Chapter 13 Corporate Text

advertisement

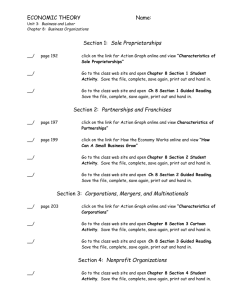

Chapter 13 Comparative Forms of Doing Business Corporations, Partnerships, Estates & Trusts Copyright ©2008 South-Western/Thomson Learning Choice of Form of Business Entity • Many factors affect the choice of business entity – Both tax and nontax – Understanding the comparative tax consequences related to the different types of entities is important for effective tax planning Corporations, Partnerships, Estates & Trusts C13 - 2 Principal Forms of Doing Business • • • • • Sole Proprietorship Partnership C corporation S corporation Limited liability company (LLC) Corporations, Partnerships, Estates & Trusts C13 - 3 Limited Liability Company (LLC) • Hybrid business form that combines the corporate characteristic of limited liability for owners with tax characteristics of a partnership Corporations, Partnerships, Estates & Trusts C13 - 4 Filing Requirements Sole Proprietorship • Files Schedule C, Form 1040 Partnership & LLC C Corporation S Corporation • Files Form 1120 • Files Form 1065 • Files Form 1120S Corporations, Partnerships, Estates & Trusts C13 - 5 Nontax Factors— Capital Formation Sole Proprietorship Partnership • Limited ability to raise capital • Can raise funds through pooling of owner resources • Ltd. p’ship can raise capital from investors C Corporation S Corporation • Greatest ease and potential for raising capital • Greatest ease and potential for raising capital, but limited number of investors Corporations, Partnerships, Estates & Trusts C13 - 6 Nontax Factors— Limited Liability Sole Proprietorship Partnership • Unlimited liability • General partners are jointly and severally liable • Ltd. partners’ liability is limited to investment C Corporation S Corporation • Generally have limited liability • Generally have limited liability Corporations, Partnerships, Estates & Trusts C13 - 7 Other Nontax Factors • Estimated life of business • Number of owners and their roles in management of the business • Freedom of choice in transferring ownership interests • Organizational formality and related costs Corporations, Partnerships, Estates & Trusts C13 - 8 Single vs. Double Taxation Sole Proprietorship Partnership and LLC • Single taxation • Single taxation C Corporation S Corporation • Double taxation • Generally, single taxation • May be subject to built-in gains tax and passive investment income tax Corporations, Partnerships, Estates & Trusts C13 - 9 Alternative Minimum Tax Sole Proprietorship Partnership and LLC • Directly subject to AMT • Indirectly subject to AMT • AMT adjustments & preferences flow through and partners subject to AMT C Corporation S Corporation • Directly subject to AMT • Indirectly subject to AMT • May have advantage here • AMT adjustments & since corp AMT rate is preferences flow through and only 20% S/H’s subject to AMT Corporations, Partnerships, Estates & Trusts C13 - 10 Controlling the Entity Tax • Various techniques can be used to control the tax liability, whether imposed on the entity or owners, such as: – – – – Distribution policy Utilization of special allocations Fringe benefits Minimizing double taxation Corporations, Partnerships, Estates & Trusts C13 - 11 Fringe Benefits (slide 1 of 2) • Generally produce the following tax consequences: – Deductible by entity (employer) providing the fringe benefit – Excludible from gross income of taxpayer (employee) who receives the fringe benefit Corporations, Partnerships, Estates & Trusts C13 - 12 Fringe Benefits (slide 2 of 2) • Favorable tax treatment of fringe benefits is available only to employees – For owner of entity to be an employee, the entity must be a corporation • Partners in a partnership are not employees • Greater-than-2% shareholders in an S corp are treated as partners – If not an employee • Deduction of cost of fringe benefit is disallowed • Owner must include cost of fringe benefit in gross income Corporations, Partnerships, Estates & Trusts C13 - 13 Minimizing Double Taxation of C Corporations (slide 1 of 5) • Several techniques are available for reducing the double taxation of C corps including: – Making