Safeguarding Customer Information Gramm

advertisement

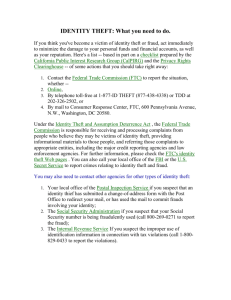

Safeguarding Customer Information Gramm-Leach-Bliley Act Compliance Ellen Harris-Small Terry Wooding 1 Why was GLBA enacted? Section 501 of the Gramm-Leach-Bliley Act requires Financial Institutions to establish standards relating to administrative, technical and physical information safeguards to protect customer records and information. 2 Safeguard Objectives: • Ensure security and confidentially of customer records and information. • Protect against any anticipated threats or hazards to the security of the records. • Protect against unauthorized access or use of records or information which could result in harm or inconvenience to customer. 3 Information Security Plan • Written to insure security and confidentiality of non-public customer financial information (NPI). • Protect against any anticipated threats and hazards. 4 • Protect against unauthorized access or use. Non-public customer information (NPI) • • • • • • • • • Credit card numbers Social Security numbers Drivers license numbers Student loan data Income information Credit histories Customer files with NPI NPI Consumer information Bank Account data 5 Financial Institutions Including Colleges and Universities must ensure that their security programs provide adequate protection to customer information in whatever format – electronic or hardcopy. 6 FTC Ruling consumer’s information is not a privacy issue but is one of security. Compliance with FERPA does not exempt colleges and universities from GLBA safeguarding regulations. 7 FERPA vs.. GLBA • The Family Education Rights and Privacy Act addresses the privacy of student information. • Gramm- Leach-Bliley Act addresses the security of customer records and information. 8 Rutgers University • Has established a committee to insure compliance. • Committee meets regularly to review and insure compliance with the act. • Performs risk assessment and regular testing. • Oversees service providers and contracts. • Trains staff to maintain security and confidentially. 9 Why Protect your Identity? Identity Theft 10 Statistics on Identity Theft in New Jersey 4802 Complaints / year • • • • • • • • 1. Credit Card Fraud 2,350 -- 49% 2. Phone or Utilities Fraud 867--18% 3. Bank Fraud 669 --14% 4. Government Documents/Benefits Fraud 396 --8% 5. Loan Fraud 356 --7% 6. Employment-Related Fraud 260 -- 5% 7. Attempted Identity Theft 477 --10% 8. Other 710 -- 15% 11 What is Identity Theft? • Under ID Theft Act, identity theft is defined very broadly as: knowingly using, without authority, a means of identification of another person to commit any unlawful activity. (unlawful activity: a violation of Federal law, or a felony under State or local law). 12 Identity Theft When someone steals your identity, they are usually using your credit to obtain goods and services for themselves that “you” will have to pay for. 13 How Does an Identity Thief Get Your Information? • Stealing files from places where you work, go to school, shop, get medical services, bank, etc. • Stealing your wallet or purse. • Stealing information from your home or car. • Stealing from your mailbox or from mail in transit. • Sending a bogus email or calling with a false promise or fraudulent purpose. - For example: pretending to be from a bank, creating a false website, pretending to be a real company, fake auditing letters. 14 From: PNC Bank Sent: May 17, 2004 6:31 PM To: abuse@rutgers.edu Subject: To All PNC bank users Dear PNC user, During our regular update and verification of the user data, you must confirm your credit card details. Please confirm you information by clicking link below. http://Cards.bank.com pncfeatures/cardmember access.shtml 2004 PNC Bank 15 How Does an Identity Thief Use Your Information? • Obtains Credit Cards in your name or makes charges on your existing accounts (42%). • Obtains Wireless or telephone equipment or services in your name (20%). • Forges checks, makes unauthorized EFTs, or open bank accounts in your name (13%). • Works in your name (9%). • Obtains personal, student, car and mortgage loans, or cashes convenience checks in your name (7%). • Other uses: obtains drivers license in your name. 16 Victims of Identity Theft • If your identity is stolen, do the following immediately: – Contact the fraud department of the three major credit bureaus (Equifax, Experian, Trans Union). – Contact your creditors and check your accounts. – File a police report. - File a complaint with the FTC. 17 Recovery • Take back control of your identity: – Close any fraudulent accounts. – Put passwords on your accounts. – Change old passwords and create new PIN codes. 18 Prevention Protect yourself Protect others Guard against fraud: • Sign cards as soon as they arrive. • Keep records of account numbers and phone numbers. • Keep an eye on your card during transactions. Also be aware of who is around you, is anyone else listening? • Check your credit report and credit card monthly statements. 