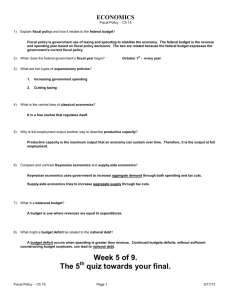

Chapter 13

advertisement

Chapter 13 Fiscal Policy Introduction Countries belonging to the European Monetary Union have agreed to follow a path of fiscal discipline, keeping government spending in line with tax receipts. Under what conditions would a government be tempted to allow expenditures to exceed receipts? Slide 13-2 Learning Objectives Use traditional Keynesian analysis to evaluate the effects of discretionary fiscal policy Discuss ways in which indirect crowding out and direct expenditure offsets can reduce the effectiveness of fiscal policy actions Slide 13-3 Learning Objectives Explain why the Ricardian equivalence theorem calls into question the usefulness of tax changes List and define fiscal policy time lags and explain why they complicate efforts to engage in fiscal “fine tuning” Slide 13-4 Learning Objectives Describe how certain aspects of fiscal policy function as automatic stabilizers for the country Slide 13-5 Chapter Outline Fiscal Policy Possible Offsets to Fiscal Policy Discretionary Fiscal Policy in Practice Automatic Stabilizers What Do We Really Know About Fiscal Policy? Slide 13-6 Did You Know That... Federal government dollars are used to fund a variety of endeavors, such as the Rock and Roll Hall of Fame and the National Cowgirl Museum? There are economy-wide effects from changes in the level of government spending. Slide 13-7 Fiscal Policy Discretionary Fiscal Policy – The discretionary changes in government expenditures and/or taxes in order to achieve certain national economic goals • • • • High employment Price stability Economic growth Improvement of international payments balance Slide 13-8 Fiscal Policy An increase in government spending will stimulate economic activity Changes in government spending – Military spending – Education spending – Budgets for government agencies Slide 13-9 Expansionary Fiscal Policy: Changes in G Price Level LRAS SRAS • The recessionary gap is caused by insufficient AD • To increase AD, use expansionary fiscal policy to increase government spending • With an increase in G, AD increases and real GDP increases to full employment 120 E1 AD1 0 Figure 13-1, Panel (a) 11.5 12.0 Real GDP per Year ($ trillions) Slide 13-10 Expansionary Fiscal Policy: Changes in G Price Level LRAS SRAS • The recessionary gap is caused by insufficient AD • To increase AD, use expansionary fiscal policy to increase government spending • With an increase in G, AD increases and real GDP increases to full employment E2 130 120 E1 AD2 AD1 0 Figure 13-1, Panel (a) 11.5 12.0 Real GDP per Year ($ trillions) Slide 13-11 Fiscal Policy Questions – Would the increase in government spending equal the size of the gap? – What impact did the expansionary fiscal policy have on the price level? Slide 13-12 Contractionary Fiscal Policy: Changes in Government Spending LRAS Price Level SRAS1 130 E1 • The inflationary gap is caused by SR equilibrium > full employment • To decrease AD, use contractionary fiscal policy to decrease government spending • With a decrease in G, AD decreases and real GDP decreases to full employment AD1 0 Figure 13-1, Panel (b) 12.0 12.5 Real GDP per Year ($ trillions) Slide 13-13 Contractionary Fiscal Policy: Changes in Government Spending LRAS Price Level SRAS1 E1 130 120 E2 • The inflationary gap is caused by SR equilibrium > full employment • To decrease AD, use contractionary fiscal policy to decrease government spending • With a decrease in G, AD decreases and real GDP decreases to full employment AD1 AD2 0 Figure 13-1, Panel (b) 11.5 12.0 Real GDP per Year ($ trillions) Slide 13-14 Fiscal Policy Change in taxes – A rise in taxes causes a reduction in aggregate demand because it can reduce consumption spending, investment expenditures, and net exports Slide 13-15 Expansionary Fiscal Policy: Changes in Taxes LRAS Price Level SRAS1 • The recessionary gap is caused by insufficient AD • To increase AD, use expansionary fiscal policy to decrease taxes • With a decrease in taxes, AD increases and real GDP increases to full employment AD1 0 Figure 13-3, Panel (b) 12.0 Real GDP per Year ($ trillions) Slide 13-16 Expansionary Fiscal