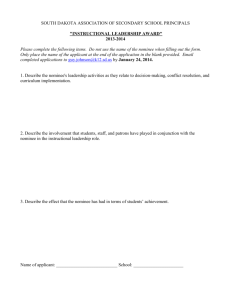

Is it Still Safe to Tell your Client

advertisement

Is it Still Safe to Tell your Client – Don’t Worry, the IRS Will Just Impose the Tax at the Corporate Level and Will Not Look to YOU personally for Payment? The Alter Ego and Nominee Lien 2012 UCLA Tax Controversy Institute October 17, 2012 (c) David L. Rice 1 Various Theories to Impose Liens • Transferee Liability – IRC Section 6901.This is a creditor protection device going back hundreds of years and is based upon common law. The basic premise is that the IRS can go after anyone who received assets for money for less than FMV. • Nominee Lien – IRC Section 6320. A Nominee situation generally involves a fraudulent conveyance or transfer of a taxpayer’s property to avoid legal obligations. In other words, even though property is held in a third party’s name, it still belongs to the taxpayer. Area Counsel approval is needed prior to filing a lien. See IRM 5.17.2.5.7.2(6). (c) David L. Rice 2 Various Theories to Impose Liens • Alter-Ego Lien. Under this doctrine the IRS can disregard an entity’s separate legal identity in order to extend liability and prevent abuse. On the other hand, if an entity is the alter-ego of the taxpayer, the the assets of the entity may be used to satisfy the debts of the individual taxpayer. This is sometimes called “reverse piercing of the corporate veil.” • Area Counsel approval is required prior to filing this type of lien. See IRM 5.17.2.5.7.1 (6) (c) David L. Rice 3 Transferee Liability • IRC § 6901 • (a) Method of collection. The amounts of the following liabilities shall, except as hereinafter in this section provided, be assessed, paid, and collected in the same manner and subject to the same provisions and limitations as in the case of the taxes with respect to which the liabilities were incurred: • (1) Income, estate, and gift taxes(A) Transferees. The liability, at law or in equity, of a transferee of property— • (i) of a taxpayer in the case of a tax imposed by subtitle A (relating to income taxes), • (ii) of a decedent in the case of a tax imposed by chapter 11 (relating to estate taxes). or • (iii) of a donor in the case of a tax imposed by chapter 12 (relating to gift taxes),in respect of the tax imposed by subtitle A or B. • (B) Fiduciaries. The liability of a fiduciary under section 3713 (b) of title 31, United States Code in respect of the payment of any tax described in subparagraph (A) from the estate of the taxpayer, the decedent, or the donor, as the case may be. • (2) Other taxes. The liability, at law or in equity of a transferee of property of any person liable in respect of any tax imposed by this title (other than a tax imposed by subtitle A or B), but only if such liability arises on the liquidation of a partnership or corporation, or on a reorganization within the meaning of section 368 (a). (c) David L. Rice 4 Transferee Liability b) Liability Any liability referred to in subsection (a) may be either as to the amount of tax shown on a return or as to any deficiency or underpayment of any tax. (c) Period of limitations The period of limitations for assessment of any such liability of a transferee or a fiduciary shall be as follows: (1) Initial transferee In the case of the liability of an initial transferee, within 1 year after the expiration of the period of limitation for assessment against the transferor; (c) David L. Rice 5 Transferee Liability (2) Transferee of transferee In the case of the liability of a transferee of a transferee, within 1 year after the expiration of the period of limitation for assessment against the preceding transferee, but not more than 3 years after the expiration of the period of limitation for assessment against the initial transferor; except that if, before the expiration of the period of limitation for the assessment of the liability of the transferee, a court proceeding for the collection of the tax or liability in respect thereof has been begun against the initial transferor or the last preceding transferee, respectively, then the period of limitation for assessment of the liability of the transferee shall expire 1 year after the return of execution in the court proceeding. (3) Fiduciary In the case of the liability of a fiduciary, not later than 1 year after the liability arises or not later than the expiration of the period for collection of the tax in respect of which such liability arises, whichever is the later. (c) David L. Rice 6 Transferee Liability • IRS must prove 5 elements (See IRM 4.11.52.5.2): • The transferor became insolvent when the transfer occurred or because of a series of transfers. • The transfer was for less than adequate consideration. • The transfer was made after the tax liability accrued. The tax liability need not have been assessed at the time of the transfer as long as the debt accrued. • The transferor was liable for the tax. • The IRS made reasonable attempts to collect the debt from the transferor or it would have been futile. Bankruptcy of a taxpayer or dissolution of a corporation. (c) David L. Rice 7 Transferee Lien • There are 3 principle methods by which the United States may proceed where assets have been transferred in fraud of creditors. • Setting aside fraudulent conveyances. • Transferee liability by civil lawsuit. • Transferee liability by notice of deficiency. • IRM