Research Papers

advertisement

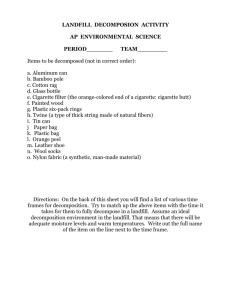

Economics Research Paper The purpose of this paper is to explore an issue of American economics in greater detail. Write a 1000 word term paper, selecting from one of the following suggestions. 1) Stadium Subsidies 2) Economic Impact of SUVs 3) Cigarette taxes 4) Other ideas Use MLA format, proper spelling and grammar. Four source minimum: at least four sources must be cited in the body of the essay. Use good sources, not just junk from the internet. Students will include a works cited page at the end of their essay. No contractions. No 1st or 2nd person pronouns are permitted (I, me, you, we, us, etc). Papers are to be typed, double spaced, and use normal margins. Research papers are not the author's personal opinion. They are papers that prove claims with evidence. All the evidence should be cited using MLA rules. Research papers will be submitted as a printed and electronic copy. Electronic copies will be submitted for a plagiarism check. Topic information continues on the next page. 1) Stadium Subsidies There was a rash of new sports stadium development that occurred in the 1990s. Most of these stadiums were built partly or wholly with government money in the form of stadium subsidies. Naturally many social groups were outraged that government money was being diverted from social programs to millionaire players and billionaire owners. Politicians have argued that stadiums bring tourism dollars into the city that far outweigh the cost of the stadium subsidy. Many economists disagree; they feel that most of the revenue stadiums generate comes at the expense of other entertainment venues within the town. Issues you may want to address in your stadium subsidies paper What are the benefits to a town of building a new stadium? Can a new stadium revitalize a decaying section of a city? Do the benefits of the government building a new stadium outweigh the costs? Does the construction of new stadiums by the government have effects in either parts of the economy (either positive or negative) Books on Stadium Subsidies Sports economics books http://economics.about.com/cs/sportseconomics/tp/sportsbooks.htm Also see if your library has a copy of: The Economics and Politics of Sports Facilities Wilbur C. Rich, Westport, Conn. and London: Greenwood, Quorum Books, 2000. Newspaper and Magazine Articles on Stadium Subsidies The best place to find articles on stadium issues is on the Sports Economics subject page of this site: http://economics.about.com/cs/sportseconomics/index.htm Policy Papers on Stadium Subsidies Mackinac Center for Public Policy - Stadium Subsidies Strike Out http://www.mackinac.org/depts/ecodevo/article.asp?ID=98 NPRI - Stadium Subsidies in Nevada http://www.npri.org/issues/issues01/i_b071801.htm Taxpayers for Common Sense - Stadium Subsidies http://www.bailoutwatch.org/stadium.htm Common Dreams - Stadium Subsidies Scalp the Public http://www.commondreams.org/views/032700-101.htm OCPA - Public Subsidies For Sports Stadiums Don’t Spur Economic Growth http://www.ocpathink.org/economics/PublicSubsidiesforSports.html Journal Articles on Stadium Subsidies Public Subsidies to Stadiums: Do the Costs Outweigh the Benefits? - Daraius Irani, Public Finance Review v25, n2 (March 1997): 238-53. The Value of Public Goods Generated by a Major League Sports Team - Bruce K. Johnson, Peter A. Groothuis and John C. Whitehead, Journal of Sports Economics v2, n1 (February 2001): 6-21. Fan Loyalty and Stadium Funding in Professional Baseball - Craig A. Depken, Journal of Sports Economics v1, n2 (May 2000): 124-38. Professional Sports and Urban Development: A Brief Review of Issues and Studies - Harrison S. Campbell, Review of Regional Studies v29, n3 (Winter 1999): 272-92. The Stadium Gambit and Local Economic Development - Dennis Coates and Brad R. Humphreys, Regulation v23, n2 (2000): 15-20. 2) Economic Impact of SUVs The SUV (Sports Utility Vehicle) is one of the most popular types of vehicle to both own and drive. Last year, SUVs and minivans outsold conventional cars for the first time. However, the SUV is increasingly coming under attack for its fuel economy, emissions standards and safety record. Vehicle fuel efficiency across the US is now at its lowest level since 1980. However, in July, California governor Gray Davis signed legislation requiring the California Air Resources Board to develop regulations to reduce greenhouse gas emissions from passenger vehicles. This includes SUVs. California accounts for 13 percent of the nation's auto market, so manufacturers of cars, SUVs and trucks are sure to comply with the state's edict, if they cannot get it softened or overturned. This could have enormous economic impact on all of the United States. Issues you may want to address in your economics and SUVs paper What impact does the lower fuel economy of SUVs have on the economy? (Think both in terms of the price at the pump and the price in health care, environment etc). What impact does the safety record of SUVs have on the economy? If passed what impact will the California bill that requires cuts in the tailpipe emissions of greenhouse gases by cars and light trucks have on SUVs and the economy? Books on Economics and SUVs High and Mighty: SUVs--The World's Most Dangerous Vehicles and How They Got That Way by Keith Bradsher Public Affairs, 2002. Economics at the wheel: The costs of cars and drivers Richard C. Porter, San Diego; London and Toronto: Academic Press, 1999. Newspaper and Magazine Articles on Economics and SUVs Common Dreams - Bush Proposal May Cut Tax on S.U.V.'s for Business http://www.commondreams.org/headlines03/0121-05.htm Houston Business Journal - There are two sides to the SUV debate coin http://houston.bizjournals.com/houston/stories/2002/12/30/editorial5.html Alternet - The SUV-Terrorism Connection http://www.alternet.org/story.html?StoryID=11715 