distributions to shareholders that are deductible by corp – Retaining earnings at corp level – Making distributions treated as a return of capital – Making the S corp election Corporations, Partnerships, Estates & Trusts C13 - 14 Minimizing Double Taxation of C Corporations (slide 2 of 5) • Deductible distributions include: – Salary payments to shareholder-employees – Rental payments to shareholder-lessors – Interest payments to shareholder-creditors • IRS scrutinizes these types of transactions – Must be reasonable Corporations, Partnerships, Estates & Trusts C13 - 15 Minimizing Double Taxation of C Corporations (slide 3 of 5) • Retain earnings at corporate level – Double tax is avoided unless corp makes distributions (actual or deemed) to shareholders • Must watch out for accumulated earnings tax problems – For distributions made in 2003 and thereafter the 15%/5% rate for qualified dividends reduces the potential negative impact of double taxation Corporations, Partnerships, Estates & Trusts C13 - 16 Minimizing Double Taxation of C Corporations (slide 4 of 5) • Make return of capital distributions – For ongoing businesses, redemption provisions may help reduce gross income at the shareholder level – Corporate liquidation provisions can be used if business will cease to operate in corporate form Corporations, Partnerships, Estates & Trusts C13 - 17 Minimizing Double Taxation of C Corporations (slide 5 of 5) • Electing S corp status – Generally eliminates double taxation but other factors must be considered such as: • Will all shareholders consent to election? • Can qualification requirements be met currently and on an ongoing basis? • Are conditions favorable to an S corp election and how long will those conditions be favorable • Distribution policy may cause problems paying tax at shareholder level Corporations, Partnerships, Estates & Trusts C13 - 18 Entity Formation (slide 1 of 2) • Generally, owners make contributions of cash and property to entity in exchange for an ownership interest – Generally, tax-free to both the entity and the owner • In corporate setting, requirements of §351 must be met – Owners and entities take a carryover basis in their ownership interest and in assets contributed, respectively Corporations, Partnerships, Estates & Trusts C13 - 19 Entity Formation (slide 2 of 2) • If FMV of property contributed > adjusted basis, may want to make special allocation – Required in partnerships – Not available for C corps or S corps Corporations, Partnerships, Estates & Trusts C13 - 20 Basis Considerations Sole Proprietorship Partnership and LLC • N/A • Profits & losses affect partner’s basis • Partner’s basis is increased by share of p’ship liabilities C Corporation S Corporation • Shareholder’s basis is not affected by corporate profits & losses • Shareholder’s basis is increased by profits, decreased by losses, not affected by corporate liabilities Corporations, Partnerships, Estates & Trusts C13 - 21 Distributions • Distributions can be made to partners, LLC owners, or S corp. shareholders tax-free – The same distribution would produce dividend income treatment for C corp. shareholders • If appreciated property is distributed to S corp. shareholders, realized gain is recognized at the corporate level (same treatment as a C corp.) – This corporate-level gain is passed-through to the S corp. shareholders Corporations, Partnerships, Estates & Trusts C13 - 22 Passive Activity Losses (slide 1 of 2) • Loss limits apply to owners of partnerships, LLCs, and S corps – Passive losses are separately stated items that flow through to owners – Passive loss rules apply at the owner level Corporations, Partnerships, Estates & Trusts C13 - 23 Passive Activity Losses (slide 2 of 2) • For corporations, only apply if a closely held corp or a personal service corp – Closely held corp—more than 50% of value of stock at any time during last half of year is owned by 5 or less individuals • Passive losses can offset active income but not portfolio income – Personal service corp—principal activity is performance of personal services by owner-employees who own more than 10% in value of corp’s stock • General