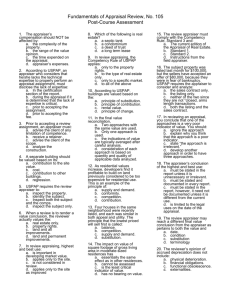

Appraisal Review - North Star Chapter of the Appraisal Institute

advertisement

Appraisal Review and Regulatory Issues in the Current Banking Environment A Bank Reviewer Appraiser’s Perspective Topics • Brief History of Regulatory Environment • Most impactful issues with the regulations • “Best Practices” for Compliance • Appraisal Review • Specific Examples from Real Appraisals Brief Regulatory History • New “Interagency Appraisal & Evaluation Guidelines” as of December 2, 2010 • Previous guidance issued in 1994 with updates on specific topics • 12/2/2010 combines everything and emphasizes common themes Important Points 1. Collateral is an important component of credit decision. 2. Independence of persons ordering, performing, and 3. 4. 5. 6. 7. 8. reviewing appraisals and evaluations. Focus on appraiser selection based on competency. Value Definitions and Scenarios. Expanded Evaluation Requirements. Appraisal or Evaluation Required? Depth of Review/Evaluation Quick Compliance Suggestions Important Component of Credit Decision • The collateral valuation program is an integral component of the credit underwriting process and, therefore, should be isolated from influence by the institution’s loan production staff. • A review of valuation information is an essential component of sound credit administration and is mandated by the Dodd-Frank Act. • Reviewing appraisals and evaluations before engaging in a loan transaction ensures the value conclusion is reliable and enables financial institutions to make informed credit decisions, manage credit risk, and meet supervisory requirements. • Loan repayment sources: 1. Borrower 2. Guarantor 3. Collateral 4. Refinance from another lender Independence of Process • Appraisers must be independent of the loan production and collection processes and have no direct, indirect or prospective interest, financial or otherwise, in the property or transaction. • USPAP requires disclosure • Interagency Guidelines simply don’t allow it. Not Independent Independent Very Important Thing to Note: • “Communication between the institution’s collateral valuation staff and an appraiser or person performing an evaluation is essential for the exchange of appropriate information relative to the valuation assignment.” • Source: Interagency Appraisal & Evaluation Guidelines, Page 21 of 70 • “An institution should not directly or indirectly coerce, influence or otherwise encourage an appraiser or a person who performs an evaluation to misstate or misrepresent the value of the property.” • Source: Interagency Appraisal & Evaluation Guidelines, Page 21 of 70 • After April 1, 2011, an institution must report non-compliance with USPAP to state appraiser boards • Must also file a Suspicious Activity Report (SAR) with Financial Crimes Enforcement Network (FinCEN) when suspecting fraud • Factual errors are major trouble, differences in opinion are more difficult to pursue. Appraisals from Other Financial Institutions • Appraisal must meet the Bank’s quality standards (and of course be compliant with USPAP & FIRREA) • Must be still valid with respect to changes to the property and market since date of value • Should confirm: • Appraiser was engaged directly by the other bank • Appraiser had no direct, indirect, or prospective interest, financial or otherwise, in the property or transaction • Cannot accept readdressed or altered appraisals with intent to conceal original client • A borrower can inform the lender that a current appraisal exists, and the lender may request it directly from the other institution • No “assignment letters” for appraisals from other financial institutions required. • Appraiser cannot be engaged by borrower. – Independence is compromised when: • a borrower recommends an appraiser or person to perform the evaluation • loan production staff selects a person to perform the appraisal or evaluation Engagement letters • Provides paper trail. • Lenders should use written engagement letters when ordering appraisals, especially for large, complex or out-of-area commercial properties. • Note: Appraisal Institute offers samples. • Also, appraisers should have their own. Preparing Customers for Appraisals Let customers know: An appraiser will be calling them to set up an inspection They will request information needed to complete the assignment, which may include: Site plans Building plans Capital expenditures (in recent years and planned) Historical income and expense statements (3 years + YTD) Rent rolls Leases Title work Previous appraisals Purchase agreement (if applicable) Expectations for Appraisers In most cases, it’s a good idea for appraisers to contact the customer within a few business days of engagement. If they are going to be late, notification to the client should occur as soon as possible. Learn the regulations to add value to your customers, by catching things that could get them in trouble. Value-in-use example. Resolving Appraisal Deficiencies • What can and cannot be asked of an appraiser: • Can: Consider additional info. about the subject or comps • Can: Provide additional support for the value • Can: Correct factual errors • Cannot: Instruct or require the appraiser to make substantial changes • If still not resolved, what options do we have? • Reject the appraisal and order a new one • Rely on an appraisal review completed by an appropriately licensed appraiser, that includes a value opinion – must comply with USPAP Standard 3 • Adjust underwriting criteria Focus on Competency • “The person selected possesses the requisite education, expertise, and experience to competently complete the assignment.” • Source: Interagency Appraisal & Evaluation Guidelines, Page 22 of 70 • Reviewer qualifications – Not required to be a state licensed or certified appraiser – Must be independent and competent – Let the appraisal stand on its own merit, aside from the specific qualifications of the appraiser. Value Definitions and Scenarios An appraisal report must: 1. Conform to USPAP. 