Show Me the Money

SHOW ME THE MONEY

Operational Damage Insurance Analysis

September 16, 2014

What were we thinking?

When we came up with this topic we:

Did not want to get bogged down in a fact pattern

Wanted to look at the logic we use in considering policies

Wanted to limit our discussion to the thought process we go through when a damage claim occurs during the course of construction

Show Me the Money | 1

As We Are All in Texas…

What is the best fast food burger in Texas?

WHATABURGER, is the correct answer.

Show Me the Money | 2

Choices

How many choices do you have when you order a WHATABURGER?

6

8

12

CORRECT ANSWER: 8

How many combinations does that make?

8 x 7 x 6 x 5 x 3 x2 = ?

10,080

Show Me the Money | 3

How many variables/combinations are there in an insurance policy?

Different Nature of Companies

Terms

Definitions

Exclusions

Endorsements

Correct Answer?

LOTS

Show Me the Money | 4

What We Are Here To Do

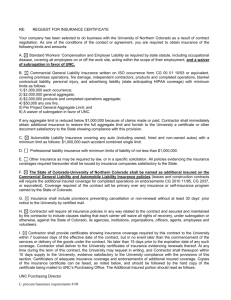

We want to take the (5) principle policies for operational damages on a construction project (CGL,

Builders Risk, Pollution, Professional Liability and Subcontractor Default Insurance) and:

Look at what they generally cover in an operational context

Look at what they generally do not cover

And, time permitting, look at the overlap of coverage between them and the priority of those coverages

Show Me the Money | 5

Introductions

Jeff Vita, Partner, Saxe Doernberger & Vita, P.C.

CGL & Pollution

Erika Bright, Partner, Wick Phillips

Builders Risk & Professional Liability

Luke J. Nolan, Senior Vice President, Willis of Texas

Contractor Default Insurance

Show Me the Money | 6

CGL

COVERS

“Property Damage” (Physical Injury to Tangible Property or Loss of Use of Non-Injured Property)

“Bodily Injury”

“Personal and Advertising Injury” – (Ex. Defamation & Trespass)

THE “OCCURRENCE” REQUIREMENT

Property Damage / Bodily Injury must be caused by an “Occurrence” (meaning accident including continuous or repeated exposure to substantially the same general harmful conditions)

In the construction context disputes arise over what is considered “Accidental” or “Fortuitous”

EXCLUDES

Business Risks – Damage to property (j(5) and j(6))

Purely Contractual Claims

Claims of a professional nature (e.g. planning, design, engineering work)

Show Me the Money | 7

CGL

KEY COVERAGE ISSUES

The Tort v. Contract Dichotomy

Claims alleging breach of contract, which involve property damage

The Project v. Non-Project losses dichotomy

Insurers often argue that policy is not intended to coverage damage to the project

Professional v. Non-Professional

E.g. Construction Management services

The “suit” requirement – recurring issue is whether the policy provides coverage in the absence of a “suit.” This leads to a dilemma insofar as the Insured receives notice of damages at the project and then incurs necessary legal costs prior to being sued.

Show Me the Money | 8

CGL – Tort v. Contract

Courts disagree as to whether breach of contract claims are covered by a CGL

Policy itself does not distinguish by cause of action

Both tort and contract claims can involve property damage

Breach of Contract claims absent property damage are not covered: e.g. delay claims, loss of value claims, etc.

The GILBERT reasoning

– Argument that breach of contract claims are excluded by policy’s contractual liability exclusion. Under Gilbert, exclusion applies when only viable claim against the insured is breach of contract.

The majority view is that the contractual liability exclusion, which concerns “assumption” of liability, only applies to indemnity claims (which are subject to the insured contract exception).

Show Me the Money | 9

CGL – Third Party v. Project Loss

Some Courts / Insurers distinguish CGL on the basis of whether the damage is to the Project or to Property outside of the Project.

Definition of “occurrence” does not distinguish by location / ownership of damaged property. A brick falling and damaging other project work is no less fortuitous than a brick falling and damaging a passing vehicle.

Business risk exclusions (j5 and j6) preclude coverage for damage to certain project work, but not the entire project. This language suggests that discerning coverage for property damage based upon what property was damaged is an artificial distinction.

