Sarbanes

advertisement

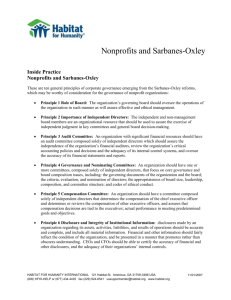

Sarbanes-Oxley - 1 COMPLIANCE & SOX Sarbanes-Oxley - 2 SARBANES-OXLEY ACT At Issue If the governance of the modern corporation isn’t completely broken, it is going through a severe crisis of confidence. At risk is the very integrity of capitalism. Directors who fail to direct and CEOs who fail at moral leadership are arguably the most important challenge facing corporate America today. Business Week (May 6, 2002) Sarbanes-Oxley - 3 SARBANES-OXLEY ACT The Solution Starts At Home The recent corporate collapses have involved many breakdowns: in ethics, in trust, in common sense, to name a few. But perhaps the most troubling breakdown is in corporate oversight. Directors, senior executives, and Wall Street analysts all failed miserably by missing – or concealing – danger signals until it was too late. Regulators will no doubt have plenty to say on the issue, but the most zealous reformers should be the companies themselves. Fortune (May 27, 2002) Sarbanes-Oxley - 4 CORPORATE GOVERNANCE STANDARDS 1900: NYSE requires distribution of annual reports to stockholders 1909: NYSE requires annual stockholders’ meeting 1926: NYSE adopts “one share, one vote” standard 1929: Stock market crash 1932: Increased financial disclosure and independent audits become mandatory 1934: SEC is formed 1955: Shareholder approval required for certain corporate acquisitions Sarbanes-Oxley - 5 CORPORATE GOVERNANCE STANDARDS 1968: AMEX publishes first guide establishing listing standards 1977: NYSE requires establishment of an audit committee comprised of independent directors 1985: NASDAQ initiates its first corporate governance listing standards 1987: Treadway Commission (COSO) established to define responsibilities of the auditor in detecting and preventing fraud Sarbanes-Oxley - 6 CORPORATE GOVERNANCE STANDARDS 1999: NYSE/AMEX/NASD adopt new rules based on Blue Ribbon Committee on Improving the Effectiveness of Audit Committees 2002: Sarbanes-Oxley Act (July 30, 2002) Sarbanes-Oxley - 7 SARBANES-OXLEY Major Objectives Improve corporate governance Reform public accounting (auditing) Reform Wall Street practices Attack insider trading and obstruction of justice (document retention) “Restore confidence in capital markets” Sarbanes-Oxley - 8 SARBANES-OXLEY ACT Major Provisions Title I: Public Company Accounting Oversight Board Title II: Auditor Independence Title III: Corporate Responsibility, Disclosure, and Governance Title IV: Enhanced Financial Disclosures Sarbanes-Oxley - 9 SARBANES-OXLEY ACT Other Provisions Title V Title VI – Analyst Conflicts of Interest – Commission (SEC) Resources and Authority Title VII – Studies and Reports Title VIII – Corporate and Criminal Fraud Accountability Title IX – White-Collar Crime Penalty Enhancements Title X – Corporate Tax Returns Title XI - Corporate Fraud and Accountability Sarbanes-Oxley - 10 PUBLIC COMPANY ACCOUNTING OVERSIGHT BOARD Established by Sarbanes-Oxley Broad powers to regulate audits and auditors of public companies Appointed by the SEC Sarbanes-Oxley - 11 PCAOB Register public accounting firms Establish auditing standards Inspect registered public accounting firms Conduct investigations and disciplinary proceedings – with ability to sanction auditors and audit firms Sarbanes-Oxley - 12 AUDITOR INDEPENDENCE Prohibits certain “nonaudit services” – Bookkeeping, financial systems design, appraisal or valuation, actuarial, internal auditing outsourcing, management or human resources, broker-dealer or investment banking, others per PCAOB Audit committee must pre-approve all auditing and non-auditing services Audit partner rotation – Audit firm rotation was discussed Sarbanes-Oxley - 13 AUDITOR INDEPENDENCE Audit Committee is directly responsible for oversight of external auditors Auditor required to discuss – All critical accounting policies and practices – All alternative accounting and disclosure treatments – Other material written communications “Cooling – off” period – CEO, CFO, Controller, etc. Sarbanes-Oxley - 14 CORPORATE RESPONSIBILITY & GOVERNANCE Audit Committee = independent directors Audit Committee has responsibility to appoint, compensate, and oversee public accounting firm performing the audit Audit Committee has responsibility to resolve disagreements over financial reporting between management and external auditors Audit Committee must establish “whistle-blower” procedures – New penalties for retaliation against them Sarbanes-Oxley - 15 CORPORATE RESPONSIBILITY & GOVERNANCE Requires executives and financial officers (CEO & CFO) to certify financial reports are accurate, complete and fairly presented Also must certify the state of internal controls Outlaws improperly influencing the auditor Sarbanes-Oxley - 16 CORPORATE RESPONSIBILITY & GOVERNANCE Reimbursement of bonuses and profits if public was misled Removal of “substantial unfitness” standard Prohibits trading during a pension “blackout” period Minimum standards for attorneys – Both in-house and outside counsel Any reimbursed funds from guilty parties be added to a fund for the benefit of victims Sarbanes-Oxley - 17 ENHANCED FINANCIAL DISCLOSURES Off-balance sheet arrangements and obligations Prohibits loans to executives and directors Insider trades within two business days Adoption of code of ethics for senior financial officers and requirements Whether at least one member of the audit committee is an “Audit Committee Financial Expert” Sarbanes-Oxley - 18 ENHANCED FINANCIAL DISCLOSURES Reconciliation of non GAAP revenue to most directly comparable GAAP measure Requires management to establish and maintain adequate internal controls and report annually on: – Management’s responsibility for such – Effectiveness of such internal controls Assessment of internal controls by management is to be subject of an attestation report by the external auditor Sarbanes-Oxley - 19 PRIVATE COMPANIES Who Should Adopt SOX May soon go public Contemplating a combination with a public company Large Not-for-profit entities – Audit committees becoming common Significant absentee owners Creditors may require SOX Sarbanes-Oxley - 20 PRIVATE COMPANIES What parts of SOX? More than internal controls Independent audit committees – “Financial expert” – Compensation & funding of committee – Approval of nonaudit services Certification of financial statements Codes of ethics Whistle-blower procedures and protections Sarbanes-Oxley - 21 CORPORATE AMERICA After SOX Must have autonomous & vigorous audit committees – “Take charge” Financial information is inherently judgmental – – – – – – Financial statements are NOT precise Users must appreciate this fact FMV reporting will increase volatility Non-financial disclosures will become more important Auditors’ opinions on overall “fairness” of statements Financial reporting should be as clear and concise as possible Committee for Economic Development March 28, 2006 Sarbanes-Oxley - 22 CORPORATE AMERICA After SOX Give SOX (esp. 404) a chance to work – PCAOB has issued new guidelines – Learning curve effects Excessive executive compensation can be tamed by Compensation Committees Directors must be selected and appraised by independent nominating committees – Issue of Non-Executive Chair – Direct nomination by shareholders Committee for Economic Development March 28, 2006