2. Be written and contain sufficient information and analysis to support the institution’s decision to engage in the transaction. 3. Analyze and report appropriate deductions and discounts for proposed construction or renovation, partially leased buildings, non-market lease terms, and tract developments with unsold units. 4. Be based on the definition of market value set forth in the appraisal regulation. 5. Be performed by state licensed or certified appraisers. In regards to #4 from Previous Slide: • Value opinions such as going-concern value, value in use, or a special value to a specific property user may not be used as market value for federally related transactions. • An appraisal may contain separate opinions of such values so long as they are clearly identified and disclosed. • The estimate of market value should consider the real property’s actual physical condition, use, and zoning as of the effective date of the appraiser’s opinion of value. Expanded Evaluation Requirements • BPO, AEMV, CMA are out, when by themselves. • Also, must consider actual physical condition. • What is an “evaluation”? “A valuation permitted by the Agencies’ appraisal regulations for transactions that qualify for the appraisal threshold exemption, business loan exemption, or subsequent transaction exemption.” • See page 31 (of 70) of the Interagency Guidelines 12-2010. How do the various “valuation products” fit into a banks collateral program? • BPO, AVM or other methods may be tools used by a bank for portfolio monitoring, etc. • BPO’s, AVM’s, etc. cannot be used as an “evaluation” because they most likely don’t comply with all of the provisions for development and content of an “evaluation”. • AVM or other methods/ technological tools may be used in the preparation of an “evaluation”, but probably will need additional information/analysis in order to comply with all of the provisions of the Guidelines. • Who can do evaluations? – Need not be a licensed or certified appraiser, but must be competent – When done by an appraiser, USPAP applies. See Advisory Opinion 13 (2010-11 Edition). – Also see AI Proposed Guide Note 13 Appraisal or Evaluation Required? • A Real Estate Evaluation is Required When: • „A new real estate-related transaction is $250,000 or less, • „A new real estate-related transaction is a business loan of $1 million or less and the sale of or rental income derived from real estate is not the primary source of repayment, or • A real estate-related transaction involves an existing extension of credit at the lending institution, provided that: • There has been no obvious and material change in market conditions or the physical aspects of property that threatens the adequacy of the institution’s real estate collateral protection after the transaction, even with the advancement of new monies; or • There is no advancement of new monies, other than funds necessary to cover reasonable closing costs. • A Real Estate Appraisal is Required When: • „A new real estate-related transaction exceeds $250,000, unless another exemption applies, • A lease is the economic equivalent of a purchase or sale of leased real estate, or • „The banking supervisor requires an appraisal be obtained. • A Real Estate Appraisal is Not Required When: • „A lien on real estate is taken as an “abundance of caution,” • „A loan is not secured by real estate, • „A lien has a purpose other than the real estate’s value, • „A new business loan is $1 million or less and the sale of or rental income derived from real estate is not the primary source of repayment, or • A renewal, refinancing, or other subsequent transaction of an existing extension of credit where an evaluation is permitted. Following are Examples of DecisionMaking Process for Appraisal/Evaluations (There are separate handouts that show them in bigger font) Is the loan amount $250,000 or greater? APPRAISAL/EVALUATION REQUIREMENT DECISION TREE - NEW CREDITS Yes No Does Transaction Amount Exceed Supervisory LTV? Yes Transaction Amount less than $1,000,000, for Owner Occupant, and not dependent on sale/rental income from property? Real Estate Taken as Abundance of Caution? No Is the borrower a high risk customer (Rated 6 or worse? Yes Yes No Yes No Yes No Yes Is the property outside of the Trade Area (7 County Metro)? Is the property outside of the Trade Area (7 County Metro)? No No Is the subject an atypical property type?** Is the subject an atypical property type?