Komputerisasi Akuntansi Keuangan dan Manajemen

advertisement

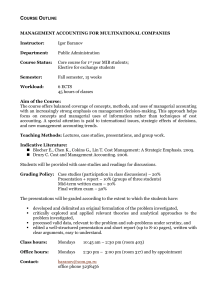

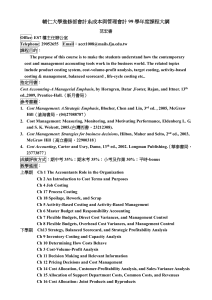

ADVANCED MANAGEMENT ACCOUNTING Definition of Management Accounting: IMA Management accounting is a profession that involves partnering in management decision making, devising planning and performance management systems, and providing expertise in financial reporting and control to assist management in the formulation and implementation of an organization’s strategy. Managerial Accounting as a Career Professional Organizations Institute of Management Accountants (IMA) Publishes Management Accounting and research studies. Administers Certified Management Accountant program Develops Standards of Ethical Conduct for Management Accountants Professional Ethics Ethical business practices build trust and promote loyal, productive relationships with customers, employees and suppliers. Many companies have written codes of ethics which serve as guides for employees to follow. Professional Ethics Competence Confidentiality Integrity Objectivity Resolution of Ethical Conflict Professional Ethics Follow applicable laws, regulations and standards. Maintain professional competence. Competence Prepare complete and clear reports after appropriate analysis. Professional Ethics Do not disclose confidential information unless legally obligated to do so. Do not use confidential information for personal advantage. Confidentiality Ensure that subordinates do not disclose confidential information. Professional Ethics Avoid conflicts of interest and advise others of potential conflicts. Do not subvert organization’s legitimate objectives. Integrity Recognize and communicate personal and professional limitations. Professional Ethics Avoid activities that could affect your ability to perform duties. Refrain from activities that could discredit the profession. Integrity Communicate unfavorable as well as favorable information. Refuse gifts or favors that might influence behavior. Professional Ethics Communicate information fairly and objectively. Objectivity Disclose all information that might be useful to management. Professional Ethics Resolution of Ethical Conflict Follow established policies of your organization. If unresolved or if policy does not exist: Clarify relevant concepts in a confidential discussion with an objective advisor to explore possible courses of action. Discuss problem with immediate supervisor. Professional Ethics Resolution of Ethical Conflict If immediate supervisor is involved in the unethical behavior, discuss at the next level. If problem is not resolved, the last resort is to resign. Generally, do not communicate ethical conflicts to outsiders. Major Themes in Managerial Accounting Behavioral Issues Information and Incentives Costs and Benefits Managerial Accounting Evolution and Adaptation in Managerial Accounting Service Vs. Manufacturing Firms Emergence of New Industries Global Competition Computer-Integrated Manufacturing Change Information and Communication Technology Product Life Cycles Cross-Functional Teams Total Quality Management Time-Based Competition Continuous Improvement Just-in-Time Inventory Focus on the Customer Managerial Accounting in Modern Production Environments • Key developments that reshaped Managerial Accounting include: – Integrated information systems – Web hosting – Just-in-time and lean production – Total Quality Management – Theory of constraints – Benchmarking and continuous improvement The Goal of Good Management is to Create Value • Cost Management is applying the value criteria to every decision we make, every activity we perform, and every process we complete. • Modern accounting systems do not just evaluate good stewardship but must provide managers with the information managers need to improve value. • Management accounting systems are used to enhance both decision making and management control. • Management accounting systems do not need to be perfect, only ‘good enough’ to increase value. New Management Trends to Create Value • Encourage Management Accounting Systems Redesign, for example. – – – – – – – – Customer focus Quality focus Delivery focus Outsourcing and the virtual company Communications Shortening product life cycles Team development Deregulation in the service sector Perubahan Lingkungan Bisnis Menentukan hal apa saja yang tidak perlu dilakukan, bagaimana perusahaan harus dikelola dan bagaimana pekerjaan dilakukan Beberapa praktek manajemen: • JIT (Just In Time) • Manajemen Mutu Total (TQM) • Rekayasa Ulang • Teori Kendala (Theory of Constrain/TOC) JIT (Just In Time) • Sistem Pengendalian Persediaan dan Produksi JIT: >> Membeli BB dan memproduksi unit output sesuai dengan permintaan aktual dari pelanggan >> Persediaan dikurangi sampai pada tingkat minimum (bahkan sampai titik nol) • Dampak JIT (perush. Manufaktur): >> Efisiensi dan mengurangi biaya (penyimpanan dan pemesanan) serta meningkatkan efisiensi dan efektifitas operasi. Bahan bahan baku yang diterima segera masuk ke proses produksi, bahan produksi lainnya segera digabungkan dan dikerjakan, dan produk yang telah jadi segera dikirimkan kepada pelanggan. TQM (Total Quality Management) Perbaikan terus menerus yang memiliki karakteristik : >> Fokus pada pelayanan pelanggan >> Pemecahan masalah secara sistematis dengan menggunakan tim yang ada di garda depan yang dibekali dengan salah satu alat manajemen >> Penentuan tolok ukur (benchmarking) yang dilakukan dengan mempelajari organisasi terbaik yang ada untuk menjelaskan tugas tugas tertentu. Increased emphasis on product quality because goods are produced only as needed Total Quality Management (TQM) - a philosophy of zero defects Gambaran utama TQM adalah meningkatkan produktivitas dengan mendorong penggunaan pengetahuan dalam mengambil keputusan dan menekan perilaku defensif yang tidak produktif. LO 8 Identify trends in management accounting. Rekayasa Ulang Proses (Process Reengineering-PR) Meliputi desain ulang secara menyeluruh proses bisnis dalam rangka menghilangkan aktivitas yang tidak bernilai tambah dan mengurangi kemungkinan terjadinya kesalahan. Rekayasa ulang mengandalkan pada spesialis dari luar perusahaan. >> Merupakan pendekatan yang lebih radikal dibandingkan TQM >> Sebagai ganti perbaikan sistem yang dirancang serial dan bertahap. >> Dalam PR suatu proses bisnis diplot dalam sebuah diagram secara detail, dikritik dan kemudian dirancang ulang untuk menghilangkan langkah-langkah yang tidak diperlukan, mengurangi kemungkinan terjadinya kesalahan dan mengurangi biaya. Proses bisnis adalah serangkaian tahapan yang harus dilakukan untuk menjalankan tugas-tugas dalam dalam suatu bisnis. Teori Kendala (Theory of Contrains/ToC) Menekankan pada pentingnya mengelola kendala yang dihadapai oleh organisasi. Karena kendala adalah sesuatu yang menghalangi organisasi, proses perbaikan akan efektif kalau difokuskan pada kendala yang dihadapi • Teori kendala didasarkan pada pandangan bahwa manajemen kendala secara efektif merupakan kunci keberhasilan Activity-Based-Costing (ABC) Allocates overhead based on use of activities Results in more accurate product costing and scrutiny of all activities in the value chain Balanced Scorecard Evaluates operations in an integrated fashion Uses both financial and non-financial measures Links performance measures to overall company objectives LO 8 Identify trends in management accounting. Review Question Which of the following managerial accounting techniques attempts to allocate manufacturing overhead in a more meaningful manner? a.Just-in-time inventory. b.Total-quality management. c.Balanced scorecard. d.Activity-based costing. LO 8 Identify trends in management accounting. The Strategic Approach to Teaching Management Accounting Topics —An Introduction Strategic Cost Management: Basic Concepts Strategic decision making is choosing among alternative strategies with the goal of selecting a strategy, or strategies, that provides a company with reasonable assurance of long-term growth and survival The key to achieving this goal is to gain a competitive advantage. Strategic cost management is the use of cost data to develop and identify superior strategies that will produce a sustainable competitive advantage. A Model of the Decision-Making Process Competitive Advantage Competitive advantage is the process of creating better customer value for the same or lower cost than that of competitors or creating equivalent value for lower cost than that of competitors. Customer value is the difference between what a customer receives (customer realization) and what the customer gives up (customer sacrifice). The total product is the complete range of tangible and intangible benefits that a customer receives from a purchased product. Michael Porter: Strategic Positioning Cost Leadership—outperform competitors by producing at the lowest cost, consistent with quality demanded by the consumer Differentiation—creating value for the customer through product innovation, product features, customer service, etc. that the customer is willing to pay for Aspects of the Two Competitive Strategies Aspect Basis of competitive advantage Cost Leadership Lowest cost in the industry Often, a limited Product line selection Lowest possible cost with high quality and Production emphasis essential product features Differentiation Unique product or service Wide variety, differentiating features Innovation in differentiating products Marketing emphasis Premium price and innovative, differentiating features