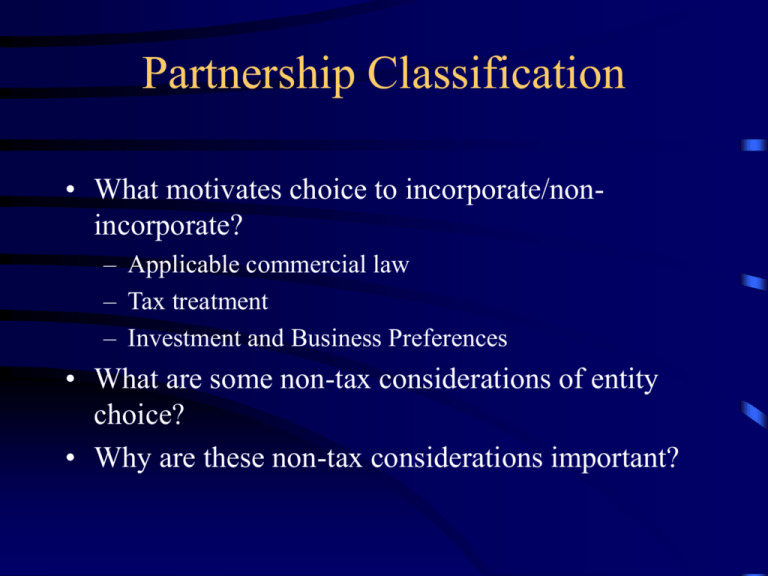

Partnership Taxation Partnership Classification

advertisement

Partnership Classification • What motivates choice to incorporate/nonincorporate? – Applicable commercial law – Tax treatment – Investment and Business Preferences • What are some non-tax considerations of entity choice? • Why are these non-tax considerations important? Relevant classification of entities for tax purposes • • • • Individual - How taxed? Corporation - How taxed? Partnership - How taxed? Compare contrast corporation and partnership taxation. • Compare contrast individual taxation and partnership taxation. What is a partnership? • IRC Sec. 761 defines partnership – – – – 2 or more persons (i.e., partners) who carry on a business for profit as co-owners • Failure to meet these requirements may result in ineligibility of partnership status • IRS Pub 541: A partnership is an unincorporated organization with 2+ members that carry on a business etc. and divide profits/losses. When do partnerships not exist/ Rules to Classify Partnerships • Not a Partnership ( Reg. Sec. 1.761) if – agreement to share expenses only – lack of co-ownership (capital interest) -facts and circumstances test – lack of a business activity / active pursuit • Rules used to classify – Check the box regulations (Regs 301.7701) / AntiAbuse Rules / Rules that allow joint ventures to be partnership or tenants in common. Key Tax Related Issues • • • • • Self Employment Tax Treatment of Liabilities At Risk Rules Passive Activity Loss Rules Tax Matters Partner: Unified Audit and Litigation Procedures..TMP must be a general partner or Member manager of LLC, not applicable to small (<10 partners) or electing large partnerships >100) electing out of Sub K treatment. Joint Tenancy v. Partnership • 3 Key reasons for proper classification – Filing Requirements..Form 1065 needed for partnerships – Tax Elections made at the partnership level…individual elections invalidated. – As TIC, co-owner can more easily use like kind exchange provisions. If a partnership, owners themselves cannot engage in like-kind exchanges. • Examples: Investment partnerships/ Expense sharing / Creditor-Debtor Partnership Tax Years • Sec 706(a) - a partner’s distributive share of partnership items is included in gross income for any taxable year of the partnership ending within or with the taxable year of the partner. – For a calendar year taxpayer, in what tax year of the individual is the following partnership information included: • Partnerships with a calendar year ending 12/31/04? • Partnerships with a fiscal year 2/1/04 to 1/31/05? • Partnerships with a fiscal year 12/1/04 to 11/30/05? • Partnership tax years generally must have the same taxable year as the common taxable year of the partners that in the aggregate have interests greater than 50% (Majority interest – generally on first day of tax year) Partnership Tax Years (continued) • If there is no partner/group of partners with the same taxable year owning >50%, the partnership must adopt the common taxable year of all of the principal partners. – Principal partner - person owning an interest of 5% or greater in partnership capital or profits. • If partnership is unable to determine its tax year by reference to the majority interest or principal partners - calendar year or year with least aggregate deferral is used. Partnership Tax Year Continued • Changes in tax years – Majority interest / Principal Partner Changes – If Y/E changes because of ownership changes, the alteration is deemed an automatic change – No 4 year spread – Use Form 1128 to make changes. • When might you see a partnership have a year end other than a calendar year? What is the most common occurrence for this situation? • A partnership can avoid the majority interest and principal partner rules if a valid business purpose for an alternate tax year exists. Tax Years - Business Purpose • Use Rev Proc 2002-38, 2002-22 to determine natural business year • Use 25% test - gross receipts from sales and services for the last 2 months of the requested tax year must exceed 25%. This must be the case for 3 years prior to the examination date. However at least 47 months must exist for examination purposes even though only 36 months are used. • If a taxpayer fails the 25% test, they may apply for a business purpose year end using a preponderance of the the facts and circumstances - both tax and non-tax considerations are factored into the request. Sec. 444 Election • Allows a year end to be kept (in case of existing partnerships or elected for new partnerships that is not the one authorized by IRS or using rules for business purpose • Requires and advance payment of the estimated deferral benefit received from the tax year difference. • Deferral cannot exceed 3 months • Firm is required to keep a non interest bearing account with the IRS. Accounting Methods • Cash / Accrual / Hybrid…what are they? • Treatment of Inventory? • Changing accounting methods – automatic versus required. • Cannot use cash method if – Tax Shelter – Have corporate partner with avg. gross receipts in excess of $5million.