Document

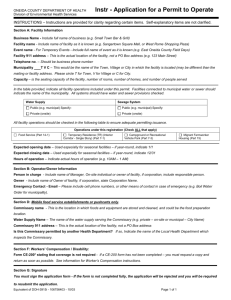

advertisement

Delivering a 21st Century Benefit Through Shopper Insights Chris Burns Director of Sales DeCA’s Vision Understand deliver our customers and a 21st Century Commissary benefit 2 The DNA For Success Articulating the direction and values of DeCA Communications, strategies and metrics to enable internal success and performance Shopper Insights Securing a deeper understanding of patrons’ wants and needs in the shopping experience Concept Team Core team charged with outlining the strategy and rules of engagement New Vision Employee Engagement Industry Engagement Communications, strategies and metrics to enable industry success and partnership 3 Millions Of Data Points To Analyze… 4 Information Drives Decision Making Defense Manpower Data Center (DMDC) American Customer Satisfaction Index (ACSI) Commissary Customer Service Survey (CCSS) Nielsen Homescan Panel Ad Hoc Industry Brand Insights Military Shopper Insights Study (MSIS) Shopper Insights POS and Market Data 5 Shopper Insights Drive Success Our Goal: Integrate, align and apply shopper insights to deliver a 21st century benefit for our patrons 6 Who Are Our Customers Total Eligible (including Dependents) 12.2M Total Eligible Households 5.3M Customers Within 20 Miles 3.1M Source: Defense Manpower Data Center, 2011 Commissary Customer Service Survey 7 Eligible Population Versus Commissary Users We Must Come up With Strategies to Get More Eligible Shoppers into our Stores! Eligible Households Within 20 Miles Commissary Users Source: Defense Manpower Data Center, 2011 Commissary Customer Service Survey 8 Understanding Those Who Do And Do Not Use Their Commissary Benefit Heavy Shoppers Light Shoppers NonShoppers • Spend over $3,000/year in 34 trips • Income: $30 to $50K+ • Age: Under 35 and 55+ (Bi-modal) • Lifestage: Younger Bustling Families and Senior Couples • Spend about $450/year in 7-8 trips • Income: $100K+ • Age: 55+ • Lifestage: Established Couples and Empty Nesters • Eligible shoppers who don’t shop the commissaries • Income: Lower income • Age: No specific age; typically male head of household • Lifestage: Singles and small scale families Source: Nielsen Homescan 52 Weeks Ending 12/31/11 Light Shopper A/O = 26.6%; Heavy Shopper A/O = 18.7% 9 FOCUS: Balance The Scale Light Shoppers New Patrons Welcome! • Source: Nielsen Homescan 52 Weeks Ending 12/31/11 • Light Shopper A/O = 26.6%; Heavy Shopper A/O = 18.7% • Does not include Drug and Dollar visits Heavy Shoppers Heavy shoppers spend over 2X more than total shopper & over 4X more than light shoppers! 10 Segmentation Helps Identify And Target Shoppers Shopper Segmentation A multi-dimensional approach that groups shoppers based on a common set of attributes and behaviors that are actionable. 11 Shopper Segmentation Framework Segment Age Income Family Size DeCA Trip Freq. DeCA Trip Size Store Portfolio Breadth DeCA Loyalty Life Stage Segment One Segment Two Demographic, attitudinal, and behavioral characteristics Segment Three Segment Four 12 Targeting Shopper Segments Military Lifestage/Behavioral Model Single service member • • • • Young unmarried Lower income Male Frequent small convenience trips On-installation family • • • • • Young families Larger households - 2-3 children Lower to moderate income Shared shopping responsibilities Frequent price/convenience stock ups Off-installation family • • • • • Established Families Smaller families with 1-2 children Moderate to upper-moderate income Female primary shopper Less frequent price driven stock ups Retirees • • • • Older empty nesters Wide range of income levels Female primary shopper Infrequent, but regular price-driven stock up trips 13 Marketing To Single Service Members Single Soldier “Stan” My name is Stan. I am a 29 year old male soldier. I grew up in in Oregon, but I am stationed at Fort Sam right now. I am junior enlisted, so I earn less than $30K. Before signing up I completed 2 years of college, which I plan to finish someday. I live in an on-post apartment with a roommate which is convenient, economical and fun. I like the commissary because it is close and convenient (right on my way home after work). I’ll often stop by after work to get something I can make quickly for dinner rather than eating in the chow hall. Key Statistics •Total Spend: $161/mo. •Age: under 30 yrs. •Income: less than $40K •Family Size: 1 •Education: some college •Trip Frequency: 1x/wk+ •Trip Driver: Convenience Source: MSIS, CCSS. I usually don’t buy a lot a one time so I can use the self checkout to get in and out quickly. I also go there occasionally to stock our fridge with food and sometimes spend over $100 on these visits – mostly quick meals and snack items I can make in the microwave. Sometimes we will cook a big meal for a group of friends and the commissary is good for that, too, since it is close, the selection is good and the price is right. Even though I like the commissary I do about half my grocery spending off-post - it is nice to get out of the military environment once in a while. Marketing To On-Installation Families On-Base “Blummers” We are a young family, 33 and 35 years old with three children. Life is hectic, particularly when I am home between deployments. I am proud to serve my country and my family is proud of my service which means a tremendous amount to me. I graduated from college with an engineering degree before I joined the service which has given me great opportunities. I am a mid-level officer and my wife works part time. We are doing OK financially, but need to be careful of what we spend and we use the WIC program to help with our youngest. My wife does a great job of managing our family