Low price Strategic Positioning There are three general strategies that have been identified: – cost leadership – product differentiation – focusing Strategic Positioning A cost leadership strategy happens when the same or better value is provided to customers at a lower cost than a company’s competitors. Example: A company might redesign a product so that fewer parts are needed, lowering production costs and the costs of maintaining the product after purchase. Strategic Positioning (continued) A product differentiation strategy strives to increase customer value by increasing what the customer receives (customer realization). Example: a retailer of computers might offer on-site repair service, a feature not offered by other rivals in the local market. Strategic Positioning (continued) A focusing strategy happens when a firm selects or emphasizes a market or customer segment in which to compete. Example: Paging Network, Inc., a paging services provider, has targeted particular kinds of customers and is in the process of weeding out the nontargeted customers. Consequences of Lack of Strategic CostManagement Information Decision-making based on guess and intuition Lack of clarity about direction and goals Over time, lack of a clear and favorable perception of the firm by customers and suppliers Incorrect decisions: choosing products, markets, or manufacturing processes that are inconsistent with the organization’s strategy For control purposes, cannot link performance effectively to strategic goals … Tools for Integrating Strategy into Management Accounting -- The Value Chain -- Strategy Maps & the Balanced Scorecard (BSC) Introducing Strategy Strengths Weaknesses Strategic Positioning Value Chain Strategy Map Balanced Scorecard (BSC) Opportunities Threats Value Chain Refers to all activities associated with providing a product or service For a manufacturing firm these include the following: LO 8 Identify trends in management accounting. Industrial Value Chain The industrial value chain is the linked set of value-creating activities from basic raw materials to the disposal of the finished product by end-use customers. Fundamental to a value-chain framework is the recognition that there exist complex linkages and interrelationships among activities both within and external to the firm. Value Chain Analysis: A Detailed Look at Strategy… The Value Chain is a linked set of valueadding activities used by an organization to deliver its value proposition to its customers. It consists of: o “Upstream” Activities o Manufacturing/Operations o “Downstream” Activities Value-Chain Analysis Identify value-chain activities Develop competitive advantage by: Identifying opportunities for adding value for the customer Identifying opportunities for eliminating nonvalue added activities and reducing cost Understand linkages among suppliers, the entity, and customers Internal and External Linkages There are two types of linkages that must be analyzed and understood: internal and external linkages. Internal linkages are relationships among activities that are performed within a firm’s portion of the value chain. External linkages describe the relationship of a firm’s value-chain activities that are performed with its suppliers and customers. There are two types: supplier linkages and customer linkages. Strategy Maps & the Balanced Scorecard (BSC) The BSC and Strategy Map are used to align the organization’s activities with achieving strategic goals, using the four perspectives: • Financial • Customer • Internal Processes • Learning and Growth vision & mission Exceed shareholder expectations Financial Customer Diversify income stream Diversify customer base Increase sales volume Improve profit margins Increase sales to existing customers Attract new customers Internal Process Target profitable market segments Develop new products Optimize internal processes Attract new customers Learning & Growth Develop employee skills Integrate systems The Balanced Scorecard (BSC): Feedback to Strategy Strategic Positioning Value Chain Strategy Map Balanced Scorecard (BSC) Activity-Based Costing (ABC), RCA, and TDABC Evolution of Cost Accounting Systems Traditional Costing Resources Allocated to ABC (simple & minimal) Resources Consumed by Resources Consumed by Activities Activities Consumed by Cost Objects ABC (multidimensional) Consumed by outputs Cost Objects channels Cost Objects Users ABC/M Framework What Things Cost Root Causes of Costs Resource Costs Resource Drivers Work Activities Performance Measures Activity Cost Assignment Cost Objects Why Things Cost Activity Drivers •Cost Reduction •Process reengineering •Cost of quality •Continuous improvement •Waste elimination •Benchmarking •Design for manufacturing Better Decision •Make versus Buy