Cancel Your Procurement Card

advertisement

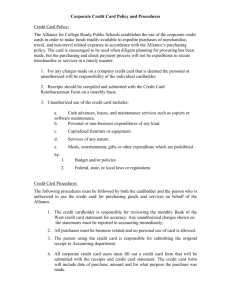

Table of Contents Contents Welcome ............................................................................................................................. 2 Corporate Agreement .......................................................................................................... 2 Activating your Procurement Card ..................................................................................... 2 Fraud Prevention ................................................................................................................. 3 Procurment Card Holders Responsibilities ......................................................................... 3 Restricted Vendors and Restricted Items ............................................................................ 5 Guidelines for Purchasing on the Internet .......................................................................... 7 Key Information for Purchasing on the Internet ................................................................. 7 Cancel Your Procurement Card ........................................................................................ 10 Report Lost or Stolen Card ............................................................................................... 10 Record Keeping Requirements…………………………………………………………..11 Welcome Welcome to the procurement card program. The following information is intended to help you with many of the questions you may have in the daily use of your procurement card. The office of the Controller has additional information about record keeping at this link: Please note- there is a separate link on this website with the procurement card application. That information is not included within this document. Corporate Agreement The agreement between Indiana State University and JPMChase Card Services is a corporate agreement. The credit of Indiana State University is used for the procurement card program. This means: 1). Cards issued to an individual are not reported as credit of the individual cardholder. 2). No information from the individual is shared or sold by JPMChase Card Services. 3). No credit check or verification is run by JPMChase Card Services on the individual cardholder. Activating your Procurement Card You must contact JPMChase card services to activate your card. The number to call is on the sticker which is located on the front of your new card. You MUST know your 991 number when you call. Fraud Prevention The cardholder should use basic security measures, as outlined below to guard against fraud. 1. DO sign your card as soon as it arrives. 2. DO keep the card in a secure location: guard the card number carefully. 3. DO save receipts and Expense Reports in a secure area, they may contain your card number. 4. DO keep an eye on the card during the transaction, and retrieve it as soon as possible. 5. DO always know where your card is. If you can’t find the card, assume the worst, have your account cancelled and request a new card. 6. DO audit your Expense Report every month closely. Make sure all charges shown are legitimate charges. 7. DO visit reputable, familiar merchants whenever possible. 8. DO report fraud immediately to Procurement Card Administrator. 9. DO NOT discard credit card slips in public areas, destroy them. Thieves can acquire your card number from receipts, slips and statements. 10. DO NOT lend your card to anyone 11. DO NOT give your card number to anyone over the phone unless you know you are dealing with a reputable vendor. Procurment Card Holders Responsibilities I agree that I have reviewed the complete program rules on the following website: http://www.indstate.edu/purchasing/ I understand those requirements and agree to abide by the program rules and regulations. I also have reviewed the information on the following website: http://www.indstate.edu/controller/finance/recordkeepingProcedures.htm#rules regarding statement reconciliation procedures, I understand those requirements and agree to follow those procedures. I have also reviewed the information below: The Purchasing Credit Card (“procard”) is intended for University purchases only, I may not make any personal purchases on the card (and I may not make personal purchases on the card and reimburse the University). I realize that personal use of the card will require reimbursement and may lead to disciplinary action. Restricted Items (may NOT be purchased on the card) Alcoholic Beverages Capital Equipment Consultant fees/honorariums Entertainment Costs Weapons/Ammunition Maintenance Agreements Controlled Substances Radioactive isotopes (prescription drugs, narcotics) Travel (except Custom Logo Items registration) Cash Advances Personal Services Gasoline/Oil Works of Art Gifts Telephone Service (local/cell) The card is to be used by the named cardholder only and is not to be loaned to another employee If lost or stolen, the cardholder MUST immediately report the missing card to Mastercard. The cardholder must also report the missing card to Purchasing the next business day. Call 1-800316-6056 to report a lost or stolen card to Mastercard. This telephone number will be available 7 days a week, 24 hours a day be calling Public Safety at 812-237-5555. The cardholder agrees to maintain a register of purchases and receipts for all purchases made. Receipts must be descriptive; listing items purchased, quantity, price and vendor name. Purchases made with this card should qualify for the institutional sales tax exemption. Is