Arizona Central - Auto makers fear backlash against SUVs http://www.azcentral.com/offbeat/articles/0108suv-opposition08-ON.html Blue Water Network - California Is Moving to Guide U.S. Policy on Pollution (PDF) http://www.bluewaternetwork.org/reports/rep_ca_global_nytimes.pdf San Francisco Chronicle - California emissions law now a model: It's cited in major new Senate bill http://www.sfgate.com/cgibin/article.cgi?file=/chronicle/archive/2003/01/09/MN60402.DTL Policy Papers on Economics and SUVs SUV.org - Environmental Double Standards for SUVs http://www.suv.org/environ.html Public Citizen - Corporate Average Fuel Economy http://www.citizen.org/autosafety/fuelecon/ Citizens for a Sound Economy - I Want My SUV http://www.cse.org/informed/issues_template.php/1103.htm CATO - No Apologies: Affirming SUV driving http://www.cato.org/research/articles/taylor021218.html Competitive Enterprise Institute - SUV Owners Under Assault Again http://www.cei.org/gencon/003,03320.cfm Journal Articles on Economics and SUVs Offsetting Behavior Effects of the Corporate Average Fuel Economy Standards - John M. Yun, Economic Inquiry v40, n2 (April 2002): 260-70 Global Warming and Urban Smog: The Cost Effectiveness of CAFE Standards and Alternative Fuels - Alan J. Krupnick et. al, Resources for the Future, Energy and Natural Resources Division Discussion Paper: 1992. 3) Cigarette Taxes Cigarette taxes are a hot topic. All 50 state governments have enacted taxes on cigarettes, and many have raised their taxes several times. Cigarette taxes are a way governments can achieve two social objectives. The first objective is to reduce the number of citizens who smoke. The government issuing the cigarette tax hopes that the rise in the cost of a package of cigarettes will induce people to quit smoking. The second objective is to raise government revenue. A cigarette tax, like any other tax, increases the amount of revenue governments can spend on social programs. Issues you may want to address in your cigarette tax paper Will cigarette taxes have the desired effect of reducing the demand for cigarettes? Do increases in cigarette taxes have any other effects? What are the distributional effects of cigarette taxes? Who pays for the bulk of the taxes: richer citizens or poorer citizens? What do governments spend cigarette tax revenues on? How much of the tax collected goes to programs designed to help people to stop smoking? How much of it goes to increased health care costs due to smoking? Statistics State Excise Tax Rates on Cigarettes http://www.taxadmin.org/fta/rate/cigarett.html Newspaper and Magazine Articles on Cigarette Taxes USA TODAY - States Consider Cigarette Tax Hike http://www.usatoday.com/news/nation/2002/01/14/usat-cigtax.htm Portland Business Journal - Cigarette tax measure may have unintended consequences http://portland.bizjournals.com/portland/stories/1996/11/04/editorial4.html Policy Papers on Cigarette Taxes Mackinac Center for Public Policy - The Unintended Consequences of Cigarette Tax Hikes http://www.mackinac.org/4927 National Center for Policy Analysis - Will a Cigarette Tax Increase Really Help Uninsured Children? http://www.ncpa.org/~ncpa/ba/ba231.html Tobacco Free Kids - Higher Cigarette Taxes Reduce Smoking and Save Lives (Great source of links and statistics as well) http://tobaccofreekids.org/reports/prices/ New York Fiscal Watch - NYC Cigarette Tax Hike Endangers Pataki Health Funding http://www.nyfiscalwatch.com/html/fwm_2002-05.html Journal Articles on Cigarette Taxes Putting Out the Fires: Will Higher Taxes Reduce the Onset of Youth Smoking? - Philip DeCicca, Donald Kenkel and Alan Mathios. Journal of Political Economy v110, n1 (February 2002): 144-69. Response by Adults to Increases in Cigarette Prices by Sociodemographic Characteristics. Matthew C. Farrely et. Al, Southern Economic Journal v68, n1 (July 2001): 156-65. The Economics of Smoking - Frank J. Chloupka and Kenneth E. Warner, National Bureau of Economic Research Working Paper: 7047. Tobacco Taxes, Smoking Restrictions, Robert L. Ohsfeldt ; Raymond G. Boyle and Eli I. Capilouto, National Bureau of Economic Research Working Paper: 6486. 4) Other Ideas Supply and demand Being a very broad topic, supply and demand can be applied almost to anything. In case of microeconomics talk about the how the change of demand influence the work of small businesses or different factors of supply and demand on example of small areas. Measures of decreased demand of fruits in winter times and its influence on small shops. How soon the change of demand influences the change of price (on the example of your local shop). Work market Also a topic that can be looked at on different levels. Think about a labor market in a small town, the position of an individual on a market or influence of work market changes on an average family. How building a plant in a small town can change the labor market in it. Problems of finding a qualified professional to work in a small town. What are the chances of a graduate to find a highly paid job? Pricing and marketing Here you can talk about the changes of pricing on different levels and how it can influence both the buyers and the sellers (take a family and a small company for an example). Compare the prices of shops in small towns and in big cities. How the increase of prices on food will influence the life of a common family. How can the owner of a shop attract buyers? Season sales in the shop “Name” and their influence on the outcome. Entrepreneurship Talk about the problems of opening and running a small business, laws and governmental programs in this area, differences of running a family business in a small town and a big city etc. Fighting the competition in a big town: serious problem for a small shop. Advantages of running a family business. Other topics Other topics may be considered with teacher approval.