Presentation - Viessmann European Research Centre

advertisement

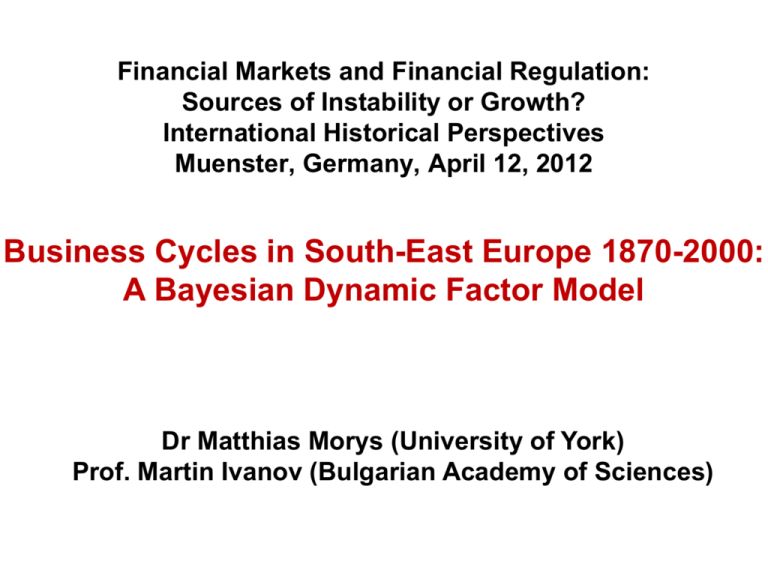

Financial Markets and Financial Regulation: Sources of Instability or Growth? International Historical Perspectives Muenster, Germany, April 12, 2012 Business Cycles in South-East Europe 1870-2000: A Bayesian Dynamic Factor Model Dr Matthias Morys (University of York) Prof. Martin Ivanov (Bulgarian Academy of Sciences) Business Cycles in Historical Perspective • “Business cycle paradox”: Research on market integration suggests high degree of business cycle synchronisation but it cannot be detected in the data • Example: Classical Gold Standard period: product and factor markets were highly integrated & quasi-universal fixed XRs (Daudin&Morys&O’Rourke 2010) • BUT Research on business cycles finds low correlation of GDP growth / de-trended GDP Example: Research on core countries 1870s - 1913 Source Average bilateral correlation Countries Time frame Statistical method: correlation of Backus&Kehoe (1992) 0.03 England, Germany 1870-1913 de-trended GDP Artis et al. (2011) 0.09 England, France, Germany 1880-1913 de-trended GDP Bordo&Helbling (2011 ) 0.04 US, E, F, G, CH, Netherlands 1880-1913 GDP growth rates Bordo&Helbling (2011) 0.09 F, G, CH, Neth. (European core) 1880-1913 GDP growth rates • equally low correlation for peripheral countries and for core countries vis-à-vis peripheral countries • literature as above & Bergman, Jonung for the Nordic countries Business Cycles in Historical Perspective • “Business cycle paradox”: Research on market integration suggests high degree of business cycle synchronisation but it cannot be detected in the data • Example: Classical Gold Standard period: product and factor markets were highly integrated & quasi-universal fixed XRs (Daudin&Morys&O’Rourke 2010) • BUT Research on business cycles finds low correlation of GDP growth / de-trended GDP • Two ways to solve the business cycle paradox: (a) correlation between business cycle synchronization and market integration not necessarily positive (Krugman 1993): trade integration regional specialization reduced output synchronization due to industry-specific shocks (b) business cycle paradox as a figment of poor GDP data Business cycle paradox a result of poor GDP data? • 3 concepts to measure GDP (production, expenditure, income) often give different results (2001 and 2007-9 US recession; Übele (2011) for German GDP data 1851-1913) • historical national accounts: interpolation reduces volatility • fine for GDP levels, but highly problematic for cycles • for a detailed critique see Ritschl et al. (2008) & Aiolfi et al. (2011) South-East Europe: we have to make a virtue out of necessity! • Pre-WW I: GDP estimates on annual basis only for AustriaHungary (Schulze 2000), Bulgaria (Ivanov 2009) and Greece (Kostelenos et al. 2007) • only Schulze (2000) in Maddison (2003) • Post-WW II: conceptual differences between System of National Accounts and Material Product Accounting (East bloc counterpart) Dynamic Factor Methodology as Solution to ‘Business Cycle Paradox’? • Many time series discarded for GDP purposes but useful for business cycle studies • In line with Burns&Mitchell 1946... (“... a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general ... contractions...”) • ... and the NBER business