15. Finance & TRA - SSANet

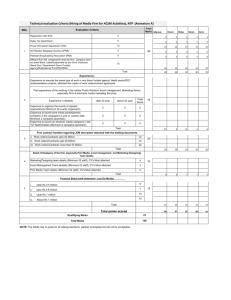

advertisement

Meeting with Employees of Kannur SSA 15-01-2013 to 28.01.2013 FINANCE AND TRA Internal Audit by M/s U A Associates, Chartered Accountants, Kozhikode : (2012-13) a. 1st half commenced from 07.01.2013. b. Independent verification of all Cash and …..Cash Card and inventory will be conducted ……in respect of all Cash Counters. c. Records of all assets and inventory may be …..updated and properly maintained before the …..audit team visits. CASH & CASH CARDS VERIFICATION BY DE: a. Should be daily balanced. b. Sale and Stock Balance should agree with balance in Stock (Regr/Knet/Sancharsoft) c. Cash Collection should be remitted on a daily basis. d. Cash balance retained – reasons should be recorded. (Reasons should be indicated in Kannurnet also for audit/vigilance reference) e. Cash &Stock Register Balance should be authenticated with the signature of I/C f. Verification of Stock of cash and cash cards on the last working day should be conducted by DE and Certificate submitted AO(CA)/(CASH) g.Abnormally high Cash Balance without reasons recorded /Irregularities in stock of cards - custodian AO/SDE as the case may be will be responsible Physical Verification of Assets. a. Detailed Circulars placed in Knet. b. Verification report to be submitted before 10.4.2013 WIP PENDING CAPITALISATION Division Value to be capitalized % of capitalization DEPCNN 419516 67 DEPKSZ 13125 96 DEPTLY 80040 93 DETCNG 65158 87 DETCNN 404307 78 DETCUU 49402 89 DETCVU 37896 98 DETIMCNN 4015035 40 DETIMPAY 373362 84 DETKNG 114865 66 DETMJR 16208 95 DETMTR 153487 72 DETNLS 116732 86 DETPAY 112767 98 DETPDL 0 100 DETSKM 167541 74 DETTLY 66049 96 DETTMB 486509 73 DETUPL 149093 65 2419522 20 10712995 SSA average :67 SSA Estimate Grand . Bank account of tower/building owners: a. All payments to be through credit to the bank account of the employee/suppliers/contractors. b. 29 cases of bank account details are still awaited in respect of tower/building owners. c. List is available in FTP .(Temp/Kannur/AOC/Nobank.) d. DEs concerned may ensure that bank account details are furnished to AO(Cash) without further delay. Absentee statement: While inputting absence of staff on Kannur Net, it may be ensured that the leave applied for is available at the credit of the individual as on that date, so that salary can be drawn as per data furnished through absentee statement. Any period of absence without leave after inputting data may be reported directly to AO (Bills) latest by 25th to avoid excess drawal cases. ABSENCE 16.11.2012(STRIKE) a. Attendance Marked as a matter of course by certain units. b. Absentee statement for Nov-Dec.12 need review and a separate report of absentee may be furnished by DE concerned before 22.01.2013 . Delay in submission of bills: a. Petty Contractors bills b. EPBT repair bills c. Hired vehicle bills Bill for attending Cable fault: 3 or 4 joints are seen for a single number In many cases INCOME TAX : a. Petty Contractors bills. b. T D S certificate for tax deducted from Interest of KSEB Deposit – pending certificate may be collected and submitted c. Employees may submit housing loan exemption certificates and other savings details to AO(bills) before 22.1.213 for exemption from tax Furnishing of Wrong PAN nos by DSA/Petty contractor. a. Income Tax returns filed online get rejected for incorrect PAN Nos. b. Penalty for incorrect filing c. Photo Copy of PAN Card may be attached with all bills wherever PAN no furnished is incorrect. (List placed in Kannurnet:Temp/Kannur/aoca.2/Invalidpan) SERVICE NOS:CDMA/GSM/WIMAX a. b. c. d. Bills generated need certification Outstanding Details placed in Knet. Proper Categorization at CML/System level Other Service Numbers – IUC payments SCRAPPING: a. Sale of Scrap 2011-12 :247 lakhs b. Sale of Scrap 2012-13 : 19 lakhs Scrapping should be expedited for realisation of maximum revenue. Separate committee may be formed in consultation with AGM(P) Collection of email id and mobile nos: 1. email id collected : 4.08%(15526) 2. Mobile no collected :61.24%(233108) Efforts may be taken to collect details of remaining numbers. Liquidation of Arrears: a. Revenue Adalath b. Smadhan scheme c. Write Off. Liquidation of Arrears: LANDLINE SEGMENT PERIOD TARGET (IN 000S) POSITION Nov-12 I Upto 31/03/2006 Nil Nil II 01/04/2006 to 31/03/2010 500 682 -182 Will be achieved III 01/04/2010 to 31/03/2012 13250 8858 4392 Achieved IV 01/04/2012 to 31/12/2010 2967 10351 -7384 a/c not finalised will be achieved VARIANCE REMARKS 1% of abf upto aug-12 BROADBAND I Upto 31/03/2012 1350 2733 -1383 II 01/04/2012 to 31/12/2012 8752 2534 6218 (5% of abf upto aug-12) achieved Liquidation of Arrears: Mobile Upto 31/03/2010 100 125 -25 will be achieved 01/04/2010 to 31/03/2012 250 250 0 achieved 01/04/2012 t0 31/12/2012 414 267 147 achieved 2043 -1543 will be achieved (1% of abf upto sep-12) CDMA Upto 31/03/2010 Wimax 500 01/04/2010 to 31/03/2012 1260 7807 -6547 action is taken to achieve the target 01/04/2012 t0 30/09/2012 241 1789 -1548 action is taken to achieve the target upto 31/03/2012 90 187 -97 upto 31/10/2012 30 120 -90 Comparison of Revenue upto Dec-12 -(in Crore) U pto D ec -12 U pto dec -11 V arianc e % varianc e 49.15 62.15 -13 -20.92 PCO 1.45 2.12 -0.67 -31.6 FTTH 0.06 0 0.06 60 SurChrg 0.85 1.35 -0.5 -37.04 32.34 28.18 4.16 14.76 ITC+FLPP 0.73 1.44 -0.71 -49.31 EB(CCTs) 0.27 0.33 -0.06 -18.18 IUC 0.06 0.22 -0.16 -72.73 Total CFA 84.91 95.79 -10.88 -11.36 Total GSM 97.47 78.74 18.73 23.79 182.38 174.53 7.85 4.5 Phones BB CFA+CM