Making Organizational Activities and Cost Drivers Organizational activities are of two types: structural and executional. Structural activities are activities that determine the underlying economic structure of the organization. Executional activities are activities that define the processes and capabilities of an organization and thus are directly related to the ability of an organization to execute successfully. Organizational Activities and Drivers Structural Activities Building plants Management structuring Grouping employees Complexity Vertically integrating Selecting and using process technologies Structural Cost Drivers Number of plants, scale, degree of centralization Management style and philosophy Number and type of work units Number of product lines, number of unique processes, number of unique parts Scope, buying power, selling power Types of process technologies, experience Organizational Activities and Drivers Executional Activities Executional Cost Drivers Using employees Degree of involvement Providing quality Quality management approach Providing plant layout Plant layout efficiency Designing and producing products Product configuration Providing capacity Capacity utilization Operational Activities Operational activities are day-to-day activities performed as a result of the structure and processes selected by the organization. Examples:Receiving and inspecting incoming parts, moving materials, shipping products, testing new products, servicing products, and setting up equipment. Organizational and Operational Activity Relationships Organizational Activity (Selecting and using process technologies) Structural Cost Driver (JIT: Type of process technology Operational Activity (Moving material) Operational Driver (Number of moves) Internal Value Chain Design Service Develop Distribute Produce Market Exploiting Internal Linkages An Example: Assume that design engineers have been told that the number of parts is a significant cost driver and that reducing the number of parts will reduce the demand for various activities downstream in the value chain. They plan to reduce the price by per-unit savings. Currently 10,000 units are produced. The data of the new design and its effects on demand are given below: Activity Material usage Labor usage Purchasing Warranty repair Cost Driver # of parts Labor hours # of orders # of defects Capacity 200,000 10,000 15,000 1,000 Current Demand 200,000 10,000 12,500 800 Expected Demand 80,000 5,000 6,500 500 Exploiting Internal Linkages (continued) Potential Savings : Material usage (200,000 - 80,000)$3 $360,000 Labor usage (10,000 - 5000)$12 60,000 Purchasing [$30,000 + $.50(12,500 - 6,500)] 33,000 Warranty repair [($28,000 + $20(800 - 500)] 34,000 Total $487,000 ====== Units 10,000 Unit savings $48.70 Activity-Based Customer Costing An Example: Suppose that the Thompson Company produces precision parts for 11 major buyers. An activity-based costing system is used to assign manufacturing costs to products. The company prices each customer's order by adding order-filling costs to manufacturing costs and then adding a 20% markup (to cover any administrative costs plus profits). Order-filling costs total $606,000 and are currently assigned in proportion to sales volume (measured by number of parts sold). Of the 11 customers, one accounts for 50% of sales, with the remaining ten accounting for the remainder of sales. Orders placed by the smaller companies are also about the same size. Data concerning Thompson’s customer activity are given on PPT 13-22: Exploiting External Linkages (continued) Large Ten Smaller Customer Customers Units purchased 500,000 500,000 Orders placed 2 200 Manufacturing cost $3,000,000 $3,000,000 *Order-filling cost allocated 303,000 303,000 Order cost per unit $0.606 $0.606 *Order-filling capacity is purchased in blocks of 45 (225 capacity), each block costing $40,400; variable orderfilling activity costs are $2,000 per order; thus, the cost is [(5 x $40,400) + ($2,000 x 202)] Exploiting External Linkage (continued) Assume that ordering costs are allocated using a new driver: Units purchased Orders placed Manufacturing costs *Orders-filling costs Order cost per unit Large Customer 500,000 2 $3,000,000 6,000 $.012 Ten Smaller Customers 500,000 200 $3,000,000 600,000 $1.20 *Order-filling capacity is allocated using number of orders. The allocation rate is $3,000 pre order ($606,000/202 orders). Implications: By using a new driver, we are drastically reducing the orderingcost per unit of the high volume customer (50% of our business). This information could assist Thompson in establishing a new strategy for pricing. Product Life Cycle Viewpoints There are three basic views of the product life cycle: – Marketing viewpoint – Production viewpoint – Consumable life viewpoint Marketing Viewpoint Units of sales Introduction Growth Maturity Decline Life Cycle Cost Management Cost Commitment Curve Life Cycle Cost % 100 90 90 percent of life-cycle costs are committed at this point 75 25 Research Planning Design Testing Production Logistics A Life Cycle Costing Example Suppose that engineers are considering two new product designs for one of its power tools. Both designs reduce direct materials and direct labor content over the current model. The anticipated effects of the two designs on manufacturing, logistical, and postpurchase activities costs are listed below: Cost Behavior Functional-based system: Variable conversion activity rate: Material usage rate: ABC system: Labor usage Material usage: Machining: Purchasing activity: Setup activity: Warranty activity: Customer repair cost: $40 per direct labor hour $8 per part $10 per direct labor hour $8 per part $28 per machine hour $60 per purchase order $1,00 per setup hour $200 per returned unit $10 per hour Life Cycle Costing (continued) Traditional Costing (Overhead allocated by direct labor hours) Direct materials Conversion costb Total manufacturing cost Units produced Unit cost a$8 Design A $ 800,000 2,000,000 $2,800,000 10,000 $ 280 ======== Design B $ 480,000 3,200,000 $ 3,680,000 10,000 $ 368 ======== x 100,000 parts; $8 x 60,000 parts b$40 x 50,000 direct labor hours; $40 x 80,000 direct labor hours Life Cycle Costing (continued) ABC Costing (Overhead allocated by direct labor hours) Direct materials Direct labora Machiningb Purchasingc Setupsd Warrantye Total product costs Units productd Unit cost Postpurchase costs a$5 Design A $ 800,000 500,000 700,000 18,000 200,000 80,000 $2,298,000 10,000 $ 230 $ 80,000 ======== Design B $ 480,000 800,000 560,000 12,000 100,000 15,000 $1,967,000 10,000 $ 197 $ 15,000 ======== Classification Manufacturing Manufacturing Manufacturing Upstream Manufacturing Downstream d$1,000 x 200 setups; $1,000 x 100 setups x 50 ,000 hours ; $5 x 40,000 hours b$10 x 25,000 parts; $10 x 20,000 parts e$200 x 400 defects; $200x 1,000 defects c$60 x 300 design hours; $60 x 2000 design hours Target Costing - Example Assume that a company is considering the production of a new trencher. Current product specifications and the targeted market share call for a sales price of $250,000. The required profit is $50,000 per unit. The target cost is computed as follows: Target cost = $250,000 - $50,000 = $200,000 Target-Costing Model MARKET SHARE OBJECTIVE TARGET PRICE TARGET PROFIT TARGET COST No PRODUCT AND PROCESS DESIGN TARGET COST MET? Yes PRODUCE PRODUCT PRODUCT FUNCTIONALITY Resource Consumption Accounting (RCA) Resource consumption accounting (RCA) is an adaption of ABC that emphasizes resource consumption by greatly increasing the number of resource cost pools, which allows more direct tracing of resource costs to cost objects than an ABC system with fewer cost centers. RCA is particularly appropriate for large organizations with repetitive operations and high-level information systems such as those provided by SAP, Oracle, and SAS. Time-Driven ABC (TDABC) When a substantial amount of the cost of a company’s activities are in a highly repetitive process (much like in the RCA example above), the cost assignment can be based on the average time required for each activity. Time-Driven Activity-Based Costing assigns resource costs directly to cost objects using the cost per time unit of supplying the resource, rather than first assigning costs to activities and then from activities to cost objects. TDABC Example TDABC computes the cost per minute of the resources performing the work activity. Assume 2 clerical workers paid $45,000 annually perform a certain activity that is expected to require 17 minutes. TDABC calculates the total cost as $45,000 x 2 = $90,000; TDABC then calculates the total time available for the activity as 180,000 minutes (assuming 30 hours per week with two weeks vacation: 2 workers x 50 weeks x 30 hours x 60 minutes per hour = 180,000 minutes per year). The TDAC rate for the activity is $0.50 per minute ($90,000 / 180,000).The cost of a unit of activity is $0.50 x 17 min = $8.50; if the activity required 20 min, then the allocation would be $.50 x 20 = $10. Customer Profitability Analysis Customer Profitability Analysis • Customer Relationship Management (CRM): • Customer Lifetime Value (CLV) • Customer Equity Customer Profitability Analysis: The Whale Curve: 80% from the top 20% (or more!) The Whale Curve Cumulative Profits 300 % 100 % 50 % 20% Most Profitable 100 % Least Profitable What Makes for a Profitable Customer? Profitable and unprofitable customers are distinguished by the demands they place on the organization Less profitable customers More profitable