cycle dating procedure (with its emphasis on movements in employment over and above GDP data) • CDFA has strong similarities to Principal Component Analysis • A cross-section of economic variables share a common factor; extracting the common factor for the entire period delivers a business cycle index that is far more accurate than GDP • Stock&Watson (2010): 250 series to analyse current US business cycle • Federal Reserve Bank of Chicago’s National Activity Index (CFNAI) • Economic history: Aiolfi et al. (2011), Ritschl et al. (2008), Sarferaz&Übele (2009), Übele (2010) Dynamic factor model Static factor model (1) yt = (n x 1) (2) yit = (1 x 1) λ0 + λ (n x 1) λ0i (n x o) + λi (1 x 1) (1 x o) ft εt + (o x 1) ft (n x 1) εit + (o x 1) (1 x 1) common component idiosyncratic component Dynamic factor model: allowance for dynamic properties (3) ft = (o x 1) (4) εit = Φ1 ft-1 (o x o) (o x 1) φi1 εi,t-1 + Φ2 (o x o) + φi2 ft-2 (o x 1) εi,t-2 (all variables are scalars) ft follows VAR(p) process, εit AR(q) process + … + Φp (o x o) + ... + φiq ft-p + ζt (o x 1) (o x 1) εi,t-q + ηit What time series are we drawing on? All sorts of time series contain information on business cycles Burns&Mitchell (1946): locomotive orders, pig iron production, bank clearings In recessions women buy more lipsticks but fewer clothes and men replace their underwear less frequently (Greenspan apparently collected data of this sort, The Economist, 29.7.2011) Our approach: 25 time series for each country 1. Sectoral output indicators: agriculture; communication; industrial output; mining; construction; transportation; fixed investment 2. Fiscal indicators: government expenditure & revenues 3. Financial indicators: M0, M3, domestic interest rate, mortgage credit 4. Trade indicators: REER, TOT; export & import 5. Other indicators: real wage; population; CPI Data mostly taken from official Statistical Yearbooks For Soviet bloc countries (Bulgaria, Romania, Yugoslavia) doublechecked with Western sources, mainly Vienna Institute for International Economic Studies CDFA versus GDP England, France, Germany, Austria-H. 1879 - 1913 France (CDFA) Germany (CDFA) England France (CDFA) (CDFA) 0.78 *** Germany (CDFA) 0.81 *** 0.81 *** Austria-H. 0.67 *** (CDFA) 0.78 *** 0.84 *** AH England (CDFA) (GDP) France (GDP) England (GDP) 0.84 *** 0.66 *** 0.72 *** 0.69 *** France (GDP) 0.28 0.55 *** 0.35 ** 0.49 *** 0.28 * Germany (GDP) 0.22 0.15 0.36 ** 0.26 0.02 0.48 *** 0.30 * 0.22 0.39 ** 0.34 ** 0.35 ** Austria-H. 0.23 (GDP) Extreme cases: Germany – England: Germany – Austria-Hungary: Germany (GDP) 0.02 0.81 versus 0.02 0.84 versus 0.02 Business cycles England, France, Germany 1879-1913 5 Baring crisis 1890 4 American banking crisis 1907 3 2 1 0 -1 -2 -3 -4 1880 1885 1890 ENGLAND 1895 1900 FRANCE 1905 GERMANY 1910 Questions we want to ask with respect to South-East Europe 1. Has there been an identifiable regional business cycle ? 2. If so, to what extent it was synchronized with W. Europe ? 3. How volatile and how persistent have SEE business cycles been compared to the ‘core’? 4. Are global / regional or country-specific shocks dominant? Countries included in our study • Austria(-Hungary), Bulgaria, Greece, Romania, Serbia/Yugoslavia • These 5 countries taken together have consistently accounted for more than 85% of regional GDP from 1870 to the present day Questions we want to ask with respect to South-East Europe 1. Has there been an identifiable regional business cycle ? 