** No No Internal Evaluation Required Third Party Restricted Use Appraisal Required Appraisal Required Lien unrelated to subject property's value (e.g. to secure access to non-real estate collateral? Yes No Is a Credit Decision Being made? No APPRAISAL/EVALUATION REQUIREMENT DECISION TREE - EXISTING CREDITS Validation of Prior Appraisal/Evaluation Allowed Yes Does Transaction Amount Exceed Supervisory LTV? Yes No Is any New Money being advanced? Yes Transaction Amount less than $1,000,000, for Owner Occupant, and not dependent on sale/rental income from property? Real Estate Taken as Abundance of Caution? No Is the borrower a high risk customer (Rated 6 or worse)? Yes Yes No Yes No Yes No Has there been any obvious material changes in the market or the subject property? Yes No Yes Is the property outside of the Trade Area (7 County Metro)? Is the property outside of the Trade Area (7 County Metro)? No No Is the subject an atypical property type?** Is the subject an atypical property type?** No No Internal Evaluation Required Third Party Restricted Use Appraisal Required Appraisal Required Lien unrelated to subject property's value (e.g. to secure access to non-real estate collateral? Yes No Depth of Review/Evaluation – Should be Prioritized by Risk • “The institution should consider the risk, size, and complexity of the transaction and the real estate collateral when determining the appraisal report format to be specified in its appraisal engagement instructions to an appraiser.” • See page 28 (of 70) of the Interagency Guidelines 12- 2010. • Although the Agencies’ appraisal regulations allow an institution to use an evaluation for certain transactions, an institution should establish policies and procedures for determining when to obtain an appraisal for such transactions. For example, an institution should consider obtaining an appraisal as an institution’s portfolio risk increases or for higher risk real estate-related financial transactions, such as those involving: • Loans with combined loan-to-value ratios in excess of the supervisory • • • • loan-to-value limits. Atypical properties. Properties outside the institution’s traditional lending market. Transactions involving existing extensions of credit with significant risk to the institution. Borrowers with high risk characteristics. Quick Suggestions: • Can’t afford to have staff appraisers? • Outsource at least some reviews – maybe the most complex • • • • • • properties. Outsource some evaluations as well. Don’t use same appraisers multiple times on the same property year after year. Don’t be penny-wise and pound-foolish. You get what you pay for. Leverage your appraisers for data and information. Make it a standard practice to bounce questions off other qualified appraisers – but keep it confidential. Rate appraisers for timeliness, quality and responsiveness. Appraisal Review • How bank reviewers are scrutinizing collateral • Real vs. Theoretical • In-place vs. Proforma • Provide useful data (not just opinion) • Convince me. • Why banks are scrutinizing collateral • Primarily regulatory and accounting reasons • Some genuinely care about the collateral component to their loan. Appraisal Review • Of course, there are those banks out there who are in “Extend and Pretend” mode, trying to rideout the storm until things calm down. • A low appraised value, even if it is undisputable, can cause the bank to incur a write-down, and impact capital reserves. • To avoid this, they will: • Delay getting new appraisals as long as possible • Go back to an original appraiser who appraised it in the peak of the market. • Look for less experienced, less competent appraisers who are hungry for work. Appraisal Review • Errors in appraisals can be from: • Time/effort issues • Not enough fee • Not enough time (client or appraiser’s fault) • Competency - very tricky • Ethical lapses – usually involves some kind of coordination/cooperation with lender, consciously or subconsciously. • Suggestions: • Read the appraisal, follow the logic. • Check the math (at least the most important sections). • Tests of reasonableness. • Watch out for giant leaps in assumptions. • Think about it as if you were going to buy the property. • Who knows, as a lender, you may end up owning it one day… • General Warning Signs: • Spelling/formatting errors • Leaps of faith • Core assumptions at extreme ends of a range • Questionable or insufficient comp data • Presence of “hedging” words (e.g. “say…”) • Contradictory logic • Failure to apply tests of reasonableness • Value equal to, or exceed costs? • Value reconciled w/current or historic selling/listing activity? • Market Analysis section Red Flags • Meaningful or meaningless? • Market participant interviews? • Request that the appraiser include a section of the report summarizing interviews of market participants (realtors/brokers, developers, city officials, etc.) about not only the market in general for the subject property type, but also the specific marketability of the subject property itself. • Information related directly to the subject property? • Important to be bouncing ideas off other market participants, including other appraisers, to make sure they aren’t missing anything. • To a certain extent, appraising consists of consensus building, between the appraiser, the client, and also brokers, developers, borrowers, etc. • Cost Approach Red Flags • Replacement Cost - does it appear reasonable? • Depreciation – have all forms been accounted for? • Physical (age) • Functional (over- or under-improvement) • External (market forces) • Entrepreneurial Incentive – is it