sales tax is charged, cardholder must go back to the vendor to get credit for any sales tax amounts. I must attend a meeting prior to receiving my purchasing card. I will inform my Supervisor that he/she must approve the issuance of a card to me and that he/she assumes overall responsibility for the card when authorizing the issuance of the card to me by confirming the email request he/she will receive. I must return the procard to Purchasing prior to my termination date. Except under extenuating circumstances, this will be done at least a week prior to my termination date. I have informed my department that the department is responsible to return the card to Purchasing if I fail to return it or if I am unable to do so. Non-adherence to any of the above procedures (and the procedures enumerated on the websites of Purchasing and the Controller’s Office noted above) may result in revocation of individual cardholder privileges in revocation of all division and/or departmental credit cards, and may include disciplinary action, up to and including termination of employment. As holder of this credit card, I agree to accept the responsibility for the protection and proper use of this credit card as enumerated above and to comply with the Terms and Conditions of the program. I acknowledge I have attended a training session regarding card use and have been informed that additional information about the program is available on the Controller’s Office and the Purchasing Department website. Restricted Vendors and Restricted Items There are two types of controls on purchases. One is restricted vendors. If a vendor has a vendor code that is restricted by the University, your card will not work if a purchase is attempted from that vendor. An example is bars and taverns. Indiana State University’s card will not work if a vendor has a vendor code of a bar or tavern. Another limitation is prohibited purchases. All personal and travel purchases are prohibited. A purchase may be prohibited, but might work depending upon the vendors code. Indiana State University restricts the following vendor codes: • • • • • • • • • • • • • • • • • • • • • Airlines, Automobile/Vehicle rentals Hotels and Motels Railroads Transportation suburban and commuter passenger, including ferries Duty Free Stores Limosines and taxicabs Cruise lines Boat leases and rentals Marinas, Marine service/supplies Air Carriers, Airlines not elsewhere classified Airports, airport terminals, flying fields Travel agencies and tour operators Transportation services not elsewhere classified Boat Dealers Motorcycle shops and dealers Motor Home Dealers Snowmobile Dealers Bars, cocktail lounges, discotheques, nightclubs, and taverns. All drinking places. Quick pay service Financial institutions, cash advances, travelers cheques, securities, insurance, etc. Package stores, beer, wine and liquor • • • Automobile Rental Agencies Gasoline Stations and Self Service Pumps Foreign Purchases (all foreign exchanges) The following items/transactions are prohibited: • Any travel including registration except registration • Alcoholic beverages • Any capital equipment • Cash advances • Computers • Consultants and speakers fees/honorariums • Controlled substances (prescription drugs, narcotics, etc.) • Entertainment Costs • Weapons/Ammunition • Works of Art • Musical Instruments • Personal Purchases • Personal Services • Maintenance Agreements • Gasoline/Oil (except small quantities for non-vehicle use) • Radioactive isotopes • Gifts • Local or cellular telephone service • Items requiring the use of the University logo, including the words Indiana State University or letters ISU. • Ordering from an online auction. • Splitting purchases to “get around” your per transaction limit. Paypal Guidelines for Purchasing on the Internet Cardholder must abide by the same guidelines he/she agreed to on the Procurement Card Application Cardholder has reviewed internet security guidelines The internet site for purchases is secured with safe electronic safety(Secure Sockets Layer or Secure Electronic Transmission protocol- see attached). Key Information for Purchasing on the Internet Always use a secure web browser Know your merchant Obtain and retain receipts Keep current with web security information Understand troubleshooting Always use a secure web browser Using Netscape Navigator version 2.0 (or later version) or any version of Microsoft Internet Explorer as your browser provides you with an added level of security when shopping on the internet. These browsers use Secure Socket Layer (SSL) technology, a proven and easy-to-use system that lets your browser automatically encrypt or scramble your personal data before sending it to the merchant via the Internet. SSL shows you that a website is secure when a lock appears in your browser window at the bottom of your screen. If an unlocked lock, or no lock at all appears, you are NOT in a secure location. You can also look at the URL, or internet location, to verify the SSL protocol is in place. Most URL’s start with http://, but when a site is secure, the URL will start with https:// (s stands for secure). Know your Merchant First, don’t give out your credit card number online unless you have read and understand the company’s privacy statement, disclaimer, terms and conditions, warranties and that the merchant offers secure shopping technology like SSL or Secure Electronic Transaction (SET). SET is an added layer of protection that is emerging as an industry standard to make online purchasing safer than ever. Some sites may claim to be