2. If so, to what extent it was synchronized with W. Europe ? 3. How volatile and how persistent have SEE business cycles been compared to the ‘core’? 4. Are global / regional or country-specific shocks dominant? Countries included in our study • Austria(-Hungary), Bulgaria, Greece, Romania, Serbia/Yugoslavia • These 5 countries taken together have consistently accounted for more than 85% of regional GDP from 1870 to the present day Implications beyond SEE... • European region best suited for analysis of “regional business cycles”: since when do they exist? (cf. Bordo&Helbling 2011, Artis et al. 2011, Aiolfi et al. 2011) • SEE has more countries than Scandinavia (4), Iberia (2) or Central&Eastern Europe (1) which go back to the late 19th century Business cycle correlations 1875 – 1913 by country pairs: Full period, 1893-1913, 1903-1913 AH Gr Greece 0.06 0.23 0.60 * Romania 0.30 * 0.31 0.51 0.26 0.33 0.45 Serbia 0.34 * 0.55 ** 0.87 *** 0.27 0.22 0.76 ** Bulgaria 0.34 * 0.28 0.03 England 0.67 *** 0.49 ** 0.45 France Germany -0.07 -0.25 -0.45 Ro Se Bu E F 0.19 0.32 0.64 ** 0.27 0.37 * 0.22 0.42 ** 0.25 0.15 0.25 0.37 0.49 0.13 0.07 0.29 0.24 0.09 0.36 -0.07 -0.29 -0.55 * 0.78 *** 0.85 *** 0.88 *** 0.23 0.12 0.59 * 0.17 0.19 0.56 * 0.48 ** 0.46 ** 0.70 ** 0.25 0.08 -0.19 0.78 *** 0.66 *** 0.73 ** 0.84 *** 0.83 *** 0.78 *** 0.08 0.25 0.57 * 0.19 0.23 0.59 * 0.34 * 0.42 ** 0.73 ** 0.18 0.07 -0.18 0.81 *** 0.77 *** 0.84 *** 0.81 *** 0.86 *** 0.87 *** G Business cycles of Austria-H., Romania and Greece 1881 - 1913 1903 - 1913 6 4 3 4 2 2 1 0 0 -2 -1 -4 -2 -6 -3 82 84 86 88 90 92 AUSTRIA 94 96 98 00 ROMANIA 02 04 06 08 GREECE 10 12 03 04 05 06 AUSTRIA 07 08 09 ROMANIA 10 11 12 GREECE • For the later period we recognise upswings and downswings which are welldocumented for other countries Long upswing in the early 1900s Interrupted by the American Banking Crisis of 1907 Another upswing in the 1910s • Confirms qualitative evidence on SEE countries (Lampe&Jackson 1982) 13 Business cycle correlations 1875 – 1913 (summary stat.): Full period, 1893-1913, 1903-1913 AH Ro Se Bu Summary statistics for SEE-5 Average r 0.26 0.13 vis-à-vis 0.34 0.13 SEE-5 0.50 0.34 0.26 0.34 0.45 0.30 0.34 0.61 0.24 0.17 -0.01 Average r vis-à-vis E, F, G 0.24 (0.24 without Bulgaria) 0.26 (0.33 “ “ ) 0.38 (0.64 “ “ ) 0.17 0.35 0.12 0.16 0.33 -0.04 0.48 0.60 -0.31 0.76 0.72 0.70 Gr 0.19 0.25 0.55 0.32 (0.37 without Bulgaria) 0.28 (0.37 “ “ ) 0.40 (0.58 “ “ ) • Business cycle integration starts at high levels (compared to previous studies) and increases the further we come to WW I: within SEE and vis-à-vis core • Effect more pronounced when Bulgaria omitted (insufficient time span?) • But: intra-core synchronization levels higher (0.80) • no regional cycle; SEE increasingly participating in a pan-European cycle Business cycles 1875 – 1913: concluding remarks • Increases in business cycle synchronization are statistically significant (Wilcoxon rank sum tests) • Our main finding – increasing synchronization of SEE countries that, however, fails to reach core country levels – is consistent with research on market integration: emphasis on increasingly integrated good