- Syneratio

advertisement

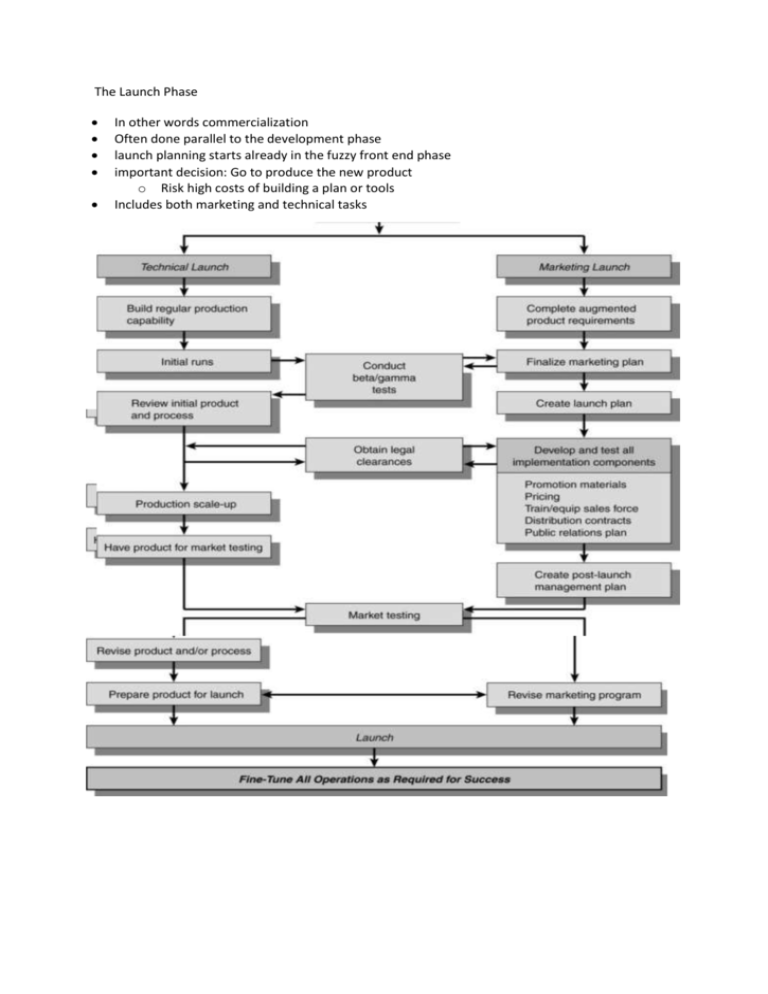

The Launch Phase In other words commercialization Often done parallel to the development phase launch planning starts already in the fuzzy front end phase important decision: Go to produce the new product o Risk high costs of building a plan or tools Includes both marketing and technical tasks There are two type of launch decisions: Chapter 16 Strategic platform decisions Type of demand sought Different levels of product newness require different kinds of impact the launch activities must have on demand o New-to-the-world product develop an entry strategy with the emphasis on stimulating the primary demand o Product improvement Customer migration the goal here is to stimulate replacement demand o new entry in an established market selective demand (drawing market share away from competition). Permanence in to stay the market versus temporary market Aggressiveness When to spend promotional dollars , fast versus slow deletion (schrappen van product/promotie) Competitive advantages (Price vs differentiation vs both) Cannibalization technologically strongest firms cannibalize their own products and production processes with newer, higher performance versions. scope of market entry (country,city,the world) Image (new vs existing) Competitive relationship (don’t destroy own business or other companies) Ways to segment of a market End use market Geographic and demographic market Behavioral and psychographic market ( Lotus notus (communicate in groups across great distances / Kevlar vests)) Benefit segmentation (identify segments according to customer research study) Micro markets specifieke markt Mass customization Specifiek product gemaakt voor een individu Collaborative customizers work with the customer in arriving at the optimal product. Japanese eyewear retailer Paris Miki inputs customer frame style preferences with facial features into a design system that makes frame and lens recommendations, which are further refined by customer and optician working together. • Adaptive customizers let the customers do the customizing themselves according to their performance needs • Cosmetic customizers sell the same basic product to different segments, but adapt the product’s presentation (such as its promotion or packaging) depending on segment needs. For example, Wal-Mart likes larger sizes of Planter’s Nuts than does 7-Eleven • Transparent customizers do not inform their customers that they are customizing the product for them. ChemStation formulates industrial soap specifi cally to its customers’ needs but packages everything it sells in the same kind of tanks. In this case, the customer cares about whether the product works and is delivered on time, not necessarily whether it is customized. Virtual product testing virtueel testen product in de markt Product characteristics that measure how soon a new product will diffuse into the Marketplace Relative advantage compatibility complexity divisibility(triability) how easily can trial portions of the product be purchased and used communicability(observability) see the benefits of the product Product life cycle Innovators early adopters early majority late majority laggards Product positioning ‘Buyers in the target market should buy our product rather than competitors’ products because: Unique product attributes (features, functions, benefits) Surrogates or metaphors (e.g., ‘developed by health specialist’, ‘used by professional athletes’) Brand = name, logo, image, values Every new product must be identified and the accurate term for what identifies products is trademark. Business have trade names. Brand equity value built by a company that provide value to both the firm and its customers as they communicate quality , build positive brand images and encourage customer loyalty Branding strategy (company, umbrella, individual brands) Trademarks and registration Good brand name (international, manage associations) Manage brand equity (value of a brand) Nonpareil: . . . because the product has no equal; it is the best (Jaguar cars and Perrier water are sold this way). Parentage: . . . because of where it comes from, who makes it, who sells it, who performs it, and so on. The three ways of parenting positioning are brand (Le Temps Chanel timepieces), company (“Everything we know about peanut butter is now available in jars” for Reese’s peanut butter, Manufacture: . . . because of how the product was made. This includes process (Budweiser beer is beechwoodaged), ingredients (Fruit of the Loom panties of pure cotton), and design (Audi’s engineering). Target: . . . because the product was made especially for people or firms like you. Four ways are end-use (Vector tire designed especially for use on wet roads), demographic (several airlines have service specially designed for the business traveler), psychographic (Michelob Light for “the people who want it all”), and behavioral (Hagar’s Gallery line for men who work out a lot, “fi t for the fi t”). Rank: . . . because it is the best-selling product (Hertz and Blue Cross/Blue