passive loss rules apply Corporations, Partnerships, Estates & Trusts C13 - 24 At-Risk Rules • At-risk rules apply to: – – – – Partnerships LLCs S corps Closely held C corps • May be more troublesome for partnerships and LLCs since liabilities are included in partner’s basis in partnership interest Corporations, Partnerships, Estates & Trusts C13 - 25 Special Allocations • Partnership and LLCs have many opportunities to use special allocations – Not generally available in C corps and S corps • May be able to achieve the same results using payments to owners for services, rents and interest Corporations, Partnerships, Estates & Trusts C13 - 26 Disposition of a Business or an Ownership Interest • Disposing of a business may be viewed as either: – A sale of an ownership interest, or – A sale of assets • Tax consequences are, in general, more favorable for a sale of an ownership interest Corporations, Partnerships, Estates & Trusts C13 - 27 Sale of Assets by Entity —Seller’s Issues (slide 1 of 3) • Sole Proprietorship – Treated as a sale of separate assets – Gain or loss is calculated for each asset • Character of income or loss depends on nature of asset Corporations, Partnerships, Estates & Trusts C13 - 28 Sale of Assets by Entity —Seller’s Issues (slide 2 of 3) • Partnership, LLC, or S Corp—Same as proprietorship – Gain/loss flows through to shareholders or partners • They report & pay tax on gain or loss • Distribution of cash proceeds does not cause double tax since basis is adjusted by gain/loss Corporations, Partnerships, Estates & Trusts C13 - 29 Sale of Assets by Entity —Seller’s Issues (slide 3 of 3) • C Corp—double taxation occurs – Gain is determined for each asset and tax paid by corporation – Net cash is distributed • Taxed as dividend, return of capital or capital gain to shareholder Corporations, Partnerships, Estates & Trusts C13 - 30 Liquidating Distribution of Assets to Owner Followed by Owner’s Sale to Third Party (slide 1 of 3) • Partnership – Distribution rules determine partner’s basis in assets received from partnership – Partner has gain if cash received > basis – Partner has loss if cash, inventory and unrealized receivables are only assets rec’d and are < basis – Character of gain on asset sale depends on nature of assets received by partner – No double tax Corporations, Partnerships, Estates & Trusts C13 - 31 Liquidating Distribution of Assets to Owner Followed by Owner’s Sale to Third Party (slide 2 of 3) • S Corp – S Corp has gain if appreciated assets distributed to shareholders – No corporate level tax unless “built-in gain” – Shareholder has gain (tax) on receipt of assets > basis (after basis increase for gain) – Shareholder’s basis in assets = FMV, so no gain on later sale of assets Corporations, Partnerships, Estates & Trusts C13 - 32 Liquidating Distribution of Assets to Owner Followed by Owner’s Sale to Third Party (slide 3 of 3) • C Corp – Double tax – Gain on distribution and tax at entity level – Net (after tax) assets distributed at FMV & result in gain to shareholder Corporations, Partnerships, Estates & Trusts C13 - 33 Purchase of Business Assets— Buyer’s Issues (slide 1 of 2) • The purchaser of individual assets is not generally affected by the type of entity through which the seller operates: – The buyer (whether individual, partnership, LLC, C corp or S corp) allocates the total amount paid to the individual assets acquired – Part of the cost may be allocated to intangible assets such as goodwill Corporations, Partnerships, Estates & Trusts C13 - 34 Purchase of Business Assets— Buyer’s Issues (slide 2 of 2) • Asset cost is recovered through depreciation, amortization, sale of inventory, collection of accounts receivable, etc... • The buyer can contribute the assets to a partnership or C corp under §721 or §351 – If the C corp is qualified, an S corp election can be made Corporations, Partnerships, Estates & Trusts C13 - 35 Sale of Business Interest— Seller’s Issues (slide 1 of 3) • Sole Proprietorship – No distinction between sale of interest or assets • Partnership – Sale of partnership interest results in ordinary income to partner for share of