introduction to state bank of india evolution of sbi

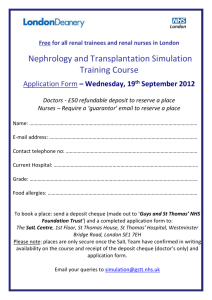

advertisement

INTRODUCTION TO STATE BANK OF INDIA EVOLUTION OF SBI Born as Bank of Calcutta (2 June 1806). Renamed Bank of Bengal (2 January 1809). Bank of Bombay (15 April 1840). Bank of Madras (1 July 1843). All three were called Presidency Banks. Amalgamated as Imperial Bank of India on 27 January 1921. Nationalized in 1955 and named State Bank of India (1st July 1955), with RBI taking 60% stake In 2008, Government of India took over the Stake of 60 % from RBI Brief History of SBI A 206 year old organisation with a network of 18000+ branches (SBI 14000+) and 27,000+ ATMs in the State Bank Group One of the largest Foreign Offices networks with 173 offices in 34 countries across all time zones Largest Core Banking network of its kind anywhere in the world Financial conglomerate providing ‘Universal Banking’ services within the State Bank Group BIRTH OF STATE BANK OF INDIA ST AS AT 31 MARCH 2012 No. of Branches 14,286 An Act was passed in Parliament in May 1955 and the State Bank of India was constituted on 1 July 1955. State Bank of India (Subsidiary Banks) Act was passed in 1959, enabling the State Bank of India to take over eight former State-associated banks as its subsidiaries (later named Associates). State Bank of India was thus born with a new sense of social purpose with 480 offices, 3 Local Head Offices and a Central Office. No. of Foreign Offices 173 In 34 Countries No. of Branches on CBS All Branches No. of employees 2,15,481 No. of ATMs (SB Group) 27,286 The Bank handles almost the entire gamut of financial services. It is a financial supermarket. The Bank extends banking services to: Corporate Sector SMEs Rural sector, especially Agriculture and allied activities Retail sector, i,e., Personal Segment The Bank has designed both Deposits as well as Advances products for specific segments as per their requirements. The loans range from Rs.100/- to say, Rs. 10,000 crores. SBI commands approximately 20% of the market share ASSOCIATE BANKS State Bank of India has the following 5 Associate Banks (ABs) with controlling interest ranging from 75% to 100%: State Bank of Bikaner and Jaipur (SBBJ) State Bank of Hyderabad (SBH) State Bank of Mysore (SBM) State Bank of Patiala (SBP) State Bank of Travancore (SBT) The 5 ABs have a combined network of 4000 + branches in India, which are fully computerized and also on CBS. The ABs have large number ATMs which are networked with SBI ATMs, providing value added services to clientele. FOREIGN BANKING SUBSIDIARIES State Bank of India has the following Foreign Banking Subsidiaries: State Bank of India (Canada) SBI International (Mauritius) Ltd. State Bank of India (California) Nepal SBI Bank Ltd. Commercial Bank of India LLC, Moscow PT Bank SBI Indonesia NON-BANKING SUBSIDIARIES / JOINT VENTURES State Bank of India has the following Non-Banking Subsidiaries : SBI Capital Markets Ltd. (SBICAP) SBI Funds Management Pvt. Ltd. (SBIFMPL) SBI DFHI Ltd. SBI Cards & Payment Services Pvt. Ltd. (SBICSPL) SBI Life Insurance Company Ltd. (SBILIFE) SBI Global Factors Ltd SBI Mutual Funds Trustee Company Pvt. Ltd. SBI Pension Fund Pvt Ltd SBI SG Global Securities Services Pvt Ltd SBI General Insurance Company Ltd SBI Payment Services Pvt Ltd OTHERS In addition to these, there are other Subsidiaries / Jointly Ventures such as: GE Capital Business Process Management Services Pvt Ltd C-Edge Technologies Ltd Macquarie SBI Infrastructure Management Pte Ltd SBI Macquarie Infrastructure Management Pvt Ltd SBI Macquarie Infrastructure Trustees Pvt Ltd Oman India Joint Investment Fund Management Co Pvt Ltd Oman India Joint Investment Fund- Trustee Co Pvt Ltd All these together constitute this mammoth organisation the “STATE BANK”. Awards & Recognitions in 2012 “Best Domestic Provider of Forex Services” (Asia Money Polls in 2012) “ Best Trade Finance Bank in India” for 2012 by The Asian Banker “Golden Peacock” Award in 2012 for Corporate Social Responsibility “Only Indian Bank in Global Fortune 500 list” ranked 285 in 2012 Ranked 29th in the Forbes Top 200 World’s most reputable companies in 2012 RESERVE BANK OF INDIA (RBI) RBI Regulates and Supervises the financial system in India Established on April 1, 1935, in accordance with RBI Act 1934 Fully owned by Government of India ROLE OF RBI Formulates, implements and monitors the monetary policy, for maintaining price stability and ensuring adequate flow of credit to productive sectors Regulator and Supervisor of the Financial System under the guidance of Board of Financial Supervision Manages the Foreign Exchange Issues and Exchanges or destroys currency and coins not fit for circulation Developmental Role- Performs a wide range of promotional functions to support national objectives Banker to the Government- performs merchant banking function for the central and state governments Banker to banks- maintains banking accounts of all scheduled banks BANKING REGULATION ACT, 1949 Enacted to safeguard the interest of the depositors, control abuse of powers by some bank personnel controlling the banks and to the interest of the economy in general Deals with banking companies and corporations mainly as a regulatory role ROLE OF BANKING REGULATION ACT The Act provides the following controls Minimum Paid up Capital Classification of Companies into Banking and Non Banking Companies Licensing of Banking Companies Restriction on branch banking Maintenance of Cash Reserves Maintenance of Assets in India Inspection of Banking Companies Schemes for Arrangement and Amalgamation etc TRANSACTIONS There are three types of transactions Cash: Where receipt / payment of physical cash is involved Transfer: Where funds are transferred from one account to another account. Clearing: Transfer transactions where funds are exchanged with other banks through clearing ACCOUNTING OF CASH TRANSACTION Concept of double entry book-keeping is followed in banks for accounting of transactions. Thus every transaction has two legs: Debit and Credit When a customer remits cash to his account, Cash balance account is debited and customer account (SBA/c, Current A/c etc) is credited. E.g., Dr Cash balance A/c Rs.1000,Cr SB A/c Rs.1000 When the customer withdraws cash, customer account is debited and cash balance account is credited. Eg.,Dr SB A/c Rs.500, Cr Cash balance A/c Rs.500 * CBS ADOPTED SINGLE ENTRY BOOK KEEPING In case of Transfer transactions the source account is debited and destination account is credited. Eg: When A issues a cheque for Rs. 5000/- to B The accounting entry is Dr The account of A Rs.5000/Cr The account of B Rs.5000/- TRANSFER BATCH A transfer Transaction may contain One debit and One credit One debit and multiple credits Multiple credits and one debit Multiple debits and multiple credits These are called transfer batches. In every batch the total amount of debit has to tally with total amount of credit. Example.: A customer wants to take a draft for Rs. 1000/-. The exchange ( service fee) for the draft is say Rs. 30/- He tenders a cheque for Rs. 1030/- along with draft Application. The accounting entry will be Dr Customer A/c Cr. Drafts Issued Cr. Exchange A/c Rs. 1030/Rs. 1000/Rs. 30/- POSTING OF TRANSACTIONS Customers normally approach the front office “Single Window Counter” where various services (receipt and payment of cash, pass book updating, draft issue remittances etc) are offered. The Single Window Operator ( a clerical staff )puts through the transaction Duly prepared Vouchers showing Branch Name, Date, Account No, Name of Account, Amount in figures & words, details of notes/instruments, signature of the tenderer etc are the basis of transactions. Cheques / Drafts payable at the branch are also vouchers for debit transactions VOUCHER A voucher should speak about the transaction in its entirity . A debit voucher should contain the name of the a/c holder in respect of customer transaction or BGL account name in respect of office transaction, a/c no on which debit is raised, amount to be be debited ,brief details of the transaction and overleaf the credit a/c no has to be written. Similarly a credit voucher should also contain all essential particulars. In transfer transactions the total amount of debit has to tally with total amount of credit. POSTING OF TRANSACTIONS Transactions put through by various tellers (Users- YOU) are accepted by the system within their passing power if otherwise in order. When it is beyond the respective passing power, it is referred to a user with higher passing power (A Case Manager/ Service Manager/ Accountant/ Any officer) by generating a queue. When the queue is authorised, the transaction is registered in the system, with corresponding debit / credit entries in the respective accounts with journal number While posting the vouchers in CBS preliminary scrutiny of the voucher should be done as like the name, signature, date ,amount in words and amount in figures, type of the instrument etc., with due diligence in order to avoid any kind of fraud. Verification of signature is mandatory (Press F10 in CBS ) Receipt of Instruments Across the counter The signature of the drawer should be verified. Cross check the Name of the payee on the instrument with Pay-in-slip Check for Date of the instrument to avoid paying of stale instruments Amount in figures and amount in words should be the same.