and factor markets before WW I but considerable cross-country differences remain (O’Rourke&Williamson 1999) • “geography of synchronization”: Austria-Hungary and Serbia (on the Western edge of the Balkans) more strongly synchronized, followed by Romania, Greece, Bulgaria (in that order) Interwar period: What are our expectations? Factors suggesting a decrease of synchronization • de-globalization (in particular reduction in trade and capital flows) • Currency instability Factors suggesting an increase of synchronization • Great Depression as “global shock” (of extraordinary size) (Backus&Kehoe 1992, Basu&Taylor 1999) • Formation of trade areas and currency blocs might lead to increased regional synchronization Specific to SEE: border changes after WW I might increase synchronization • Yugoslavia, Romania gain at the expense of Austria, Hungary and (to a smaller extent) Bulgaria • established trade relationships between cities/regions continue even if in different countries after WW I • similar rational holds for bank lending • some evidence for this in the Yugoslav case (Aleksic 2009) Business cycles II: Interwar Period Bilateral correlations of cyclical component (1919-1941) Bu Bulgaria Germany France England 0.14 0.26 0.22 0.46 0.68 0.19 0.42 0.32 0.41 0.79 0.24 0.46 0.51 0.56 -0.09 0.54 0.49 0.51 -0.05 0.08 0.29 0.32 0.32 0.44 0.42 0.38 0.48 Ro Yu Au Gr 0.71 0.72 0.59 0.82 Romania 0.71 Yugoslavia 0.72 0.82 Austria 0.59 0.68 0.79 Greece 0.14 0.19 0.24 -0.09 Average 0.54 0.60 0.64 0.49 Average excl. Greece 0.67 0.74 0.78 0.69 0.12 • Very high levels of business cycle integration between Bulgaria, Romania, Yugoslavia and Austria, but Greek case different • Average correlation between these 4 countries at 0.72, with little change before and after 1929 (0.79 versus 0.77) • Correlation intra-core and core-periphery increase after 1929 (to 0.66 & 0.63) but do not reach intra-SEE-4 synchronization level SEE regional business cycle • Only exception is Germany which in the 1930s is as synchronized with SEE-4 as SEE-4 among each other (0.73) How to explain the regional business cycle? And how to explain the Greek exception? No accepted “narrative” of interwar business cycles but three factors are seen as particularly relevant (Ritschl&Straumann 2010): (1) WW I: wartime recession (standard case) versus wartime boom (mainly neutral countries)? In case of wartime recession, peak normally 2 – 3 years after end of WW I (2) impact on the national business cycle from tying to (in the 1920s) and untying from (in the 1930s) the gold standard (3) development of bilateral trade patterns (1) The effect of World War I 6 Greece 4 2 0 -2 -4 -6 20 22 24 26 28 BULGARIA YUGOSLAVIA 30 32 34 36 38 ROMANIA GREECE • All SEE countries follow standard pattern of wartime recession... • ... but Greece is involved for longer in hostilities due to Greek-Turkish war (1919-1922) • Peaks follow end of hostilities with 2 – 3 year lag: 1920 for Austria, Bulgaria, Romania 1921 for Yugoslavia 1923 for Greece (2) Business cycles and exchange-rate regime 6 4 2 0 -2 -4 Greece -6 20 22 24 26 28 BULGARIA YUGOSLAVIA 30 32 34 36 38 ROMANIA GREECE • monetary stabilization in the 1920s almost simultaneous (Bulgaria, Greece: 1928; Romania, Yugoslavia: 1929); exception: Austria (1923) • 1930s: Austria, Bulgaria, Romania, Yugoslavia