included? Is it adequate? • Without it, why would anyone build it? • In current market, very rare that cost equals value. • Sales Comparison Approach Red Flags • Arbitrary, unless there are “smoking gun” comps. • Pay attention to range of sale prices per unit (both unadjusted and adjusted). • The target should most often harden. • Use of old, incompletely reported, poorly analyzed or not truly comparable sales. • Dramatically different tenant profiles. • Fee Simple vs. Leased Fee • Inconsistency in adjustments. • Income Approach Red Flags • Direct Capitalization vs. Discounted Cash Flow. • Stabilized Income vs. Non-Stabilized Income. • Rate = Risk • Fee Simple vs. Leased Fee • Which represents the true “as-is” value of the subject property? • Considerations for above- or below-market contract rent? • Asking Rents vs. Actual Lease Comps • Full burden of expenses shown? • Reconciliation Section Red Flags • Should lead reader to conclusion. • Watch for inconsistencies in approaches to value. • They should rarely be that far off. • If they are, then there should be a logical, reasonable explanation. Examples from Real Appraisals Example 1 • Summary of Three Approaches to Value for a purchase of an existing, fully functional retail building, to be renovated for a unique, special use: • Cost Approach - $865,000 ($192.22/SF of GBA) • Sales Comparison Approach - $860,000 ($191.11/SF) • Income Approach - $635,000 ($141.11/SF) • Final value conclusion - $860,000 ($191.11/SF) • FYI, total project cost = $862,050 • Of which, $327,080 is renovation costs. • Or is it $202,000? Example 1 • Summary of Three Approaches to Value for a purchase of an existing, fully functional retail building, to be renovated for a unique, special use: • Cost Approach - $865,000 ($192.22/SF of GBA) • Sales Comparison Approach - $860,000 ($191.11/SF) • Income Approach - $635,000 ($141.11/SF) • Final value conclusion - $860,000 ($191.11/SF) • FYI, total project cost = $862,050 • Of which, $327,080 is renovation costs. • Or is it $202,000? Example 1, continued • Cost Approach • Cost up as the special use (“as-completed” condition), but then 100% of renovation costs were added on top. • There were conflicting amounts for renovation costs. • Actual costs from construction bid lower. • Functional and external obsolescence not shown in report. Example 1, continued Cost Approach Source = Marshall Valuation Classification Section/Page Class C - Average Base Cost Building (shell) Heating/Cooling Adjustment Additional soft cost Entrepreneurial Profit Replacement Cost Adjustment Factors Perimeter Adjustment Market Conditions Location Architectural Entrepreneurial Total Adjustments 0.975 1.020 1.180 1.064 1.000 1.239 Adjusted Replacement Cost Cost $317,070 $22,500 $45,000 $45,000 $429,570 $532,237 Example 1, continued Cost Summary Shell Cost Renovation Less Depreciation $532,237 $327,080 Age/Life, 10/70 14.30% -$122,882 Depreciated Cost $736,435 Value Indication $736,435 Site Value $190,000 Value Indication via Cost Approach $925,000 • 100% of Renovation Costs Added to Replacement Cost New. • No functional or external obsolescence addressed. Example 1, continued • Actual Construction Bid is Lower: Actual Construction Bid Acquisition Renovation Contingency 5% Sac/Wac Total Total/SF $535,000 $202,000 $36,850 $88,200 $862,050 $191.57 Example 1, continued • Sales Comparison Approach: • Again, Functional and external obsolescence not considered/shown in report. • Are there any considerations for overimprovement of an existing market-standard property for a special use? • External obsolescence present in current market? • Is it reasonable to add 100% of renovation costs on top of “as-is” sales comparison approach conclusion? Example 1, continued Abbreviated for this presentation: Comparable Sales Sale 1 Sale 2 Sale 3 (Pending) Net % Adjustments Indicated Value Indication "As-Is" -15.00% $119.00 $535,500 -15.00% $118.06 $531,250 -25.00% $123.59 $556,146 Cost to Convert $325,000 $860,619 $860,000 $325,000 $856,368 $855,000 $325,000 $881,269 $880,000 Rounded Example 1, continued • Income Approach: • Can you follow the logic, or is it leap of faith assumption? • Interpretation of breakeven rent analysis? • Any larger implications relative to other approaches to value? Example 1, continued Breakeven Rent Analysis Project Cost $862,500 Overall Rate: 0.0871 Required Net Income: $75,124 Required Net/SF: $16.69 Net from tenant space: $13,500 Net from main space: $61,623.75 Net required/SF: $19.04 Example 1, continued • Market Rent Conclusion, however, is $12.17 per square foot (on a blended basis). • Appraisal report asserts that “the difference between the net rent conclusion and breakeven is significant. The calculation demonstrates that owner occupancy is more feasible than rental.” • Is that reasonable? Example 1 • Summary of Three Approaches to Value for a purchase of an existing, fully functional retail building, to be renovated for a unique, special use: • • • • Cost Approach - $865,000 ($192.22/SF of GBA) Sales Comparison Approach - $860,000 ($191.11/SF) Income Approach - $635,000 ($141.11/SF) Final value conclusion - $860,000 ($191.11/SF) • As a percentage, is this significant? What’s a typical LTV? • FYI, total project cost = $862,050 • Of which, supposedly $327,080 is renovation • Or is it $202,000? Example 2 • “Self-Contained” appraisal report • Multi-tenant, partially owner-occupied industrial property. • No breakdown of individual tenant spaces, nor office/warehouse percentages. • Current vacancy 21-28% - as derived by reviewer. • Effective date of mid-2010. From the market analysis section: • “Unemployment is historically low. It was 4.5% in January 2008 – nearly a full point below the national average of 5.4%. • “Median Family income was $66,809 in 2006…” • “The median price of Twin Cities homes sold in 2007 was $225,000” The entire income approach – recreated for this presentation: Some excerpts: • “The appraisers’ calculate the anticipated benefits (cash flows and reversion) into property value…” – Though only Direct Capitalization applied. • “market rents has been obtained from the appraisers’ records and from other sources such as MNCAR, Colliers, Turley, Martin and Tucker.” Example 2, continued • Ah, the old, one-page Income Approach. • Mentions that part of the fourth unit is vacant, and all of • • • • the fifth, but doesn’t tell us how much space that is and what impact it could have. Turns out it is most likely something around 21-28%. Appraiser uses 11% vacancy and collection loss – is this reasonable? No rent comp information. No expense analysis. Example 3 • Failed residential condominium development • Approximately 10% of units sold • Construction not yet completed • Regulations regarding “Tract Developments” apply (See Appendix C of Interagency Guidelines). • “Appraisals for these properties must reflect deductions and discounts for holding costs, marketing costs, and entrepreneurial profit supported by market data.” Example 3, continued Report states that the value scenarios will be: 1) Estimate the “as-completed” value of the condo units 2) Estimate the “as-is” value of the condo units; the cost to complete the units and the common elements is known. 3) Discount the retail sales estimate to present value based on current supply and demand in this market. Are these the appropriate value scenarios? Example 3, continued Floor First Second Third Value Per SF "As-Completed" Summary Aggregate Unit # of Units Square Footage N/A N/A N/A Aggregate Value $4,220,580 $5,135,904 $4,770,484 Total: $14,126,968 Rounded to: $14,130,000 *Floor height adjustment of 3% per floor. • This is essentially the “Gross Retail” value, or the sum of the retail values of the individual units, once completed. • As a side note, this amount was greater than the sum of the list prices of the units at the time. Example 3, continued Completion Cost Cost Per Type Line Item Models $11,000 Office Unit $25,500 Incomplete Units $2,366,000 Total Unsold Units $2,402,500 Contingency (10%) 10% Total Cost $2,642,750 Rounded $2,640,000 Example 3, continued As-Completed Market Value $14,130,000 Less: Cost to Complete $2,640,000 As-Is Market Value $11,490,000 Rounded $11,490,000 Example 3, continued “Consideration of a discount is required by both USPAP and OCC 94/55 when the marketing/holding period of a property is forecast to exceed one year. Given the timing of the development, a discount to present value is appropriate. Theoretically, sales should accelerate once the common elements are complete and occupancy increases. A compounding discount rate of 5% is used to discount the retail sale estimate. In essence, the sales per square foot in the third year are discounted 15%. The discount accounts for holding costs (taxes, insurance, etc.) during the sellout period. The first table below summarizes the allocation. The remaining charts reflect the discounting process.” Example 3, continued Year 1 Floor # One Two Three Year 2 Floor # One Two Three Year 3 Floor # One Two Three Value per SF Aggregate Present Unit SF Value Value Factor $1,406,860 $1,712,160 $1,590,112 Value per SF $1,339,867 $1,630,629 $1,514,392 $4,484,888 Aggregate Present Discounted Unit SF Value Value Factor Value @ 10% $1,406,860 $1,712,160 $1,590,112 Value per SF 0.952381 0.952381 0.952381 Total Discounted Value @ 5% 0.907029 0.907029 0.907029 Total $1,276,063 $1,552,979 $1,442,278 $4,271,319 Aggregate Present Discounted Unit SF Value Value Factor Value @ 15% $1,406,860 $1,712,160 $1,590,112 0.863838 0.863838 0.863838 Total $1,215,299 $1,478,531 $1,373,727 $4,067,557 Example 3, continued Summary Year 1 Year 2 Year 3 Discounted Value Rounded to $4,484,888 $4,271,319 $4,067,557 $12,823,765 $12,820,000 Example 3, continued • Holding Costs, Marketing Costs and Entrepreneurial Profit • Actual signed listing agreement, included 7% market fees on all units sold. • The first year of the appraiser’s discounting process only deducts 5% total, and only for the 1/3 of the units he allocates during that year. • If marketing costs aren’t even covered, what about all real estate taxes for the unsold units, entrepreneurial profit? Construction costs? • How much profit would be required for a project like this? • What is Statement 2 in USPAP about? • The misuse of the DCF? • Now which value are we supposed to use? Example 3, continued As-Completed Market Value $14,130,000 Less: Cost to Complete $2,640,000 As-Is Market Value $11,490,000 Rounded $11,490,000 Summary Year 1 Year 2 Year 3 Discounted Value Rounded to $4,484,888 $4,271,319 $4,067,557 $12,823,765 $12,820,000 Example 3, continued • DCF from subsequent appraisal from a different appraiser: 25% Example 3, continued • FYI, the equivalent annual discounts