Gehaltssystem und *struktur AHK Slowenien

advertisement

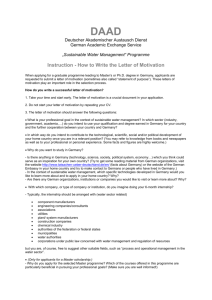

Germany – Opportunities and Potentials Maribor 27. November 2014 Why Germany? Germany at a Glance Key Sectors Slovene German Business Relations Who we are? Why Germany? Germany at a Glance Key Sectors Slovene German Business Relations Who we are? Germany From “the sick man of Europe” (The economist, 19.5.2005) To “Europe´s engine!” (The economist, 11.3. 2010) To “Germany´s Economic Model: what it offers to the world” (The economist, 14. 4.2012) Germany: One of the most productive economies in OECD Vocational education More important still to Germany's industrial strength is the country's education system. Lessons learned Mittelstand and family business: the backbone of the German industry Successful model of export and investment support sheme Germany: Strengths of the market Market size Germany has the largest economy in Europe and is Europe´s largest domestic market Easy access English widely spoken and accepted as business language Situated at the heart of Europe with instand access to established markets and emerging markets in Europe DoingWhy business in Germany Germany? Mario Ingo Soos Deutsche Botschaft Laibach How foreign investors view Germany’s future • 54% expect Germany to become even more attractive to investors over the next three years • Becoming increasingly attractive for innovation activities and highly skilled talent • How surveyed investors see Germany in the year 2020: Global leadership in environmental technology Centre for research and development Model for entrepreneurially minded society Source: Ernst & Young Germany after the crisis „ “ Which EU-countries will benefit the most from the crisis from your point of view?” Germany France Poland Great Britain Switzerland Bright outlook for investors in Germany Russia Others Nobody Not specified Figures in % Source: Ernst & Young 9 • • • • High labour productivity: opinions from the business world Germany’s level of training and process and product quality make it Europe’s No. 1 investment location for US companies (US Chamber of Commerce, Business Barometer 2014) 82% of foreign-company managers surveyed rate German workers’ skill levels as attractive (Ernst & Young, Germany as a Business Location 2010) “Despite comparatively high wage costs, our German locations are among the most productive worldwide thanks to the workers’ outstanding skill levels and motivation.” (Rolls-Royce) Germany is the most attractive Investment location in Europe (US Chamber, Business Barometer 2014) “Invented in Germany” High Tech and Innovation: Source: GTaI Picture: Hahn Meitner Institute Berlin Innovation clusters: close cooperation between research institutes, the business sector and universities 2008: more than 11,000 European patents (twice as many as France and the United Kingdom combined) EU leader in patents that are also registered in the EU, USA and Japan (“triad patents”) German business sectors – global leaders in terms of market size and growth potential: information and communication technology chemicals and plastics transport and logistics photovoltaics medical technology Why Germany? Germany at a Glance Key Sectors in Germany Slovene German Business Relations Who we are? Germany at a glance • Bruises in general economy ….. • … still covered up by structural strengthts • Domestic economy intact spending instead of saving • Headwinds from exports • Consumption resisting downturn Germany at a glance • Construction: moving down a gear • German exports are still on a high level • “European home market” are making major contribution but still stuttering • Product innovation gaining in importance • Skilled employees hart to find even during downtown Germany at a glance Indicators (Percentage change on preceding year) GDP (real) GDP by expenditure (real): Private consumption expenditure Machinery and equipment Construction Domestic Demand Export (Mrd. EUR) -Growth rate Import (Mrd. EUR) -Growth rate GDP per Head (EUR) Unemployment rate in % Total employment Quelle Commerzbank, Statistisches Bundesamt Deutschland 2012 2013 0,7 2014 Forecast 0,42,1 0,8 0,91,5 -4,0 -2,24,0 -1,4 -0,34,0 -0,3 0,71,9 1.096 1.0941.138 3,2 0,64,1 906 896941 1,4 1,34,7 32.280 33.355/ 6,8 6,96,7 1,1 0,60,6 2015 1,7- 2,0 1,7 6,3 3,7 2,1 4,6 5,1 / 6,6 0,3 Germany at