Policy: Changes in Taxes LRAS Price Level SRAS1 E2 120 110 E1 • The recessionary gap is caused by insufficient AD • To increase AD, use expansionary fiscal policy to decrease taxes • With a decrease in taxes, AD increases and real GDP increases to full employment AD2 AD1 0 Figure 13-3, Panel (b) 11.5 12.0 Real GDP per Year ($ trillions) Slide 13-17 Expansionary Fiscal Policy: Changes in Taxes LRAS • The inflationary gap is caused by SR equilibrium > full employment • To decrease AD, use contractionary fiscal policy to increase taxes • With an increase in taxes AD decreases and real GDP decreases to full employment Price Level SRAS1 E1 120 100 E2 AD1 AD2 0 Figure 13-3, Panel (a) 12.0 12.5 Real GDP per Year ($ trillions) Slide 13-18 Fiscal Policy Question – What would be the long-run impact on of a tax cut on real GDP if the economy is at full-employment equilibrium? Slide 13-19 Fiscal Policy Tax rates and tax revenues – Will an increase in tax rates always raise tax revenue? Slide 13-20 Possible Offsets to Fiscal Policy Indirect crowding out – Increases in government spending without raising taxes creates additional borrowing Slide 13-21 Possible Offsets to Fiscal Policy Crowding-Out Effect – The tendency of expansionary fiscal policy to cause a decrease in planned investment or planned consumption; this decrease normally results from the rise of interest rates Slide 13-22 The Crowding-Out Effect LRAS Price Level SRAS Expansionary policy causing deficit spending initially shifts from AD to AD2 E2 140 130 Equilibrium GDP below full-employment GDP—recessionary gap E1 AD2 AD1 0 Figure 13-5 11.5 12.0 Real GDP per Year ($ trillions) Slide 13-23 The Crowding-Out Effect Price Level LRAS SRAS E2 140 135 130 Expansionary policy causing deficit spending initially shifts from AD to AD2 E3 Due to crowding out, AD shifts inward to AD3 Equilibrium GDP below full-employment GDP—recessionary gap E1 AD2 AD3 AD1 0 Figure 13-5 11.5 12.0 11.75 Real GDP per Year ($ trillions) Slide 13-24 The Crowding-Out Effect, Step-By-Step Figure 13-4 Slide 13-25 Possible Offsets to Fiscal Policy Direct crowding out – Direct Expenditures Offsets • Actions on the part of the private sector in spending money that offset government fiscal policy actions • Any increase in government spending in an area that competes with the private sector Slide 13-26 Possible Offsets to Fiscal Policy Planning for the future: The Ricardian equivalence theorem – Ricardian Equivalence Theorem • The proposition that an increase in the government budget deficit has no effect on aggregate demand Slide 13-27 Possible Offsets to Fiscal Policy Planning for the future: The Ricardian equivalence theorem – The reason for the offset • People anticipate that a larger deficit today will mean higher taxes in the future and adjust their spending accordingly Slide 13-28 Policy Example: The Direct Offset of Government Grants Some scientific and engineering research is conducted by private companies that receive government grants as part of their funding. To the extent that this research would be conducted anyway, even without the grant, then the public expenditure is simply replacing a private one. Slide 13-29 Possible Offsets to Fiscal Policy The supply-side effects of changes in taxes – Expansionary fiscal policy involving the reduction of marginal tax rates in order to: • increase productivity, since individuals will work harder and longer, save more, and invest more • increase productivity, which will lead to more economic growth Slide 13-30 Possible Offsets to Fiscal Policy Supply-Side Economics – Creating incentives for individuals and firms to work more or to increase productivity will shift the aggregate supply curve to the right. Slide 13-31 Possible Offsets to Fiscal Policy Question – Would a tax increase cause you to work more or less? Slide 13-32 Possible Offsets to Fiscal Policy Laffer Curve Tax rates and tax revenues rise together Tax revenues are at a maximum Tax rates and tax revenues fall together Figure 13-6 Slide 13-33 Discretionary Fiscal Policy in Practice Question – Is fiscal policy as precise as it appears? Slide 13-34 Discretionary Fiscal Policy in Practice Time