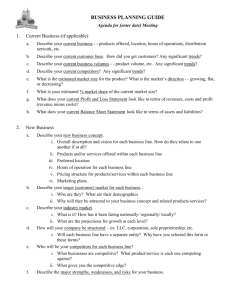

Identification

advertisement