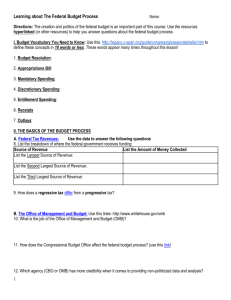

Document

advertisement

Chapter 3 Fiscal Deficits, Public Debt, and The Current Account © Pierre-Richard Agénor The World Bank 1 Structure of Public Finances The Government Budget Constraint Assessing the Stance of Fiscal Policy Fiscal Imbalances and External Deficits Consistency and Sustainability Sustainability and the Solvency Constraint Commodity Price Shocks and Fiscal Deficits Public Debt and Fiscal Austerity 2 Constraints on fiscal policy and macroeconomic management: inadequate tax base and limited ability to collect taxes (result in tax evasion and a growing informal sector); reliance on money financing (result in macroeconomic instability, capital flight, and currency crises); high levels of public debt (cause a pressure on real interest rates and financial volatility and macroeconomic instability). 3 Structure of Public Finances Conventional Sources of Revenue and Expenditure Seigniorage and Inflationary Finance Quasi-Fiscal Activities and Contingent Liabilities 4 Conventional Sources of Revenue and Expenditure Figure 3.1: Public revenue and expenditure patterns vary across developing countries. Structure of conventional sources of revenue and expenditure differs significantly between industrial and developing countries. 5 F i g u r e 3 . 1 a C e n t r a l G o v e r n m e n t : R e v e n u e a n d E x p e n d i t u r e ( I n p e r c e n t o f G D P , a v e r a g e o v e r 1 9 9 0 9 5 ) R e v e n u e E x p e n d i t u r e A f r i c a B u r k i n a F a s o C a m e r o o n E t h i o p i a In d ia In d o n e si a K o r e a G a b o n M a la ysi a G h a n a Ne p a l G u i n e a K e n y a M a d a g a s c a r M a l a w i P a ki sta n P h il ip p in e s S in g a p o r e M a u r i t i u s S r i L a n ka Z a m b i a Z i m b a b w e T h a i la n d 0 5 1 0 1 5 2 0 2 5 3 0 3 5 05 10 15 20 25 30 S o u r c e : W o r l d B a n k . 6 F i g u r e 3 . 1 b C e n t r a l G o v e r n m e n t : R e v e n u e a n d E x p e n d i t u r e ( I n p e r c e n t o f G D P , a v e r a g e o v e r 1 9 9 0 9 5 ) R e v e n u e E x p e n d i t u r e L a t i n A m e r i c a M i d d l e E a s t a n d N o r t h A f r i c a A r g e n t i n a E g y p t B o l i v i a J o r d a n B r a z i l C h i l e M o r o c c o C o l o m b i a O m a n C o s t a R i c a E c u a d o r S y r i a M e x i c o T u n i s i a N i c a r a g u a P e r u T u r k e y U r u g u a y Y e m e n V e n e z u e l a 0 1 0 2 0 3 0 S o u r c e : W o r l d B a n k . 4 0 0 1 5 3 0 4 5 7 Main differences (Burgess and Stern (1993)): Shares of total tax revenue and total central government expenditure in output are larger in industrial countries (Figure 3.2 and Figure 3.3). Explanation: increased need for risk insurance as the degree of openness and exposure to large external shocks increase. (Rodrik, 1998b). Composition of spending: Developing countries devote a substantially larger fraction of expenditures to general public services, defense, education, and other economic services. Industrial countries spend more on health and social security. 8 F i g u r e 3 . 2 a T a x R e v e n u e a n d P e r C a p i t a R e a l G D P 1 / ( A v e r a g e o v e r 1 9 8 0 9 5 ) 5 0 T a x R e v e n u e ( i n p e r c e n t o f G D P ) 4 0 3 0 2 0 1 0 0 0 5 0 0 0 1 0 0 0 0 1 5 0 0 0 2 0 0 0 0 P e r c a p i t a r e a l G D P i n 1 9 8 7 U S d o l l a r s S o u r c e : W o r l d B a n k . 1 / 4 4 d e v e l o p i n g c o u n t r i e s a n d 1 7 i n d u s t r i a l i z e d c o u n t r i e s a r e i n c l u d e d . A d a r k c i r c l e r e f e r s t o d e v e l o p i n g c o u n t r i e s a n d a l i g h t e r c i r c l e t o i n d u s t r i a l c o u n t r i e s . 9 F i g u r e 3 . 2 b G o v e r n m e n t E x p e n d i t u r e a n d P e r C a p i t a R e a l G D P 1 / ( A v e r a g e o v e r 1 9 8 0 9 5 ) G o v e r n m e n t E x p e n d i t u r e ( i n p e r c e n t o f G D P ) 6 0 5 0 4 0 3 0 2 0 1 0 0 0 5 0 0 0 1 0 0 0 0 1 5 0 0 0 2 0 0 0 0 P e r c a p i t a r e a l G D P i n 1 9 8 7 U S d o l l a r s S o u r c e : W o r l d B a n k . 1 / 4 4 d e v e l o p i n g c o u n t r i e s a n d 1 7 i n d u s t r i a l i z e d c o u n t r i e s a r e i n c l u d e d . A d a r k c i r c l e r e f e r s t o d e v e l o p i n g c o u n t r i e s a n d a l i g h t e r c i r c l e t o i n d u s t r i a l c o u n t r i e s . 10 F i g u r e 3 . 3 a I n d u s t r i a l C o u n t r i e s : G o v e r n m e n t S p e n d i n g , 1 8 7 0 1 9 9 6 ( I n p e r c e n t o f G D P ) F r a n c e G e r m a n y 1 8 7 0 1 8 7 0 1 9 1 3 1 9 1 3 1 9 2 0 1 9 2 0 1 9 3 7 1 9 3 7 1 9 6 0 1 9 6 0 1 9 8 0 1 9 8 0 1 9 9 0 1 9 9 0 1 9 9 6 1 9 9 6 0 2 0 4 0 6 0 0 2 0 4 0 6 S o u r c e : I n t e r n a t i o n a l M o n e t a r y F u n d . 11 F i g u r e 3 . 