are as follows: • Year 1 – 30.7% • Year 2 – 41.42% • Year 3 – 52.78% Example 3, continued Example 4 • Vacant residential and commercial land in rural Wisconsin. • First, the residential land: Example 4, continued Abbreviated for this presentation: Land Sales Adjustment Summary Location Adjustment 0% Size Adjustment 0% Net Adjustment 0% Adjusted Sale Price: $240,000 /Acre $3,310.34 Minimum per Acre (adjusted): Maximum per Acre (adjusted): Average per Acre (adjusted): Concluded Value per Acre: 5% -5% 0% $55,290 $3,668.88 0% -5% -5% $64,173 $6,755.00 $2,592.00 $9,052.58 $4,388.00 $4,500.00 5% 0% 5% $90,720 $2,592.00 0% -5% -5% $59,323 $6,881.99 5% 0% 5% $170,100 $2,835.00 0% -5% -5% $127,823 $9,052.58 Example 4, continued • Adjustments are applied to Gross Sale Price, which • • • • • usually only works if the comps are really good. How about the range in adjusted values? Grouping of comps by site size shows two clear groups, one small and one large (subject fits in the large group). The small site size comps have much higher per acre sale prices than the larger comps (65% difference). No adjustment is greater than +/-5% for site size though. Then it appears that a rounded average of all the comps is used, even though the subject is clearly part of the larger site size group. Example 4, continued Subject is 52.43 acres Example 4, continued Sale/List Price per Acre - Organized by Site Size: Sale/List Price Comparable # Sale/List Price Total Acres per Acre 5 $69,000 8.62 $8,005 3 $70,000 9.5 $7,368 7 (Listing) $149,500 14.12 $10,588 2 $57,000 15.07 $3,782 4 $90,000 35 $2,571 6 $180,000 60 $3,000 1 $250,000 72.5 $3,448 Subject N/A 52.43 N/A Average of 3 Smallest Comps (Site Size): $8,654 Average of 3 Largest Comps (Site Size): $3,007 % Difference Smallest to Largest Averages: 65.26% Example 4, continued • Next, the commercial land: Example 4, continued Commercial Land Sales Adjustment Summary Sale Date Nov-10 Aug-08 Unadjusted Sale Price per SF $0.51 $1.09 Property Rights Conveyed 0% 0% Financing 47% 0% Conditions of Sale 0% 0% Expenditures After Purchase 0% 0% Time/Market Conditions -5% -14% Location Adjustment 0% 0% Size Adjustment 0% -5% Visibility 0% 0% Zoning 0% 0% Net Adjustment 0% -5% /SF $1.04 $0.89 Minimum per Acre (adjusted): Maximum per Acre (adjusted): Average per Acre (adjusted): Concluded Value per Acre: Feb-08 Listing $0.62 $1.92 0% 0% 0% 0% 0% -10% 0% 0% -16% 0% 0% 0% -5% 0% 0% 0% 15% 0% 10% 0% $0.57 $1.73 $0.57 $1.73 $1.06 $1.00 Example 4, continued • Range of adjusted sale prices per SF: • $1.04, $0.89, $0.57 (for the three closed sales) • $1.73 for the active listing • Don’t be fooled by the per SF analysis – doesn’t sound like a large difference when talking about a span of $0.50. • Remember that it’s per square foot. What is it as a percentage? • Why the range? Example 4, continued Clue from comp 1 write-up: Comments: Property was acquired by the village from XXXXXX who defaulted on a deed. The village then turned around and sold the parcel to XXXX for $43,600 which included TIFF incentives. The village clerk mentioned that the board estimated that the market value of the land with the TIFF contribution was estimated at $1.09/SF. Example 4, continued Clue from comp 1 write-up: Comments: Property was acquired by the village from XXXXXX who defaulted on a deed. The village then turned around and sold the parcel to XXXX for $43,600 which included TIFF incentives. The village clerk mentioned that the board estimated that the market value of the land with the TIFF contribution was estimated at $1.09/SF. Example 4, continued Commercial Land Sales Adjustment Summary Sale Date Nov-10 Unadjusted Sale Price per SF $0.51 Property Rights Conveyed 0% Financing 47% Conditions of Sale 0% Expenditures After Purchase 0% Time/Market Conditions -5% Location Adjustment 0% Size Adjustment 0% Visibility 0% Zoning 0% Net Adjustment 0% /SF $1.04 Minimum per Acre (adjusted): Maximum per Acre (adjusted): Average per Acre (adjusted): Concluded Value per Acre: Aug-08 $1.09 0% 0% 0% 0% -14% 0% -5% 0% 0% -5% $0.89 Feb-08 Listing $0.62 $1.92 0% 0% 0% 0% 0% -10% 0% 0% -16% 0% 0% 0% -5% 0% 0% 0% 15% 0% 10% 0% $0.57 $1.73 $0.57 $1.73 $1.06 $1.00 Example 4, continued • First, the math on this adjustment. How does a positive adjustment of 47%, plus then a negative adjustment of 5% turn $0.51/SF into $1.04? • Also, what about the impact of Tax Increment Financing on a sale price of a comp? • What are the terms, and who benefits from the TIF? • In this case, the buyer got the land for free, and got his entire site improvement costs covered. • Which direction should that adjustment be? Example 5 • Large apartment complex • No renovation project or stabilization component part of analysis • Summary of historical NOI and appraiser’s forecast summarized in table below: Net Operating Income: 2006 2007 2008 2009 2010 Appraiser's Proforma $173,102 $343,078 $351,783 $272,937 $200,989 $504,587 Example 6 • New construction office/warehouse property • Land Value Conclusion - $1,000,000 • Final Value Conclusion - $2,435,000 Example 6, continued Where does the extra $300,000 come from? Example 6, continued Range of Sale Price per SF of GBA - Improved Sales: 1 2 3 Unadjusted $57.87 $104.96 $53.83 Net Adjustments 47% -17% 59% Adjusted $85.07 $87.12 $85.59 4 $67.32 35% $90.88 5 $41.38 90% $78.62 • Comp 2 is an office/tech condo, with 