a glance Share of Total GDP and Population in the European Union 2013 GDP (in EUR Share of Total Population Share of Total billion) GDP (EU-27) (in million) Population (EU-27) GERMANY France UK Italy Spain Netherlands Sweden Poland USA Japan EU-27 Eurozone 2.738 2.059 1.908 1.560 1.022 603 420 390 10.957 4.122 13.075 9.170 21% 15,7% 14,6% 12% 7,8% 4,6% 3,2% 3% 80,5 65,6 63,9 59,7 46,7 16,8 9,6 38,5 309 128 501 331 16% 13% 12,6% 11,8% 9,2% 3,3% 1,9% 7,6% Why Germany? Germany at a Glance Key Sectors in Germany Slovene German Business Relations Who we are? Key Sectors in Germany • Automotive • Machinery & Equipment • Metal and Metal Processing Industry • Food & Beverage, Organic Food • ICT Industry • Energy & Environmental Industry • Construction Industry Growth Industries Renewable Energies & Resources Chemicals & Healthcare - Photovoltaics - Chemical Industry and Polymers - Energy Efficiency - Renewable Resources and Bioenergy - Chemicals-Related Process Industry - Energy Storage and Fuel Cells - New Materials/ Composite Materials - Solar Thermal Energy - Red Biotech - Medical Devices Industry - Geothermal Energy - Pharmaceuticals Industry - Wind Energy - Waste to Energy, Recycling and Sustainable Water Resource Management Mechanical & Electronic Technologies Service Industries - Consumer Goods/Retail - Electronics and Microtechnology - Food and Beverages - Machinery and Equipment - Information and Communications Technology - Transportation and Technologies - Applied Sciences and Technology Transfer - Business Services - Transportation and Logistics - Tourism Germany Trade & Invest Emerging Industries Energy Efficiency Sector Creating the Future for a Clean Environment Industry & Market Numbers • market leader in energy efficiency technologies • turnover of about EUR 67 billion per year • double-digit growth rates expected in coming years • 1/3 of companies active in the sector realize profit margins of over 10% • average workforce growth of about 15% per year Construction industry • The construction industry is one of the most important sectors of the German economy • Germany’s Construction Industry: Strong Growth Followed by Stagnation • Construction Work on Existing Buildings Dominates • Total market volume: 312,7 bill EUR • Residential construction: 179 bill EUR • Energy related modernization: 57,5% Safety & Security Industry "Made in Germany" for Future Security Industry & Market Numbers • • • • • Largest market in Europe High market potential with industry turnover of 20.3 billion Euro Industry forecast to record 55% growth by 2015 IT security will grow by 124% within the next six years Identification, authentication, and biometrics revenue forecast to increase by 87% by 2015 • Market for protection technologies against theft, burglary, and assault expected to grow by 33% through 2015 • Record IT security hardware and software spending of 2.3 billion Euro ICT Industry Germany's ICT Industry: Shaping Europe’s Digital Future Industry & Market Numbers • • • • Europe’s largest ICT market in terms of revenue volume (20 percent of total EU market volume). With 5.5% global market share, German ICT industry is ranked fourth worldwide. Turnover of EUR 137 billion Germany’s ICT industry employs a workforce of around 850,000 ICT Industry Germany's ICT Industry: Shaping Europe’s Digital Future Growth Areas IT Security: The market for IT security is growing due to steadily increasing risk potential Cloud Computing: There is significant international demand for secure and cost-effective cloud solutions and services Smart Grids: Increasing importance of sustainable energy supply offer great opportunities for smart grid adoption and ICT solutions for smart grid. Automotive Industry Driving Performance through Technology Industry & Market Numbers • Europe's largest automobile market • Average manufacturer and supplier turnover of more than EUR 300 billion • 30 final assembly plants with a production capacity of over one third of total automobile production in Europe • The German auto industry invest annually EUR 19.6 billion in R&D • 3,650 patents per year (= 10 patents a day Automotive Industry Market Potential • Germany has a very competitive auto parts market with many domestic and foreign manufacturers • Suppliers are mostly specialized • New Automotive Deal • Consolidation process-oriented sectors • Just in Time Just in Sequence • After sales market is expected to grow in the coming years Automotive Industry Smart Mobility Electric mobility is the technology of the future but existing technologies must be optimized Opportunities for Automotive Suppliers The demand for new technology for this market is enormous Vehicle manufacturers require core components such as batteries and electric motors for electric. Machinery & Equipment Industry Market Leadership Powered by German Engineering Industry & Market Numbers • • • • Annual turnover 173 billion Euro Growth rates between of 7 and 12 percent Domestic market: 87 billion Euro Highly innovative sector producing 28% of the worlds mechanical engineering patents • Technical fields with high import rates: drive technology (10.7%), air technology (9.3%), valves and fittings (6.7%), construction equipment (6.2%) Machinery & Equipment Industry Market Potential • Imports: EUR39.1 billion • One of the fastest growing industry sectors in Germany • High domestic demand from industries like the automotive, electronics, chemicals, food as well as the renewable energies sector • very. attractive to foreign companies seeking to sell their high-tech products and components abroad Metal & Metal Processing Industry Industry & Market Numbers • Metal and metal products imports totaled EUR 68.7 billion • Sixty two percent of the imported metal products came from the European Union • In 2012 15 million tons of steel were processed in the production of metal products • The non-ferrous metal industry registered sales of EUR 43.5 billion i Plastics Industry Germany is Europe's No.1 Plastics Location Industry & Market Numbers • Leadership in plastics production and consumption, export and import, and in investment in fixed assets and expenditure in R&D • Turnover EUR 88 billion, 7,200 companies, 440,000 employees • About 70 application-oriented university and non-university research institutes in the field of polymer and materials research in close collaboration with the plastics industry • Over 40 regional plastics clusters, innovative networks and competence centers Electronics & Microtechnology Your Market for Next-Generation Technology Industry & Market Numbers • • • • • • Turnover of 165 billion Euro Market is estimated to grow to 180 billion Euro Fourth largest industry segment in Germany by revenue 12 billion Euro R&D expenses annually Microelectronics is one of our fastest-growing industry sectors market potential for automotive and industry electronics Energy & Environmental Technologies Bioenergy Industry Solar Industry Wind Industry Environmental Technologies Closed Loop Recycling and Sustainable Water Technologies Industry & Market Numbers Environmental technologies is one of the most important economic sectors in Germany Turnover: 85 billion Euro in German World Market Share for Recycling Technology: 24% (Material Separation devices have 64% of the world market) More than 320,000 Employees Consumer Goods & Retail Large Markets Create Major Opportunities Industry & Market Numbers • Europe's leading consumer market with 82 million affluent consumers • Private spending remained increasing • Private spending in the leisure and apparel segments is permentently growing due to higher private income • Germany's consumer electronics market fasted growing segment Food & Beverage Industry Supplying the Full Spectrum of Consumer Needs Industry & Market Numbers • Germany is Europe's second largest food producer with sales of 149.5 billion Euro • Germany is a net importer of food & beverage products • Largest sector sub-segments: meat (22.7%), dairy (15.4%), confectionery food (9.4%), and baked goods (8.7%) • Major national and international players, including Dr. Oetker Group, Südzucker AG, Vion Food Group, Kraft Foods Deutschland GmbH, Nestlé, etc Food & Beverage Industry Supplying the Full Spectrum of Consumer Needs Market trends • High demand for health and wellness as well as functional food products to prevent or overcome conditions including diabetes, high blood pressure and cholesterol • Movement for organic food and “free of” foods e.g. lactose and gluten-free products • Driving demand for highly convenient foodstuffs including ready-to-eat meals, frozen foods, desserts, and baked goods • Ethnic foods, beauty foods and fair trade products Market Potential • Large size of the German market in the food and beverage sector are very attractive to exporters worldwide • German consumers are generally well informed. They expect high quality and low prices for their food and beverage products Market Access • The German food & beverage industry is highly fragmented and competitive. • Exporting companies should be aware that product packaging is very important to German consumers since they are highly environmentally conscious • Manufacturers, importers, distributors and retailers must make sure that their packaging materials for their food products comply with the EU's and Germany's domestic regulations in terms of recycling and disposal. There are several dual system companies licensed in Germany offering various waste disposal schemes Why Germany? Germany at a Glance Slovene German Business Relations Fit for Business How to find a partner? Slovenian-German Economic Relations German-Slovenian foreign trade balance (in 1000 EUR) 5,000,000 4,000,000 3,000,000 Export to Germany 2,000,000 Import from Germany 1,000,000 0 2005 2006 2007 2008 2009 -1,000,000 Source: Statistical Office of the Republic Slovenia 2010 2011 2012 2013 2013 1000 EUR Country Import share (%) Total 2013 1000 EUR Import 100 22.196.684 Country Total Export Export share (%) 21.627.647 100 Germany 19,12 4.244.165 Germany 4.449.301 20,57 Italy 15,63 3.469.033 Italy 2.493.537 11,53 Austria 11,36 2.520.667 Austria 1.843.978 8,53 Croatia 4,80 1.064.788 Croatia 1.441.499 6,67 France 4,34 963.287 France 1.153.853 5,34 Netherlands 3,01 667.294 Russia 1.018.784 4,71 Russia 2,03 451.929 Serbia 664,842 3,07 Serbia 1,86 411.929 Hungary 631.890 2,92 Source: Statistical Office of the Republic Slovenia Slovenian-German Economic Relations Market share of German federal states in Slovenian imports from Germany 5% 8% 18% Baden-Württemberg 5% Bayern Nordrhein-Westfalen 16% 17% Market share of German federal states in Slovenian exports to Germany 7% 5% 8% 31% Hessen Niedersachsen Neue Bundesländer Baden-Württemberg Bayern Nordrhein-Westfalen 20% Hessen 22% Niedersachsen Neue Bundesländer Source: Statistical Office of the Republic Slovenia Why Germany? Germany at a Glance Key Sectors Slovene German Business Relations Who we are? The German Chamber Network Global network in 80 countries with 120 offices •50,000 member firms •1,700 coworkers •98% of the German foreign trade “AHK – worldwide competent on-site” AHKs as member organizations AHKs as service providers to companies AHKs as official representation of German industry and commerce WHO WE ARE? The German-Slovene Chamber (AHK Slovenia) is a respected and recognised brand. We are a trusted, a non-profit B2B organization with a strong network both in the Slovenia and Germany. Currently, over 200 companies and from the GermanSlovene business community are members. OUR GOALS Promotion of bilateral trade relations between Germany and Slovenia; Mediation, promotion and development of business relations between both countries; Lobbying and representation of interests of our Members in relation to national and other organs and institutions in both countries; OUR GOALS One-stop-shop for Slovenian and German enterprises; Exclusive platform for Best Practice Exchange Internationalization of our members as „gateway to Germany “ Increase of the attractiveness of Slovenia as business location Our Chamber: Membership Growth Founded: 2006 250 First bilateral Chamber of Commerce 235 227 12 Employees (German-Slovenian) 180,000 212 160,000 193 200 140,000 170 153 120,000 150 131 100,000 Erträge/prihodki 114 80,000 100 60,000 55 40,000 50 20,000 0 0 2006 2007 Anzahl/število 2008 2009 2010 2011 2012 2013 2014* ACTIVITIES Company Visits Round tables with politicians Lectures TOP Der Deutsche Ball Delegations Summer picnic International Business Drink Best Practice Meetings Symposia Conferences Business Breakfast Workshops Trade Fairs . OUR INTERNATIONALIZATION SERVICES Slovene Pavilions at Trade Fairs Information about German companies Debt collection in Germany Legal information about Germany German VAT returns Commercial agents Fact-Finding Missions to Germany Tax services for Germany and Slovenia Workshops Market Entry Germany Starting a business in Germany and Slovenia Gertrud Rantzen Predsednica Telefon: +386 1 252 88 63 E-Mail: gf@ahkslo.si http://slowenien.ahk.de