Show Me the Money | 10

CGL – Professional v. Means & Methods

CGL Coverage is designed to insure non-technical aspects of project work; most if not all CGL policies, include an exclusion for professional liability, which pertains to those aspects of the job that are considered to involve a high degree of skill or expertise (e.g. engineering or design.)

CGL is intended to work in harmony with the Professional Liability

There are grey areas regarding the question of whether risk is considered professional or general work.

Project Safety Responsibilities

Monitoring / Oversight of Construction Work

Construction Management

Show Me the Money | 11

CGL – “Suit” Requirement

“Please sue me!”

CGL Policy provides defense of a “suit” and indemnity for a “legal obligation to pay damages.”

Defense is not owed in the absence of a suit, or similar proceeding such as an arbitration. (Some courts consider an environmental PRP letter to constitute a suit.)

With respect to indemnity, courts are divided on whether a “legal obligation to pay” requires a judgment or settlement of a suit.

Voluntary Payment / Cooperation Clause Concerns – certain insurers take aggressive stance that coverage is not owed in the absence of a lawsuit. This can stymie pre-suit attempts to investigate and resolve claims.

Show Me the Money | 12

Pollution

Coverages Vary

A good program will cover:

Losses stemming from both general and professional negligence

Both sudden and gradual pollution conditions

Asbestos, EIFS and Lead Abatement

Emergency Clean Up Costs

Remediation to own property

Remediation to other property

Transportation costs

Mold / Fungi

Business Interruption

Historical Contamination / Fill Coverage may be necessary if construction involves a formerly developed work site.

Show Me the Money | 13

Pollution

What is generally not covered:

Criminal Fines / Punitive Damages

Contractual Liability

War or Terrorism

Known Conditions

Intentional Acts

Show Me the Money | 14

Pollution

OVERLAP

Traditional v. Non-traditional Pollutants

In some jurisdictions pollution exclusion is limited to “traditional” pollutants (e.g. environmental pollutants, hazardous by-products).

In others the exclusion applies more broadly to naturally occurring and everyday materials (e.g. cleaners and paints that have noxious fumes).

In the former scenario there may be overlap between the CGL and Pollution coverages.

GAPS

High SIR Requirements

“Claims Made and Reported Coverage” – Short or No Retroactive Date or Look back period.

(Pollution can be available on an “occurrence” basis.)

Fines / Penalties

– Criminal Fines and Penalties are excluded. Civil fines may be covered.

Show Me the Money | 15

Builders Risk

Builders risk insurance is a form of property insurance covering physical loss or damage during construction.

Traditionally, builders risk insurance covers the “gap” in insurance coverage in the time period before the project is ready for use or occupancy.

Show Me the Money | 16

Builders Risk Policies

How are they written?

Most Builders Risk policies are written on an “all risk” basis, meaning that the policy will cover all risks of property damage unless the cause is specifically excluded.

What do they cover?

Covered property will include the project property at the job-site and also should include coverage for building materials, supplies, equipment and fixtures intended to become a “permanent” part of the completed project.

Who is insured?

Both the owner and the contractor have “insurable interests” in the project; therefore, it is common and usually sound practice that a builders risk policy should name the owner, the general contractor and subcontractors of every tier as insureds, as well as mortgagees and lenders who have financial interest in the project.

When does coverage start?

When construction “ commences”, which is not always clear.

When does coverage end?

When construction is “complete”

“Complete” means “when it can be put to the use for which it was intended”

Not when significant work remains, even if the building is used for some limited basis

Show Me the Money | 17

Builders Risk Policies

What are the limits?

The coverage limits usually will be measured by the completed value of the project.

But, that does not mean a loss will be paid on a “valued” basis:

The completed value typically is stated as the maximum amount of loss that a carrier will pay.

The actual amount paid will be determined by the cost to repair or replace the damaged property or equipment

(replacement costs), which may or may not include contractor overhead and profit.

Policies often include specified sublimits for certain categories of loss, such as coverage for flood, pollution cleanup, mold remediation, earthquake, whether or not the fault of a contractor or subcontractor.

How are they triggered?

“Physical loss or damage” means property in an initial satisfactory state that changed into an unsatisfactory state.

“Physical loss or damage” usually does not include faulty initial construction.