customers Small order quantities Special products ordered Heavy discounting Unpredictable demands Delivery times change High technical support Slow payment (imputed interest) Large order sizes Standard products ordered Little discounting Predictable demands Delivery times standard Low technical support On-time payment (imputed interest) These demands can be estimated by activity costs and activity cost drivers Migrating Customers to Higher Profitability – A Strategic Analysis Very Types of Customers Profitable High (Creamy) Product Mix Margin Low (Low Fat) Low High Cost-to-Serve 76 Very unprofitable Customer Relationship Management (CRM) Requires Strategic Cost Management Data Who is more important to pursue with the scarce resources of our marketing budget? Our most profitable customers? Our valuable customers? What is the difference? The “customer lifetime value” (CLV) measure is intended to answer this question. most You are a pharmaceutical supplier: which customer is more important? Dentist A Dentist B Sales = $750,000 Sales = $375,000 profits = $100,000 profits = $40,000 Age 61 Age 25 Which is more profitable? Which is more valuable? Customer Lifetime Value (CLV) What is it? The projected economic value of customer relationships during the whole period of the relationship between the customer and company. The Measure The net present value (NPV) of all future profits from that customer; it is a projection, from when the customer is acquired or from the current date. Customer Equity What is it? The economic value of ALL customer relationships. The Measure The sum of the CLVs for all customers. How Used Provides a measure of the value of the company from the perspective of customer profitability. The Management & Control of Quality (including Six-Sigma and Lean) Relationship between TQM & Financial Performance A Strategic Model for Managing Quality Lean Manufacturing • • • • At the heart of lean manufacturing is the Toyota Production System (TPS): a long-term focus on relationships with suppliers and coordination with these suppliers; an emphasis on balanced, continuous flow manufacturing with stable production levels; continuous improvement in product design and manufacturing processes with the objective of eliminating waste ; and flexible manufacturing systems in which different vehicles are produced on the same assembly line and employees are trained for a variety of tasks Accounting for Lean There are three reasons why the improvements in financial results typically appear later than the operating improvements from implementing lean. • Customers will benefit from the improved manufacturing flexibility by ordering in smaller, more diverse quantities. • Improvements in productivity will create excess capacity; as equipment and facilities are used more efficiently, some will become idle. • The decrease in inventory that results from lean means that, using full cost accounting, the fixed costs incurred in prior periods flow through the income statement when inventory is decreasing. Accounting for Lean Lean accounting uses value streams to measure the financial benefits of a firm’s progress in implementing lean manufacturing. Each value stream is a group of related products or services. Accounting for value streams significantly reduces the need for cost allocations (since the products are aggregated into value streams) which can help the firm to better understand the profitability of its process improvements and product groups. Lean Accounting – Value Streams Rimmer Company Value Stream Income Statement Digital Cameras Sales Operating Costs Materials Labor Equipment related costs Occupancy costs Total Operating Costs Less Other Value Stream Costs Manufacturing Selling and Administration $ $ 25,200 168,000 92,400 11,200 585,000 $ $ - 120,000 10,000 130,000 240,000 10,000 158,200 (10,000) $ 148,200 Total 540,000 $ 1,125,000 154,000 $ 450,800 12,800 88,000 48,400 4,800 296,800 Value Stream Profit before inventory change Less: Cost of decrease in inventory Value Stream Profit Video Cameras $ 250,000 380,000 136,000 (20,000) 294,200 (30,000) 116,000 $ Less Nontraceable Costs Manufacturing Selling and Administration 155,000 54,000 Total Nontraceable Fixed Costs Operating Income 264,200 209,000 $ 55,200 Operational and Management-level Performance Measurement Performance Measurement • Motivation and Evaluation – Incentives: right decisions • Align performance measurement with strategy – Incentives: working hard • Compensation and bonus plans – Equity/fairness • Controllability • Cost allocations • Operational-level and Management-level Operational Performance Measurement with a Flexible Budget Schmidt Machinery Company Analysis of Operations For the period ended October 31, 20X6 2010 2010 Data Item for Analysis