(* otherwise the amount in words should be paid as per sec 18 of NI act) In case of receipt of cash across the counter due care should be taken in handling the voucher. Proper scrutiny should be done so as to ensure the Name, Account no, Signature, Amount in figures and amount in words are in support of the details and denomination that have been mentioned in the voucher. It is important to press F7 in CBS which shows the short name of the customer to ensure that the account no and name are correct and also the amount is going into the corresponding account. In case of payment, proper care should be taken in ensuring the basic details that are required as per NI act, 1881 and see that the payment is made in good faith to the absolute person. In case of transfer, the name of the payee or the last endorsee should tally with the pay in slip. The teller should brand a crossing stamp immediately on the face of the instrument to avoid conversion . The teller can receive or pay only if it is within his passing power. If the transaction is beyond the passing power ,the teller routes the transaction to the Case Manager/Accountant for authorization by giving a queue by branding the partition stamp and mentioning the queue number. After the transaction is done, the teller/ user should brand a partition stamp on the voucher by mentioning journal number. NOTES In Core banking environment Capability level, Transaction group, User type are three types of menus, which help in assigning proper menus and rights to various users. Capability Level : It is a numeral from 0 to 9.It is similar to the passing powers. Transaction Group : Numerals like 2,3,20 etc available to the user ( Cashier,Teller ) Teller : In the Core banking environment all the users are referred to as tellers. PASSING POWERS Passing Power of various users/tellers depends on their capability level in CBS. Grade Enquirer Assistants(sub staff Promotees) Capability level 0 Nil Nil 1 15000 20000 Cash Transfer Assistants(Newly Recruited) 2 Senior Asstt. Special Asstt. Senior Spl Assts/A M (JMGS1) Field Officer Dy. Mgr(Acctts.) (MMGS2) Manager of Division 8 Any amount Branch Manager 9 Any amount 3 50,000 4 5 6 25000 1,00,000 1,00,000 2,00,000 20000 4,00,000 5,00,000 Any amount 7 Any amount Case Manager will either be a Special Assistant or an Asst. Manager. Only BM is empowered to pass debits in Profit and loss accounts. User Type : A numeral is assigned to an user ( Officer/ Staff ) with specific role, for instance in a branch, Branch Manager --User Type : 45 Cash Officer --User Type : 60 Accountant --User Type : 50. Generally, there will be only one person with User type 50 and 60 in any branch and the rest of the users are given types 1 & 40 in any branch. INPUT FORMS What ever data is keyed in to the system, whether it is financial or non financial it should be supported by an input form. This is a mandatory requirement. Input forms include Pay-in slips, withdrawal forms, cheques, Account opening forms, cheque book requisition slips, request originating from the customer in the form of a letter etc. DROP BOX Drop box is an initiative sought to eliminate customer waiting and also free up branch staff without materially compromising on the security of the instruments dropped in the drop box. Free up the time of staff in receiving and acknowledging the instruments It has three slits for out station collection, clearing and on branch instruments. Slits are colour coded for easy identification. Drop box shall be kept close to the entrance at a prominent and secure place allowing 24*7 access. Despite persuasion if a customer insists on counter foil, it may be issued by the authorised official.The instrument should be kept in the drop box to boost up the confidence of the customer in his presence CLEARING Bank’s function also involves transfer of funds from one place to another. There will be a continual stream of cheques drawn on each of the other banks. Exchange of such cheques takes place in the clearing house. Clearing is an arrangement through which a bank exchanges cheques drawn on other banks for those drawn on it. RBI or SBI or its Associate Bank or in the absence of either one of the public sector banks in that centre shall be manging the clearing house. The manager of the Bank shall be the ex-offficio president of the clearing house. CHEQUE TRUNCATION Cheque truncation is one of the ways to compress the clearing cycle to enable faster clearances of local and inter city cheques by stopping the physical movement of cheques at the point where the image of the cheque is captured carrying out further processing with electronic records of their content. Cheque truncation would be based on the Electronic image. . Cheques should be truncated at the Presenting bank itself with option for truncating at individual branches or at the service branch. The preservation period should be 1 year for the paper instruments and 8 years for the electronic image of the instruments MICR CLEARING To enable fast sorting of the large volume of clearing MICR cheques were introduced. Coding cheques with Magnetic Ink Character Recognition (MICR) codes enables speedy sorting using machines. MICR code consists of 9 digit numeric character denoting The centre The bank And the branch on which the cheque is drawn Eg., In MICR Code 682002003 682 is the first three digits of the pin code of the centre 002 is the code of the bank 003 is the local serial number of the branch CENTRALISED CLG PROCESSING CENTRE As a part of the Business Process Re-engineering (BPR) , CCPCs are set up in major centre to centralize the clearing work. Inward cheques are debited to the accounts online from CCPC. Reduces the need for the physical movement of cheques. Speeds up the clearing process. Reduces the workload at the branches enabling the branch officials to concentrate more on the marketing aspect and cross selling. Will effectively change the status of the customers at branches from Branch Customers to Bank Customers. Covers all segments Per, SME, C&I and Agri HOME BRANCH – The branch where the customer maintains his accounts NON-HOME BRANCH – All branches other than the Home branch are called Non Home Branches INTER CORE BR.TRANSACTIONS – Transactions between One or more CBS branches Transfer of funds from Home branch or other CBS branch by debit to the customer’s a/c for credit of own a/c or to third party a/c held at another CBS branch Deposit of cash at Non Home branch for credit to for credit to own a/c held at any CBS branch upto a ceiling of Rs25000/ NO CEILING ON AMOUNTS FOR CREDITS TO OWN ACCOUNT AT HOME CENTRE AND NO CHARGES FOR SUCH CREDITS. CUSTOMERS CAN OPERATE THEIR HOME BRANCH A/C FROM ANY OTHER NON HOME BRANCH FOR PURCHASE OF DDs, &BCs PER Segment Deposit Products Deposits Demand Current Savings Time Term Recurring Product Types at a glance 1. Savings Account 2. Current Account 3. Term Deposit Account 4. Recurring Deposit Account Savings Account – Features 1. Meant basically for inculcating the savings habit or thrift in persons 2. Not to be used for commercial or business purpose 3. Interest paid on the account balance, paid Half Yearly & calculated on daily basis. 4. Bank may close an account should it have any reason to believe that the account holder has used her/ his account for a purpose for which it is not allowed Savings Account – Who can open? Personal Accounts 1. Single person in his or her name 2. Two persons in joint names payable to i. Either or Survivor ii. Both Jointly iii. Both or Survivor iv. Former or Survivor v. Later or Survivor 3. By more than two persons in joint names payable to i. All of them or the survivors or the last survivor ii. Any one or more of them or survivors or the last survivor iii. A particular person during his/her lifetime or survivors jointly or the last survivor 4. Minor - operated by i. Singly ii. Jointly with Guardian iii. Guardian on behalf of minor 5. Illiterate Persons 6. Blind Persons 7. Sick & Old Persons 8. Physically handicapped / Incapacitated Persons Non-Personal Accounts 9. Trusts, Associations, Clubs, Societies 10. Regimental Funds, Military Units 11. Schools, Colleges 12. Primary Co-operative Credit Society financed by a bank 13. Khadi & Village Industries Board 14. Agricultural Produce Market Committee 15. DWACRA & other SHG groups 16. Farmers’ Clubs, Vikas Volunteer Vahini 17. Institutions exempt from payment of income tax under IT Act, 1961. Savings Account – Operations Facilities provided 1. Cheque Book (on request) 2. ATM-Debit Card 3. Internet Banking 4. Mobile Banking 5. Nomination Savings Account – Operations – Deposits 1. Minimum Cash deposit Rs.10/2. Cheques, drafts, dividend warrants drawn on the name of the account holder can be deposited into the account 3. Deposit of third party instruments endorsed in favor of account holder not allowed Savings Account – Operations – Withdrawals 1. Minimum Cash withdrawal Rs.50/- and in round rupees only. 2. Withdrawal form can be used only the account holder for receiving payments. 3. Passbook should always accompany a withdrawal form. 4. Cheques issued only for the specified account can be used. 5. Cheques must be written legibly and any alterations to be authenticated with full signature. 6. Signature on withdrawal form, cheque or any other communication with bank to match with specimen signature on record with bank. 7. Care to be taken in case of 1. Dormant Accounts: Accounts without withdrawals for 12 months. 2. Inoperative Accounts: Accounts without any customer transactions (deposit or withdrawal) for the past 24 months. 3. Accounts of Minor, Illiterate, Blind & Incapacitated persons 8. Passbook provided for evidencing record of transactions. 9. First 25 cheque leaves issued free of cost. Additional at per cheque leaf cost as per service rules. 