adopt deflationary policies cum foreign exchange controls Greece leaves gold standard in 1932 and defaults • Trough of Great Depression: • 1931 for Greece • 1933 for Austria, Romania, Yugoslavia • 1934 for Bulgaria • supportive of Eichengreen&Sachs (1985): early departure means quicker recovery (3) Trade patterns show increasing focus on Germany 1929 1933 1937 Export to Germany Bulgaria 42.5 45.1 47.1 Hungary 42.1 38.2 41.0 Romania 37.0 27.2 24.1 Yugoslavia 24.1 35.6 35.2 Bulgaria 29.8 44.4 58.2 Hungary 33.2 39.5 44.2 Romania 36.6 27.8 40.1 Yugoslavia 33.0 29.3 42.7 Import from Germany Source: Warriner, 1939: 58. Summary On Dynamic Factor Methodology • Can be employed successfully even for relatively short periods of time such as the interwar period Empirical findings • CDFA suggests much higher business cycle synchronisation than historical national accounts Pre-WW I • increasing business cycle synchronization, both within SEE and vis-à-vis the core economies • SEE increasingly participates in pan-European business cycle (i.e., no regional business cycle) Interwar period • emergence of a regional business cycle based on similar wartime experience (i.e. wartime recession), monetary developments and trade patterns • Greece is not part of this business cycle but Germany is Thank you very much ! We are looking forward to your comments matthias.morys@york.ac.uk hadjimartin@abv.bg Business cycles III: Postwar Period Does trying to detect a regional business cycle make sense despite the Iron Curtain? • Was there business cycle integration in the Soviet bloc at all? • Common external shocks: oil price shocks 1973/1979 • SEE contains the two “unruly children” of the Soviet bloc: (a) Yugoslavia: after 1949 (break with Stalin) opens economically towards the West by increasing trade and importing capital; even labour mobility (Gastarbeiter experience with West Germany) (b) Romania: similar (though less pronounced) developments after the oil price shock; becomes IMF member in early 1980s Do these interactions lead to a business cycle with Western Europe? General finding for Austria/Greece confirmed: relatively high integration with E, F, G in the 1950s and 1960s, less so in 1970s but then again in the 1980s and 1990s. Soviet bloc business cycle integration versus synchronisation with West Germany, 1950s – 1970s 4 4 .3 3 3 .2 2 .1 1 .0 0 -.1 -1 -.2 -2 -.3 -3 -.4 2 1 0 -1 -2 -3 -4 56 58 60 62 64 66 BULGARIA_ Germany W. Germany Yugoslavia 68 70 72 74 76 ROMANIA_ Ro Bu 0.48 -0.30 -0.53 -0.31 -0.70 Romania -0.30 -0.31 Bulgaria -0.53 -0.70 1956 1958 1960 1962 YUGOSLAVIA_ Yu 0.48 -.5 1954 0.56 0.56 1964 1966 1968 1970 1972 GERMANY - Bulgaria and Romania well integrated - Yugoslavia fairly well integrated with West Germany but not at all with Bulgaria, Romania Soviet bloc business cycle integration versus synchronisation with West Germany 1950s - 1970 Germany W. Germany Yugoslavia 1970 - 1988 Germany Yu Ro Bu 0.48 -0.30 -0.53 W. Germany -0.31 -0.70 Yugoslavia 0.42 0.56 Romania 0.34 0.57 Bulgaria -0.39 -0.12 0.48 Romania -0.30 -0.31 Bulgaria -0.53 -0.70 0.56 Yu Ro Bu 0.42 0.34 -0.39 0.57 - 0.12 0.28 0.28 • Not only Yugoslavia is connected to West European business cycle, but from the 1970s onwards also Romania • Bulgaria appears increasingly isolated; supports the political history story