encrypted, when they actually are not. If you are not sure, select another vendor. You can check Yahoo! Shopping which lists many of the online merchants who use secure technology for safe electronic transactions. (others may have similar lists). Second, don’t judge reliability by how nice or flashy a website may seem. Anyone can create, register and promote a website; it’s relatively easy and inexpensive. Most legitimate merchants list their address, phone number, and/or contact person. Third, online auction sales remain the number one internet fraud reported to the National Consumer league’s Internet Fraud Watch. Indiana State University prohibits the use of any credit card for all online auctions. Fourth, know the vendor’s return policies. Who pays freight? Must product be returned in original, undamaged box? Are returns accepted? Is a return authorization number required? Returns are the biggest fault of some internet suppliers. Last, if you have questions about a merchant, you can contact a buyer in Purchasing for advice or check the company’s complaint record with the Better Business Bureau. (see web address in last section of this document). Obtain and retain receipts Every type of purchasing card transaction must have a receipt. An acceptable receipt for an Internet purchase includes a screen copy of the order from and/or confirmation you receive from the merchant verifying that they received your order. You may receive this confirmation immediately following the submission of the order or it may be sent to your email address later. Internet receipts must be files with your monthly reconciliation just as any other receipt would be filed. Understand Troubleshooting If you have placed an order online with a merchant and one or more of the following occur, call JPMChase immediately to cancel your credit card. Also e-mail and call Ernie Kramer in Purchasing AFTER you have requested your card be cancelled by the bank. You don’t receive the order within a reasonable amount of time (generally two weeks) and you are not receiving returned phone calls from the vendor. The phone number on the website is no longer a working number You hear the merchant went out of business. Ernie Kramer ext 3600 ernie.kramer@indstate.edu JPMCHase to cancel card (report lost, stolen, or suspected misuse per above) 1-800-316-6056 Protect yourself with current information. Links to stay informed (not in priority order) 1. www.consumer.gov Federal agency website provides consumer information 2. n and publications. 3. www.bbbonline.org Better Business Bureau 4. http://uk.shopping.yahoo.com Internet shopping advice. Cancel Your Procurement Card A card may be cancelled at any time. It must be cancelled prior to termination of employment with the University. To cancel a card, fill out the procurement card cancellation form on this website and hand deliver it to Purchasing along with the card to be cancelled. The cancellation form is available on the Purchasing website under JPMChase. Report Lost or Stolen Card Note: if card is lost or stolen call JPMChase Card Services immediately at 1-800316-6056 . Then call Purchasing and send an e-mail to ernie.kramer@indstate.edu. If you suspect the confidentiality of your card number has been compromised, treat it as a lost or stolen card. Public Safety will keep this lost/stolen card number on file and available by calling their 24 hours per day hotline at 812-237-5555. You are still responsible to call JPMChase Card Services, even if you call Public Safety to obtain the number. If a card is stolen, in addition to reporting to JPMChase Card Services (1-800-316-6056 ), the card must be reported to the law enforcement agency in charge of the jurisdiction where the card was stolen. The cardholder must request a report number from the officer writing the police report and a copy of the number submitted to Purchasing when requesting a replacement card. If your card is stolen from on campus, or from an unknown location, contact Public Safety at 911 (from a campus phone ONLY). Call 237-5555 if calling from an outside phone. If you lose your card, report it to the Public Safety Office. (Some law enforcement agencies do not take a report on a lost card). A report number will be issued by Public Safety. To obtain a replacement card, a police report number will be required in all cases. Record Keeping Requirements Procurement Card Recordkeeping Responsibilities Cardholders should always obtain an original itemized vendor receipt for each transaction. If a cash register tape does not have descriptions, write them on the tape. The first transaction without proper substantiated receipt, the cardholder will have to complete an affidavit (Missing Vendor Receipt form). This is a one-time only form. Any further missing itemized receipts are to be repaid by the cardholder to the University. a. b. c. d. e. Itemized Vendor Receipt: Is defined as an original invoice, original cash register receipt, original sales slip, or original packing slip which contains an itemized list of goods purchased, with dollar amounts, and the name and location of the supplier. An employee of the supplier must sign handwritten receipts. Internet Purchases: At least ONE of the following types of documentation is required. We prefer that you use the top of the receipts from the top of the list. 1. Original itemized invoice or packing slip. 2. Print out of the online order confirmation. 3. Print out of the email confirmation. 