10. The maximum number of debit entries permitted in each account is 30 per half year or as decided from time to time. Debits counted – All debits excluding State Bank ATM withdrawals, Internet & Mobile Banking Debits and service charges. Savings Account – Closure 1. Letter addressed to the Manager Operations/Branch Manager for closure of accounts signed by all the account holders. 2. Unused cheque leaves to be returned to bank (to be destroyed by bank and mentioned on the request for closure) 3. ATM-Debit Card to be returned to bank (to be destroyed by bank and mentioned on the request for closure) 4. Passbook to be returned to bank. (Bank official can update the passbook and physically cancel the passbook as closed and return to the account holder) Savings Deposit – Product Variants • No Frills Account • Small Deposit Accounts • Normal Savings Account • Savings Plus • Premium Savings Account • Yuva SB Account • Minor Account • Salary Package Savings Account (Bundled) • Savings Account for Non Residents (NRE/NRO) Savings Deposit – No Frills Accounts Purpose In order to enable the common man to open/ maintain bank accounts at a nominal cost. Eligibility Individuals of 18 years and above, earning a gross income of Rs.5,000/-p.m or less as per self-declaration Mode of operation The accounts can be operated singly, jointly or with 'either or survivor' or 'former or survivor' or 'anyone or survivor' facility Initial Deposit : Rs. 50/Minimum Balance : Nil Maximum Balance : If the value of business connection with a 'no-frills' account holder, including other liability products like Recurring Deposit or Term Deposit, exceeds Rs.10,000/- , the account will cease to be a basic banking account. The account will then be treated as a normal Savings Bank account, governed by the terms and conditions applicable to such accounts. With ATM Facility No INB Facility Savings Deposit – Small Deposit Account ‘Small Account’ means a savings account in a banking company where – i) The aggregate of all credits in a financial year does not exceed rupees one lakh; ii) The aggregate of all withdrawals and transfers in a month does not exceed rupees ten thousand; iii) The balance at any point of time does not exceed rupees fifty thousand. While opening accounts as described above, the customer should be made aware that if at any point of time, the balances in all his/her accounts with the bank (taken together) exceeds Rupees Fifty Thousand (Rs. 50,000/-) or total credit in the account exceeds Rupees One Lakh (Rs. 1,00,000/-) in a year, no further transactions will be permitted until the full KYC procedure is completed. In order not to inconvenience the customer, the bank must notify the customer when the balance reaches Rupees Forty Thousand (Rs. 40,000/-) or the total credit in a year reaches Rupees Eighty thousand (Rs. 80,000/-) that appropriate documents for conducting the KYC must be submitted otherwise operations in the account will be stopped. Savings Deposit – Savings Plus Benefits: • Gives the Option to the customer to PUSH the balance to higher interest earning deposit and PULL back at his convenience/requirement. • Works on FIFO or LIFO as per the choice of the customer • Unitised Break up Facility • Minimum Deposit Amount : Rs. 5,000/- • Threshold Limit : Minimum Rs. 5,000/- • Period of Deposit : 1 Year to 5 Years • Automatic Roll Over on Maturity Savings Deposit – YUVA To entice the Youth Segment and bring them in our fold. A new product ’Yuva S.B. Account’, where a bundle of value propositions and services are offered. The product, if popularized and encouraged among the target group will mobilize more CASA deposits, augment use of alternate channel products. With higher disposable income they are likely to branch out into demat services, mutual funds and insurance products. Corporate Salary Package - USP Current Account – Features 1. Can be opened by individual or cor 2. No Interest is paid on the account balanceporate bodies for their business/commercial purpose. 3. . 4. Low cost deposits for the bank. Current Account – Who can open? 1. Can be opened by individuals, either singly or jointly, by sole proprietorship firms, partnerships, Joint Hindu Family, companies (public or private limited), clubs, trusts, societies, govt. bodies, organizations, etc. 2. Current Account cannot be opened in the name of minors as the bank donot have right to recover any amount if the balance in the account is adverse ( Contract with a minor is void ab initio ) Facilities provided 1. Cheque Book (on request) 2. ATM-Debit Card (only for individual/ Proprietary Concerns) 3. Internet Banking/Corporate Internet Banking (As applicable) 4. Mobile Banking 5. Nomination (only for individual accounts) 6. Minimum Cash deposit Rs.10/7. Minimum Cash Withdrawal Rs.50/8. No restrictions on number of transactions 9. Operation of account only by cheque. 10. Operated by authorised signatories (in case of non-individual accounts) as per the mandate on record with the banks. Term Deposit Account – Features 1. Deposits accepted for fixed duration/time 2. Can be opened by all category of customers 3. Highest Interest earning deposit account 4. Duration 14 days to 10 years (minimum 7 days for deposits above Rs.1 crore) 1. Interest rate depends on tenure of deposit, customer category/type (ex. NRI, Senior Citizen, etc), deposit amount. 2. Deposits auto-renewed on maturity if no specific instructions given by customer. 3. Premature closure attracts penalty of 0.50% over the interest rate applicable for the completed period(Nil between 7D up to 180 days (< 15L),Nil between 7D to 1Y (> 15LSingle Dep.). 4. TDS on annual interest above Rs.10,000 if PAN number and Form 15G/H not submitted.(both should submitted). 5. Loan/Overdraft can be sanctioned up to 90% of principle and accrued (and unpaid interest) at 0.50% above the contracted deposit rate. 6. Payment of principle and/or interest either fully or partly exceeding Rs.5000/- other than by transfer to the depositor’s account requires discharge over revenue stamp. 7. Deposit receipt/advice is not transferable. 8. Care to be taken in case of 1. Illiterate persons – photographs to be renewed every three years 2. Blind persons 9. Nomination to be taken invariably as the deposits are non-transactional in nature 10. All Instructions for payment/transfer/renewal of principle and/or interest either fully/partly premature/ on maturity must be properly endorsed in the deposit receipt/advice or letter addressed to the bank. 11. Maturity proceeds if exceeds Rs.20,000/- or more to be invariably be credited to account or paid through Account payee cheque ( Section 269 of IT Act) Recurring Deposit Account – Features 1. Fixed monthly installments paid for a pre-determined period payable with interest on maturity. 2. Same rate of interest as Term Deposits. 3. Benefit of compounding. 4. No TDS on interest earned. 5. Encourages regular consistent savings (on the lines of Systematic Investment Plan) 1. Can be opened for a tenure between 12 to 120 months. 2. Minimum monthly deposit of Rs.100 (Rs. 50 in Rural), thereafter in multiples of Rs.10. 3. Maturity date is on expiry of the contracted term or 30 days from payment of the last installment, whichever is later 4. Transactions recorded in the Passbook provided to the customer for the account. 5. All conditions of Term Deposits apply mutatis mutandis Nomination Facility on Accounts 1. Section 45 ZA of Banking Regulation Act covers Nomination 2. Nomination – For hassle-free payment of balances in the deposits incase of death of the depositors 3. To be signed by all the account holders of the deposit. 4. In case the nominee is a minor, the account holders to name another major person to receive the proceeds on behalf of the minor during his minority. 5. Nomination to be taken on the Nomination Form DA1 6. Separate nominations to be filed for different accounts. 7. In case of term deposits, recurring deposits no fresh nomination needs to be obtained on renewal. 8. Form DA2 for Nomination Cancellation and Form DA3 for change of nominee. 9. All nominations to be recorded in the register and in CBS 10. Acknowledgement to be given to the Depositor(s) 11. A legend “ Nomination Registered” to be mentioned on the Pass Book 12. If the Depositor requests for mentioning the name of the nominee on the passbook, his request to be acceded to. 13. Standard claim form to be submitted along with death certificate to claim the amounts covered by nomination 14. CONCEPT OF COMMERCIAL CREDIT BASIC PRINCIPLES OF LENDING Lending of funds constitutes the main business of any banking company. Bank’s income is predominantly earned from interest and discount on funds so lent Basic Principles/ guidelines for lending Safety Liquidity Purpose of lending Spread of Risks Consideration of Security Basic Principles of Lending Safety Character of the Promoter/ Borrower- implies honesty, integrity, regularity and promptness in fulfilling his promises and repaying his dues, sense of responsibility, reputation and goodwill which he enjoys in the eyes of others Capacity of the Promoter/ Borrower – ability, competence and experience of the borrower. Whether he possess the necessary Technical Skill, Managerial Capacity and experience to run an industry or unit Capital of the Promoter/ Borrower- Stake of the Borrower in the business of Trade. By investing adequate Capital in the business, the borrower/ promoters are likely to evince adequate interest in running the unit being financed by the Bank SMALL AND MEDIUM ENTERPRISE (SME) As per MSMED Act, 2006, Based on Original Investment in Plant & Machinery, the enterprises are classified as under: WORKING CAPITAL FINANCE Working Capital Current Liabilities 1. Short term borrowings (including bills purchased) 