3 b I n d u s t r i a l C o u n t r i e s : G o v e r n m e n t S p e n d i n g , 1 8 7 0 1 9 9 6 ( I n p e r c e n t o f G D P ) I t a l y J a p a n 1 8 7 0 1 8 7 0 1 9 1 3 1 9 1 3 1 9 2 0 1 9 2 0 1 9 3 7 1 9 3 7 1 9 6 0 1 9 6 0 1 9 8 0 1 9 8 0 1 9 9 0 1 9 9 0 1 9 9 6 1 9 9 6 0 1 2 0 3 0 4 0 5 0 6 0 0 1 2 0 3 0 4 0 5 0 6 0 0 S o u r c e : I n t e r n a t i o n a l M o n e t a r y F u n d . 12 F i g u r e 3 . 3 c I n d u s t r i a l C o u n t r i e s : G o v e r n m e n t S p e n d i n g , 1 8 7 0 1 9 9 6 ( I n p e r c e n t o f G D P ) U n i t e d K i n g d o m U n i t e d S t a t e s 1 8 7 0 1 8 7 0 1 9 1 3 1 9 1 3 1 9 2 0 1 9 2 0 1 9 3 7 1 9 3 7 1 9 6 0 1 9 6 0 1 9 8 0 1 9 8 0 1 9 9 0 1 9 9 0 1 9 9 6 1 9 9 6 0 1 2 0 3 0 4 0 5 0 6 0 0 1 2 0 3 0 4 0 5 0 6 0 0 S o u r c e : I n t e r n a t i o n a l M o n e t a r y F u n d . 13 Main source of central government revenue: in both groups is taxation; however, the share of nontax revenue in total revenue is much higher in developing countries. Within total tax revenue, the relative shares of direct taxes, taxes on domestic goods and services, and taxes on foreign trade vary across developing countries and over time (Figure 3.4). In industrial countries, income taxes account for the largest share of tax revenue. There has been a gradual move away from trade taxes to taxes on domestic sales as economies develop and their domestic production and consumption bases expand. 14 F i g u r e 3 . 4 a D i r e c t T a x e s ( I n p e r c e n t o f t o t a l t a x r e v e n u e ) 1 9 8 0 1 9 9 5 T a x e s o n i n c o m e , p r o f i t s , a n d c a p i t a l g a i n s C o l o m b i a K u w a i t C o s t a R i c a M a l a y s i a E c u a d o r M e x i c o E g y p t P a k i s t a n E t h i o p i a P h i l i p p i n e s G h a n a S r i L a n k a I n d o n e s i a S y r i a J o r d a n T h a i l a n d K e n y a T u r k e y K o r e a V e n e z u e l a 0 2 0 4 0 6 0 8 0 0 2 0 4 0 6 0 8 0 S o u r c e : W o r l d B a n k . 15 F i g u r e 3 . 4 b I n d i r e c t T a x e s ( I n p e r c e n t o f t o t a l t a x r e v e n u e ) 1 9 8 0 1 9 9 5 D o m e s t i c t a x e s o n g o o d s a n d s e r v i c e s C o l o m b i a K u w a i t C o s t a R i c a M a l a y s i a E c u a d o r M e x i c o E g y p t P a k i s t a n E t h i o p i a P h i l i p p i n e s G h a n a S r i L a n k a I n d o n e s i a S y r i a J o r d a n T h a i l a n d K e n y a T u r k e y K o r e a V e n e z u e l a 0 5 1 0 S o u r c e : W o r l d B a n k . 1 5 2 0 0 5 1 0 1 5 2 0 16 Within direct taxes, the share of tax revenue raised from individual incomes is much larger than that from corporations in developing countries, while the reverse is true in industrial countries. Need for revenue in developing countries is large. Reasons: Need for the government to invest in infrastructure, foster the development of market institutions, and encourage employment creation in order to reduce poverty. 17 Deficit bias: due to the fact that although fiscal policy is decided collectively, the parties involved do not fully recognize the full social cost of the programs they support (commons problem). Taxation systems in many developing countries remain highly inefficient. Key reason: severe administrative and political constraints on the ability of tax authorities to collect revenue. Consequences: direct taxation plays a much more limited role in developing countries and high tax rates tend to be levied on a narrow base (encourage tax evasion and lead to a high degree of reliance on monetary financing). 18 Seigniorage and Inflationary Finance Developing countries tend to rely more on seigniorage than industrial countries. Reasons: limited administrative capacity and political constraints hinder the collection of tax revenue in developing countries; limited scope for issuing of domestic debt. Seigniorage consists of the amount of real resources extracted by the government by means of base money creation. 19 Seigniorage revenue (conventional measure): (M/P) = (M/P) -(P-1/P)(M-1/P-1) = (M/P) + [(P - P-1)/P-1](M-1/P) = m + [/(1+ )]m-1 (1) M : nominal base money stock; P : price level; m M/P; P/P-1 . 20 Equation (1): seigniorage is the sum of the increase in the real stock of money, m, and the change in the real money stock that would have occurred with a constant nominal stock because of inflation, /(1+)]m-1. Second term represents the inflation tax, with [/(1+)] denoting the tax rate and m-1, tax base. When m = 0 (stationary state), seigniorage is equal to the inflation tax. If monetary base is bearing any interest, Equation (1) overstate seigniorage revenue and a correction must be made to obtain an appropriate measure. 21 Alternative seigniorage definition: interest burden foregone by the government through its ability to issue non-interest-bearing liabilities. This is private sector's revenue loss from foregone interest earnings (opportunity cost of money) corresponds to an equivalent revenue gain for the government from issuing money, iM/P, where i is the nominal short-term interest rate. Figure 3.5: differences across countries in the use of seigniorage---from almost 12% in Yemen to less than 1% in Tunisia. Figure 3.6: reliance on seigniorage tends to be associated with large fiscal deficits. 