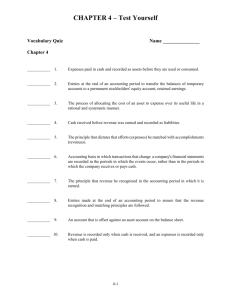

Adjusting Entries

advertisement

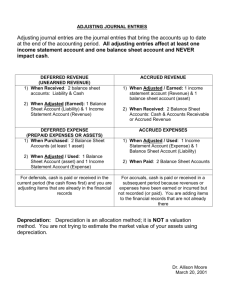

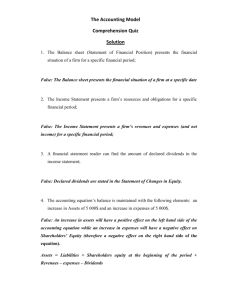

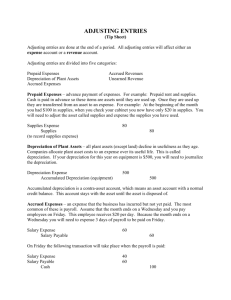

BTB110 Nature of the Adjusting Process GAAP (generally accepted accounting principles) includes a reference to the time period concept. This concept requires that revenues and expenses be reported in the proper accounting period. The use of accrual basis accounting is required by GAAP. Under the accrual basis of accounting, transactions and events are reported in the income statement in the period in which they occur. For example, revenue is reported when the services are provided to customers because that is when the revenue is earned. Cash may or may not be received from customers during this period. The accounting principle that supports this reporting of revenues is called the revenue recognition principle. Under the accrual basis of accounting expenses are also reported in the same period that they occur. For example, utility expenses incurred in December are reported as an expense And matched against December revenues even though the utility bill may not be paid until January. The accounting concept that supports the reporting of revenues and related expenses in the same time period is called the matching principle. By matching revenues and expenses, net income or net loss for the period is properly reported on the income statement. Although GAAP requires the accrual basis of accounting, some businesses use the cash basis of accounting. Under the cash basis of accounting, revenues and expenses are reported on the income statement in the period in which the cash is received or paid. For example, fees are recorded as revenue when cash is received from clients; likewise, wages are recorded when cash is paid to employees. The net income (or net loss) is the difference between cash receipts(revenues) and cash payments (expenses). For most businesses, the cash basis will not provide accurate financial statements for user needs. It is for this reason that we focus on the accruyal basis of accounting. The Adjusting Process At the end of the accounting period, many of the account balances that have been generated through transactions can be reported in the financial statements without change. For example, the balances of the cash and the land accounts are normally the amounts reported on the balance sheet. Under the accrual basis of accounting, some accounts need updating at the end of the month/quarter/year. The updates are the province of the accounting department. The analysis and updating of accounts at the end of the period before the financial statements are prepared is called the adjusting process. All adjustments affect at least one income statement item, and one balance sheet item, and never involve cash. Types of Accounts Requiring Adjustments Five basic types of accounts require adjusting entries, as shown below: 1. Prepaid expenses 2. Unearned revenues 3. Accrued revenues 4. Accrued expenses 5. Amortization of capital assets Prepaid expenses are the advance payment of future expenses and are recorded as assets when cash is paid. They are not recorded as expenses because although cash has traded hands, the expense has not yet occurred. Prepaid expenses fit the definition of an asset because they provide future benefits. Prepaid expenses become expenses over time, or due to normal operations. Eg. Paid $2400 as a premium on a one-year insurance policy on December 1. If we were to record this information using transaction analysis, we would show an increase to the Prepaid Insurance account (an asset), and an equal decrease to the Cash account (Asset). By the end of December, one month’s worth of insurance has expired and needs to be expensed. This is where the adjustment comes in. At the end of December, we can allocate $200 to insurance expense (decrease Retained Earnings) and deduct $200 from the Prepaid Insurance account. (Asset). Unearned Revenues are the advance receipt of future revenues and are recorded as liabilities when the cash is received. Unearned revenues become earned revenues over time or during normal operations. Eg. On December 1, received $300 from a local retailer to rent land for three months. When the cash is received, it has not yet been earned because the land has not been used by the retailer. Our analysis of this transaction should show an increase to the cash account (Asset), and an increase to the unearned revenue account (liability). On December 31, the retailer will have been using the land for one month. The purpose of this adjustment will be to convert a portion of the unearned revenue into Revenue Earned. In this situation, we need to show an increase in Revenue (increase to Retained Earnings), and a decrease to the unearned revenue account (decrease a liability). The size of this adjustment is for $100 because one-third of the rental has been earned. Accrued Revenues are unrecorded revenues that have been earned, and for which cash has not yet been received. Accrual accounting tells us that because the work has been completed, revenue has been earned and should be reported on the financial statements. Eg. At December 31, $8000 of fees has been earned but has not yet been billed to clients. By definition, anything that has been earned but not yet received is a receivable. Therefore, at the end of the year, the adjustment that we prepare is meant to show that there is accrued revenue (an asset increase) and fees earned (an increase to Retained Earnings). Accrued Expenses are unrecorded expenses that have been incurred and for which cash has not yet been paid. Wages owed to employees at the end of a period but not yet paid is an accrued expense. An obligation exists to pay out that amount at some point in the future. Eg. At December 31, wages of $1250 are owed to employees. By definition, money owed but not yet paid is a payable (a liability). Therefore, at December 31, our analysis of this transaction should show that an expense has been incurred (a decrease to retained earnings), and that wages are payable to the employees (an increase to a liability). Amortization expense reflects the “using up” of an asset. Amortization is associated with long term assets such as buildings, equipment, and vehicles in the sense that the usefulness of the assets decrease as they are used from year to year. Another word for amortization is depreciation. Because of the historical cost principle, we are not allowed to reduce the value of a long-term asset directly. Rather, we use a contra account called accumulated depreciation to represent the total of the ‘used up’ value of the asset over time. Eg. The amortization of equipment is calculated at $500 for the year. If amortization on equipment is being recognized, then we are justified in allocating $5000 to an expense account (a decrease to retained earnings). This $5000 expense is associated with accumulated amortization , a balance sheet account that we label a negative asset or a contra account because the $5000 is a decrease to the assets. Exercises with Adjustments 1. Classify the following items as (a) prepaid expense, (b)unearned revenue, (c) accrued revenue or (d) accrued expense. 1. 2. 3. 4. 5. 6. 7. 8. A two-year premium paid on a fire insurance policy Fees earned but not yet received Fees received but not yet earned Salary owed but not yet paid Subscriptions received in advance by a magazine publisher Supplies on hand Taxes owed but payable in the following period Utilities owed but not yet paid 2. At the end of December, the first year of operations, the following selected data were taken from the financial statement of Monita Forche, a lawyer: Net income for the year Total Assets at December 31 Total Liabilities at December 31 Total Equity at December 31 $135,800 750,000 250,000 500,000 In preparing the financial statements, adjustments for the following data were overlooked: a) b) c) d) Unbilled fees earned at December 31, $6,700 Amortization of equipment for December, $3,000 Accrued wages at December 31, $2,150 Supplies used during December, $1,975 Using the information given above, determine the correct amount for Net income, and the total assets, liabilities and owner equity. Net Income Total Assets Total Liabilities Total Owner Equity Reported Amounts $135,800 $750,000 +6,700 +6,700 $250,000 $500,000 Corrections Adjustment (a) Adjustment (b) Adjustment © Adjustment (d) Corrected Amounts +6,700