2. Unsecured loans 3. Public deposits maturing within one year 4. Sundry Creditors (trade) 5. Interest / other charges accrued due 6. Advance/progress payment from customers 7. Deposit from dealers (subject to conditions) 8. Install. of term loans(*)/debentures/redeemable pref.shares 9. Statutory liabilities 10. Misc. C.L. - Dividends or other payments due in 12 months Current Assets 1. Cash & Bank Balance 2. Investments : a) Govt. & other Trustee Securities b) Fixed Deposits with Banks 3. Receivables 4. Instalments of deferred receivables due within one year 5. Raw Material / components used in manufacturing 6. S - I - P & Finished Goods 7. Advance payment of Tax 8. Pre - paid expenses 9. Advance for purchase of raw materials etc. 10. Money receivable from sale of fixed assets ( in 12months) OPERATING CYCLE CURRENT ASSETS (C/A) The term ‘Current Assets’ is used to designate those assets that in ordinary course of business can be or will be converted into cash, or sold or consumed or turned over without undergoing diminution in value and without disrupting the operations during the operating cycle of the business usually not exceeding one year. CURRENT LIABILITIES (C/L) & NWC ‘Current Liabilities’ are those liabilities intended to be paid within a year out of C/A or out of the income of the business. The excess of C/A over C/L is known as Net Working Capital (NWC) or Liquid Surplus. NWC represents that portion of WC which has been provided from Long Term Sources. WORKING CAPITAL FINANCE The manufacturing activity consists of a sequence of operating cycles The time that elapses between cash outlay and cash realization by sale of finished goods and realization of book debts (sundry debtors) is known as the length of the operating cycle Working Capital is defined as “ Funds required to carry the required level of Current Assets, to enable the unit to carry on its operations at the expected levels uninterruptedly” Working Capital Finance is repayable on demand WORKING CAPITAL FINANCE Thus, Bank Finance is to be made with reference to: Operating Cycle of the Unit Estimated / Projected level of operations Nature of projected CA / CL Profitability Liquidity TERM LOAN AND ITS FEATURES A Term Loan is an advance which is granted usually against the security of the borrower’s Fixed Assets for a fixed term of not less than 3 years, is intended normally for financing acquisition of Fixed Assets, with a repayment schedule normally not exceeding 8 years. Term Loans may be drawn / disbursed in lump sum or in instalments depending on the nature of the project. Term Loans are repayable out of the future earnings of the unit, in instalments, and as per a pre-arranged schedule. TERM LOAN & ITS FEATURES.…. An element of risk is inherent in any type of loan because of the uncertainty of the repayment. The longer the duration of the credit, greater is the attendant uncertainty of repayment and consequently higher risk to banks. Thus, risk involved in Term Loans is greater. PURPOSE OF TERM LOAN Acquisition of Fixed Assets such as Land, Building, Plant & Machinery. Modernisation / renovation / expansion / diversification of an existing unit. Strengthening NWC. Other Long Term Requirements – VRS. Purchase of second hand machinery. Acquisition of balancing equipments. Replacement of high cost debt (For residual period only). TERM LOANS Vs. WORKING CAPITAL Purpose of TL is for acquisition of FA. Advance is not repayable on demand, but in instalments ranging over a period of years. Repayment is not out of the sale proceeds of the goods, but out of the future earnings of the unit. Security (FA) not readily saleable. APPRAISAL OF TERM LOANS The purpose of Term Loan appraisal is to ascertain whether the project is sound – technically, economically, financially and managerially and is ultimately viable as a commercial proposition. Appraisal of a project involves the examination of: 1. Prima facie acceptability. 2. Technical Feasibility. 3. Economic Viability. 4. Financial Feasibility. 5. Commercial Viability. 6. Managerial Competency. 7. Other parameters. 8. Miscellaneous Issues. NON FUND BASED FACILITIES WHY NON FUND BASED BUSINESS No immediate outlay of funds It is a contingent liability i.e liability that may or may not incurred by an entity depending on the outcome of a future event Fee based income, no interest cost. Administration is easier. Banks play the role of intermediaries. Margins bring deposits. Only net outstanding attracts capital adequacy norms. BASIC TYPES OF NFB FACILITIES BANK GUARANTEES LETTER OF CREDIT Some basic facts about BGs A commitment – irrevocable obligation on the part of issuing bank To pay specified sum of money Due to non fulfillment or breach of a contract by the applicant Ensures contracts are completed If there is non performance or default, gives remedy OPERATIONAL ASPECTS Standard format – clauses Validity period – extensions Discretionary powers – performance guarantee with approval from controllers Period beyond (18) months Reversal of liability Invocation ACCOUNTING ENTRIES At the time of issue: Dr. Constituents Liability on BG issued account Cr. BG Issued account. At the time of invocation: Dr. Party’s account Cr. Remittance account Reverse the first set of entries. Letters of Credit Facilitates trade – domestic & international Helps in reducing working capital requirement for buyer Helps seller to get immediate payment though credit is extended by him Bank intermediates and lend its creditworthiness for which it charges the applicant Transactions are guided by UCPDC Letter of Credit An arrangement by means of which a bank (issuing bank) acting at the request of a customer (applicant) undertakes to pay to a third party (beneficiary) a predetermined amount by a given date according to agreed stipulations and against presentation of stipulated documents Parties to a Letter of Credit Applicant (Buyer) Issuing Bank (opening bank) Beneficiary (Seller) Advising Bank Confirming Bank Negotiating Bank (Paying Bank) Reimbursing Bank SME LIABILITY PRODUCTS Category : Current Account Authorized Branches : All Branches Purpose : Fee Collection Account (All types of fee by Educational institutions, Boards conducting competitive examinations etc) Quarterly Average Balance: Rs.25000/- Penalty for non maintenance: Rs.1000/-per quarter Penalty for closing within 12 months: Permitted type of Transactions: Non supported Transactions: Rs.500/- Cash, Transfer & Clearing Batch & Trickle feed transactions Transactions not permitted : Transactions other than fee collection/ donations not permitted Cash handling charges : waived OD Facility Charges for transaction Number of fee items : No : Rs.50/- from the remitter separately and to be credited to the non-home branch commission account. : Maximum 10 types of fee can be collected in single account Cheque Book : Facility not available (Funds can be transferred through authorization/sweep) CINB : Available (Free) some of the branches have come across complaints of wrong/inadequate MIS in Power Jyoti product on account of the following:I. Acceptance of fees/contributions without entering the required details. II. Capturing incorrect values in the key field of Reference number. III. Fee bifurcation details not captured/captured incorrectly. To obviate the above illustrated difficulties, GITC, CBD Belapur has come out with a pre populated module in Power Jyoti whereby the collecting branches need not input data. Instead, the relevant data would be uploaded by the home branch (where Power Jyoti account is opened) on receipt of the same from the Power Jyoti account holder. Thereafter, only the key data, like reference number, would be required to be keyed in at the collecting branch to get the requisite pre populated particulars/data. Category: Current Account Authorized Branches : All Branches having ATM/INB facilities are available To provide basic banking facility to the low profile business community Purpose: Target group: Firms/ engaged in any business Individuals/Proprietorship Firms/ Partnership activity Quarterly Average Balance: Rs.1000/- (No OD will be permitted in the account) Penalty for non maintenance: Rs.300/-per quarter Cash Withdrawals: Maximum Rs.15000/- per day through ATM only (No cash withdrawal is permitted at the cash counter of the branch) Cash Remittance : Maximum Rs.10000/- per day at Branch Cheque Book : Restricted to 25 leaves in a financial year @ Rs.5/- per cheque. Additional cheque leaves cost @Rs.10/- per cheque Drawings per cheque: Rs.15000/- (inscription printed) Other Features: Free Internet Banking & ATM cum Debit Card Facility Transfer of Funds to other accounts at the branch free of charge Standing Instructions for payment of loan installments at the branch free of charge for payment to other accounts for a fee of Rs.50/- per transaction. ECS facilities available at select branches for payment of telephone bills, Insurance Premia at applicable charges. Immediate credit of outstation Cheques up to maximum amount of Rs.15,000/- per cheque. Collection of outstation cheques and transactgion of Inward Bill business at normal charges Category: Current Account & Savings Bank linked to Corporate Liquid Term Deposit Purpose: To Provide a scheme with option for sweep and reverse sweep to meet the requirements of organizations that have cash accruals needing safe investment options. Eligibility : Corporates / Institutions / Trusts / Small & Medium Enterprises who manages the P F / any other trust account of their employees. Minimum Balance : C/A -- Rs.10000/- Period of Term Deposit : ; SB – Rs.1000/- Minimum -- 12 months Maximum -- 36 months Other Features: Auto sweep on