partnership’s ordinary income assets; capital gain for remainder Corporations, Partnerships, Estates & Trusts C13 - 36 Sale of Business Interest— Seller’s Issues (slide 2 of 3) • S Corp – Sale treated as sale of stock • Results in capital gain or loss to shareholder – In general, no corporate-level consequences • However, if purchaser is not qualified shareholder, S election is automatically terminated Corporations, Partnerships, Estates & Trusts C13 - 37 Sale of Business Interest— Seller’s Issues (slide 3 of 3) • C Corp – Sale treated as sale of stock • Results in capital gain or loss to shareholder – No corporate level consequences Corporations, Partnerships, Estates & Trusts C13 - 38 Purchase of Business Interest— Buyer’s Issues (slide 1 of 3) • If the purchaser acquires an interest in one of these types of entities, he or she is treated as follows: • Sole Proprietorship – Purchaser is deemed to buy assets • Purchase price is allocated to assets • Assets are depreciated, amortized, etc... Corporations, Partnerships, Estates & Trusts C13 - 39 Purchase of Business Interest— Buyer’s Issues (slide 2 of 3) • Partnership – Purchaser buys partnership interest – Purchaser may ask partnership to make §754 election to step up inside basis in assets Corporations, Partnerships, Estates & Trusts C13 - 40 Purchase of Business Interest— Buyer’s Issues (slide 3 of 3) • S Corp or C Corp – Purchaser buys stock – There is no effect on underlying assets owned by the entity Corporations, Partnerships, Estates & Trusts C13 - 41 Tax Attributes of Different Business Forms (slide 1 of 19) Maximum # Owners Max Tax Rate Sole Prop. Partnership (or LLC) One individual At least two 35% 35% Owner Partner S Corp. Max = 100 Individuals, estates, some trusts only 35% Shareholder (Corp. may have built-in gains or PII tax) Corporations, Partnerships, Estates & Trusts Tax Paid By . C13 - 42 Tax Attributes of Different Business Forms (slide 2 of 19) Maximum # Owners C Corp No max limit (some States require at least two owners) Max Tax Rate 35% corporate level plus 15% max. on qualifying distributions Corporations, Partnerships, Estates & Trusts Tax Paid By . Corporation pays first, then owner pays if distribution C13 - 43 Tax Attributes of Different Business Forms (slide 3 of 19) Tax Year Allowed Timing of Taxation Sole Prop. Owner’s yr. Owner’s yr. end Partnership LLC Majority or End of p/ship Principal tax year Ptrs or “least aggregate deferral” year Corporations, Partnerships, Estates & Trusts Income Allocation . N/A (1 owner) Profit/loss sharing ratio Some special allocations OK C13 - 44 Tax Attributes of Different Business Forms (slide 4 of 19) S Corp. Tax Year Allowed Timing of Taxation Income Allocation Calendar year or business purpose End of Corp tax year Per share, per day C Corp. No restrictions (generally) Corp reports at N/A end of tax yr; Shareholder reports dividends received Corporations, Partnerships, Estates & Trusts C13 - 45 Tax Attributes of Different Business Forms (slide 5 of 19) Contribution of Property to Entity Character of Income Taxed to Owners . Sole Prop. Not taxable Retains source characteristics Partnership Generally not taxable Conduit-retains source characteristics Corporations, Partnerships, Estates & Trusts C13 - 46 Tax Attributes of Different Business Forms (slide 6 of 19) Contribution of Property to Entity Character of Income Taxed to Owners . S Corp. Taxable unless meets §351 Conduit-retains source characteristics C Corp. Taxable unless meets §351 All source characteristics lost when income distributed to owners Corporations, Partnerships, Estates & Trusts C13 - 47 Tax Attributes of Different Business Forms (slide 7 of 19) Loss Allocation to Owners Limitation on Loss Deductible by Owners Sole Prop. Not applicable Amount invested plus liabilities of business Partnership Profit and loss sharing ratios Ptr’s investment plus share of partnership liabilities Corporations, Partnerships, Estates & Trusts C13 - 48 Tax Attributes of Different Business Forms (slide 8 of 19) S Corp. C Corp. Loss Allocation to Owners Limitation on Loss Deductible by Owners Per share/ per day S/holder’s investment plus loans