However, courts have held that insured property is “damaged” if it is unable to perform its intended function, even if not physically harmed.

What usually does not constitute physical loss or damage?

Costs due to delay; or

Costs beyond repair of the structure

Show Me the Money | 18

Builders Risk Policies

What are common exclusions?

Faulty Design or Workmanship

“The cost of making good faulty or defective workmanship, material, construction or design, but this exclusion shall not apply to damage resulting from such faulty or defective workmanship, material, construction or design ”

Purpose is to cover accidents resulting from defective design and workmanship, but not the cost of repairing the defect itself.

However, exclusion applies only to exclude insured builders negligent work.

Faulty Workmanship Exclusion – Additional Notes

Cases addressing coverage for damage caused by faulty workmanship and design are MANY and inconsistent.

The key issue is such cases is to identify a factual basis for distinguishing the uninsured defective workmanship or defective part from the resulting, insured consequential (or ensuing) property damage.

Rule of Thumb: when actual, “physical” damage to other, non-defective property is caused by a defective part or by faulty workmanship, the resulting loss is insured, even if the cost of repairing or replacing the defective component itself is barred.

What are common exclusions?

Latent Defects

Defects that:

Could not have been detected through reasonable inspection, or

Could not be discovered by any known and customary test.

Some courts include defects caused by negligent design or construction, as long as the defects are not discoverable upon “reasonable inspection.”

Insured can avoid exclusion by showing they were able to discover the presence of the damage itself, as opposed to the cause of the damage.

Show Me the Money | 19

Builders Risk Policies

What are common exclusions?

Inherent Vice

Defined as:

“not related to an extraneous cause but to a loss entirely from internal decomposition or some quality which brings about its own injury or destruction.”

But where external force causes damage, it is not an inherent vice.

Many Builders Risk policies exclude a specific cause of damage, “unless such loss results from a peril not excluded in this policy”

Generally, if a loss occurs as a result of two concurring perils, one insured and one not, then the loss is covered only to the extent it can be traced back to the covered peril.

However, when the exclusion is qualified (as above), there is coverage where an otherwise excluded peril is itself caused by a covered peril.

Example: corrosion damage to machinery was covered, notwithstanding the rust damage exclusion, where that exclusion was qualified by an exception for damage resulting from a covered peril and the corrosion itself was result of a covered peril – faulty design. Nat’l Fire Ins. Co. of Pittsburgh, PA v. Valero Energy Corp., 777 S.W.2d 501, 506

(Tex. App. – Corpus Christi 1989, writ denied).

Show Me the Money | 20

Builders Risk Policies

What Should you Consider When Purchasing?

Obtain the broadest form of coverage available / reasonable.

Policy should cover the owner, contractor and all subcontractors and mortgagees.

Carefully consider the needed period of coverage.

Consider whether coverage is needed and may be obtained for maintenance / warranty work and postcompletion property damage.

Consider adding specific endorsements to cover identifiable risks of loss that may be unique to the project.

If a loss occurs, develop appropriate strategies to maximize recovery, including determining causation and

“resulting” damage issues.

What Should you Know When Submitting a Claim?

Read your policy and be aware of procedural requirements and deadlines

These requirements may include:

Submission of a “proof or loss”

Giving “examinations under oath”

Audits of books and records

An Appraisal of the amount of the loss; and

Filing suit against the insurer within a shortened, specified time period.

Show Me the Money | 21

Professional Liability Policies

What does a Professional Liability policy cover?

Claims against the insured alleging an act, error or omission arising out of the performance of professional services.

Who should get it?

Architects

Engineers

Contractors

How are they written?

Almost all professional liability policies are written on a claims-made basis.

For coverage to apply, the claim must be made during the policy period.

Note: Every policy will have a retroactive date , usually the inception date of the first professional liability policy.

Any claims arising out of work done prior to the retroactive date are specifically excluded.

Show Me the Money | 22

Professional Liability Policies

Why Should Contractors Consider PL Coverage?

Limitations in Builders Risk and CGL Coverage

Increased Risks Assumed by Contractors:

Construction Management Responsibilities:

A contractor may perform construction management services. All these activities create a recognized standard of care by the construction manager and a corresponding professional liability risk.

