Power Point Presentation only - International Right of Way Association

1

Welcome to the

International Right of Way

Association’s

Course 401

Appraisal of Partial

Acquisitions

401-PT – Revision 2 – 01.20.07.CAN

2

Introductions

Who we are…

What we do…

Where we do it…

How long we’ve been doing it…

Our goals for the course...

3

Objectives

(1)

At the end of the course, you will have ...

Reviewed the basic principles and the valuation process

4

Objectives

(2)

At the end of the course, you will be able to ...

Utilise both the Before and After Rule and the Summation Method in the valuation of partial acquisitions

Understand and allocate the partial acquisition compensation among its components (i.e., value of the part taken, injurious affection, special benefits to the remainder, cost to cure)

5

Objectives

(3)

At the end of the course, you will be able to ...

Employ various methods to analyse and quantify the impacts of partial acquisitions on remainder properties

Analyse easement acquisitions and understand better easement valuation methods

6

Objectives

(4)

At the end of the course, you will be able to ...

Be better expert witnesses.

7

Controlling Documents

• Federal and Provincial Expropriation Acts

• Canadian Uniform Standards of Professional

Appraisal Practice (CUSPAP)

8

Housekeeping

9

Schedule

(1)

(Day One)

Review of Principles,

Valuation Process and Terms

Larger Parcel

Introduction to the Summation Method and the Before and After Method

10

Schedule

(2)

(Day Two)

More on the Summation Method and the

Before and After Method

Effects on the Remainder Property

Income Approach

11

Schedule

(3)

(Day Three)

Cost Approach

Compensable and Non compensable Damages

Benefits

12

Schedule

(4)

(Day Four)

Easements

(Day Five)

Litigation

Open Forum

Exam

13

Value Principles

• Substitution

• Supply and Demand

• Anticipation

• Consistent Use

• Contribution

14

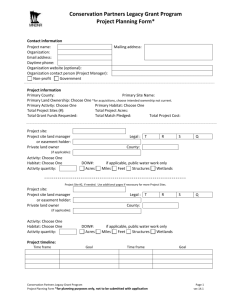

Valuation Process

Appraisal Problem Definition

Scope of Work

Data Collection and Description

Land Value Opinion

Three Approach to Value

Reconciliation and

Final Value Opinion

Defined Value Opinion Report

15

Valuation Process

Appraisal Problem Definition

• Identification of the client, intended use, and users

• Value to be developed

• Date of the value opinion

• Identity and location of the subject property

• Property rights to be valued

• Limiting conditions

16

Valuation Process

Scope of Work

• Degree to which the property is inspected or identified

• Extent of research into physical and economic factors

• Extent of data research

• Type and extent of analysis applied to arrive at opinions or conclusions

17

Valuation Process

Data Collection and Description

• Market area data

• Comparable property data

• Subject property data

18

Valuation Process

Highest and Best Use

The reasonably probable and legal use that is physically possible, appropriately supported, and financially feasible, and that results in the highest value.

• Physically possible?

• Legally permissible?

• Financially feasible?

• Maximally productive?

19

Valuation Process

Cost Approach

• Develop a value opinion for the land

• Estimate the cost new of the improvement

• Deduct depreciation

• Add land value opinion to the depreciated improvement value

20

Valuation Process

Direct Comparison Approach

• Research the market for comparable data

• Develop relevant units of comparison

• Compare the sales to the subject and adjust for dissimilarities

• Reconcile the value indications into a final value opinion

21

Valuation Process

Income Approach

• Estimate the subject’s annual potential gross income

• Determine a vacancy and collection loss

• Subtract the vacancy and collection loss from the potential gross income

• Estimate annual property expenses and subtract the expenses from the effective gross income to arrive at the net operating income

• Develop a capitalization rate

• Convert the net operating income into value

22

Valuation Process

Defined Value Opinion Report

• Narrative

• Short narrative

• Form

23

Valuation Process

Appraisal Problem Definition

Scope of Work

Data Collection and Description

Land Value Opinion

Three Approach to Value

Reconciliation and

Final Value Opinion

Defined Value Opinion Report

24

Terms

(1)

• Larger parcel

• Before and After Method

• Summation Method

• Before value

• After value

• Value of the part taken

25

Terms

(2)

• Value of the part taken, as part of the whole

• Value of the remainder, as part of the whole

• Value of the remainder after the acquisition, disregarding special benefits

• Injurious affection

26

Terms

(3)

• Value of the remainder after the acquisition, considering special benefits

• Benefits

• Cost to cure

• Easement

• Due compensation

27

Larger Parcel

… the tract or tracts of land, which possess a unity of ownership and have the same, or an integrated, highest and best use.

28

Larger Parcel “Tests”

• Unity of title

• Unity of use

• Contiguity or proximity

29

Two Methods

• Summation Method

• Before and After Method

30

Summation Method

Payment is made for the value of the part taken plus (injurious affection minus special benefits to the remainder property).

The amount of injurious affection minus the amount of special benefits cannot be less than zero dollars.