Shield); not very useful on a new item unless also positioned under parent brand. Endorsement: . . . because people you respect say it is good. May be expert (the many doctors who prescribed DuoFilm wart remover when it was prescription-only) or a person to be emulated (NEC cellular phone keys were designed for Mickey Spillane). Experience: . . . because its long or frequent use attests to its desirable attributes. Modes are other market (Nuprin’s extensive use in the prescription market), bandwagon (Stuart Hall’s Executive line of business accessories are “the tools business professionals rely on”), and time (Bell’s Yellow Pages). The latter two of these are also of limited use on new products. Competitor: . . . because it is just (or almost) like another product that you know and like (U.S. Postal Service Express Mail, just like the leading competitor except cheaper). Predecessor: . . . because it is comparable (in some way) to an earlier product you liked (Hershey’s Solitaires addition to the Golden line). On one end of the spectrum are businesses that put their corporate name on every product they make. This is sometimes called an umbrella brand strategy Chapter 17 Prelaunch building the capability to compete (training of sales and other promotion people, building service capability etc) putting out preannouncements The preannouncement decision is often tied to whether there are network externalities Indirect network externalities sales dependant of complementary products (xbox games in relation with the xbox direct network externalities product sales dependant on the number of people that have adopted it Preannouncement: Often a planned sequence of announcements Advantages: •Hype interest in the upcoming product •Keep current customers from switching •Encourage prospective customers to wait Danger •Entry blocked by competition (e.g., through aggressive pricing) •Actual launch will be delayed Beachhead landing on enemy soil (starting!) announcement kicks off at the beachhead pha Technical department have in recent years come to realize they didn’t need to have every possible technical capability instead they form Strategic alliances with universities / government units / private research. Promotion & Pricing Advertising (creating awareness to stimulate trial) Coupons (reinforce awareness, stimulate trial) Publicity (education for radical innovation) Sampling (experience advantage through usage) Introductory pricing (skimming vs. penetration) Price administration (rebates or money back guarantees) New product advertising Communicate difference within a specific product category Communicate benefits of the product difference Communicate support for benefits Communicate relevance of benefits Stimulate (captures attention, amusing, fun to watch) Sales & distribution Shows / demonstrations (clarifying advantage, use) Technical support (incompatibility in usage process) Distribution structure (direct vs. indirect channels) Intensity of coverage (maintenance service) Distribution incentives (stimulate availability) Barriers to trial Lack of interest in the claim Lack of belief in the claim Rejecting (an attribute of) the product Competitive ties Doubts about trial Lack of usage opportunity Cost Routines Relative advantage & compatibility One sequence of periods goes like this: (1) nondisclosures; (2) product testing—beta testers sign confidentiality forms; (3) anticipation— position releases telling about the problem being solved; (4) influentials—press kits for editors, industry researchers, and some customers; (5) broadcast PR—full press releases, product for reviews; (6) promo pieces—the start of advertising. Stages 3 and 4 are used for preannouncements, usually subtle signaling, • The innovative new product. For some products, the strategic objective is to get a foothold in the market early in the product life cycle. Common tactics accompanying this kind of launch are a broad product assortment, a new brand name and distribution channels, and a higher price. • The offensive improvement. The strategic objective here is different: to erect barriers to entry. Managers find it more beneficial to use existing distribution channels, high consumer promotion and advertising, and a broad product assortment. • The defensive addition. For other products, the strategic objective is to increase penetration in existing markets; appropriate tactics include smaller assortments, penetration pricing, and promotions to the customer and the sales force. 