80% office finish. • Subject is not a condo, and has only 16% office finish. Example 7 • Industrial building, three spaces, two currently leased. • Engagement letter asked for Leased Fee analysis. • Good example of what reviewers are looking for these days. Example 7, continued “The third tenant is leased on a month-to-month basis, which expires May 31, 2013.” Example 7, continued • Rent comps less than compelling. • Wide unadjusted range of rents - $5.58 NNN for office warehouse w/20% finish, $7.19 NNN for a “distribution center” with 5% office finish, $8.00 Gross for office warehouse w/58% finish. • No lease start dates, although one rent comp had expired in 2010, another one expires/d in 2012, and another one expires in 2014, which at least suggests that they must not be too recent indications. • Report says rents haven’t changed, but doesn’t include any real way to prove that. Example 7, continued • Adjusted range of rent comps was $5.12 to $5.64 on a net • • • • • basis. Appraiser concludes to market rent of $5.20. Then applies this market rent to the entire space, as if it were a fee simple analysis. Resulting Potential Gross Rent is $129,064, on a net basis. Actual Contract Rent is $95,795, on a net, modified gross and gross basis. The largest tenant is paying on a Gross basis, and in total, over 60+% of the total space is paying less than full expenses. Example 7, continued • If evidence were so compelling that contract rent was below market: • Why hasn’t the landlord increased rents? • What has the appraiser assumed by doing it this way? • Current tenants are actually paying this higher rate already? • A potential buyer would be able to walk right in and increase the rents immediately? • If one of the tenants was not willing to pay, and vacated the space, are there other tenants lined up to fill the space at the higher rent? • Who should be taking this risk? The lender? The equity position? • Would the cap rate change at all given the below market rents? Example 7, continued • One last thing to note on this deal: • Appraiser had full historical income and expense information for the subject property for the three most recent years. • Yet, in the income/expense reconstruction section, they were not included. Example 7, continued Potential Gross Income 18,520 SF 6,300 SF x x $5.20 $5.20 = = $96,304 $32,760 Total Potential Gross Income $129,064 Less Vacancy & Collection Loss @ 8% -$10,325 Effective Gross Income: $118,739 Less: Operating Expenses Management Expenses (3%) $118,739 Vacancy Expenses Reserves for Replacement x 3% 8% = = = $3,562 $6,453 $8,687 -$18,702 $100,037 Indicated As Is Market Value Indicated As Is Market Value $100,037 $100,037 8.00% = 8.50% = $1,250,463 $1,176,906 Example 7, continued • The Appraisal of Real Estate, 13th Edition, pages 466, 482-492,496 & 498. • On page 483, potential gross income comprises: • Rent for all space in the property—e.g., contract rent for current leases, market rent for vacant or owner-occupied space, percentage and overage rent for retail properties • Rent from escalation clauses • Reimbursement income (emphasis added) • All other forms of income to the real property… Example 7, continued • On page 484, operating expenses comprised of: • Fixed expenses • Variable expenses • Replacement allowance • It is extremely helpful to the reviewer if a full burden of expenses is shown. Especially if an appraiser is provided the historical data. • It makes it easier for the reviewer to validate/invalidate your assumptions when there’s adequate detail presented. Example 8 • New construction office building in an area where most properties are 50-60 years old at least. • Appraisal report showed market rents equal to the breakeven rent. Rent comps from other areas. • Market rent was concluded to be $22 per square foot on a net basis. • 2% vacancy and collection loss applied. • Capitalized land-only real estate taxes, but states in the report: • “as the property becomes fully assessed the tax load will increase significantly.” • Concluded value was equal to the construction costs - $1,400,000. Example 8, continued • Actual contract rent turns out to be $16 on a gross basis. • Actual vacancy is 20%. • Actual operating expenses turn out to be triple what the original appraiser had estimated. • Subsequent re-appraisal of the leased fee interest - $500,000 value conclusion. Example 8, continued • In between the original appraisal and the new one, the bank had requested that an appraiser take a look at the situation. • In a letter to the bank, not an appraisal, the appraiser stated, among other things, the following: • “Based on my brief investigation of the property and conditions under which it is currently leased, I believe that it is reasonable to assume that the property is likely to fall into a value range somewhere between $750,000 and $900,000.” • “I of course cannot provide you with an estimate of market value for this property without going through all the proper and accepted appraisal practices and protocol required to do so.” Example 8, continued • “Based on my brief investigation of the property and conditions under which it is currently leased, I believe that it is reasonable to assume that the property is likely to fall into a value range somewhere between $750,000 and $900,000.” • That’s seven hedging words in one sentence. Example 9 • An