Before and After Method

31

Payment is the difference between the value before the acquisition and the value after the acquisition. No breakdown of the compensation is required and theoretically

(but not practically) the market value of the acquisition could be nil. In practice, the owner must be compensated for the value of the land taken, regardless of any betterment to the remaining lands.

32

33

Summation Method

(1)

• Value of the whole, before acquisition

• Value of the part taken, as part of the whole

• Value of the remainder, as part of the whole

• Value of the remainder after the acquisition, disregarding special benefits

34

Summation Method

(2)

• Injurious affection

• Value of the remainder after the acquisition, considering special benefits

• Special benefits to remainder

• Net injurious affection or net special benefits

• Total compensation

35

Before and After Method

Before value

(minus) After value

(equals) Total compensation

36

Recap Day One

37

Recap Yesterday and Look at Today

38

Out of Whack?

(1)

“…$75,000 home

… and a mere slice of land around the corner

…just sold for

$100,000.”

“It causes consternation…

(w)e got one appraisal at

$48,000 and one at $135,000…”

39

40

Features Affecting Land

• Accessibility

• Access

• Landlocking

• Size and Shape

• Frontage

• Topography

41

Features Affecting

Site Improvements

• Landscaping

• Private utilities

• Utilities

• Municipal services

42

Features Affecting

Building Improvements

• Functional utility

• External obsolescence

43

44

Income Approach

• Estimate the subject’s annual potential gross income

• Determine a vacancy and collection loss

• Subtract the vacancy and collection loss from the potential gross income

• Estimate annual property expenses and subtract the expenses from the effective gross income to arrive at the net operating income

• Develop a capitalization rate

• Convert the net operating income into value

45

Reconstructed

Operating Statement

Potential Gross Income

(minus) Vacancy and Collection Loss

(equals) Effective Gross Income

(minus) Operating Expenses

(equals) Net Operating Income

46

Rates

Ro

Yo

47

48

49

Recap Day Two

50

Recap Yesterday and Look at Today

51

Cost Approach

• Develop a value opinion for the land

• Estimate the cost new of the improvement

• Deduct depreciation

• Add land value opinion to the depreciated improvement value

52

Depreciation

A loss in value from any cause.

• Physical deterioration

• Functional obsolescence

• External obsolescence

53

Cost to Cure

… the cost to restore an item to its pre acquisition state.

54

55

56

Injurious Affection

… a loss in value to the remainder property as a result of a partial acquisition.

57

Benefits

… an increase in value to the remainder property as a result of a partial acquisition.

58

Recap Day Three

59

Recap Yesterday and Look at Today

60

Easement

… a non possessory interest one has in the property of another for a specific purpose.

61

Dominant and Servient Estates

62

Valuation Concepts

• What the owner has lost, not what the agency has gained

• Unit Rule

• Remainders (The 3 “Rs”)

63

Remainders (The “3Rs”)

(1)

• Remnant

• Residual

• Remainder

64

Remainders (The “3 Rs”)

(2)

1

2

3

65

Remainders (The “3 Rs”)

(3)

Remnant

Residual

1

2

3

Remainder

66

Easement Information

Sources

• Easement document

• Statutes and Case law

• Custom and Usage

• Market perceptions

67

Market Perceptions

“Property owners…are due compensation, even if the ‘cancerphobia’ driving down the worth of their land is unjustified or irrational…”

68

Valuation Considerations

• Nature of the easement

• Rights taken

• Applicable laws

• Characteristics affecting value

• Easement effects

69

Estates

Dominant estate is the property benefited by the easement.

Servient estate is the property burdened by the easement.

70

Easement Categories

• Sub surface easement

• Surface easement

• Overhead easement

71

1

72

2

73

74

4

75

5

76

6

77

7

78

8

79

9

80

10

81

4 11

82

Temporary Easement

… an easement that is for a limited duration.

83

Recap Day Four

84

Recap Yesterday and Look at Today

85

Expert Witness

… is an individual qualified by knowledge, skill, experience, training and education to testify in a legal proceeding.

86

The 3 “Cs”

• Communication skills

• Competence

• Competitiveness

87

Litigation Contexts

• Pre trial conferences

• Discovery

• Trials

88

Discovery

… the techniques and procedures by which each attorney obtains information from the opposing party, witnesses and other parties. Discovery includes written interrogatories and depositions .

89

Open Forum

90

Objectives

(1)

You have ...

Reviewed the basic principles and the valuation process

91

Objectives

(2)

Right now, you are able to ...

Utilize both the Before and After Method and the Summation Method in the valuation of partial acquisitions.

92

Objectives

(3)

Right now, you are able to ...

Understand and allocate the partial acquisition compensation among its components (i.e., value of the part taken, injurious affection, special benefits to the remainder, cost to cure).

93

Objectives

(4)

Right now, you are able to ...

Employ various methods to analyse and quantify the impacts of partial acquisitions on remainder properties.

Analyse easement acquisitions and understand better easement valuation methods.

94

Objectives

(5)

Right now, you should

Be better expert witnesses.

95

Thank you!

401-PT – Revision 2 – 01.20.07.CAN