4. Print out of the completed online order form. Purpose of Purchase: We need the University business purpose of the purchase to determine the appropriateness of the purchase. You will need to enter this information on your transactions at https://sdol.mastercard.com/jpmorganchase here on a weekly basis. Registrations: You can now pay for all registrations with the procurement card. 1. Registrations when the employee travels. When the registration is for out of town conference to pay for the registration, there must be an approved travel authorization in place. When the transaction is posted to the JPMorgan Chase website (SDOL), you will have to change the account code from your default account code to 70890 and enter your travel authorization number in the field TA/Encumbrance #. For the purpose of the purchase, you will enter the traveler’s name. 2. Registration when the employee is staying at Indiana State University. For conference and webinar/teleconference registration, you will not have to have a travel authorization. When the transaction is posted to the JPMorgan Chase website, you will have to change the account code from your default account code to 70579. For purpose of the purchase, you will enter the employee’s name and the conference or workshop name. Sales Tax: Indiana State University is exempt from sales tax. Indiana state sales tax charges should not be accepted on Procurement Card purchases. The University’s tax exemption nmber is on the face of the Procurement Card. You, as the cardholder, need to be sure that the vendor does not charge you sales tax. We are NOT exempt from all types of taxes. And we are NOT exempt from the sales tax on food purchases at restaurants. f. Purpose of the Purchase: We need the purpose of the purchase to determine the appropriateness of the purchase. You will need to enter the information for your transactions on SDOL in the field “Expense Description” under the Financial tab and then Account Summary. This should not be a list of what was purchased or a person’s name, but rather why you are purchasing the items. g. Expense Report: This report is your credit card statement. This report contains transactions, purpose of purchases, and fields for cardholder and reviewers signatures. The cardholder can print your expense Report from SDOL website after the 20th of each month. h. Reconciliation: It is the cardholder’s responsibility to reconcile all purchases with the Expense Report. The cardholder will match the Expense Report transactions with the original itemized receipts. Any discrepancies are the cardholder’s responsibility to correct by contacting the vendor within 30 days of the end of the billing cycle. The cardholder will sign and date the Expense Report with the original itemized receipts and forward them to the Departmental Reviewer within 30 days of the end of the billing cycle. i. Departmental Reviewer: The Departmental Reviewer should also reconcile the Expense Report transactions with the original itemized receipts. The Departmental Reviewer should be the departmental head or some he/she designates to be the Department Reviewer of the cardholders. The Departmental Reviewer should be someone that is financially qualified to understand the reason for the purchase and knows whether the purchase is for the department’s benefit. The Department Reviewer will be responsible for seeing that the reconciliation of the Expense Report with the original itemized receipts is completed. Then sign and date the Expense Report and forward the Expense Report with the original itemized receipts to the Procurement Card Auditor within 30 days of the end of the billing cycle. Procurement Card Audit Process All Procurement Card transactions will be audited. The Internal Auditor of the University or the State Board of Accounts (state auditors) will select a number of cardholders to audit for appropriateness of transaction and record keeping procedures. Procurement Card auditing procedures are established to verify that the Procurement Card is being used appropriately by the cardholder, that the cardholder and the department are maintaining the records. Procurement Card audit issues are described below: a. The following non-complaint situations may result in cancellation of the cardholder’s card. 1. Inadequate documentation to support the purchase. 2. Inappropriate Purchase which does not benefit the department or the University. 3. Purchases split to get around the maximum transaction amount. 4. Expense Reports that have not been reconciled by the cardholder or Departmental Reviewer. 5. The reconciliation was not done within the 30 days from the end of the billing cycle. b. Cardholders may be subject to disciplinary action, including termination, for the following non-compliant situations. 1. Use of the procurement card for personal purchases. 2. Not reporting a lost or stolen procurement card immediately. 3. Other excessive violations of Procurement Card policies. c. For violations of the policy, you will be notified and given one week to correct the violation. If not correct by the cardholder within the deadline, the cardholder will be notified and given one more week to correct the violation. The cardholder’s supervisor will be notified on the second notice. At the end of the second notification period if the violation has not been correct, the cardholder’s Procurement Card limits will be lowered to zero until the violation is corrected and audited by the Procurement Card Auditor. Once the violation has been corrected and approved by the Procurement Card Auditor, the cardholder limits will be raised back to the defaulted limits, and the restrictions will be lifted.