Chapter 14

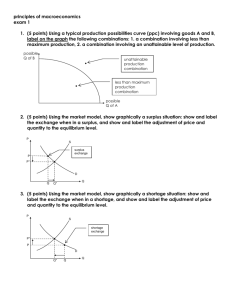

Equilibrium and Efficiency

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All Rights Reserved.

Main Topics – Ch 14~16

Chapters 14~16 provide an introduction

to the analysis of competitive markets.

Ch 14 – Investigate differences between

market equil. in the SR and LR. Also,

welfare properties of competitive equil.

Outcomes.

Ch 15 – Uses the tools to study the

effects of govt. policies.

Ch 16 – Look at equil. in many

competitive markets at the same time.

14-2

Main Topics

What makes a market competitive?

Market demand and market supply

Short-run and long-run competitive

equilibrium

Efficiency of perfectly competitive

markets

Measuring surplus using market demand

and supply curves

14-3

What Makes a Market

Competitive?

Buyers and sellers have absolutely no effect on

price

Three characteristics:

Absence of transaction costs

This means when different sellers produce the same product

buyers will have no difficulty identifying and purchasing from

the seller who offers it at the best terms.

Product homogeneity: products are identical in the

eyes of their purchasers

Products are differentiated when some purchasers view the

products as different.

Presence of a large number of sellers, each accounts

for a small fraction of market supply

14-4

What Makes a Market

Competitive?

When all three factors are present…

Consumers have many options and buy from

the firm that offers the lowest price

Each firm takes the market price as given and

can focus on how much it wants to sell at that

price

Few markets are perfectly competitive

We use this this method because…

Provide useful tool for analyzing how changes in

input costs, taxes, etc. affect the price and qty sold.

Provide very good end results to both consumers

and producers so is useful as a benchmark.

14-5

Market Demand and Supply

Market demand for a product is the sum of the

demands of all individual consumers

Graphically, this is the horizontal sum of the

individual demand curves

For simplicity, assume that all demand comes from

consumers and all supply comes from firms

Market supply of a product is the sum of the

supply of all the individual sellers

Graphically this is the horizontal sum of the

individual supply curves

Very similar to the procedure for constructing market

demand curves

14-6

Figure 14.1: Market Demand

14-7

Figure 14.2: Market Supply

14-8

S-R vs. L-R Market Supply

Long-run and short-run market supply curves may differ

for two reasons:

Firm’s short-run and long-run supply curves may differ

Over time, set of firms able to produce in a market may change

S-R curves are found by summing the supply curves of

all current suppliers.

L-R supply curve is found by summing supply curves of

all potential suppliers

Free entry in a market implies that anyone who wishes

to start a firm has access to the same technology and

entry is unrestricted

With free entry, the number of potential firms in a market

is unlimited (or is it?)

Long-run market supply curve is a horizontal line at ACmin

14-9

Figure 14.4: Long-Run Supply

14-10

Figure 4.5: Market Equilibrium

At equilibrium price,

Qs=Qd

Market clears at

equilibrium price

Given demand and

supply functions, can

use algebra to find

the equilibrium

14-11

Long-Run Competitive Equilibrium

Equilibrium price must

equal Acmin…why?

Firms must earn zero

profit

Why? Does this mean

they don’t make any

money over their input

cost?

Active firms must

produce at their

efficient scale of

production …Why?

14-12

Responses to Changes in

Demand

Market response is different in short-run (number of

firms is fixed) than in long-run (with free entry)

Begin from a point of long-run equilibrium, suppose

demand curve shifts out

In short run, new equilibrium is achieved through

movement along the short-run supply curve

Price rises

In long run, firms enter the market

New equilibrium brings return to initial price but at a higher

quantity

14-13

Price ($/bench)

Figure 14.7: Response to an

Increase in Demand

S10

B

A

C

P* = ACmin

= 100

S

^

D

D

2000

4000

Garden Benches per Month

14-14

Long-Run Competitive Equilibrium

14-15

Responses to Changes in

Fixed Cost

Start from a long-run equilibrium

Consider the case where fixed costs decrease while

variable costs remain the same

In short run:

Average cost curve shifts downward, decreases minimum

average cost and minimum efficient scale

Since marginal costs have not changed and number of firms is

fixed, equilibrium is unchanged

Active firms make a positive profit

In long-run:

Firms enter market

Market equilibrium shifts, price falls and quantity rises

14-16

Figure 14.8: Response to a

Decrease in Cost

14-17

Responses to Changes in

Variable Cost

Start from a long-run equilibrium

If variable costs change, firm’s marginal and

average cost curves both shift

Short-run supply curve shifts

Sort-run equilibrium changes

Basic procedure in all cases:

Find new short-run equilibrium using new short-run

supply curve of initially active firms

Find new long-run equilibrium using new long-run

supply curve which reflects free entry

14-18

Price Changes in the Long-Run

So far we’ve assumed that the prices of firms’ inputs do

not change

Reasonable if increases in amounts of inputs used are small

compared to overall market

Or when supply in input markets is very elastic

In general, though, when demand for a product

increases, prices of inputs used to make it may change

This is a general equilibrium effect; the market we are

studying and the market for its inputs must all be in

equilibrium

Taking the input price effect into account in the analysis

of the market response to an increase in demand

changes the result

Price of the good rises in the long run

14-19

Price ($/bench)