22 F i g u r e 3 . 5 S e i g n i o r a g e ( I n p e r c e n t o f G D P , a v e r a g e 1 9 9 3 9 5 ) A r g e n t i n a L e b a n o n B o l i v i a M a l a y s i a B r a z i l C h i l e M e x i c o P a k i s t a n P e r u C o l o m b i a C o s t a R i c a E c u a d o r E g y p t P h i l i p p i n e s S i n g a p o r e S r i L a n k a S u d a n E t h i o p i a G h a n a I n d i a T h a i l a n d T u n i s i a T u r k e y J o r d a n U r u g u a y K e n y a V e n e z u e l a K o r e a Y e m e n 024681 0 1 2 024681 0 1 2 S o u r c e : W o r l d B a n k . N o t e : S e i g n i o r a g e i s m e a s u r e d a s t h e c h a n g e i n t h e b a s e m o n e y s t o c k d i v i d e d b y n o m i n a l G D P . 23 F i g u r e 3 . 6 F i s c a l D e f i c i t s a n d S e i g n i o r a g e ( I n p e r c e n t o f G D P , a v e r a g e 1 9 9 3 9 5 ) 4 A l g e r i a V e n e z u e l a M o r o c c o 3 I n d i a Seignora 1/ B o l i v i a T u r k e y E c u a d o r P a k i s t a n Z a m b i a U r u g u a y E g y p t K e n y a 2 P h i l i p p i n e s S r i L a n k a S i e r r a L e o n e n d o n e s i a T u n i s i a I P e r u C h i l e K o r e a T h a i l a n d D o m i n i c a n R e p . C o s t a R i c a N i c a r a g u a M e x i c o 1 A r g e n t i n a J o r d a n 0 8 6 4 2 0 2 4 F i s c a l b a l a n c e , i n c l u d i n g g r a n t s 2 / S o u r c e : W o r l d B a n k . 1 / S e i g n i o r a g e i s t h e c h a n g e i n t h e b a s e m o n e y s t o c k d i v i d e d b y n o m i n a l G D P . 2 / C e n t r a l g o v e r n m e n t o n l y . 24 Quasi_Fiscal Activities and Contingent Liabilities Quasi-fiscal activities: operations whose effect can in principle be duplicated by budgetary measures in the form of an explicit tax, subsidy, or direct expenditure. Carried out by the country's central bank, by public sector banks and other public financial institutions, such as development banks. Main examples of quasi-fiscal activities: Subsidized credit: lending at preferential rates by the central bank to the government or other public entities, or subsidized lending by specialized public sector financial institutions to the private sector. 25 Manipulation of reserve and statutory liquidity requirements, through, for instance, central bank regulations requiring commercial banks to hold large reserves. Multiple exchange rate practices: it may be a surrender requirement on export proceeds at a rate that is more appreciated than the market rate. This implicit tax on exports may have potentially large distortionary effects on trade flows and production patterns. Exchange rate guarantees: given by the central bank on the repayment of principal and interest on foreign-currency denominated debt of other public sector or private sector entities. 26 Bailout of troubled commercial banks: central bank provides an infusion of capital in troubled banks, or directly takes control of some of the nonperforming assets of problem banks. Sterilization operations : central bank pays interest on its liabilities at a rate higher than the one earned on the foreign exchange reserves that it chose to accumulate. Examples of the importance of quasi-fiscal deficits: Chile and Argentina. Monetary authorities in both countries extended emergency loans to financial institutions and suffered large losses from exchange rate guarantee programs. 27 Consolidated quasi-fiscal deficits averaged more than 10% of GDP a year in Chile. In Argentina, quasi-fiscal deficits of the consolidated public sector were roughly as large as conventionally-measured deficits; together they averaged 25% of GDP a year. Quasi-fiscal activities lead to the creation of contingent implicit liabilities (obligations that the government is expected to fulfill, although required outlays are typically uncertain before a failure occurs). 28 Contingent explicit fiscal liabilities: obligations that the government is legally compelled to honor if the entity that incurred them in the first place cannot do. Because of severe distortionary effects of contingent liabilities together with direct liabilities on the allocation of resources, eliminating or reducing the scope of quasi-fiscal activities is a key objective of macroeconomic management. 29 The Government Budget Constraint 30 Budget constraint: g + B + G - (TT+TN) + iB-1+ i*EBg-1 = L * EB*g (2) G: public spending on goods and services; TT: tax revenue ; TN: non-tax revenue; B: end-of-period stock of domestic public debt (bears interest at the market-determined rate i); Bg*: end-of-period stock of foreign-currencydenominated public debt (bears interest at i*); E: nominal exchange rate; Lg: nominal stock of credit allocated by the central bank. 31 Left-hand side of Equation (2): components of the budget deficit; spending on goods and services and debt service, net of taxes (conventional fiscal balance). Right-hand side: government finances its budget deficit by either issuing domestic bonds, borrowing abroad, or borrowing from the central bank. Primary fiscal balance: D=G-T where T = TN + TT . 