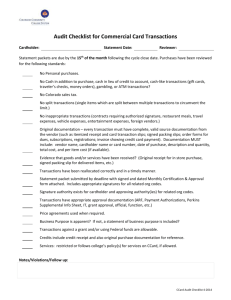

Review Checklist

advertisement

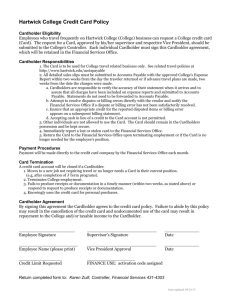

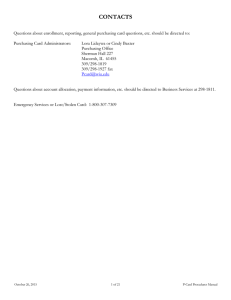

ProCard Reviewer Tips PR001A Procurement Services Montey Caston Updated January 22, 2014 Objective • Understand what a ProCard approvers responsibilities entail. • Learn to use Pathway, cardholder statements and receipts to ensure accurate transaction documentation. Awareness • Ignorance of the law excuses no one • Cardholders and Approvers who accept and use the ProCard are responsible for knowing and upholding policy. Here at DePaul • 835 Active Cardholders • 200 Approving Officials • In 2013 – 72,000 Transactions, $17.6 million – 360 transactions or $88,000 per AO – $245 = average transaction (up from $203) – $321,000 not approved on time – 37% spent from April - June Responsibility of Approver • Determine department’s need of card(s). • Ensure cardholders are compliant with university policies. • Review submitted transactions to ensure proper documentation, appropriateness of business expenses and proper chartfield allocation. • Reject transactions that do not meet requirements and conduct timely follow-up with cardholder. Responsibility of Approver • Have a clear understanding of why each purchase was made and who authorized the purchase. • Ask Questions! • Report any suspected fraud to Procurement Services and Internal Audit. Establishing a Review Process • Managers are the university’s first level of defense. • Determine realistic monthly review processes as well as departmental policy for storing receipts. • Perform random checks outside of regular statement approval timeline. – The threat of a future investigation reduces the occurrence of fraudulent behavior from 75% to only 43%. Accessing the Data • Printed & Submitted monthly cardholder statement • PaymentNet transaction query tool • Other reports & data in PaymentNet • Vendor Receipts Levels of Data • Transaction date, Dollar amount Level 1 • Vendor name, location, category • Purchase ID, sales tax amount Level 2 • Merchant Alias • Item description, unit cost, quantity Level 3 • Passenger name, location and dates of travel Using the Data • Compare data provided by the vendor with information and documents provided by the cardholder. • Line item detail (Level 3) from Pathway, if available, should match original, itemized receipt. • Travel dates and passenger names should match dates of conference and attendees identified in cardholder notations. Reviewing Backup Documentation • Determine acceptable forms of backup. • Know what you’re looking at. • Compare documentation/receipts with other expenses from the same vendor. Is this a receipt? Reviewing Backup Documentation • Receipts confirm payment has been made and the transaction is complete. – They include dates, amount, purchase method, tax amount, shipping amount • Receipts do not include: – Buttons or icons labeled “Submit to order”, “Checkout”, or “Update Shopping Cart”. – Estimated tax – Estimated shipping Additional Areas of Concern • Transactions reported as fraud/disputed – Follow up to see that credit was received – If transaction is fraud, the card should be cancelled immediately • Meals and Entertainment • Travel (Hotels, Airfare & Lodging) • Spending Restrictions – Grants – Alcohol, International Airfare • 3rd Party Reimbursements – Items paid upfront by DePaul but to be reimbursed by a 3rd party (conference dues, meals, etc.) Meals & Entertainment • Review Checklist: – Compare last 4 digits of credit card number on receipt to employee’s credit card number(s). – Check where the receipt was issued, e.g. “Bar,” “Patio Bar,” “Room Service,” etc. – Review the time that receipt was generated and compare to the meal being submitted (Saturday at 9:34 p.m. and identified as lunch?). – Check receipt to see if number in party is identified and compare to list of attendees. – Compare the expenses, receipts, and times for other employees in attendance. Meals & Entertainment • Review Checklist (cont.) – Compare the meal location and time to the employee’s itinerary and schedule. – Does the meal fall on the day of departure or return? – Is the signature authorization receipt the only documentation submitted or is an itemized receipt also available? – Does the receipt include items or charges other than food/drink (e.g. purchase of restaurant gift card along with the meal for personal use at a later time.)? – In addition to the business purpose, are the names, titles, and affiliations to DePaul documented for all attendees? Travel • Review Checklist: – Does the traveling employee name match the passenger name provided by the level 3 detail? – Do the dates of travel match the dates of conference and/or hotel stay? – Is an itinerary the only documentation provided by the cardholder or is a boarding pass also included? – Was this trip preapproved or is there evidence of a clear, legitimate business purpose? – Does this employee regularly purchase airfare or have a history of canceled trips? Hotel and Lodging • Review Checklist: – Are original receipts made available for all expenses? – Are all pages of the hotel invoice present? – Is the itinerary the only supporting piece of documentation? – Check for the number of occupants on the receipt and compare check-in and check-out dates with dates of travel. – Were personal expenses billed to the room? Other Review Tips • Never too busy to avoid accountability. • Get to know the cardholder and understand their role to determine regular spending habits. • Check to see if the cardholder has also submitted expense reimbursements. • Hold all cardholders to the same standards. Who to Call if Fraud is Suspected? • Procurement Services – (312) 362-7510 • Internal Audit – (312) 362-8392 • Misconduct Reporting Hotline – (877) 236-8390 • JPMorganChase – (800) 316-6056 Questions? Q&A