8 In several nonfood product categories, the practice of stocklifting is spreading. As an example, Midwest Quality Gloves purchased from Lowe’s Home Improvement Warehouse 225,000 pairs of garden gloves made by its competitor, Wells Lamont, thus clearing the shelves to fill them with its own product. The Chapter 18 Market testing check if the market wants your product before spending a lot of money test marketing sell the products in 2 cities as a test Methods: Pseudo Sale o (speculative sale (would you buy?), o simulated sale(false buying situation and observe what they do) Controlled Sale o informal A type of market test in which one or a few salespeople make calls on intended market users and full presentations are made. There is actual request for the order. However, product has not been released to the full sales force, o direct marketing is een Engelse term voor reclame maken voor producten door potentiële klanten direct en persoonlijk te benaderen. o minimarket beschikbaar in 1 of 2 wall marts Full Sale (test marketing, rollout) Insights gained: Solid sales forecasts with greater accuracy Diagnostic information to revise or refine any aspect of the launch Take action based on market test results! Many firms have replaced the traditional test market with a product rollout (initially limited-distribution sale, gradually expanded to the full market). Test marketing refers to that type of market testing in which a representative piece of the total market (usually, one or more metropolitan markets in and around cities) is chosen for a dress rehearsal Test marketing is not dead, but marketers now prefer a market testing method called rollout. It gives the dress rehearsal value of a test market but avoids many of its problems. It is sometimes called tiered marketing or limited marketing. Indeed, many fi rms will say they do not do market test, but frequently use rollouts. A rollout has many advantages. The biggest are that it gives management most of the knowledge learned from a test market, it has an escape clause without losing the full budget if things bomb, and yet we are well on our way to national availability as early rollout results start coming in Chapter 19 The launch management system Spot potential problems Select those to control o Consider expected impact/damage Develop contingency plans for problem management Design the tracking system o Select variables o Devise measuring system o Select trigger points Fourth, it is helpful to start with a satisfi ed customer or industrial user and work back from that satisfaction to determine the hierarchy of effects necessary to produce it. On consumer packaged goods, this hierarchy is the same one used earlier in the A-T-A-R model 1. Spot potential problems. The first step in getting ready to play NASA on a new product launch is to identify all potential weak spots or potential troubles. These problems occur either in the firm’s actions (such as poor advertising or poor manufacturing) or in the outside environment (such as competitive retaliation). As one manager said, “I look for things that will really hurt us if they happen, or don’t happen.” 2. Select those to control. Each potential problem is analyzed to determine its expected impact. Expected impact means we multiply the damage the event would cause by the likelihood of the event happening. The impact is used to rank the problems and to select those that will be “controlled” and those that won’t. 3. Develop contingency plans for the control problems. Contingency plans are what, if anything, will be done if the difficulties actually occur. The degree of completeness in this planning varies, but the best contingency plans are ready for immediate action. For example, “We will up commission on the new item from 7 percent to 10 percent, by fax to all sales reps” is a contingency plan. It’s ready to be put to work immediately. “We will undertake the development of a new sales compensation plan” is no contingency plan. 4. Design the tracking system. As with NASA, the tracking system must send back usable data fast. We must have some experience so we can evaluate the data (Is our slow-down in technical service typical on big electronic devices like ours, or do we have a problem building?). There should be trigger points (for example, trial by 15 percent of our customers called on, by the end of the first month). These points (if not met) trigger the contingency plan. Without them, we just end up arguing. Remember, money to execute a contingency plan has to come from somewhere (someone else’s budget), and thus every plan faces opposition from people who want to delay implementing it. Oddly, one problem usually overlooked is the possibility of being too successful. It sounds like a nice kind of problem to have, but it can be expensive and should be anticipated if there is any particular reason to think it might happen The most common company failure is inadequate distribution, particularly at the retail or dealer level. Now we hit perhaps the toughest part of launch management. How will we actually measure whether one of our key problems is coming about? We need relevant, measurable, and predictable tracking variables. A variable is relevant if it identifies the problem, measurable if we can get a statistic showing it is or isn’t, and predictable if we know the path that the statistic should follow across the page. An After Action Review is designed to capture the events leading up to the product launch and to try to understand the thinking behind the actions taken. The goal is to identify what went right (so it can be duplicated) and what went wrong (to identify weak areas in the fi rm’s processes that need to be fixed).