32 Then (2): * = Lg + B + EB*g (3) D + iB-1 + i*EBg-1 Conventional fiscal deficit can be sensitive to inflation. Key reason: effect of inflation on nominal interest payments on the public debt. Limitations of conventional deficit under inflation: No longer a reliable indicator of sustainability of fiscal stance (issuance of public debt occurs at a rate in excess of the growth rate of the resources 33 available for eventual debt service). No longer provide an adequate measure of fiscal effort by policymakers. Primary balance is a more reliable measure. Economists often use an alternative to conventional balance, operational balance (defined in real terms). 34 Difference between conventional balance and operational balance: Assume B* = 0. Equation (3) becomes: D + iB-1 = Lg + B. Divide both sides by P: d + i(P-1/P)b-1 = (Lg/P) + (P-1/P)(B/P-1), (4) d: real primary deficit; b: real stock of government bonds. 35 After some calculations: d + rb-1 = (Lg/P) + b, (5) r = [(1+i)/(1+)] - 1: real interest rate. Left hand side of (4): nominal deficit deflated by the price level P. Left hand side of (5): total deficit in real terms. Comparing these two: simply deflating the conventional fiscal balance by current prices leads to an overestimation of the real deficit by the amount: [/(1+)]b-1. 36 This represents the compensation to creditors for the falling real value of their claims on government caused by inflation. To see the difference: In Brazil, for example, conventional deficit 27.3%, operational deficit 4.5%, primary deficit -0.5% in 1988. Figure 3.7: sharp differences between operational and primary balance. Operational deficit becomes problematic when inflation is highly variable, because of difficulties in measuring and interpreting real interest payments. Inflation may also affect noninterest expenditure and revenue, thus all three measures of fiscal 37 deficits. F i g u r e 3 . 7 B r a z i l : A l t e r n a t i v e M e a s u r e s o f t h e F i s c a l B a l a n c e 1 / ( I n p e r c e n t o f G D P ) 6 I n t e r e s t p a y m e n t s P r i m a r y b a l a n c e 4 2 0 2 O p e r a t i o n a l B a l a n c e 4 6 1 9 8 51 9 8 61 9 8 71 9 8 81 9 8 91 9 9 01 9 9 11 9 9 2 1 9 9 31 9 9 41 9 9 51 9 9 6 S o u r c e : B e v i l a q u a a n d W e r n e c k ( 1 9 9 7 ) . 1 / G e n e r a l g o v e r n m e n t o n l y ( F e d e r a l g o v e r n m e n t a n d s t a t e s a n d m u n i c i p a l i t i e s ) . 38 It can reduce real revenue in the presence of collection lags (Olivera-Tanzi effect). Lag between the time tax payments are assessed and the time they are collected by the fiscal authorities. If n is collection lag (in months), monthly inflation rate, the amount by which real revenue drops is: (1+ )-n-1. If n = 1 and = 10%, drop in revenue = 9.1%. In a high-inflation environment, the effect of inflation on the interest bill tends to exceed its effect on spending and revenue. 39 Assessing the Stance of Fiscal Policy 40 Tools for assessing the medium-term stance of fiscal policy are structural budget deficit and fiscal impulse measure. Key idea to assess medium-term fiscal strategies properly: determine which changes in actual budget balances reflect structural factors, (discretionary fiscal policy action), rather than cyclical movements. Changes in deficit attributable to the business cycle (or short-term fluctuations in aggregate demand) is self-correcting. Changes in deficits attributable to structural factors can be offset only through discretionary measures. 41 Removing cyclical component from the observed budget balance provides a more accurate indication of medium-term fiscal positions : structural budget balance. First approach to calculate structural budget balances: Budget elasticities are used to adjust revenues, TS , and total expenditures, GS , for movements in the cyclical output gap, GAP. GAP: difference between actual and potential (or capacity) output, in proportion of potential output. 42 Structural budget deficit: DS = GS - TS = G(1 - GGAP) - T(1 - TGAP), G and T : elasticities of expenditure and revenue. 43 Second approach to calculate structural budget balances: Used by IMF. Cyclical revenue and expenditure components are expressed as ratios to GDP and estimated using parameters that describe the cyclical response of revenue and expenditure to movements in the cyclical output gap. Budget deficit as a percentage of GDP: d = g - , g: observed total expenditure-to-GDP ratio; : observed total revenue-to-GDP ratio. 