Principles of PM Part 1 - Property Management Licensing

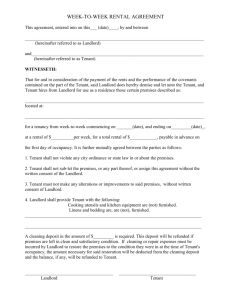

advertisement