Hiring Design Firms as Subcontractors or A/E Joint Venture:

A growing number of projects are utilizing design-build project delivery where the contractor is acting as the lead design-builder or enters into a joint venture with a design firm.

Self-Performed Design:

Some contractors have an in-house design staff consisting of legally qualified architects, engineers, land surveyors and landscape architects who have the responsibility for reviewing and stamping drawings.

Show Me the Money | 23

Professional Liability Policies

Why might a Contractor not rely on someone else’s PL Coverage?

When a contractor leads a design-build project and hires an architect/engineer as a subcontractor, the contractor may rely on the professional liability policy of the design firm. But, it is important to know the limitations of the architect or engineer’s professional coverage:

Single Aggregate Limit

The policy limit applies to all current and past work and the limit includes defense cost. You could be sharing the limit with many other firms.

Low Limits

A majority of design firms carry professional limits of $1 million or less.

Claims-Made Policy

If the design firm non-renews their policy or moves the retroactive date forward after they finish your project, you will be left with no protection.

No Additional Insured Protection

Most professional liability underwriters for design firms will not name another firm as an additional insured.

Show Me the Money | 24

Professional Liability Policies

What are the common exclusions?

Express warranties or guarantees

Obligation to obtain insurance or bonds

Product manufactured or supplied by the insured

Employers’ liability / Workers compensation claims

Employment-related practices

Nuclear energy liability

Insured vs. Insured Claims

Claims based on events the insured knew about prior to policy inception

Failure to perform professional services on time

Failure to complete a project on time

Bankruptcy or insolvency of the named entity

Pollution, asbestos

Return or reduction of professional fees

Punitive damages

Personal injury

Cost estimates exceeded

Bodily injury or property damage resulting from means and methods of construction

Show Me the Money | 25

Contractor Default

Coverage

Loss:

Direct Costs:

Labor

Material

Equipment

Replacement Subs

Legal

Unpaid Suppliers

Indirect Costs:

LAD’s

Extended Overhead

Project Acceleration

Show Me the Money | 26

Contractor Default

Highlights

Coverage

Project Attaching or Subcontract Attaching

5-10 year tail on coverage

Can be extended to project owner, financial interest endorsement

Only applies if GC becomes insolvent

Reputation

Control

GC determines if Sub is in default

Default must be upheld (if contested)

GC determines how to remedy default

Exclusions

Subs providing professional services (generally if > 50% of cost are professional)

Subcontracts or projects > 3 years in duration (Zurich, XL)

Power projects, unless specifically underwritten (Zurich, XL)

Subcontracts > $40M in value (Zurich, XL)

Show Me the Money | 27

Contractor Default

Control

Empowers Construction Manager to use its standard project procedures to manage subcontractors

Contractor pre-qualifies, selects and manages subcontractors

Contractor defaults subcontractor per terms and conditions of the subcontract agreement

Payment

Performance

Insolvency

Contractor cures the defaulted subcontractor in most efficient manner without third-party approval

Supplement Workforce of defaulted sub

Pay Labor of defaulted sub

Pay Material of defaulted sub

Pay to correct work to confirm to project specifications

Terminate defaulted sub and engage new sub

Show Me the Money | 28

Contractor Default

Default Reality

Default Impacts:

Defaults typically cost 1 ½ to 2 times the original subcontract value

Additional time costs such as acceleration, liquidated damages, attorney’s fees.

Critical path defaults can derail the entire project / schedule delay / certificate of occupancy delay / utilization of facility unknown

Strained relationships with Project Owners

Show Me the Money | 29

Let’s continue this discussion in the Hall!

Thank you on behalf of our distinguished panel & Willis.

Show Me the Money | 30

Questions?

Show Me the Money | 31

Thank you!

Jeffrey J. Vita, Esq.

Partner

Saxe Doernberger & Vita, P.C.

jjv@sdvlaw.com

203.287.2103

Erika Bright, Esq.

Partner

Wick Phillips erika.bright@wickphillips.com

214.740.4050

Luke J. Nolan

Senior Vice President

Willis of Texas luke.nolan@willis.com

972.715.2115

Paul J. Becker (Moderator)

Assistant Vice President

Willis, Risk Control & Claims Advocacy paul.j.becker@willis.com

972.715.2131

Show Me the Money | 32