44 Decomposing the revenue and expenditure ratios into structural components (S and gS)and cyclical components (C and gC) : d = (gS + gC) - (S + C). Impact of cyclical component on budget deficit: dC = gC - C = GGAP - TGAP, G and T: cyclical response of expenditure and revenue ratios to an increase of 1 percentage point in cyclical output gap. 45 Overall effect of the business cycle on the budget: (G - T). Structural budget deficit: dS = d - dC. Two approaches are basically equivalent: T (T -1)(T/Y); G (G -1)(G/Y) T/Y, G/Y: revenue-to-GDP and expenditure-to-GDP ratios. 46 Presenting the estimates as ratios to GDP makes it easier to evaluate the sensitivity of estimates of structural budget balances to changes in assumptions about cyclical output gap and cyclical responsiveness of the budget. Key aspect of the cyclical adjustment is the estimation of potential output. Industrial countries: a common approach is first to estimate a production function linking output to capital, labor, and total factor productivity. Potential output is then estimated as the level of output that is consistent with normal capital utilization, and natural rate of unemployment. 47 Developing countries: Potential output is approximated by trend output, which can be estimated for instance by Hodrick-Prescott filter. Fiscal impulse measure: First step: decomposition of the actual budget deficit into a cyclically neutral component and a fiscal stance component. Cyclically neutral component: calculated by assuming that government expenditures increase proportionately to potential output and that revenues increase proportionately to actual output. Fiscal stance: residual between the cyclically neutral and the actual budget deficits. 48 Second step: calculate the fiscal impulse as the annual change in the fiscal stance measure. Negative value: contractionary demand impulse. Positive value: expansionary demand impulse. Fiscal stance was significantly more expansionary than what conventional indicators (such as the primary deficit) indicated. Limitations: Beside to discretionary fiscal policy measures and business cycle, other factors can be important for movements in the structural components of revenues and expenditures: 49 Revenue side: changes in natural resource revenues, nonneutralities of the tax system with respect to inflation. Expenditure side: changes in interest rates, changes in the demographic composition of the population. Chand (1993): fiscal impulse measures do not include the effect of automatic stabilizers on aggregate demand. Effects of fiscal policy on long-term interest rates and the distortions associated with tax and transfer programs on the supply side of the economy are not included. 50 Fiscal Imbalances and External Deficit 51 Key issue for policymakers in developing countries: correlation between fiscal and external deficits. Link between fiscal accounts and external balance: (Ip - Sp) + (G - T) = J - X - NT , Ip: private investment; Sp: private saving; G: current government spending; T: current government revenue; J (X): imports (exports) of goods and services; NT: net current transfers from abroad. 52 Counterpart to the current account balance is the government fiscal deficit and the investment-saving balance of the private sector. As long as (Ip - Sp) is stable, changes in fiscal deficits will be closely associated with movements in current account deficits. Figure 3.8: correlation between budget deficits and current account deficits not suggest any clear pattern. Correlation between fiscal and external deficits depends on the effect of fiscal policy on the private sector's investment and saving decisions. Fiscal deficits may respond to, rather than cause, changes in the current account. 53 F i g u r e 3 . 8 B u d g e t D e f i c i t s a n d C u r r e n t A c c o u n t D e f i c i t s ( I n p e r c e n t o f G D P , a v e r a g e o v e r 1 9 8 0 9 5 ) 3 2 V e n e z u e l a A l g e r i a 1 K o r e a P a n a m a 0 T u r k e y B r a z i l 1 M e x i c o 2 U r u g u a y K e n y a M a l a y s i a o l o m b i a A r g e n t i n aC I n d i a B u r u n d i Curentacoble 3 Z i m b a b w eP a k i s t a n 4 M o r o c c o E g y p t 5 J a m a i c a 6 P h i l i p p i n e s G h a n a C h i l e P e r uT h a i l a n d T u n i s i a S r i L a n k a 7 8 I n d o n e s i a C ô t e d ' I v o i r e N e p a l C a m e r o o n E c u a d o rB a n g l a d e s h B o l i v i a C o s t a R i c a P a r a g u a y S e n e g a l H o n d u r a s 9 1 4 1 3 1 2 1 1 1 0 9 8 7 6 5 4 3 2 1 0 1 O v e r a l l b u d g e t d e f i c i t , i n c l u d i n g g r a n t s S o u r c e : W o r l d B a n k . 