provides that notice of deficiency should be looked at first. See IRM 5.1.14.2. (c) David L. Rice 8 Nominee Liens Neither the Code nor Regulations address nominee liens, however the Supreme Court has legitimized their validity. GM Leasing Corp. v. United States, 429 U.S. 338(1977). To establish a nominee lien situation, it must be shown while a third party may have legal title to the property, it is really the taxpayer that owns the property and who enjoys its use and benefit. The difference between a fraudulent conveyance and a nominee situation can overlap. However, a nominee situation is one in which the conveyance is not intended to divest the transferor of rights, whereas in fraudulent conveyance situations, there is no “simulated” transfer and it is intended to divest the taxpayer of his or her rights. (c) David L. Rice 9 Nominee Liens Factors • Nominee liens involve one or more of the following: • • • • The taxpayer previously owned the property. The nominee paid little or no consideration for the property. The taxpayer retains possession or control of the property. The taxpayer continues to use and enjoy the property conveyed just as the taxpayer had prior to the conveyance. • The taxpayer pays all or most of the expenses of the property. • Close relationship between the parties. • Failure to record conveyance. • See Robert A. Politte v. U.S. Civil No. 07cv1950 AJB (USDC Cal. 2012) and U.S. v. Thornton, 859 F.2d 151 (9th Cir. 1988). (c) David L. Rice 10 Nominee Lien • Amount of liability is limited to the FMV of property transferred. Much narrower than transferee or alter-ego theory. • Not entitled to Collection Due Process Hearing. However, taxpayer in question must have had rights to a CPD or taxpayer will be entitled to CDP rights on the filing of a nominee lien. • Must be approved by Area Counsel. See IRM 5.12.1.2.11. • Only entitled to a CAP hearing. See IRM 8.24.1.2. The CAP procedures do not give the Appeals Officer much authority beyond reviewing the administrative handling of the taxpayer’s case. The problem is that Area Counsel has reviewed and signed off. (c) David L. Rice 11 Alter-Ego Lien • Similar to a nominee lien, this is an equitable remedy which will be applied whenever necessary to avoid injustice” or where public policy demands it. • However, the alter ego doctrine is concerned about the relationship between the taxpayer and the alter-ego. In other words does the taxpayer control another individual or entity? Whereas, the nominee lien is concerned about the relationship between the taxpayer and the property in question. Title to property versus rights of possession and use. (c) David L. Rice 12 Alter-Ego Lien • In California, two conditions must be met before the alter ego doctrine will be invoked. • First, there must be such a unity of interest and ownership between the corporation and its equitable owner that the separate personalities of the corporation and the shareholder do not in reality exist. • Second, there must be an inequitable result if the acts in question are treated as those of the corporation alone. (Automotriz etc. De California v. Resnick (1957) 47 Cal. 2d 792, 796 [306 P.2d 1, 63 A.L.R.2d 1042] • See Sonora Diamond Corp. v. Superior Court, 83 Cal. App. 4th 523, 99 Cal. Rptr. 2d 824, (Cal. App. 5th Dist. 2000) (c) David L. Rice 13 Alter-ego Lien state v federal law • State law applies in determining whether the alter-ego doctrine applies. See Old West Annuity and Life Ins. Co. v. Apollo Group, 605 F.3d. 856 (11th Cir. 2010) and Drye v. U.S., 528 U.S., 528 U.S. 49, 58 (1999). In California the courts will look at the following factors: • • • • • • • • • • (c) David L. Rice 1. Individual’s ownership of all stock in a corporation; 2. Use of the same office or business location; 3. Commingling of funds and other assets of the individual and corporation; 4. An individual holding out that he is personally liable for the debts of a corporation; 5. Identical directors and officers; 6. Failure to maintain minutes. 7. Disregard of corporate formalities 8. Inadequate capitalization. 9. Use of corporation as a mere shell, instrumentality or conduit for the business of the individual. See Towe Antique Ford Foundation v. IRS, 72 AFTR2d. 5495(9th Cir. 1993) and Thomas Misik v. Thomas D’Arco, 197 Cal. App 4th. 1065 (2011). 14 Alter-Ego Lien • IRS issues Notice CC-2012-002 on 12/2/11 indicating that the IRS will try and assert federal law in making a determination of alter-ego. In doing so the Office of Chief Counsel suggested to their counsel that they should present the Tenth Circuit’s broadly defined factors set forth in NLRB v. Greater Kansas City Roofing, 2 F3d 1047 (10th Cir. 1993). In that case the court held that the federal alter ego test in a two prong test: (1) whether there is such a unity of interest and lack of respect given to the separate identity of the corporation by its shareholders that the personalities and assets are indistinct, and (2) whether adherence to the corporate fiction sanctions a fraud, promotes injustice, or leads to an evasion of legal obligations. (c) David L. Rice 15 Alter- Ego Lien • Persons identified as alter-egos are not entitled to CDP hearings and Area Counsel must approve the lien. See IRM 5.12.1.2.11. • The person identified as the alter-ego may appeal under the Collections Appeal Program process. (c) David L. Rice 16