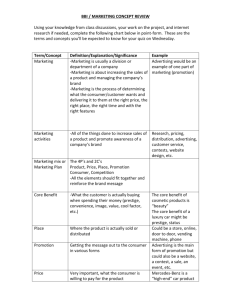

Document

advertisement

Soap Industry P R E S E N T E D B Y: A B I G A I L C L I F F O R D, T E S S B E R G H O F F, M A H A K G O E L , U D E M E A K PA E T E Why the Soap Industry? Interesting Product positioning comparable to diamond industry Relatively inelastic demand Homogenous nature demands unique advertising Differentiation based on brand image Traditionally steeped in negative advertising Industry Background ABIGAIL CLIFFORD Industry Background Soap is a multi - billion dollar industry Majority of soap is sold in supermarkets and mass merchants Total number of units sold each year is 3.1 million (10 billion pounds) Hotels discards 2.6 billion bars of soap every year Humanitarian efforts for washing hands History Production began during the colonial times where main ingredients where in abundance Remained a locally produced good until Revolutionary War Early 19th century and the rise of the Textile Industry stimulated the rise of soap making firms By the early 1840s Cincinnati became the soap industry leader containing 17 companies including Proctor & Gamble No Advertising, No Branding, Small Firms Post Civil War Emergence of brands and product differentiation Advertising became the biggest innovation Invention of radio created a new avenue of advertisement P&G pioneered radio advertising through creating daytime serial dramas By 1962 soap firms were spending 250 million annually on advertising 90% on TV P&G spending 190 million Todays Market Aging population has paved the way for new companies and increased product differentiation Rising germ free attitude Increased preference towards liquid soap over bar soap Innovation in firms to create soaps with dual purposes Brand Market Share Other 29% Dove 21% Dial 14% Olay 6% Caress 6% Irish Spring 7% Soft Soap Lever 2000 9% 8% The industry 650 establishments in the US alone The change in the millennium market creates slightly easier entry through change in preferences and innovation Still highly competitive No government regulations Success comes from businesses of scale Advertising Differences WOMEN Advertise to achieve emotional response Highly combative through comparative advertising Easy to repeat innovative additions to product MEN Focus on overall image Offer many more aspects to brand More persuasive than combative Scent of product large factor Organization Profitability of individual companies depends on efficient operations and effective sales and marketing Pricing set by the firms The top 50 companies control 90% of revenue Most firms manufacture in similar manners US is the biggest consumer of soaps P&G In August they began to streamline their brands down to their 80 most profitable Their company market share is divided into personal care 35%, food 28%, homecare 18%, and refreshment 19% The overall goal is to reduce carbon footprint through innovation and sustainability In 2014 they recorded 81 billion in sales Unilever Unilever is a Britain founded multinational company 400 brands focused on health and well being In 2014 they recorded a profit of 48.44 billion euros Revenue of personal care products 17,739 billion euro Skin care and hair care market worldwide 12.9% Grocery store market world wide 50.1% Personal Care Foods Refreshment Home Care 18% 36% 19% 27% Industry Market Share Others Private Label5% 7% Johnson & Johnson 7% Colgate Palmolive Co. 8% Unilever 42% Henkel Group 11% HHI= 2200.14 (Highly Concentrated) Procter & Gamble 20% Unilever Procter & Gamble Henkel Group Johnson & Johnson Private Label Others Colgate Palmolive Co. Female Personal Care Brands TESS BERGHOFF Dove Subsidiary of Unilever Founded in 1957 Dove Beauty Bar Headquartered in the United Kingdom Target Market: Women 20-40 Estimated $5.8 Billion brand value Dove Advertising ◦ Original focus on product attributes ◦ Ads featured traditional models ◦ 2004 Campaign for Real Beauty ◦ Celebration of diversity ◦ Widen definition of beauty Dove Advertising Dove ‘Beauty Sketches’ 114 Million Views in one month Lead to 4 Billion blogger media impressions Dove Advertising Social Media Presence ◦ ◦ ◦ ◦ 23 Million Facebook followers 164,000 Twitter followers Interactive Community #choosebeautiful campaign Dove Advertising Corporate