weekly basis The threshold limit is Rs.50000/- Auto sweep takes place whenever there are surplus funds. Reverse sweep is on either LIFO/FIFO basis No overdraft/loan facility is permissible All branches are authorized to open accounts Interest is paid as per card rates (less any premature penalty) applicable for the periods Features: Issued and paid at all CBS branches Can be issued to existing/new SB, CA and CC accounts in addition to normal cheque books. Personalized cheque books with customer details are issued. Continuous stationery is also issued on separate request to CSD. Upper limit for PER customers is Rs10 lacs and SME customers is Rs.50 lacs. Charges for Issue are free for all Power packs Transaction charges are applicable for Power super, Power Lite and Power Base. No payment charges are to be levied. The charges applicable for MCC should be explained to the customers before enlisting their names. No cash payments allowed at non home branches for SME customers. No third party cash payment MCCs drawn on borrowal accounts may be paid based on the availability of drawing power, if otherwise in order. Paying Branch should not override the DP of loan account holders while paying MCC, under any circumstances. Paying branch should key in the complete name of payee while paying MCC so that name of payee will appear in MCC report at home branch. Following are Inter-core transactions offered to SME customers: Deposit of cash at non home branches Deposit of cheques at Home / Non home branch, drawn on any branch (for credit of home branch a/c) Encashment of cheque at non-home branch Remittance of funds from Home branch account to third Party a/cs at another branch Inter core transaction charges (a/c to a/c charges only) are removed for all types of customers (SME/MCG/CAG) vide CC Cir.No.NBG/BOD-GB/ 26/2012-13,dated 18th June, 2012 (Will be taken care by CBS soon) However, for cash deposits, applicable cash handling charges, if any, will be extra and to be collected at the time of deposit separately Concessions/relaxations are applicable only for inter-core transactions and not available for Multi city cheques and RTGS/NEFT transactions. WHY RURAL ? Saturation of urban markets. High competition & low spread in retail advances Lack of demand for credit from industrial sector Emerging rural market Improved Infrastructure Improved Rural Savings ADVANTAGE SBI…… Largest and unmatched network of branches in every nook & corner of the country. Strong customer base. Large contingent of trained & experienced workforce. Pioneers in agriculture lending: More than half a century of experience in agri business. Our brand-image and people trust is unmatched in the rural India. Branch Channel MRT Channel Features of BC/BF Agri products at a glance Kissan Credit Card (KCC) OBJECTIVE a. To meet the short term credit requirements for cultivation of crops b. Consumption requirements of farmer household c. Working capital for maintenance of farm assets and activities allied to agriculture, like dairy animals, inland fishery etc. d. Post harvest expenses e. Investment credit requirement for agriculture and allied activities like pump sets, sprayers, dairy animals etc. Agri products at a glance Kissan Credit Card (KCC) Eligibility i. All Farmers – Individuals / Joint borrowers who are owner cultivators ii. Tenant Farmers, Oral Lessees & Share Croppers iii. SHGs or Joint Liability Groups of Farmers including tenant farmers, share croppers etc. Fixation of Limit ance. Agri products at a glanceKCC limit will be worked out on the basis of: a. Short Term Loan Requirements b. Investment credit requirement of small value in the nature of farm implements/ equipments etc. Short term credit limit is fixed for the first year depending upon : i. the crops cultivated as per proposed cropping pattern & scale of finance ii. post harvest/household/ consumption requirements and iii. Maintenance expenses of farm assets, crop insurance, Personal Accident Insurance Scheme (PAIS) and Asset insur Kissan Credit Card (KCC) Fixation of Limit For every successive years (2nd, 3rd, 4th, and 5th year), the limit will be stepped up @10%. Investment credit requirement of small value in the nature of farm implements/equipments etc (like sprayer, plough etc.,) and repayable within a period of one year will be included while fixing KCC limit Maximum permissible limit (KCC Limit) Short term loan requirement (5th yr) (STL) + Estimated investment loan requirement Maximum Drawal Limit (MDL) STL limit + small term loan Limit (repayable in one year) for respective year Agri products at a glance Nature of account: KCC will be in the nature of revolving account. Credit balance in the account, if any, to fetch interest at Savings bank rate. Validity period of KCC limit will be 5 years, subject to annual review. Revival letters before 3 yrs AGRICULTURAL GOLD LOANS Why G0ld Loans ? Agricultural Gold loan is one of the ways of extending financial assistance to farmers for meeting their agricultural expenses. It is the most secured loan as per Bank’s experience and NPA is almost nil / negligible. Objective To extend hassle free finance to farmers / agriculturists against Gold Ornaments / gold wares to increase their liquidity to meet crop production expenses, investment expenses related to agriculture and / or allied agricultural activities. Eligibility Engaged in agriculture or allied activities Engaged in activities permitted by RBI to be classified under agriculture. It is not necessary to insist for land record extracts or physical inspection of the farm before sanction of Gold loans. The applicant should satisfy the KYC guidelines. Necessary enquiries about the applicant pursuing the activity to be done. Purpose crop production expenses creation of assets to be used in farming operation or for allied agricultural activities like Dairy, Poultry, Fisheries etc Eligibility Engaged in agriculture or allied activities Engaged in activities permitted by RBI to be classified under agriculture. It is not necessary to insist for land record extracts or physical inspection of the farm before sanction of Gold loans. The applicant should satisfy the KYC guidelines. Necessary enquiries about the applicant pursuing the activity to be done. Purpose crop production expenses creation of assets to be used in farming operation or for allied agricultural activities like Dairy, Poultry, Fisheries etc Quantum of Loan: The amount of loan that can be granted against security of gold ornaments should not be higher than the advance value of gold ornaments pledged. Advance value: This is the price of gold (18,22 & 24 carat purity) advised by LHO every month less margin. Margin: 20% on price of gold advised by LHO. Operational Procedure: Branch functionaries / sanctioning Authority should satisfy themselves by oral enquiry about the applicant being otherwise eligible. Photograph of borrower is to be obtained in all cases and affixed to loan opening form and Gold loan register also. Due date for repayment / or instalments to coincide with harvesting and marketing of crops raised. Valuation of the security i.e. Gold Ornaments is based on weight and fineness of the gold content. Operational Procedure: a. Touch stone method b. Nitric Acid method c. Specific gravity method Services of local goldsmith can be used only in exceptional cases for large advances and his fees paid by debit to branch interest account. Details of the gold ornaments pledged like description, gross weight, net weight, valuation rate and advance value are noted in the Gold ornaments take delivery letter (SIM-GL/2) and is certified by the cash officer. Gold Loans can be granted to joint borrowers also on E or S, F or S, L or S and B or S terms. Gold Loans can be issued to illiterate borrowers also after explaining them about the implications of the loan and the various documents obtained. CREDIT LIMITS FOR SHGs MICRO FINANCE (MF):“Micro Credit can be defined as the provision of thrift, credit and other financial services and products of very small amount to the poor in rural, semi-urban and urban areas for enabling them to raise their income levels and improve their living standards.” SHG – BANK LINKAGE Bank linkage is of three types SHGs financed directly by the banks. SHGs financed directly with NGOs facilitation. Indirect finance to SHGs through NGOs / MFIs: NGOs/ MFIs are financed by the bank for on lending to the SHG promoted by them. SCHEME FOR FINANCING DAIRY UNITS Dairy Plus OBJECTIVES: To improve quality production of milk at the farm level. To finance milk producing members of ‘AMUL’ pattern societies. To promote bulk financing in agricultural sector priority sector lending. Agri products at a glance SCHEME FOR FINANCING DAIRY UNITS PURPOSE OF LOAN: Construction of dairy shed Purchase of quality milch animals, Milking machine chaff cutter SCHEME FOR FINANCING DAIRY UNITS Dairy Plus: Eligibility Individual farmers, who are members of society (Amul pattern) or members of recognised private milk dairies, having age below 65 years Individual Dairy Units having less than 10 animals Applicant should own min. 0.25 acres of land for every 5 animals for growing fodder and be in a position to procure the balance requirements locally Dairy Plus: LOAN AMOUNT: Rs.5 lakh at one time with the following sub-limits: S.NO. PURPOSE MAXIMUM LOAN 1. Animals purchase Rs.1.50 lakh* 2. Milking Machine purchase Rs.0.40 lakh 3. Shed construction Rs.3600 per animals 4. Chaff cutter purchase Rs.5,000 unit cost with 10% deviation, if necessary Total quantum will be based on the repaying capacity Tractor Loan Schemes NEW TRACTORS: OBJECTIVE: GRANTING LOANS TO FARMERS FOR