from s/holder to corporation Not applicable Corporations, Partnerships, Estates & Trusts Not applicable C13 - 49 Tax Attributes of Different Business Forms (slide 9 of 19) Sole Prop., Partnership and S Corp. At-risk Rules Applicable? Passive Loss Rules Applicable? . Yes, at the owner, partner or shareholder level. Indefinite carryover of unused losses Yes, at the owner, partner or shareholder level. Indefinite carryover of unused losses Corporations, Partnerships, Estates & Trusts C13 - 50 Tax Attributes of Different Business Forms (slide 10 of 19) At- risk Rules Applicable? C Corp. Yes, for closely held corporations. Indefinite carryover of unused losses. Corporations, Partnerships, Estates & Trusts Passive Loss Rules Applicable? . Yes, for closely held and personal service corporations. Indefinite carryover of unused losses. C13 - 51 Tax Attributes of Different Business Forms (slide 11 of 19) Capital Gains Capital Losses . Sole Prop. Owner level 5/15% tax Up to $3,000 against ord. income. Indefinite carryover of excess. Partnership and S Corp. Conduit-owners report shares same as Sole Prop. Conduit-owners report shares same as Sole Prop. C Corp. Taxed at Corporate level up to 35 %. Carried back 3 yrs, forward 5. Can only offset capital gains. Corporations, Partnerships, Estates & Trusts C13 - 52 Tax Attributes of Different Business Forms (slide 12 of 19) Consequence of Earnings Retained by Owners Treatment of Nonliquidating Distributions . Sole Prop. Taxed when earned; increases investment Not taxable in S.P. Partnership Same as S.P. Not taxable unless cash or liability relief > Ptrs. basis Corporations, Partnerships, Estates & Trusts C13 - 53 Tax Attributes of Different Business Forms (slide 13 of 19) Consequence Of Earnings Retained by Owners Treatment of Nonliquidating Distributions . S Corp. Same as S.P. Generally not taxable unless distribution > AAA or stock basis. May be dividend if E & P from Sub C year. C Corp. Taxed to corp. as earned. Possible AE Tax. Taxed in yr received up to AE & P or if > stock basis. Corporations, Partnerships, Estates & Trusts C13 - 54 Tax Attributes of Different Business Forms (slide 14 of 19) Sole Prop. Partnership Sale of Ownership Interest . Treated as a sale of each asset. Gain character depends on asset nature. Treated as sale of underlying ordinary income assets. Remainder treated as sale of partnership interest (capital gain). Corporations, Partnerships, Estates & Trusts C13 - 55 Tax Attributes of Different Business Forms (slide 15 of 19) Sale of Ownership Interest S Corporation or C Corp. . Treated as sale of corporate stock (capital gain). Loss may be ordinary if §1244 applies, otherwise capital. Corporations, Partnerships, Estates & Trusts C13 - 56 Tax Attributes of Different Business Forms (slide 16 of 19) Fringe Benefits §1244 Built-in Avail. to Owners? Available?Gains effect? Sole Prop. No No N/A P’ship No No N/A S Corp. Some if < 2% owner Yes Possible corp. level tax C Corp. Available Limited by anti-discrim.rules Yes No effect Corporations, Partnerships, Estates & Trusts C13 - 57 Tax Attributes of Different Business Forms (slide 17 of 19) §1231 Gains and Losses Foreign Tax Credits . Sole Prop. Taxable or deductible by owner. 5 yr. lookback rule. Owner level Partnerships and S Corps Conduit—same as S.Prop. Conduit—same as S.Prop. C Corp. Taxable/deductible at corp. level 5 yr. Corporate level lookback rule Available Corporations, Partnerships, Estates & Trusts C13 - 58 Tax Attributes of Different Business Forms (slide 18 of 19) Sole Prop. Alternative Min. Tax Applies at owner level (26% or 28%) Partnership Applies at or S Corp. ptr or shareholder level Tax ACE Preference Adjustment Items . N/A Determined at owner level N/A Corporations, Partnerships, Estates & Trusts Conduit—entity preferences (26% or 28%) pass thru to owners for their AMT calc. C13 - 59 Tax Attributes of Different Business Forms (slide 19 of 19) Alternative Min. Tax C Corp. ACE Adjustment Applies at Corp. 75% x (ACE level (20%) -AMTI) is added to AMTI (or subtracted) Corporations, Partnerships, Estates & Trusts Tax Preference Items . Subject to AMT at corporate level C13 - 60