appraisal review ordered by a participant bank (who was in Extend and Pretend mode). • Commercial land in outlying area. • Massively oversupplied submarket. • Zero new development in past couple years. • Zero land sales in immediate area for past two years, despite significant listing price reductions. • Over 30+ active listings of competing commercial land within 2 miles of subject. Example 9, continued • From the review: • “The appraisers discuss the currently offered listings in the area and describe a range from $8.00 to $25.00 per square foot. The subject is listed for $8.50 per square foot. In other words, brokers in this market believe the inherent value of land in this market area is $8.00 to less than $25 per square foot.” • Is that true? Is that what the brokers believe? Example 9, continued • From the review: • “The appraisers assert that the highest and best [use] is commercial development, but that the absorption period could be 3 to 5 years…The appraisers indicate that the marketing/exposure period for the property is 6 to 12 months.” • “The Interagency Guideline [sic] requires that the appraiser consider if a discount for absorption holding cost or incomplete construction is needed. While there is no market basis for the discount, it is common to apply a percentage that equals the holding cost for a portion of the absorption period. This does not mimic the behavior of a typical developer, who would pay the required price and figure the added cost into the final product. In this case, the appraisers avoid this issue by selecting a marketing period of less than 1 year (although this contradicts the 3 to 5 year absorption).” Example 9, continued • Is development timing the same thing as marketing and exposure period? • Is it reasonable to say that a typical developer would “pay the required price and figure the added cost into the final product”? • Another way of asking that is, do developer’s have complete control over what they can get for the “final product”? Example 9, continued • From the review: • “The quality of the…sales comparison approach is average. Five sales are presented; none are from the competitive market area…” • “The preadjusted range is from $4.72 to $7.10 per square foot.” • “The net adjustments range from -10% to -25%, and each sale is adjusted downward on a net basis.” • The appraiser had concluded $4.50 per square foot, based primarily on the rough market conditions and oversupply. Example 9, continued • The reviewer did their own search for comps: • “A data search of land sales in XXXXX, YYYYY and ZZZZZ counties revealed 25 sales. Further refining the data set resulted in an alternate data of five sales. The sales ranged from $6.68 to $9.36 per square foot. All five closed during 20XX. All five are zoned for commercial use. The alternate data set is closer physically [proximity]…” • No other information on the reviewer’s comp set provided. Example 9, continued • “In summary, three items contradict the appraiser’s conclusions. First, the assessor values the property at $7.72 per square foot. Second, the current listing at $8.50 and other listings in the neighborhood from $8 to $25 per square foot contradict the appraiser’s conclusion. Lastly, the alternate data set ranging from $6.68 to $9.36 supports a value closer to the listing.” • The subject had been listed for $7.87 per square foot for two years, the broker reporting zero interest at that price. • The subject has since been listed at $5.00 per square foot for over a year, still with no interest. Example 10 • Land appraisal • Subject was 100% usable (no wetlands, steep slopes, etc.) • No adjustments made to Comp 2, but… Example 10, continued Example 11 • “Test of Reasonableness” • Subject is a busted condo development (24 units) • Appraiser was asked to re-appraise one year after first appraisal • 1st appraisal, he projected an absorption rate of 6 units per year • 0 units sold between 1st and 2nd appraisal • Absorption rate projected in 2nd appraisal? • …6 units per year. • Doesn’t mean that it’s wrong, just that it will take more convincing the second time around. Example 12 • What about expenses on vacant space? Potential Gross Income Net Rent 25,000 SF X $ 6.00 = $ 150,000 $ 150,000 $ 30,000 Effective Gross Income $ 120,000 Operating Expense "Typical Net Lease" Reserves for Replacement Management $ $ $ 2,400 6,000 $ 111,600 Total Income Less Vacancy & Collection Loss Net Income 20% 2% 5% Example 13 • Small multi-tenant retail building appraisal • Appraiser only viewed a rent roll, not actual leases • Appraiser assumed all leases were gross terms • Leases were actually structured in several ways; net, gross, and semi-gross • Property was under-valued Example 14 • The lack of an adjustment IS an adjustment. • Property was residential development land. • Effective date was October 2009. Transaction Date: Market Conditions Adjustment: Sale 1 Sale 2 Sale 3 Jul-08 Aug-07 Feb-08 15 Months 24 Months 20 Months Sale 1 Sale 2 Sale 3 0% 0% 0% Example 14, continued • When did the Credit Crisis occur? • August/September 2008? • The sales are from before then. • How could Market Conditions adjustments be supported? • MLS data • Building permit data • Broker interviews and market reports • Market participate interviews (i.e. sellers and buyers) • Analyzing the change in lending conditions • Other ways? Questions