PURCHASE OF TRACTORS AND IMPLEMENTS TO ENABLE THEM TO IMPROVE CROP YIELD BY UTILISING ON THEIR OWN FARM & INCREASE INCOME BY CUSTOM HIRING Purpose: To purchase new tractors, accessories and implements Tractor Loan Schemes Quantum of Loan : The quantum of loan will be based on the invoice price of the tractor less margin stipulated as per the scoring model. Margin : Margin varies from 5% to 20% depending on the scoring as well as DSCR. Other schemes in Tractor Loan: Sanjeevani- for tractor upgradation Mahindra- Vishwas & TAFE-Nayaroop: Financing for used tractors. Negotiable Instruments Act 1881 NI Act 1881 defines negotiable instruments. A “negotiable instrument” means a promissory note, bill of exchange or cheque payable either to order or to bearer Banker includes any person acting as a banker and any post office or savings bank covered under the Act NI ACT,1881 Negotiable Instruments Act: Law relating to promissory notes, bills of exchange and cheques and it also deals with ‘negotiation, noting and protesting’ etc. It is transferable by mere delivery in respect of bearer instrument and by endorsement and delivery in respect of order instrument CHARACTERISTICS OF A NEGOTIABLE INSTRUMENT Notice of transfer is not necessarily to be given to the party liable on the instrument A Holder in Due Course gets a better title than transferor PROMISSORY NOTE SECTION 4 OF NI ACT DEFINES A PROMISSORY NOTE AS UNDER: A PROMISSORY NOTE is an instrument in writing (not being a bank note or a currency note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument BILL OF EXCHANGE SECTION 5 OF NI ACT DEFINES BILL OF EXCHANGE: A BILL OF EXCHANGE is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person, to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument CHEQUE According to Sec. 6: A “cheque” is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand and it includes the electronic image of a truncated cheque and a cheque in the electronic form. ESSENTIALS OF A CHEQUE Instrument in writing Unconditional Order Drawn on a specified banker Specified sum of money Payable on Demand The Holder of a promissory note, bill of exchange or a cheque means any person entitled in his own name to the possession thereof and to receive or recover the amount due thereon from the parties thereto. SECTION 9: HOLDER IN DUE COURSE “Holder in due course” means any person who for consideration became the possessor of a promissory note , bill of exchange or cheque if payable to bearer or the payee or endorsee thereof if payable to order, before the amount mentioned in it became payable and without having sufficient cause to believe that any defect existed in the title of the person from whom he derived his title PAYMENT IN DUE COURSE(SEC10) Payment in accordance with the apparent tenor of the instrument(The appearance or what the instrument contains such as date, amount etc) Payment in good faith( There should not be any room for suspicion as to the presentation and the nature of the transaction) Payment without negligence(Complying with the rules prescribed for making payment) Payment to a person in possession of the instrument entitled to receive payment SECTION 18 If the amount undertaken or ordered to be paid is stated differently in words and figures, the amount in words shall be the amount undertaken or ordered to be paid AGENT FOR COLLECTION If the proceeds of the cheque are credited to the customer’s account after the cheque is realised then the banker is said to be acted as an agent for collection. MATERIAL ALTERATION An alteration which makes significant variations in the rights and liabilities of the parties is called a material alteration. Eg. Date Name Time or place of payment Rate of Interest Amount etc., Such material alterations are to be authenticated by the drawer of the instrument under full signature, for payment SECTION 131 Conditions for Protection: As per Sec 131, a banker who has in good faith and without negligence received payment for a customer of a cheque crossed generally or specifically to himself, shall not be liable in case the title of the cheque is proved defective provided 1) The bank must have acted in good faith and without negligence. 2) The cheque collected must be crossed. 3) Bank has received the payment as agent for collection. 4) Bank has collected the cheque in the duly introduced Account of customer only. 5) Collection has been with good faith and without negligence Section 131 contd Section 131 contd SECTION 138-142 New secs 138-142 added in 1988,detailing penalties for bouncing of cheques due to insufficiency of funds. Dishonour of cheque for insufficiency, etc., of funds in the accounts is a punishable offence. Dishonour of cheque for insufficiency, etc., of funds in the account. If a cheque in discharge of a liability is returned by the bank unpaid, due to insufficient funds, such person shall be deemed to have committed an offence and shall, be punished with imprisonment for a term which may extend to 1 [two years], or with fine which may extend to twice the amount of the cheque, or with both: AGENT FOR COLLECTION If the proceeds of the cheque are credited to the customer’s account after the cheque is realised then the banker is said to be acted as an agent for collection. Before putting through any transaction in CBS it is important for every user-YOU to bear in mind the various sections of Negotiable Instruments Act,1881 • GOVERNMENT BUSINESS • Importance of Govt. Business • Handles Govt. Business as agent of RBI as per Sec.45 of RBI Act and Sec.32 of SBI Act. • Recognition as Government Banker has earned us lot of trust • Crores of ‘Risk Free’ Other Income • Helps in increase in CASA deposit due to – Govt. Departments Accounts – Pension Accounts – Salary Accounts • Importance of Govt. Business • Highlights: – Government Business contributes more than 30% of other income of National Banking Group. – No NPAs – No capital adequacy requirement for operations – Government of India is our biggest customer – Facilitates cross selling of P Segment products and other products – Larges Commission earner Areas on Concern: Penalty on account of delayed reporting Lack of job knowledge at branch level Low priority at branch level Importance of Govt. Business • Importance of Govt. Business Govt. Business: Challenges – Entry of private sector Banks – Government Commission Rates likely to be reduced – Demand for high technology products – Bank neutral policy of Government – e-Biz portal: Transactions will be routed through CBI • Highlights MARCH 2012 • Highlights MARCH 2012 • Challenges • Government of India, our biggest customer, expects • a high degree of accounting excellence • Job knowledge • speedier credit of funds collected by our branches • faster reconciliation • Implementation and upgrading technology in offering the services • professional approach • Close liaison with Government officials • History of Govt. Business • Initially the RBI appointed State Bank of India as its sole agent at all places where RBI had no office or branch. • In 1970, the Government empowered the RBI to appoint PSBs as agents at any centre. • By 1976, the SBI, Associate Banks and nationalized banks were acting as agents of the RBI. • RBI has authorized four private sector banks viz. ICICI Bank Ltd., UTI Bank Ltd., IDBI Bank Ltd. and HDFC Bank Ltd. for conduct of Government Business from October 1, 2003. • SCOPE OF GOVERNMENT BUSINESSES • Process of Conducting Govt. Business • All branches conducting Government business have been classified into: – DEALING BRANCHES : These are Branches which conduct Government Business and route their transactions through Focal Point / Link Branch. – FOCAL POINT / LINK BRANCHES : These are branches which consolidate the transactions reported to them by the receiving branches, including their own transactions. • All the authorized dealing branches will report Government transactions through Focal Point Branch by way of daily statements, which are consolidated and reported to the Central Account Section (CAS), RBI. • Government Transactions : Reporting • Process of Conducting Govt. Business • The Central Accounts Section (CAS) at the RBI maintains the principal accounts of both Central Government. • The principal accounts in Nagpur are based on the daily position / aggregate receipts and payments in respect of each Government, Ministry / department, received from RBI offices and agency banks. Each of the accredited agency bank has set up a link office at Nagpur to liaise with CAS for funds settlement. • CAS, Nagpur, thus plays a pivotal role in consolidating the transactions and working out the overall daily position of each government department / ministry. OLTAS • It is On Line Tax Accounting System meant FOR CBDT Transactions • Data is transmitted to Tax Information Network(TIN) hosted by NSDL. • Data flow from DBs to FPBs and then to Link branch who would upload to NSDL • Extension of new facilities for convenient payment of taxes by tax payers through net banking • Payment of the taxes through single Challan with PAN of the tax payer being the key identifier • Providing limited access to tax Payers to view particulars of their tax payments through internet • OLTAS Work Flow • OLTAS • There are 3 types of Challans viz., ITNS 280, 281 and 282 • ITNS 280, 282 are Non-TDS challans which require PAN and ITNS 281 is TDS challan which requires TAN • Quoting of PAN/TAN is now mandatory from 01.01.2005 for accepting tax payment • Procedure for acceptance of taxes at the receiving branches • Scrutiny of Challan • Challans tendered with Cash • Challans tendered with Cheque/Draft • Issuance of Paper Token • Acknowledgement of Challan • Numbering of Challans • Role of Collecting Branch • The Collecting Branch – Assigns a running serial number – Captures all relevant data and transmit it to its Nodal Branch – Identify all those challans against which instruments were returned unpaid – Generate separate printouts of the scrolls and forward the same to the Nodal Branch for onward transmission to the ZAO. – In case of any error the collecting bank will transmit the corrected information on-line to TIN through an error record to ZAO through 'Error Scroll" to be sent through Nodal branch. • PAN Validation • 1ST TO 4TH Characters should be alphabetic • 5TH Characters should be alphanumeric • 6th to 9th characters should be numeric only • 10th Character should be alphabetic • 4th Characters should be among the following A,B,C,F,H,J,L,P,T,G • TAN validation • First 3 Letter should be valid RCC code • 4th Character should be alphanumeric • 5th to 9th Characters should be numeric • 10th Characters should be alphabetic • MAJOR HEAD CODES • Code Description • 04020 Corporation Tax • 04021 Taxes on Income other than Corporation Tax • 04023 Hotel Receipt Tax • 04024 Interest Tax • 04025 Securities Transaction Tax • 04028 Other Taxes on Income & Expenditure • 04031 Estate Duty • 04032 Taxes on Wealth • 04033 Gift Tax • MINOR HEAD CODES • Code Description • 100 Advance Tax • 102 Surtax • 106 Tax on distributed profits of domestic • 107 Tax on distributed income to unit holders • 200 Tax deduction at source • 300 Self Assessment Tax • 400 Tax on Regular Assessment companies • CODE MATCHING • Major Head Code • 04020 100, 102, 106, 107, 200, 300, 400 • 04021 100, 102, 106, 107, 200, 300, 400 • 04023 100, 300, 400 • 04024 100, 300, 400 • 04025 300, 400 • 04028 100, 300, 400 • 04031 100, 300, 400 • 04032 100, 102, 106, 107, 300, 400 • 04033 100, 300, 400 • Payment of interest on delayed transfer of tax collections • The tax collections effected by the designated branches of the authorized banks have to be credited to the Government Account, promptly on day-to-day basis. The maximum number of days allowed for crediting tax collections to Government Account at CAS, Nagpur are : • Payment of interest on delayed transfer of tax collections • If there is any delay beyond the period prescribed above, the banks are liable to be charged interest for delayed period. The interest for delayed remittance as mentioned above, is to be quantified and collected from the defaulting bank by the ZAOs. The rate of interest to be charged is Bank Rate as prevailing (which is generally notified biannually on May 1 and November 1) plus 2% or as decided by Reserve Bank in consultation with CGA from time to time. • Reasons for Penalties Minor Head Code Wrong submission of PAN Non submission of Data / Scrolls on time Non reconciliation of the discrepant amount Missing instruments/ Challans - entire lot of data remains unsettled and attracts penalty Wrong submission of agency commission • Data Entry Errors • Invalid Assessment Year • Invalid Minor head for the given Major head • Invalid Name • Invalid PAN/TAN • Invalid prefix for Branch Scroll Header • Invalid challan sequence • Reasons for income leakage Apart from paying the penalty, if we do not claim the disbursed amount including pension payment in time, it will result in income leakage and also result in opportunity loss of interest/ payment of interest in call money market. Agency commission if under claimed also results in income leakage. Wrong submission of claim takes longer time in settlement thus income leakage. If we club the challans and enter the whole amount as a single credit entry, it will result in income leakage • AGENCY COMMISSION • Receipts – Physical mode Rs.50/Transaction • Receipts – e mode Rs.12/Transaction • Pension payments Rs.65/Transaction • Other than pension payments-Turnover basis 5.50 paise per Rs.100 • EASIEST • Electronic Accounting System In Excise & Service Tax • Click on the GBSS Icon • Enter your Branch Code, User-id & Password • Now Select Excise Module using Module Drop Down • Click on Easiest entry Menu and Select Excise or Service Tax head • EASIEST • Enter the 15 digit Assessee Code • Click on AddTransaction. • The Assessee Details are displayed on the screen • If not found user have to fill the Assessee details as per the Challan • Select the Mode of Payment and then enter Amount in round Rupees • EASIEST • Enter the account number and other details asked on the screen • For Clearing enter the Cheque details • When the transaction is completed, a computerized Receipt will be generated • Reversal: If transaction done on any previous day need to be reversed or modified then it first be reversed • PUBLIC PROVIDENT FUND SCHEME, 1968 • Adult individuals can open PPF account, No HUF or NRIs can open PPF A/c • SUBSCRIPTION – Min Rs. 500/- Max Rs.1,00,000/-, Not more than 12 installments - in Multiples of Rs.5/- • Nomination facility available • Rate of interest payable 8.6% per annum • Avail loan from 3rd to 6th financial year • One withdrawal per year from 7th to 15th financial year • Tenure 15 years extendable by 5years any no. of times • PUBLIC PROVIDENT FUND SCHEME, 1968 Who cannot open the account • Accounts cannot be opened now by NRIs (with effect from 25.7.2003) , by HUF and AOP- Association of persons (with effect from 13.5.2005) • Institutions/Artificial persons cannot open. • Joint accounts cannot be opened even by individuals. • A power of Attorney cannot open or operate an account • PUBLIC PROVIDENT FUND SCHEME, 1968 • Accounts become discontinued if minimum Rs.500/- not subscribed in a year. They can be revived during the maturity period only if a default fee of Rs.50/- with arrear subscription of Rs.500/- paid for each year. • Discontinued accounts not entitled for obtaining loan and partial withdrawals, before revived. • Discontinued accounts can be closed after 15 years. A new account cannot be opened when there is a discontinued account. Instead, Depositor can revive the discontinued account. • Account can be transferred from one office to other i.e. from one P.O. to another P.O., from one Bank to another Bank/branch, from Bank to Post office and vice-versa. • Interest is allowed for a calendar month on the lowest balance at credit between the close of 5th day and at the end of the month and shall becredited at the end of each year. • PUBLIC PROVIDENT FUND SCHEME, 1968 Loans and Partial withdrawals from the Fund, position on attaining Maturity etc. • A repayable loan can be had from 3rd to 6th year. • A non-repayable partial withdrawal can be had once in a year from 7th financial year. • An account becomes matured for closure on the 1st day of the 17th financial year (1st April). • On the above date, the subscriber has the following options: • i) To close the account • ii) To continue the account for any period without further deposits and make one withdrawal in a year: No option in writing is needed. Any amount can be withdrawn without any limits not exceeding once in a year. He cannot open a new account while continuing to have a matured account without further deposits • iii) To continue the account with usual annual deposits for one or more block periods of 5 years without any loss of benefit: option in writing is necessary within one year from the date of maturity of the account i.e. in 17th year, 22nd year, 27th year etc. • a) During the extended period of 5 year Block, a total of 60% of the balance can be withdrawn either in one or more installments not exceeding 1 time every year. PUBLIC PROVIDENT FUND SCHEME, 1968 One example of loan that can be obtained in various years: • PUBLIC PROVIDENT FUND SCHEME, 1968 ONE EXAMPLE OF PPF WITHDRAWAL • PUBLIC PROVIDENT FUND SCHEME, 1968 • Tax benefits available • Rate of Interest on loan is 2% • Loan repayable in 36 months • Senior Citizen Saving Scheme-2004 • The scheme was introduced by the Government in the year 2004 • Eligibility: • (i) An individual who has attained the age of 60 years and above on the date of opening of an account. • (ii) Who has attained the age of 55 years or more but less than 60 years and who has retired on superannuation or otherwise on the date of opening the account. • NRIs and HUFs cannot open the account • Min. Rs.1000/- Max. Rs.15.00 lacs per individual in multiples of Rs.1000/- • Cash Deposit allowed upto Rs.1 lakh • Senior Citizen Saving Scheme-2004 • Period 5 years and extension by 3 more years • Open account within one month of date of receipt of retirement benefits with proof • Rate of Interest 9.30% per annum payable quarterly 31st March, 30th June, 30th September and 31st December • Nomination facility available • No tax benefits • Senior Citizen Saving Scheme-2004 • Proof of age : Birth Certificate, PAN Card, Passport, Vote Card, Driving License, Ration Card, DOB certificate from school last attended A certificate from employer regarding superannuation and retirement amount received • Unclaimed interest will not earn any interest • Senior Citizen Saving Scheme-2004 • Premature closure of Account: The depositor may be permitted to withdraw the deposit and close the account at any time after expiry of one year subject to the following conditions; • In case the account is closed after expiry of one year but before the expiry of two years, an amount equal to one and half percent of the deposit shall be deducted and the balance paid to the depositor, • In case the account is closed on or after two year, an amount equal to one percent of the deposit shall be deducted and the balance paid to the depositor. • E-FREIGHT • A freight payment automation scheme for the Railways and Corporates who