Eminent domain takings, pursuant to the United States Constitution, requires just compensation. These constitutional requirements apply to all governments and protects all forms of property.

The public use requirement is satisfied so long as there is a conceivable public purpose fur the taking.

A taking occurs whenever a regulation permanently dispossesses an owner or prevents their use and enjoyment of the property.

Compensation for the taking must be the market value of the property.

The amount of compensation is the current market value not the value that will occur due to the public improvement. Compensation is required for regulations that constitute takings, no matter how long or short the regulation may endure.

126

Eminent Domain

The Takings Clause

• All governments in the United States have the power to take private property for public purposes, but that power (the eminent domain power) is limited by the U.S. Constitution, state constitutions, state statutes and judicial decisions.

• The U.S. Constitution's Fifth Amendment specifically provides that "private property [shall not] be taken for public use without just compensation.“ This is called the "takings clause" or the

“eminent domain" clause.

• These requirements protect all property and applies to all governments.

• The takings clause serves two important and related purposes.

1. Prevent forcible redistribution of property

2. Takings permitted only for public benefit

127

Eminent Domain

The meaning of public use

A literal reading of the Constitution's text would limit governmental power to take private property to instances where the property will actually be used by the public (e.g., as a park. school. road, or military base).

The question becomes pronounced when seizures are designed to produce some collateral public benefit.

The famous Kelo v. City of New London case is illustrative of this

New London, Connecticut decided to condemn a number of private residential properties in the Fort Trumbull area of the city in order to assemble a 90-acre tract for an integrated redevelopment plan.

Significant portions of the property were to be conveyed to private developers to construct (1) a "small urban village, consisting of shops, restaurants, and a waterfront hotel; (2) 80 new residences: (3) office and retail space; and (4) a marina, parking, and "water-dependent commercial uses."

The Court ruled that the taking was rationally related to a conceivable public purpose.

128

Leasehold Interests

The Law of Landlords and Tenants

At common law a lease was viewed as personal property, but today its viewed as real property.

The nature of a leasehold interest is:

A. An estate in land

B. A present possessory interest in the leased premises by the tenant; and

C. A future interest (reversion) in the leased premises by the landlord/owner

The Three Major Types of Tenancies are represented by the phrase:

P ull Y our W eight:

A. Periodic Tenancy

B. Tenancy for Years

C. Tenancy at Will

A tenancy for longer than one year, must by in writing due to the statute of

129 frauds

Leasehold Interests

The Law of Landlords and Tenants

The doctrine of Quiet Enjoyment means:

A landlord must deliver the premises to the tenant for the tenant’s exclusive use and protect against the entry into the premises.

Assignments vs. Subleases:

An Assignment relieves the tenant of liability on the lease whereby a sublease retains liability and makes the tenant the landlord for the new tenant.

Security

Recent cases have held that landlords are liable to tenants for injuries caused by third party criminals where the landlord has failed to comply with

Housing code provisions, failed to maintain ordinary security measures (such as working locks) or failed to maintain extra advertised security measures.

130

Thank You

For being a wonderful class!!!

131