Social Responsibility Advertising Goodwill ◦ Image Acceptance ◦ Breast Cancer Campaign Launched ‘Movement for Self Esteem’ in 2010 ◦ Partnered with the Global Advisory Board, Boys & Girls Club, Girls Inc, and Girl Scout Olay Subsidiary of Proctor & Gamble Founded in South Africa in 1953 “anti-aging” fluid Acquired by P&G in mid 1980s Target: Women 30-50 Estimated $4 Billion brand value Olay Advertising ◦ Focus on Elegance and Exclusivity ◦ Adherence to Traditional Beauty Standards ◦ Models and Celebrities Olay Advertising ◦ 2012 Launch of Olay Essentials ◦ Attempt to target a younger customer base ◦ Launch of mobile app and advertisements Olay Advertising ◦ 2014 ‘Your Best Beautiful’ Campaign ◦ Campaign Ambassador Katie Holmes ◦ “I want to have skin like a royal” Olay Advertising Online Social Media Presence ◦ 6.3 Million Facebook followers ◦ 100,000 Twitter followers ◦ ‘Olay for you’ website & mobile app Male Personal Care Brands MAHAK GOEL Axe Overview Subsidiary of Unilever First launched in 1983 in France Target Market: Men 18 – 30 Estimated Brand Value: $421 Million Products: Deodorants, shampoo, shower gel, aftershave, cologne, skin care, hair styling products Axe Advertising The Axe Effect Campaign Popularity increased in 2000s in America Main focus is how the everyday man is irresistible when he wears Axe Heavy use of models Sex Appeal Axe Advertising Axe Social Media Shower Pooling Campaign Facebook Likes: 4M Twitter Followers: 135 K Axe SWOT Strengths Fragrance Brand positioning Variety of product International reach Availability Weaknesses Narrow Target Expensive Sexual Appeal Products overlooked Design Opportunities Large product line for men International expansion Brand image in sports Social media expansion Threats Competitors Focused solely on sex Degrades women Old Spice Advertising Founded by the Shulton Company Introduced Early American Old Spice for Women in 1937 Closely followed by Old Spice for men in 1938 Bought by Proctor and Gamble in June 1990 Target Market: Men 18 onward Estimated Brand Value: $903 Million Products: shaving cream, aftershave, deodorant, body wash, and body spray Old Spice Advertising The Man Your Man Can Smell Like Campaign Marketing to Women for Men’s Products Heavy focus on masculinity Celebrity Endorsement: Former NFL Player Isaiah Mustafa Humor Advertising Old Spice Social Media Response Campaign in 2010: Answering Twitter and Facebook Queries Over 180 short commercials Targeted social media celebrities, such as Ellen DeGeneres Personalized ads Raw Data Analysis U D E M E A K PA E T E Sales in the Industry Average Amount per Ad $250,000 $229,557.14 $200,000 $150,000 $100,000 $84,300.00 $54,670.21 $50,000 $0 Dove Axe Brands Old Spice Average Advertising Time 17 16.5 Seconds 16 15.5 16.49 15 14.5 15 14 Old Spice 15 Axe Brands Dove Old Spice Primetime Advertising Old Spice Advertising • Majority of prime time advertisements took place on sports related programming Programs Advertised On WORLD SRS GAME 5 BROOKLYN NINE-NINE-FOX GOTHAM-FOX NBA BSKB PLYFF GM NFC CHMPSHP GM 0 0.5 1 1.5 2 Number of Advertisements 2.5 Axe Primetime Advertising Programs Advertised On SATURDAY NIGHT CLG FTBL 5 NBA COUNTDOWN-ABC 1 NBA BSKB PLYFF GM 1 NCAA BB PLYF GM 1 • All of the advertisements took place during sports-related programs • Reinforce males as target audience Number of Advertisements Dove Primetime Advertising • Advertised on 100+ shows during primetime • Indicative of wide audience reach • Larger target audience Olay Primetime Advertising 5 4.5 4 3.5 3 2.5 No soap advertisements by Olay during prime time 2 1.5 1 0.5 0 Category 1 Category 2 Series 1 Series 2 Category 3 Olay • “Age is the enemy” • Age renewal, vanishing creams • Brand image has trickle down effect to their soap brand Target AudienceMiddle Age women hoping to retain youth Recommendations Olay Look for growth potential in soap segment Axe Show more initiatives towards CSR Engage the female audience to buy for significant others Old Spice Introduce “traditional” line, catered to men 40+ Capitalize on gaps in market for older men Recommendations Industry React to sluggish sales for bar soap, shift emphasis Complementary Advertising (Health & Beauty) Cater towards a larger ethnic audience Questions? Thank you!