54 Consistency and Sustainability The Consistency Framework Fiscal and External Sustainability 55 A Consistency Framework Anand and van Wijnbergen (1989) model. The framework can be operated in two modes: deficit mode: allows the analyst to calculate a financeable deficit, given targets for inflation and other macroeconomic variables; inflation mode: allows the calculation of the rate of inflation consistent with given targets for the fiscal deficit and other macroeconomic variables. In the presence of various macroeconomic targets, sources of fiscal deficit financing become interdependent and determine the level of the primary deficit that can be financed from below the 56 line. If actual deficit exceeds the level that can be financed (given the other policy targets), policymakers must adjust their fiscal stance or revise their other objectives. 57 Government budget constraint: * = Lg + B + EB*g (8) D + iB-1 + i*EBg-1 G: public spending on goods and services; TT: tax revenue ; TN: non-tax revenue; B: end-of-period stock of domestic public debt (bears interest at the market-determined rate i; Bg*:end-of-period stock of foreign-currencydenominated public debt (bears interest at the rate i*; E: nominal exchange rate; Lg: nominal stock of credit allocated by the 58 central bank. First step: consolidate the balance sheets of the government and the central bank. Add and subtract ER*: * = (Lg + ER*) + B D + iB-1 + i*EBg-1 (9) + E(B*g - R*) 59 Balance sheet of central bank: Assets Lg ER* Liabilities CU M RR NWcb } CU: currency in circulation; RR: reserves held at the central bank by commercial banks against their deposit liabilities; NWcb: central bank's accumulated profits or net worth. 60 Monetary base: M = CU + RR. Change in monetary base: M = Lg + ER* - NWcb. Net profits of central bank is interest earnings on official reserves : i*ER-1* = NWcb 61 After rearrangements: D + iB-1 + i*EB*-1 = B + EB* + M (12) Two observations are useful at this stage: Because base money is considered a liability of the public sector, net foreign assets held by the central bank must be subtracted from the government's foreign debt to calculate the net external liabilities of the public sector. 62 The above derivations remain almost identical if the central bank lends to commercial banks and to the private sector. Definition of the base money stock needs to be adjusted to correspond to the central bank's net liabilities to the private sector. This is done by defining the adjusted monetary base as the sum of currency in circulation minus central bank credit to the private sector; required reserves minus central bank loans to commercial banks. 63 Dividing by P (in real terms): d + rb-1 + r*zb*-1 = b + zb* + M/P, d = D/P: real primary deficit; b = B/P: real value of the stock of domestic debt in terms of domestic goods; b* = B*/P*: real value of the stock of foreign debt in terms of foreign goods, with P* denoting the foreign price level; z = EP*/P: real exchange rate, r and r*: real interest rates in terms of domestic and foreign goods. 64 r and r* are defined such that 1 + r = (1 + i)/(1 + ); 1 + r* = (1 + i*)/(1 + *). 65 After rearranging: d + rb-1 + (r* + z) zb*-1 ^ = b + (z/z-1)(zb*) + M/P, z = z/z-1: rate of depreciation of the real exchange rate. After substitution of seigniorage revenue from equation (1): ^ d + rb-1 + (r* + z) zb*-1 (17) = b + (z/z-1)(zb*) + m + (/(1+ ))m-1. 66 This equation can be used in various ways to ensure the consistency between fiscal policy and macroeconomic targets. It can generate two types of values for a given money demand function: value of the primary fiscal deficit that is consistent with a given total debt-to-output ratio and an inflation target; ~ value of , that is consistent with a given total debt-to-output ratio and a target for the primary fiscal deficit. 67 First mode: simple possibility is to assume that both domestic and foreign debt ratios grow at the constant rate of growth of output, g: b/b-1 = g , (zb*)/z-1b*-1 = g. Measuring all variables in proportion of output yields: b/y = g(b-1/y), * /y) = g(zb-1 (zb*)/y = g(z-1b-1 * /y)(z-1/z). 68 Dividing each term in Equation (17) by output, and using the preceding results to substitute for (zb*)/y: d/y + rb-1/y + (r* + ^z)zb*-1/y = g(b-1/y) + g(zb*-1/y) + m/y (18) ~ ~ + (/(1+ ))m -1/y. 69 ^ g, ~, and a properly For given values of r and r*, z, specified money demand function equation (18) determines the financeable primary deficit: d y = - (r - g)b-1/y - (r* + z - g)zb*-1/y ^ f ~ ~ + m/y + (/(1+ ))m -1/y. Given the value of the financeable primary deficit the reduction in the actual deficit-to-output ratio, d/y|a, required to achieve consistency can be calculated: d y d = y d y a f 70 For a given target value of d/y|f , Equation (18) allows one to calculate the consistent (or sustainable) rate of inflation. In this case, however, multiple solutions for the sustainable inflation rate may arise if the money demand function is nonlinearly related to inflation and/or nominal interest rates. In practice, estimates of base money demand are derived by using a complete model of portfolio choice that includes: demand for currency; demand for sight deposits, time deposits; 71 foreign-currency deposits all as a function of income, inflation and interest rates. Demand for reserves by commercial banks may be estimated by using a simple portfolio model, taking into account existing legislation on reserve requirements. Major advantage of this extended approach: it allows the investigator to assess the effects of changes in financial regulations on the financeable fiscal deficit or the sustainable rate of inflation. 