19 Annual credit bureau report • New Jersey residents are entitled to one free annual credit report. • If you are denied credit, you are allowed to request one free copy of your credit report. • Check your report for accurate information, open accounts, balance information, loan information, etc. 20 Credit Bureau Links • Equifax – www.equifax.com – To order a report, 1-800-685-1111 – To report fraud, 1-800-525-6285 • Experian – www.experian.com – – To order a report, 1-888-397-3742 To report fraud, 1-888-397-3742 Trans Union – www.tuc.com – To order a report, 1-800-916-8800 – To report fraud, 1-800-680-7289 21 Have you been a Victim? 22 You may be a victim if: • • • • You are denied credit. You stop getting mail. You start getting collection calls/mail. You start getting new bills for accounts you do not have or services you did not authorize. • Your bank account balances drops. 23 Damages • • • • Time Money Credit rating Reputation 24 Good Practices • Photocopy the contents of your wallet/purse. • Photocopy your passport (keep a copy at home and one with you when you travel). • Empty your wallet/purse of non-essential identifiers. • Do not use any information provided by the people who may be trying to scam you look it up yourself. • Shred documents before you depose of them. 25 GLBA requires us to PROTECT CONSUMERS from substantial harm or inconvenience. 26 What can we do to guard NPI? • Keep confidential information private. • Use care when asking or giving SSN. • Use secure disposal methods. • Protect the privacy of data transmissions. • Improve procedures. 27 Actions to prevent Others from becoming Victims • Determine what information you need. • Provide a secure workplace. • Always ask for a student’s ID or debtors account number. • Keep prying eyes away from customer’s information. • Don’t expose NPI information to the outside world. 28 Actions to prevent Others from becoming Victims • Take care when you provide employee’s or customers’ personal information to others. • Know & explain how you handle personal information. • Ask for written permission prior to sharing personal information. • Report problems or concerns to managers or supervisors. 29 Remember to always maintain confidentiality, security and integrity : Avoid – – – – – unauthorized disclosure removing information from your office sharing information tossing information in the trash down loading or e-mailing information. 30 General Privacy • Do not provide correcting information for account verification questions. • Be suspicious. • Be paranoid. • Don’t be afraid to say no when asked for information that is not required to conduct the current business transaction. 31 What are university assets? 32 Rutgers University Assets Are customer information and records assets? 33 Safeguarding Information • Information takes many forms. • Information is stored in various ways. • Data assets have unique risks. 34 Safeguarding Information Your Role: • • • • • • Ensure Physical Security. Select and Protect hard to guess passwords. Avoid email traps and disclosures. Back up files. Log off your computer when not in use. Do not open emails with attachments from unknown sources. • Obliterate data before giving up your computer. • Recognize social engineering tactics. 35 Safeguarding Information Your role as a user…. What else can you do? 36 Check your work area! • • • • Do you leave NPI reports on your desk? Is NPI stored in unlocked file cabinets? Keep computer disks secure. Do not save NPI on your computer C drive. 37 Safeguarding Information Your role…. The University has many policies and procedures to help you, learn them. 38 University Regulations & Guidelines related to Safeguarding Standards for University Operations Handbook • Confidentiality • Accounting for Financial Resources • Acceptable Use of Network &Computing Resources: – – – – – Agreement for Accessing Information Acceptable Use Policy Guidelines for Interpretation of Acceptable Use Acceptable Use Supplement Basics 39 Potential Damages to Rutgers • • • • • • Reputation Violation of federal and state laws Fines Reparation costs Recovery costs Increased prevention costs Georgia Tech accidental release of credit card to the internet cost them over $1,000,000. 40 Management’s Expectations “Rutgers places a high level of trust in you, its faculty and staff, and requires that University assets under your control be protected and properly safeguarded from loss and misuse.” Joanne G. Jackson Senior V.P. October 24, 2001 41 Expectations • All RU employees are responsible for securing and caring for University property, resources and other assets. • RU relies on the attention and cooperation of every member of the community to prevent, detect and report the misuse of university assets. 42 Prevention • Protect yourself • Protect others 43 Safeguarding customer information and university assets is everyone’s job! 44