Identity Theft and You

advertisement

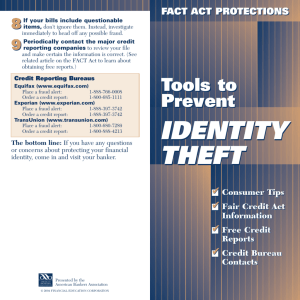

Identity Theft and You Presented to Delta Kappa Gamma February 4, 2006 – Beeville, Texas By: Brian T. Burris The Burris Law Firm Is there a problem? • How many people are affected? • How big is the problem? • Who is affected? (Surely not me!) How many people are affected? •Good news or bad news? •The good news is… • that the number of identity thefts fell from the year 2004 to 2005 •The bad news is… •That the number of victims in the year 2004 was approximately 9.3 million! •In 2005, the number “fell” to 8.9 million How big is the problem? •Identity theft is a world-wide problem. •In the U.S. alone, the composite loss to victims was $57 billion in the year 2005 •That number is up from $54.4 billion in the year 2004 How does that affect me? •Who is your most likely victim? •People earning less than $35,000 per year report the most instances of identity theft. •The average fraud during the year 2005 was $6,383 per victim… •Up from $5,885 in 2004 •The largest frauds, however, are typically… How does that affect me? •Committed against those earning between $75,000 and $100,000 per year •The average fraud committed against these persons was $9,978 in the year 2005 How does that affect me? •Question – how much time does it take the “average” victim to discover identity fraud? •According to the Federal Trade Commission… •12 months! How does that affect me? •Question – once identity theft is discovered, how much time should a victim expect to invest to “recover” from the problem? •According to the Federal Trade Commission… •175 hours How does that affect me? Who steals identities? Someone at your workplace…4% A random person…8% Someone at a company with access to personal information…13% A friend, neighbor or in-home employee…18% A complete stranger outside the workplace…24% A family member or relative…32% How does that affect me? •BOTTOM •Unless LINE!!!!! you have… •An extra $6,000 sitting around that you have contemplated setting fire to, •An extra 175 hours of free time to spend on the phone with credit agencies, etc., •And don’t need credit in the near future, •Take steps to PROTECT YOURSELF! How to protect yourself. How does a person discover that she is a victim? ---Get a phone call or letter telling you that you have been approved or denied credit for accounts that you didn’t request ---You cease to receive a credit card statement or some of your mail doesn’t seem to come ---Your credit card statement includes charges for things that you never bought ---A collection agency tells you that they are collecting on an account that you never opened How to protect yourself. If you are aware of any unusual activity with regard to any financial institution…. INVESTIGATE – IT COSTS YOU NOTHING! I got an e-mail the other day… VISA/Mastercard Scam TRUE! More examples…. “Phishing” “Payment processing”–it’s a part time…scam Nigerian “rich uncle” scam Lottery scams Free credit report scams Free gift scams Sign-In Rosters – Watch Them More examples…. E-Mail Chains/Pyramid Schemes “If you forward this letter to ten of your friends, Bill Gates will pay you….” NOTHING!!!!!!!! More examples…. Employment Scams In-Store Security Scam Jury Duty Scam IRS/Bank Scams Ultra-Low Mortgage Brokers Skimmers How do I avoid identity theft? What shouldn’t I do? DO NOT: Leave your social security card in a discoverable place…that includes your purse Print personal information on your checks (like driver’s license, date of birth, SSN) Leave receipts (ATM, credit card) behind Let your credit card out of your sight Accept offers from credit agencies that you haven’t heard of (Experian, TransUnion, Equifax) Keep PIN numbers in your wallet How do I avoid identity theft? DO NOT: Put your important information on your computer if it is (i) used by others, (ii) connected to the internet, or (iii) not password protected. How do I avoid identity theft? DO: Keep a copy of your credit cards, other documents that you keep in your purse (keep them in a secure place…with your social security card) Write “Photo ID Required” instead of signing cards Shred or destroy records, statements, and credit card offers that you receive If necessary, protect your mail box. Either incoming or outgoing can be a problem! Know who you are dealing with when applying for credit, a job, etc. How do I avoid identity theft? DO: Place passwords on your bank/credit accts Take your name off of the telemarketer’s hit list – 1-800-382-1222 is the National Do Not Call Registry toll-free number Review your credit card statements carefully. Make sure that you recognize vendors and amounts that appear there. Close old credit accounts (dept. stores) How do I avoid identity theft? General Tips: BE DEFENSIVE WITH YOUR PERSONAL INFORMATION! Ask salesperson if they need information. If you are suspicious, use alternative payment method (cash) or don’t buy! MONITOR YOUR CREDIT REPORT – 1-877322-8228 or www.annualcreditreport.com What if I become a victim? Immediately call the fraud departments of all three credit bureaus: Equifax: 1-800-525-6285 Experian: 1-888-EXPERIAN TransUnion: 1-800-680-7289 What if I become a victim? Place a “fraud alert” on your accounts. This can help prevent an identity thief from opening additional accounts. Theoretically, each company is required to contact the other two when a fraud alert is entered, but you should contact all three, just in case! What if I become a victim? If you become a victim, you are entitled to free copies of your credit report – request them! Get fraudulent information removed. What if I become a victim? If you confirm victim status, request that an “Extended Fraud Alert” be placed on your account. A Fraud Alert stays on your account for 90 days. An Extended Alert is for 7 years. Will mean delays in approval of credit, you will have to produce positive ID to do so. What if I become a victim? If you spot a fraudulent credit account, contact the creditor directly. Speak with someone in the fraud department. File a police report with (i) your local police department or (ii) the community where the fraud took place. Get a copy of the report. What if I become a victim? Keep EVERYTHING related to the fraud, including your correspondence with creditors, credit agencies, etc. File a complaint with the FTC. While the feds might not take any further action, they do maintain a database that is utilized by law enforcement agencies nationwide. REMEMBER! Would you give your purse to a stranger? It is YOUR information. Protect it. Keeping a strong “front line” defense against identity theft goes a long way. If you see something out of the ordinary going on at your neighbor’s house, you exercise caution. Do so when someone is snooping around for YOUR information. REMEMBER! If you were suspicious that someone had broken into your house, you would investigate, right? Do so if you are suspicious that your identity has been stolen. Follow up. Follow up. Follow up again. REMEMBER! If you discover that your identity has been stolen, refer to your brochure as a starting point. If you need further guidance… Just call my mom. Contrary to her claims, she doesn’t know everything, but…. She has my phone number! REMEMBER! Use your common sense! Don’t become a victim. Questions. IDENTITY THEFT AND YOU Brian T. Burris The Burris Law Firm