lags – Recognition Time Lag • The time required to gather information about the current state of the economy Slide 13-35 Discretionary Fiscal Policy in Practice Time lags – Action Time Lag • The time required between recognizing an economic problem and putting policy into effect – Particularly long for fiscal policy Slide 13-36 Discretionary Fiscal Policy in Practice Time lags – Effect Time Lag • The time it takes for a fiscal policy to affect the economy Slide 13-37 Discretionary Fiscal Policy in Practice Fiscal policy time lags are long. A policy designed to correct a recession may not produce results until the economy is experiencing inflation. Fiscal policy time lags are variable in length (1–3 years). The timing of the desired effect cannot be predicted. Slide 13-38 Policy Example: An Unexpected Leak in the Stream of Tax Revenues Federal income taxes are collected based on the dollar amount of wages and salaries. As employees have accepted more of their compensation in the form of health benefits, this has dampened growth of the tax base. Slide 13-39 Automatic Stabilizers Automatic Stabilizers – Changes in government spending and taxation that occur automatically without deliberate action of Congress • Examples: – The tax system – Unemployment compensation – Welfare spending Slide 13-40 Automatic Stabilizers Government Transfers and Tax Revenues Unemployment compensation and welfare Tax revenues Budget surplus Budget deficit The automatic changes tend to drive the economy back toward its full-employment output level 0 Figure 13-7 Y2 Y1 Real GDP per Year ($ trillions) Slide 13-41 Automatic Stabilizers Government Transfers and Tax Revenues Unemployment compensation and welfare Tax revenues Budget surplus Budget deficit 0 Figure 13-7 Y2 Yf Y1 Real GDP per Year ($ trillions) Slide 13-42 What Do We Really Know About Fiscal Policy? Fiscal policy during normal times – Congress ends up doing too little too late to help in a minor recession. – Fiscal policy that generates repeated tax changes (as it has done) creates uncertainty. Slide 13-43 What Do We Really Know About Fiscal Policy? Fiscal policy during abnormal times – Fiscal policy can be effective • The Great Depression • Wartime Slide 13-44 What Do We Really Know About Fiscal Policy? The “soothing” effect of Keynesian fiscal policy – Assume • We know how to use fiscal policy to prevent another depression – Results • Stable expectations encourage a smoothing of investment spending Slide 13-45 Issues and Applications: U.S. Government Budget Projections Despite having agreed to certain terms of fiscal discipline, both France and Germany have allowed government spending to exceed tax receipts. Marginal tax rates were reduced in order to stimulate aggregate demand and to boost productivity. Because nether government reduced spending in the short term, both countries found that expenditures were exceeding tax receipts. This stimulative effect led to higher growth in real GDP and a reduction in unemployment. Slide 13-46 Summary Discussion of Learning Objectives The effects of discretionary fiscal policy using traditional Keynesian analysis – Increases in government spending and decreases in taxes increase aggregate demand. – Decreases in government spending and increases in taxes decrease aggregate demand. Slide 13-47 Summary Discussion of Learning Objectives How indirect crowding out and direct expenditure offsets reduce the effectiveness of fiscal policy – Deficits increase interest rates – Some government spending replaces private spending The Ricardian equivalence theorem states that government borrowing to finance deficits causes people in anticipation of higher interest rates to repay the loans. Slide 13-48 Summary Discussion of Learning Objectives Fiscal policy time lags and the effectiveness of fiscal “fine tuning” – The time lags for fiscal policy are the recognition time lag, action time lag, and the effect time lag. – The time lags are long and variable. Automatic stabilizers are changes in tax payments, unemployment compensation, and welfare payments that automatically change with the level of economic activity. Slide 13-49 End of Chapter 13 Fiscal Policy