72 In practical applications, it is common to use a twoor three-year moving average of actual real output growth rates and interest rates, and a constant real exchange rate (z = 0), to generate an ex ante measure of sustainability. 73 Two other considerations: Assessing the magnitude and likelihood of realization of contingent liabilities, such as foreign exchange guarantees, may be critical to assess the fiscal stance and its sustainability. See Towe (1990). Measures of the primary balance should include quasi-fiscal losses. Degree of concessionality of foreign debt must be accounted for in assessing sustainability. See Cuddington (1997). For many developing countries, foreign financing contains a sizable grant element. 74 The larger that element is, the higher will be the level of foreign indebtedness consistent with fiscal sustainability. In effect, concessionality reduces the effective real interest rate on foreign borrowing. 75 Functioning of the consistency framework: Assume RR = 0. So M = CU. Demand for currency: ln(CU /y)=0.1 - 1.5 ln(1+) - 2.1 ln(1+i). Assume b* = 0, g = 0.02, ~ = 0.63, r = r* = 0.04, d/y = 0.04 and targeted debt-to-output ratio = 0.1. Then from (18): d/y = 0.027, for t = 1 d/y = 0.028, for t = 2,…,9 d/y = 0.030, for t = 10. 76 Suppose: policymaker’s objective is to find the inflation rate that is consistent with a primary deficitoutput ratio constant at 0.03. Sustainable inflation rate: = 73%, for t = 1 = 71%, for t = 2 = 58%, for t = 10. Limitations: It lacks a simultaneous determination of the primary deficit, output growth rates, and the real interest rate. Lenders play no role. 77 Fiscal and External Sustainability Fiscal sustainability is neither necessary nor sufficient for external sustainability. The behavior of the private sector is a crucial link in explaining any divergences between fiscal and external sustainability. Any increase in government dissavings, given private savings and national investment behavior, will translate automatically into an increase in the current account deficit. However, a sustainable fiscal stance need not be sufficient for external sustainability if private sector behavior is such that its net savings are highly negative and/or falling. 78 Extension by Parker and Kastner(1993). Key feature: net private savings are added to net public savings to determine the current account balance. Real interest rates are determined endogenously, and are specified as depending in part on the debtoutput ratio. This captures the existence of a risk premium: the higher the level of public debt, the lower the probability that debt will be sustainable, the higher the risk of default, and the higher the real interest rate. Taxes are exogenous. 79 For given targets for output growth, inflation, and domestic and foreign borrowing, the model generates consistent estimates of public spending. The difference between financeable expenditure and actual expenditure provides the fiscal adjustment required to meet both fiscal and external targets. Model: attempt to capture explicitly the role of the private sector in assessing external sustainability. It shows the need to account for general equilibrium interactions among macroeconomic variables. Lenders play an active role. 80 Sustainability and the Solvency Constraint 81 Consistency framework is static and focuses on flow budget constraint. Budget constraint has also intertemporal dimension. Intertemporal solvency condition: central to an evaluation of the medium- and long-run sustainability of fiscal deficits and public debt. 82 Assume no foreign financing of the deficit. Then budget constraint: d + rb-1 = b + M/P, d: real primary deficit; b: real value of the stock of domestic debt in terms of domestic goods; r: real interest rates. 83 Rewrite: b = [(r - g)/(1+g)]b-1 + d - s, (20) d = d/y:ratio of primary deficit to GDP; b = b/y:ratio of government debt to GDP; s = M/Py: ratio of seigniorage revenue to GDP; g: rate of growth of real GDP. If r > g, b will increase explosively, unless s exceeds d by sufficiently large amount. 