non-profit financials for board members

advertisement

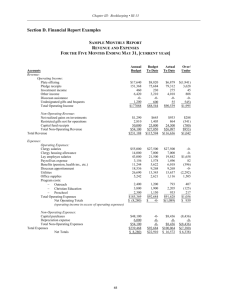

Understanding Non-Profit Financials for Board Members By Suzanne Eikenberry April 17, 2015 workshop What financial questions should a board ask? (There may be questions specific to your non-profit, but these are general enough to apply to most.) ALL ORGANIZATIONS 1) Before budgeting, do our programs meet our strategic goals? What programs/resources do we need to include in a budget to meet our goals, and which should not be included? 2) Where is our money coming from? Is there a good mix of sources? How secure is our income? 3) Do we have a rainy-day fund/reserve? 4) Are we likely to face cash-shortages this year? If so are they temporary? How will we handle them? 5) Do we have positive or negative net income? Do our assets outweigh our liabilities? This can be lean since you are not in the profit-making business, but should be ample enough to secure the future of the organization. 6) Do we have systems/policies in place to ensure that there is no fraud or unethical actions? 7) How are we doing compared to our budget? If there are big differences, why? 8) Are we using our resources to effectively meet our goals? Some funders measure this by looking at the percentage of expenses for fundraising and administration costs. To look at this number, expenses (including salary) need to be recorded properly. 9) Where is our greatest risk? MANY ORGANIZATIONS 10) Do we have enough unrestricted funds to cover operating expenses? Tapping into donor/grant restricted funds for purposes other than those stated by the donor is DANGEROUS. 11) Are our programs bringing in enough money to support themselves? If not, is that ok? For example, you run an afterschool program with a fee from parents that runs in the red. If your mission is to care/nurture kids this program may be essential. It might mean that there are missed grant opportunities there too. Understanding cash vs. accrual accounting 1) Cash reports are based on when a check was written or payment received 2) Accrual reports based on when expense was incurred or money earned/pledged 3) A restricted grant may be on your balance sheet for a long time before moving to “income” on your P&L if you used deferred revenue accounts. 4) Accrual is better for non-profits. Reading a Budget v Actual/ Income Statement/P&L/Statement of Activities, Statement of Functional Expenses Range of time covered (ex Y-T-D, month, etc) Income & Expenses 1) Income a. Should be by source so that you can see funding mix b. Restricted grants might not be reflected in here until the income is “earned” if you use deferred revenue—you might need a separate fundraising report from your director. c. If you use restricted net assets, you may need a separate report on amounts remaining in restriction since your income can be misleading. 1 www.SuzanneEikenberry.com • email: suzanne.eikenberry@gmail.com • phone: 802-522-3901 d. Are there large variances from the budget? Is this due to timing, or something else? Will it be resolved by year end? e. You may need to ask what is included in certain lines since groups vary in how they record items before year-end close (ie pledged income, grants received even if deferred, etc) 2) Expense a. Look at large variances—don’t get bogged down in small details! Ask for reasons why. b. This is a control mechanism for you to make sure that expenses match those approved by the board. 3) Net income a. If negative, you may need to look at creating a plan B (for example if major grant did not come in, how will you find other money or reduce spending or tap into reserves)? b. If you look at this number by program, it might help with strategic planning Reading a Balance Sheet/Statement of Financial Position Single day snapshot Assets-Liabilities=Net Assets (aka Equity) 1) Assets a. Cash—actual money in your bank account b. Receivables-money people owe you both earned and pledged c. Prepaid expenses (not big for most) d. Physical assets (ie building, office equipment, website, vehicles) 2) Liabilities a. Money you owe including Accounts Payable, Payroll Liabilities (taxes, benefits due), outstanding loans & credit card balances b. Vacation accruals (how much would you owe in vacation pay if employees left today)—these matter, although many simple systems neglect them c. Deferred revenue-money received for which the purpose/time has not been fulfilled or earned (if you charge for programs. If this is greater than your cash—LOOK CLOSELY! 3) Net Assets/Equity a. For a non-profit, this is different than for a business, but still equals assets minus liabilities. b. This should be a positive number! c. Restricted net assets (often only updated annually) are restricted funds which you have not meet the restrictions on yet (either temporarily for grants or permanently for endowments) Year-end reports may look very different than interim reports. How money moves between income statement and balance sheet 1) Prepaid expenses-move to P&L when expense is “incurred” or item is “used” 2) Generally, unconditional pledges are counted as income when pledged (including most unrestricted). Restricted pledges may stay on balance sheet as deferred rev. until funds are released from restriction. Small non-profits may record this differently. 