were regularly transporting goods (raw material / finished products) through the Railways. • Enhance the convenience of Corporate customers as they need not deposit freight charges at various loading points, and can make payment from their corporate office • COLLECTION OF EXAM FEE (UPPSC/SSC etc.) • Candidates will apply online on the web site of UPPSC • He will generate challan from web site • The SWO will accept cash and through Screen No.7125 credit the pooling account number printed on the challan • After completing the transaction, the challan should be stamped with Cash receipt stamp with date and Journal No. • PENSIONS • KYC norms should be observed in true spirit at the Branches • All the PPOs should be routed through FPLB/Nodal Branches as per extant instructions of the Bank • Security features of PPOs should be verified to ascertain their genuineness • Signatures of the Government officials should invariably be verified before making the payment of the cheques issued by Government Departments • PENSIONS • Information of re-marriage of family pensioner and request to stop pension to be submitted to the concerned Department and the release of pension should be stopped • Computerized PPOs are printed on computer and not typed • PPO has been signed by an authorized officer in ink and should be verified with specimen signatures • PPO bears the embossing seal (uncolored) • Proper identification of pensioner with reference to identification marks, photographs should be carried out. • PENSIONS On receipt of the PPO of a pensioner at the Branch: • The CRO/the authorized official will collect the duly filled-in and signed Life Certificate / Non Re-marriage Certificate / Non Re-employment Certificate • Collect undertaking for recovery of excess amounts of pension / arrears paid subsequently, and • Forward the PPO along with the certificates and the undertaking, obtained from the pensioners, to CPPC on the same day • PENSIONS Handling of Pensioners’ requests/grievances • Pensioners’ requests/grievances should be attended to promptly and courteously by the Branch officials and under no circumstances should any pensioner be directed to CPPC. It should also be ensured by the Controller of the Branch that adequate number of staff members, depending upon the number of pensioners at the branch, have been provided the user IDs to access the pension software. • PENSIONERS GROWTH THANK YOU CROSS SELLING OUR BANKING BUSINESS U/S 6 of BRA Accepting Deposits for onward lending Is this business remunerative now? OUR BASIC BANKING BUSINESS Deposit Rate 100 Int Paid 8% 8 Expected Return? SLR & CRR 11% 11 -11 (-30) Priority Sector 70 5% 1.5 -9.5 (-28) 42 9% 2.5 -7.0 Other & PER (-21) 21 12% 2.5 -4.5 C&I (-21) 0 8.5% 1.8 -2.7 If you want to earn Rs4.50 on Rs 21 lent to C&I, what would be the Int Rate? 21% What is the Result? If we do Banking depending only on Fixed Deposits, it is resulting in a loss finally. What is the way out to earn profit from our basic business? 1. Increasing CASA 2. Increasing High Risk Advances. LIMITATIONS CASA- High Competition High Yielding Advances – High Risk Competition from: PSBs; Pvt. Banks & Foreign Banks. Also New Pvt. Sector Banks from Corporate Groups are coming soon to increase the level of competition. Corporates have other sources of funds. Any other ways left? You are correct! – Cross Selling!! What is Cross Selling? What is Up selling? What are the areas of cross selling that offer us Fee Based Income? 1. SBI Life- Cardif- SA- CIF2. SBIMF/ Other MFsSociete General- ACE 3. SBI GI- IAG Australia- SP 4. SBI Cards- GE Capital CROSS SELLING Why Cross Selling? i) Declining spreads ii) Reducing Market Share iii) Increasing Competition iv) Changing customer expectation v) Customer Retention and Customer acquisition ADVANTAGES OF CROSS SELLING No outlay of Funds Hence no NPAs. Hence no provisions. Also no Risk weighted Assets. Hence no CRAR requirement No- negative transfer pricing. COI on commission earned through CS. Incentives for Staff. TRANFER PRICE MECHANISM 25% of Commission/brokerage earned by branches on Cross Selling products of SBI Life, General Insurance, Mutual Funds Rs.200 per SBI Credit Card sourced and approved by the SBI Cards Ltd A penalty is being introduced for those branches located in SBI Card issuing centers which could not sponsor the minimum number of application ADVANTAGES FOR CUSTOMERS? Savings habit- Participation in Investments All financial products under one roof Convenience & Transparency Life Insurance Coverage is very low in India Continued Services from Branch Staff Relationship, Customer Orientation (Financial Planning), Customers’ Choice. IF YOU DON’T SELL---Will a needy customer stops buying? Then from whom? If from an in-transparent company? If it is a private agent? Who is at loss? Your customer at loss--who is responsible? HOW SHOULD BE OUR APPROACH WHILE SELLING? Aim at long term Relationship Give suitable Financial Planning Have product knowledge Offer products suitable for customers’ needs Proper Guidance & After sale service Customer Education Leveraging Existing Data Base for Cross Selling :i) Home Loan as base product ii) PPF customers iii) Perusing clearing cheques Cross selling as an aid for reducing cost and generating revenue MUTUAL FUNDS What is a mutual fund? Why Mutual Funds? Term of Investment? What is a unit? What is NAV? Who is Fund manager? What is Growth? MUTUAL FUNDS MUTUAL FUNDS The advantages of investing in a Mutual Fund are: · Professional Management · Diversification · Convenient Administration · Return Potential · Low Costs · Liquidity · Transparency · Flexibility · Choice of schemes · Tax benefits · Well regulated TYPES OF MUTUAL FUND SCHEMES By Structure: Open ended Schemes Close ended Schemes TYPES OF MUTUAL FUND SCHEMES By Investment Objective: Growth Schemes Income Schemes Balanced Schemes Money market Schemes TYPES OF MUTUAL FUND SCHEMES Other Schemes: Tax Savings Schemes Sector Specific Schemes Growth of Mutual Funds Products of SBI Mutual Fund Large Cap & Blend Schemes i) Magnum Equity Fund ii) Magnum Index Fund iii) Magnum Multiplier Plus iv) SBI Blue Chip Products of SBI Mutual Fund Sectorial Schemes i) MSFU Contra Fund ii) MSFU Emerging Business Fund iii) MSFU FMCG Fund iv) MSFU IT Fund v) MSFU Pharma Fund vi) Magnum Comma Fund Products of SBI Mutual Fund Other Equity Schemes SBI Arbitrage Opportunities Fund Magnum Midcap Fund Magnum Balanced Fund Tie-ups : i) Franklin Templeton ii) Fidelity MF iii) TATA MF iv) UTI MF SYSTEMATIC INVESTMENT PLAN (SIP) Dollar Cost Averaging Markets up Increased NAV for your UNITS Market fall More Units for this month miracles of early age savings !!!! Why Life insurance? But what if we live long? When was the last time we reviewed our Pension Plans? We’ll need more money to maintain our Pre-retirement Lifestyle We’ll have to provide for a longer time due to Increasing life expectancy Increasing cost of Health and Medical care beyond the rate of inflation What is Insurance? Insurance is the pooling of resources by a large no. of people making small contributions (premiums) & sharing of losses caused by insured perils of the unfortunate few (Life Cover) When someone dies and you make contributions to his family it is called Charity but when you contribute (pay premiums) before death to cover the family in future, it is called Insurance. What is Risk? Risk may be defined as a condition in which there is a possibility of an adverse deviation from a desired outcome that is expected or hoped for. General Risk? Two conditions: Risk in Insurance Pure & Speculative Risk Pure risk: situations where there is a loss or no loss. It is based on probability and is mathematically predictable. Speculative risk: situations where there are chances of gain or a loss. Speculative risk is not insurable. Types of Risk Personal risk – death, disability, illness, accident, unemployment etc. Property risk (Movable & immovable) – loss or damage to property by fire, theft, terrorism, war, flood etc. Liability risk – third party risk, eg. accident while driving a car, or negligence by a professional etc. Risk to life Primarily, there are two types of risk to life: Risk of dying too young . …. Risk of living too long ….. Risk Management High frequency-low severity……Reduction High frequency-high severity.….Avoidance Low frequency-low severity…….Retention Low frequency-High severity…..Transfer Insurance is a mechanism for transfer of risk. Life Insurance Products Term Whole life Endowment Money back Children’s plans Annuity plans Life Insurance Products Annuity plans-single-regular Immediate annuity-deferred Group plans ULIPS Insurance In India Low Human Life value in India, that is why we insure our property, home, factory furniture but not ourselves. India is an under insured country (24 % penetration among the insurable population) and this is a country that has the maximum cases of heart disease and diabetes. India is the 2nd most populous country (16.9 % of world population) in the world but forms only 0.7% of the insurance population Our products are … Our processes are … Our competitive advantages Key success factors Easy to sell SBI’s strong brand Customer loyalty & trust Management support Commitment of the sales & support functionaries Bancassurance INSURANCE SELLING Why Insurance ? What are the benefits of selling insurance products What is SBI Life ? What is Bancassurance ? What are the benefits of Bancassurance OTHER CROSS SELLING PRODUCTS Credit Cards Benefits to the Bank by selling Credit Cards Avenue of other income Income by selling General Insurance Products Importance of Government Business For Product knowledge: Visit