budget, which is always tight. Key Statistics •Total Spend: $395/mo. •Age: 30-40 yrs. •Income: $40-$90K •Family Size: 2-5 •Education: college grad. •Trip Frequency: 1+ x/wk •Trip Driver: price/conv. Source: MSIS, CCSS. We live on base because it is more economical, convenient to work, and feels safe. We are pretty loyal to the commissary and rely upon it to make ends meet; we go there at least once a week. We like the commissary for its low prices, convenient location, great sales, plus just feeling safer there. However, we still like to explore the variety and take outings to stores off-base where we can be more relaxed. We end up spending about half our grocery dollars there. When we go outside the gate we are typically looking for: • A fun and relaxing environment • Great sales that we have seen in store fliers or websites • Unique or specialty items that are only sold there Marketing To Off-Installation Families Off-Post “Olivers” I would call us a settled family. We are both 38 years old and have 2 kids at home. I graduated from college before the service and my husband got part way through and never went back. Both my husband and I have been in the service for quite a while – I am a mid-level officer and my husband is senior enlisted. With both of us working life is crazy, particularly if one of us is deployed. Even though we both work, money always seems to be tight. We have a budget and are disciplined about following it. We use the commissary for most of our big grocery trips which is about 1 or 2 times a month. It is inconvenient to drive all the way there and deal with getting onto post and the crowds at the store, but we can save over $100 in one trip so it’s worth it. Key Statistics •Total Spend: $390/mo. •Age: 30-50 yrs. •Income: $60-$100K •Family Size: 2-4 •Education: college grad. •Trip Frequency: 1+ x/wk •Trip Driver: price/conv. Source: MSIS, CCSS. Otherwise we shop locally – it’s less stressful, quicker, and if you study the flyers, collect coupons, and look on the stores’ websites you can find good prices there too. As a result we end up spending more than half our dollars locally. The commissary is about saving money – good everyday prices, great sales when you find them and coupons in the store. But it’s not very close to home, takes a long time to get in/out, is crowded and sometimes stresses me out. Has limited hours and I never know what will be on sale so I can’t plan my trip very well. Marketing To Our Retirees Retired “Ron” I retired from the military with 25 years of service so I take advantage of great benefits like the commissary and other base services like the exchange and cheap gas. We are both in our late 50’s and our kids are grown up and on their own. Neither of us ever attended or finished college. With our fixed income, we watch what we spend. We regularly look at all the flyers, coupons we get in the mail, and on-line to help us plan and save money. We are exceptionally proud of being an ex-military family and love to visit the base. It’s a long trip so we usually end up going only about once a month. Key Statistics •Total Spend: $358/mo. •Age: >50 yrs. •Income: $40-$90K •Family Size: 2-3 •Education: college grad •Trip Frequency: 1-2x/wk •Trip Driver: price/pride Source: MSIS, CCSS. The main reason for the trip is stocking up on groceries at the commissary – especially the great deals on meat, frozen foods, and canned goods. We will often end up with two full carts and spend over $300. We particularly enjoy the safe environment, premium brands, coupons in the store, and the good selection. The only challenges are that it is a long drive, takes a long time to get through the store, and we don’t get any information about what is on sale so it is hard to plan our trip. For all our other shopping needs, which includes most of our perishable foods, quick trips between visits to the commissary, and to take advantage of sale items, we will go to the local grocery stores or Wal-Mart. Shopper Insights To Drive And Bring Our Vision To Life Shopper/Patron Segmentation • Who, What, When, Where and Why • Segmentation Model • Go-to-Market Plan Brand Development • Brand Identity • Brand Positioning • Brand Marketing Shopper/Patron Marketing • Message (Brand, Benefit, Education) • In-Home, On-Installation and In-Store • Pre-Trip Planning 18 Current Initiatives To Improve The Patrons’ Experience • Loyalty card being developed – September rollout • Patron Communication of Savings – Store operations utilizing signage to communicate perimeter savings – destination departments • Produce Initiatives – Establishing career path, reviewing both the USDA requirement & physical inventory process • Pre-order / Pre-pay Test for Guard & Reserve Sites • Promotional package being streamlined to enable efficiency at field level 19 Current Initiatives To Improve The Patrons’ Experience • Commissary of the future – Perimeter focus – what should perimeter & center store look like – Store flow, layout and adjacencies being reviewed – Future planogram software will help enable store specifics – SKU optimization continuous – increase in-stock availability – Category indexing & contribution to total sales • Speed to market on new items & approved planograms in place is being emphasized • Marketing plan is being developed to integrate initiatives 20 Complete integrated marketing plan Deploy loyalty card Identify additional initiatives to enhance the instore experience & layout actionable plans FY2013 Identify key strategies & tactics to engage targeted shopper segments Next 180 Days Next 90 Days What We Will Do Next… Begin to execute strategies and tactics to engage targeted shopper segments and enhancement of the in-store experience 21 22