Figure 14.11: Price Changes in

the Long-Run

S10

B

^

AC

min=110

ACmin=100

A

^

E

S

S

C

^

D

D

2000

4000

Garden Benches per Month

14-20

Aggregate Surplus and

Economic Efficiency

Perfectly competitive market produces an outcome that

is economically efficient

Net benefits indicate that consumers’ benefit from the goods

exceed the costs of producing them

Aggregate surplus equals consumers’ total willingness

to pay for a good less firms’ total avoidable cost of

production

Total benefits from consumption equal to willingness to

pay

Area under consumer’s demand curve up to that quantity

Total avoidable costs of production include all of a

firm’s costs other than sunk costs

Area under its supply curve up to its production level

14-21

Willingness to Pay

14-22

Avoidable Cost of Production

14-23

Aggregate Surplus

Total Willingness to Pay =$8+6.75=$14.75

Total Cost of Producing=$5+$3=$8

Total Aggregate Surplus = $6.75

An economic system that maximizes

aggregate surplus creates the largest

possible net social benefit to be distributed

among society’s members.

14-24

Maximizing Aggregate Surplus

Smith’s The Wealth of Nations (1776) commented on

the “invisible hand” of the market

The self-interested actions of each individual lead to

economic efficiency

“he intends only his own gain, and he is in this…led by

an invisible hand to promote an end which was no part

of his intention”

No way to increase aggregate surplus in perfectly

competitive markets by changing:

Who consumes the good

Who produces the good

How much of the good is produced and consumed

Competitive markets maximize aggregate surplus

14-25

Effects of a Change on Who

Consumes the Good

Begin from the competitive equilibrium

Take one unit of the good from Consumer A

and give it to Consumer B

Cannot increase aggregate surplus

Value any consumer attaches to a unit of the good

they don’t buy must be less than the market price

Value any consumer attaches to a unit of the good

they do buy must be more than the market price

If we take the good from someone who

purchased it and give it to someone who didn’t,

aggregate surplus must fall

14-26

Effects of a Change in Who

Produces the Good

Changing who produces the good can’t increase

aggregate surplus

To achieve this, would have to reassign sales in a way that

would lower the total cost of production

Begin from the competitive equilibrium

Reduce sales of Producer A by one unit, increase sales

of Producer B by one unit

Cost of producing any unit of output that a firm chooses to sell

must be less than the equilibrium price

Cost of producing any unit of output that a firm chooses not to

sell must exceed the equilibrium price

Any shift in production from one firm to another must

raise the total cost of production and lower aggregate

surplus

14-27

Effects of a Change in the

Number of Goods

Changing the total number of units of the good

produced and consumed also lowers aggregate

surplus

Any unit of a good that is produced and consumed in a

competitive market equilibrium must be worth more

than the market price to the consumers who buy them

Must also cost less than the market price to produce

Those units of output must therefore make a positive

contribution to aggregate surplus

Any units that aren’t produced and consumed should

not be; they will lower aggregate surplus

14-28

Measuring Total WTP and

Total Avoidable Cost

Market demand and supply curves can be

used to measure total willingness to pay and

total avoidable cost

Measure consumers’ total willingness to pay for

the units they consume by the area under the

market demand curve up to that quantity

When all consumers face the same market price

Measure producers’ total avoidable costs for

the units they produce by the area under the

market supply curve up to that quantity

When all producers face the same market price

14-29

Figure 14.18: Measuring Total

Willingness to Pay

If 3 cones are consumed, what is the total willingness to pay?

If the price is $2.30, how may cones would be sold?

14-30

Aggregate Surplus

Can use market supply and demand curves to

measure aggregate surplus

Consumers’ total willingness to pay is area

under market demand curve up to the quantity

consumed

Producers’ total avoidable cost is the area

under the market supply curve up to the

quantity produced

In a competitive market without any

intervention, aggregate surplus is maximized

No deadweight loss: reduction in aggregate

surplus below its maximum possible value

14-31

Consumer and Producer Surplus

Consumer surplus is the sum of consumers’

total willingness to pay less their total

expenditure

Sum of individual consumers’ surpluses

Also called aggregate consumer surplus

Producer surplus is the sum of firms’ revenues

less avoidable costs

Sum of individual firms’ producer surpluses

Also called aggregate producer surplus

Aggregate surplus = Consumer surplus + Producer Surplus

14-32

Figure 14.19: Aggregate,

Consumer, and Producer Surplus

14-33

Exercise 14.5

The market demand function for corn is

Qd=15-2P and the market supply function

is Qs=5P-6, both quantities measured in

billions of bushels per year. What are the

aggregate surplus, consumer surplus and

producer surplus at the competitive

market equilibrium?

14-34

Exercise 14.5

The first step is to set supply and demand equal and to solve

for equilibrium price:

Qs = Qd

5P – 6 = 15 – 2P

7P = 21

P = $3.00

At a price of $3, we can see from either supply or demand that

quantity will be 9 billion bushels per year. We also need the

highest price at which quantity supplied equals zero and the

lowest price at which quantity demanded equals zero. We

find these two numbers by plugging in 0 for Qd and Qs and

solving for the prices that result.

Qd = 15 – 2P

Qs = 5P – 6

0 = 15 – 2P

0 = 5P – 6

2P = 15

6 = 5P

14-35

P = $7.50

P = $1.20

Exercise 14.5

Now we can compute the areas of the triangles.

CS = ½(Q)($7.50 – P)

PS = ½(Q)(P – $1.20)

CS = ½(9)($7.50 – $3)

PS = ½(9)($3.00 – $1.20)

CS = $20.25

PS = $8.10

Aggregate surplus is the sum of consumer and producer

surplus:

AS = CS + PS

AS = $20.25 + $8.10

AS = $28.35

14-36