that Bulgaria was a more “committed” member of the Soviet bloc Summary On Dynamic Factor Methodology • Can be employed successfully even for relatively short periods of time such as the interwar period Empirical findings • CDFA suggests much higher business cycle synchronisation than historical national accounts Pre-WW I • increasing business cycle synchronization, both within SEE and vis-à-vis the core economies • SEE increasingly participates in pan-European business cycle (i.e., no regional business cycle) Interwar period • emergence of a regional business cycle based on similar wartime experience (i.e. wartime recession), monetary developments and trade patterns • Greece is not part of this business cycle but Germany is Post-WW II • Onset of the Cold War almost completely extinguishes regional business cycle integration • increasing links with the West of Yugoslavia, later Romania sees re-emergence of a common business cycle vis-à-vis Austria (and West Germany) Thank you very much ! We are looking forward to your comments matthias.morys@york.ac.uk hadjimartin@abv.bg Business cycles in the interwar period: The Greek exception 6 4 2 0 -2 -4 -6 20 22 24 26 BULGARIA 28 30 32 ROMANIA 34 36 38 YUGOSLAVIA 6 4 2 0 -2 -4 -6 20 22 24 26 28 BULGARIA YUGOSLAVIA 30 32 34 ROMANIA GREECE 36 38 Raw slide related to table 1 Source Average correlation Countries Time frame Statistical method: correlation of Morgenstern (1959) Backus&Kehoe (1992) 0.83 E, F, G 1870-1914 concordance index (NBER tradition) 0.03 E, G 1870-1913 de-trended GDP Artis et al. (2011) 0.09 E, F, G 1880-1913 de-trended GDP Bordo&Helbling (2011 ) 0.04 E, F, G, Ne, CH, US 1880-1913 GDP growth rates Bordo&Helbling (2011) 0.09 F, G, Ne, CH 1880-1913 GDP growth rates Uebele (2011) 0.61 E, F, G 1862-1913 CDFA business cycle indices Example: Austria-Hungary 1875-1913 4 5 4 4 3 4 3 3 2 3 2 2 1 2 1 1 0 1 0 0 -1 0 -1 -1 -2 -1 -2 -2 -3 -2 -3 -3 -4 -3 -4 -4 -4 -5 1875 -5 1875 1880 1885 1890 BUSINESS_CYCLE 1895 1900 1905 TRANSPORTATION r = 0.76 1910 -5 1880 1885 1890 1895 BUSINESS_CYCLE 1900 1905 1910 MANUFACTURING r = 0.63 • transportation: transported goods in million tons (Statistical Yearbooks) • manufacturing : component of GDP reconstruction by Schulze 2010 • transportation: quintessentially disaggregate data, raw data not influenced by prices • the individual series with the highest correlation are in our case: manufacturing, construction, transportation (often > 0.70), M0, M3, exports, government revenue Some comments on data reconstruction / estimation • SEE is often seen as terra incognita by cliometricians but a “new economic history” of SEE could easily be written • Main source: official Statistical Yearbooks (publication of which started shortly after gaining political independence in 1870s & 1880s) • Comparison with Mitchell’s Historical Statistics often shows major discrepancies • For the post-WW II period, local sources for BG, RO & YU were doublechecked with Western sources on Soviet bloc countries (Vienna Institute for International Economic Studies, Marrer et al.) • First attempt ever to construct some of the time series based on a unified methodology for all countries: CPI, REER & TOT • Time series are de-trended with HP filter (λ = 6.25) • Bayesian estimation (more flexible when dealing with short time series)