Units Sold Sales Variable Expenses Contribution Margin Fixed Expenses Operating Income Actual Flexible Budget Variance 780 0 $639,600 350,950 $288,650 $160,650 $128,000 $15,600 50 $15,650 $10,650 $5,000 Flexible Budget F F F U F Sales Volume (Activity) Variance Master (Static) Budget 780 220 U 1000 $624,000 351,000 $273,000 $150,000 $123,000 $176,000 99,000 $77,000 $0 $77,000 U F U $800,000 450,000 $350,000 $150,000 $200,000 U Management Performance Measurement Cost Centers • Engineered Cost (cost driver: volume based) •Flexible Budget • Discretionary Cost (cost driver?) •Master Budget • “Profit Center” – one step from outsourcing… Management Performance Measurement • Profit Centers: • Variable costing income statements • Issue of transfer pricing • Role and importance of nonfinancial performance indicators • Investment Centers: • ROI vs. RI vs. EVA® •Measurement issues • Issue of transfer pricing • Role and importance of non-financial performance indicators Management –Level Performance Measurement: When to Use Profit or Cost Center Customer Plant Warehouse Using Software in the Strategic Cost Management Using Software in the Strategic Cost Management 1. Excel: Goal Seek Solver 2. ABC: OROS (SAS), SAP, … Excel 3. Simulation: Crystal Ball, @Risk, Excel(Formulas/Functions) ABC Software: OROS Quick (from SAS) • Comprehensive: resources through objects • Allow a couple of classes • Short Tutorial, 13 pages, couple of hours • Blue Ridge Manufacturing Case Introduction to Management Accounting Strategic Positioning Ethics Implementing Strategy Product Costing Cost Behavior (Planning and Operational Control) The Value Chain Volume Based (Job Costing) Cost Estimation The Balanced Scorecard Management Control CVP Analysis Master Budget Activity based Costing Decision Making Flexible Budgets Product Life Cycle Target Costing Life Cycle Costing Cost Accounting Strategic Positioning Ethics Implementing Strategy The Value Chain The Balanced Scorecard Product Costing Cost Behavior (Planning and Operational Control) Job Costing Product Life Cycle Cost Estimation Target Costing CVP Analysis (ABC) Life Cycle Costing ABC Costing Process Cost Joint Costs Standard Costing Master Budget (ABC) Decision Making (ABC) Managing Constraints Advanced Management Accounting Strategic Positioning Ethics Implementing Strategy Cost Behavior (ABC-based) The Value Chain Cost Estimation (Regression) The Balanced Scorecard (BSC) Management Control (TP) Executive Compensation Business Valuation Product Life Cycle Target Costing CVP Analysis Master Budget Decision Making (LP) Life Cycle Costing Comparison of JIT Approaches with Traditional Manufacturing and Purchasing JIT 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Pull-through system Insignificant inventories Small supplier base Long-term supplier contracts Cellular structure Multiskilled labor Decentralized services High employee involvement Facilitating management style Total quality control Buyers’ market Value-chain focus Traditional 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Push-through system Significant inventories Large supplier base Short-term supplier contracts Departmental structure Specialized labor Centralized services Low employee involvement Supervisory management style Acceptable quality level Sellers’ market Value-added focus Example Backflushing 1. 2. 3. 4. 5. 6. 7. 8. To illustrate backflush costing and compare it with the traditional approach, assume that a JIT company had the following transactions during June: Raw materials were purchased on account for $160,000. All materials received were placed into production. Actual direct labor costs, $25,000. Actual overhead costs, $225,000. Conversion costs applied, $235,000. All work was completed for the month. All completed work was sold. The difference between actual and applied costs is computed Traditional Journal Entries 1. Materials Accounts Payable 160,000 2. Work in Process Materials 160,000 3. Work in Process Payroll 25,000 4. Overhead Control Accounts Payable 160,000 160,000 25,000 225,000 225,000 Traditional Journal Entries 5. Work in Process Overhead Control 210,000 6. Finished Goods Work in Process 395,000 7. Cost of Goods Sold Finished Goods 395,000 8. Cost of Goods Sold Overhead Control 210,000 395,000 395,000 15,000 15,000 Backflush Journal Entries 1. Raw Materials and in Process 160,000 Accounts Payable 160,000 2. No entry 3. Combined with overhead: See next entry. 4. Conversion Cost Control Payroll Accounts Payable 250,000 25,000 225,000 Backflush Journal Entries 5. No entry 6. Finished Goods Raw Materials and in Process Conversion Cost Control 395,000 160,000 235,000 7. Cost of Goods Sold Finished Goods 395,000 395,000 8. Cost of Goods Sold 15,000 Conversion Cost Control 15,000 End of Week