84 Assume constant r and g and solve (20) recursively forward from period 0 to N: N b0= [(1+g)/(1+r)]h(sh-dh) h=1 +[(1+g)/(1+r)]NbN. Outstanding stock of domestic debt must be equal in value to the present discounted value of the future stream of seigniorage revenue, sh, adjusted for the primary fiscal deficit, dh, between the current date and some terminal date N, plus the present discounted value of the debt held at that terminal future date. 85 Suppose N is the relevant terminal date. Solvency constraint requires: bN 0. Solvency constraint: b0 N h=1 [(1+g)/(1+r)]h(sh - dh) . (23) For a solvent government b0 cannot exceed, the present discounted value of future seigniorage revenue, adjusted for the primary fiscal deficit. Policy is sustainable if this constraint holds. 86 This framework can be used for various policy exercises: It can be used to calculate the magnitude of the primary deficit-output ratio that would be needed to get from an initial debt-output ratio b0, to a target future value of that ratio H periods later, bH. This quantity can be called required primary deficitoutput ratio. By comparing the required ratio to the actual ratio the primary fiscal gap can be obtained (Blanchard, 1993). Solvency is not sufficient to identify a unique fiscal stance. 87 Lack of uniqueness: governments possess some degrees of freedom in the selection of fiscal policy instruments that they can manipulate to ensure solvency, as well as the timing of use of these instruments. If solvency constraint is violated, the following main policy options may be considered to close the solvency gap: either by cutting spending or by raising tax and nontax revenues; increase current and future seigniorage revenues (limited); 88 declare an outright default or impose a unilateral moratorium on debt payments (may increase risk premium). In practice, solvency analysis is fraught with difficulties. Solvency constraint imposes only weak restrictions on fiscal policy. If r < g, a primary surplus is not necessary to achieve solvency. The government can run a primary deficit of any size. Size of the debt-to-output ratio: influence on the private sector's perception of the government's commitment to meet its intertemporal budget constraint, and its ability to do so. 89 As the debt ratio continues to grow, private agents may become skeptical about the government's ability to meet its budget constraint. This loss of credibility may translate into higher interest rates. The larger the outstanding debt-to-output ratio is, and the longer appropriate policy actions are postponed, the greater will be the magnitude of the primary surplus needed to satisfy the solvency constraint. Because governments typically face a limit to the tax burden that they can impose on their citizens, they face a feasibility constraint on the amount of revenue that they can raise. 90 Commodity Price Shocks and Fiscal Deficits 91 In the short run, commodity price shocks may also play a role on fiscal deficit. Since many developing economies depend heavily on primary commodities for the bulk of their export receipts, tax revenues are strongly affected by movements in commodity prices. When commodity prices rise, government revenues are boosted both directly, in countries where commodityproducing sectors are state owned, and indirectly, through increased revenues from trade and income taxes. 92 Collier and Gunning (1996): These windfall gains are used to finance procyclical expenditures. Result: when prices have declined, these countries have been left with large and unsustainable fiscal deficits. Reason as noted by Cooper (1991): governments typically behave as if positive shocks are permanent, and negative shocks are temporary. Expansion of government spending induced by a transitory improvement in the terms of trade was accompanied also by a sustained real exchange rate appreciation (Dutch disease). 93 Designing contingency mechanisms and institutional structures that are capable of ensuring that governments engage more in expenditure smoothing. 94 Public Debt and Fiscal Austerity 95 Fiscal austerity may be expansionary (oppose to the Keynesian view). Bertola and Drazen (1993): negative fiscal multiplier. Expectations about future policy actions may have a major effect on interest rates, depending on their degree of credibility. If the policy measures are fully credible, when austerity program begins, interest rates may fall immediately. Reason: credible policy announcement may be viewed as reducing the risk of higher inflation, currency overvaluation, and possibly future financial instability. 96 As a result, the risk premium in interest rates is likely to decline. Expansionary effects of reduction in interest rates on output: demand side: by lowering the cost of capital and thereby increasing investment, and by stimulating consumption of durables; supply side: by reducing the cost of financing working capital needs for credit-dependent firms. Even though there is virtually no evidence on the importance of negative fiscal multiplier effects in developing countries, it has important implications for the design of adjustment programs. 97