General Motors SWOT Analysis

advertisement

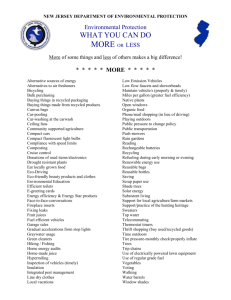

General Motors SWOT Analysis Strengths Large Market Share General Motors, as one of the largest and oldest automakers in the world, has accumulated a vast market share over the years. Global and Domestic Experience GM is able to draw on past experiences with changing market demands and both internal and external factors as it has been through numerous similar circumstances before at various times during its existence. Variety of Brands The variety of brands GM operates gives the company a wide array of options in dealing with its current position. GM can choose to focus on certain core brands and build outwards from them, or experiment under different brand names with new varieties of vehicles and marketing in order to formulate a path that will best suit its goals. It can partake in such experimentation without the fear of marring the name of its other brands, as they are not all closely associated with one another by the average consumer. Weaknesses Currently behind competitors on Alternative Fuel movement While numerous companies such as Honda and Toyota have long since implemented gasoline-electric hybrid vehicles into their lineups, GM is only now starting to do so. As such, they missed the initial adoption of such vehicles, and now must fight to take market share away from established competitors. Vertically Organized Corporate Structure A well-documented weakness of General Motors is the company’s rigid vertical hierarchy, in which important decisions are made generally only at the top and filtered down through the company. Many such decisions have obviously not been beneficial for the company, and have placed it now in circumstances that perhaps could have been avoided to some degree had a more open, flat structure been in place. Consumers losing confidence After seeing the company flailing in the face of the recession and readily accepting a government bailout, many consumers have lost faith in the company. This becomes an issue when looking towards future relations with the car company in terms of warranties and servicing. Consumers are likely inclined to go with a company that will almost certainly still exist in 10 years. Tied to the U.S. Market As demonstrated by the effects of the recession, General Motors is clearly tied to the U.S. economy. If it slows, so to do GM’s sales. Opportunities Alternative Fuel movement While GM may have lagged in adopting the hybrid car movement, they still have numerous opportunities in further alternative fuel markets, which they are now attempting to take advantage of, such as hydrogen and electric powered automobiles. Expansion into the Global Market As foreign markets become more and more developed, the market for automobiles is ever-expanding. GM has had success already in the Chinese market, and must continue to do so there while also looking for other growing markets. Numerous Brand Names Again, the variety of brands under GM leave it numerous opportunities to target niche markets without harming the core of the company. “Clean Slate” One positive effect of the recession for GM is that it has given the company an excuse to essentially “start over”, something they are clearly attempting to do as indicated by their new slogan, “Reinvent”. Threats Rising Fuel Prices Rising fuel prices are a threat to any traditional automaker, and make the creation of alternatively fueled vehicles ever more important. Fast Growing Competitors Asian competitors such as Hyundai with an emphasis on economy and fuel efficiency of vehicles are growing at a rapid pace. This poses a large threat for GM, who must attempt to retain market share and grow as well. Rise of Supply Costs GM’s costs are tied to the industry prices for materials such as steel. GM must establish a solid, reliable supply chain or look into cheaper materials should the price of such materials increase for any reason.