A47

advertisement

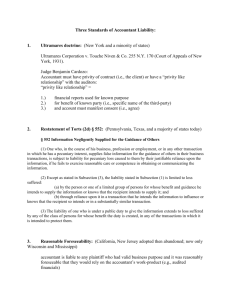

Twomey Jennings Anderson’s Business Law and the Legal Environment, Comprehensive 20e Anderson’s Business Law and the Legal Environment, Standard 20e Business Law: Principles for Today’s Commercial Environment 2e Chapter 47 Accountant’s Liability and Malpractice Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning What is Malpractice? • When a contract requires a party to perform services, the party must perform with the care exercised by persons performing similar services within the same community. • If the party negligently fails to observe those standards, there is both a breach of contract and a tort. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 2 Malpractice Malpractice consists of both: Breach of Contract Accountant (party to contract) fails to fulfill duties. Malpractice Tort Plaintiff must show that defendant’s breach was negligent or willful. Accountant is negligent or commits fraud. Plaintiff bringing suit for malpractice may choose which action to pursue: Breach of Contract Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning Tort 3 Differences In choosing which action to pursue, a plaintiff may consider: BREACH OF CONTRACT Limited by Contract Runs from Date When Contract Was Broken Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning TORT LIABILITY Damages Statue of Limitations Can Be Greater Than Contract Law Damages Runs from Date When Harm Was Discovered 4 Liability to Third Parties • No privity of contract: third persons may also sue the accountant for malpractice. • When the malpractice suit is brought against an accountant for negligence, courts differ as to when a third person may sue and what the plaintiff must show to bring such a suit. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 5 Liability to Third Parties • Liability is evaluated by one of these rules: – – – – – – The Privity Rule The Contact Rule The Known User Rule The Foreseeable User Rule The Intended User Rule The Unknown User Rule Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 6 Theories of Liability • Some courts refuse to let the third person sue; these courts require PRIVITY between the parties. • In New York, sufficient CONTACT with the third party can make the accountant liable just as if there was privity. • In some states, it is sufficient that the third person was a KNOWN USER of the accountant’s information. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 7 Theories of Liability (cont’d) • Some courts go allow third parties to sue if it was REASONABLE TO FORESEE that the third party use the accountant’s information. • Some courts limit suit to those nonprivity plaintiffs who were INTENDED to rely on the accounting work. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 8 Theories of Liability (cont’d) • A few courts use a FLEXIBLE approach, deciding each case as it arises. • Finally, an accountant is not liable to a non-privity UNKNOWN user when the accountant has no knowledge of any way the party could be affected. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 9 Liabilities Malpractice (Tort) Liability for Statutory Violations Breach of Contract Anyone in Privity of Contract Client Beneficiaries of Statutory Protection (Section 11-1933 Act Section 10b-1034 Act) Liability to - Differing Decisions Known-User Contacts Foreseeable User No liability to Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning Interloper 10 Defenses To Liability • To a limited degree, an accountant is protected from malpractice liability by: – A clear, conspicuous disclaimer of liability, or – The contributory or comparative negligence of the plaintiff. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 11 Fraud Malpractice • When an accountant is guilty of fraud, the intended victim of the fraud may sue the accountant even though privity of contract is lacking. Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 12 Sarbanes-Oxley Act of 2002 • Imposes significant liability on auditing firms for fraud, securities violations and obstruction of justice. • Auditor Independence. – Public Company Accounting Oversight Board. – Auditors must remain independent (no conflicts of interest). Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 13 Sarbanes-Oxley Act of 2002 • Accountants must register with Accounting Oversight Board. • Corporate audit committees. • Records retention (Arthur Anderson). Copyright © 2008 by West Legal Studies in Business A Division of Thomson Learning 14