3) If using deferred revenue, restricted grants-moved to P&L when money is spent (although may only be adjusted annually). Restricted contributions can act as grants, but ask your CPA for specific cases 4) If using net assets, the restricted income is counted when received (or pledged) and only the net asset balance changes when funds are spent. 5) Assets-each year, only depreciation amount moves. Understanding Non-Profit Financials for Board Members; presentation by Suzanne Eikenberry 2 • suzanne.eikenberry@gmail.com • 802-522-3901• www.suzanneeikenberry.com Understanding a Cash Flow Forecast (vs budget) 1) A cash flow forecast is CASH (not accrual) based unlike your budget 2) A cash flow forecast lets you play with real scenarios and timing to make sure that you have enough money in the bank to pay your expenses when they are due 3) You can separate cash into restricted and unrestricted here, but that can be complex (or simple!) depending on your organization 4) NOTE: a Cash Flow Statement is a different report! Cash Flow Statements reconcile your accrual reports with your cash reports. Audit vs Review vs Compilation Need an audit if: spend $750K or more of federal funds in a year or requested by grantor More info at https://www.councilofnonprofits.org/nonprofit-audit-guide/federal-law-audit-requirements Audits rarely detect fraud Audits An audit provides the highest level of assurance on an organization’s financial statements. An audit provides assurance that an organization’s financial statements are free of material misstatement and are fairly presented based upon the application of generally accepted accounting principles. An audit includes: confirmation with outside parties testing selected transactions by examining supporting documents completing physical inspections and observations considering and evaluating the internal control system of the organization Reviews A review provides limited assurance on an organization’s financial statements. During a review, inquiries and analytical procedures present a reasonable basis for expressing limited assurance that no material modifications to the financial statements are necessary; they are in conformity with generally accepted accounting principles. This “does it make sense” analysis is useful when the organization needs some assurance about their financial statements, but not the higher level of assurance provided by an audit. Compilations A compilation provides no assurance on an organization’s financial statements. The CPA takes financial data provided by the nonprofit and puts them in a financial statement format that complies with generally accepted accounting principles. There are no testing or analytical procedures performed during a compilation. Source: http://www.nonprofitaccountingbasics.org/audit/audit-vs-review-vs-compilation Information on audits, etc: https://www.councilofnonprofits.org/nonprofit-audit-guide 3 Understanding Non-Profit Financials for Board Members; presentation by Suzanne Eikenberry • suzanne.eikenberry@gmail.com • 802-522-3901• www.suzanneeikenberry.com Financial Statements Compiled by CPA Statement of Financial Position (aka Balance Sheet with focus on restricted/unrestricted) Statement of Activities (basically P&L with restricted/unrestricted in separate columns; income by source; expense by program/admin/fundraising; focus on change in net assets) Statement of Functional Expenses (Expenses with rows as type of expense (personnel, rent, etc) and columns by program/admin/fundraising) Statement of Cash Flows—basically reconciles cash to accrual accounting (for non-profits with an focus on restricted & unrestricted) Notes, including details on temporarily restricted net assets Closing notes: Your non-profit is in business to meet a need. Your financial reports/accounting systems should support that. You should be able to get reports that you need from the accounting system. However, sometimes some inaccuracy is worth it in order to save $/staff time for limited increased accuracy (for ex recording salary at year end to match pay period). Data in=data out. Don’t skimp on the bookkeeping function. Reports should answer questions—not just be pro-forma. Don’t waste time on special reports no one will look at or that does not answer key questions. The Board needs to define what they need to know/what questions they are asking the staff to answer. This can be specific to each organization. You might have a one-time report (such as net income on an event). Stay at a high level—don’t get bogged down in the details. Staff can take care of that. Resources to bring to your board: Webinar for boards: http://www.wallacefoundation.org/knowledge-center/Resources-for-FinancialManagement/Documents/The-Boards-Financial-Leadership.pdf Andy Robinson & Nancy Wasserman book “The Board Member’s Easier Than You Think Guide to Nonprofit Finances” 4 Understanding Non-Profit Financials for Board Members; presentation by Suzanne Eikenberry • suzanne.eikenberry@gmail.com • 802-522-3901• www.suzanneeikenberry.com