Financial Accounting and Accounting Standards

Chapter

7-1

Internal Control and Cash

Chapter

7-2

Financial Accounting, Fifth Edition

Study Objectives

1.

Define fraud and internal control.

2.

Identify the principles of internal control activities.

3.

Explain the applications of internal control principles to cash receipts.

4.

Explain the applications of internal control principles to cash disbursements.

5.

Prepare a bank reconciliation.

6.

Explain the reporting of cash.

7.

Discuss the basic principles of cash management.

8.

Identify the primary elements of a cash budget.

9.

Explain the operation of a petty cash fund.

Chapter

7-3

Fraud and Internal Control

Fraud

A dishonest act by an employee that results in personal benefit to the employee at a cost to the employer.

Three factors that contribute to fraudulent activity.

Illustration 7-1

Chapter

7-4

SO 1 Define fraud and internal control.

Fraud and Internal Control

The Sarbanes-Oxley Act

2002

(SOX)

Companies must develop principles of control over financial reporting. continually verify that controls are working.

Independent auditors must attest to the level of internal control.

SOX created the www.pcaob.com

Chapter

7-5

SO 1 Define fraud and internal control.

Fraud and Internal Control

Internal Control

Methods and measures adopted to:

1.

Safeguard assets.

2.

Enhance accuracy and reliability of accounting records.

3.

Increase efficiency of operations.

4.

Ensure compliance with laws and regulations.

Chapter

7-6

SO 1 Define fraud and internal control.

Fraud and Internal Control

Internal Control

Five Primary Components:

1.

Control environment.

2.

Risk assessment.

3.

Control activities.

4.

Information and communication.

5.

Monitoring.

Chapter

7-7

SO 1 Define fraud and internal control.

Fraud and Internal Control

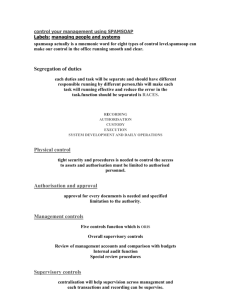

Principles of Internal Control Activities

Establishment of Responsibility

Control is most effective when only one person is responsible for a given task.

Segregation of Duties

Related duties should be assigned to different individuals.

Documentation Procedures

Companies should use prenumbered documents and all documents should be accounted for.

Chapter

7-8

SO 2 Identify the principles of internal control activities.

Fraud and Internal Control

Principles of Internal Control Activities

Illustration 7-2

Physical

Controls

Chapter

7-9

SO 2 Identify the principles of internal control activities.

Fraud and Internal Control

Principles of Internal Control Activities

Independent Internal Verification

1. Records periodically verified by an employee who is independent.

2.

Discrepancies reported to management.

Human Resource Controls

1. Bond employees.

2. Rotate employees’ duties and require vacations.

3. Conduct background checks.

Chapter

7-10

SO 2 Identify the principles of internal control activities.

Chapter

7-11

Chapter

7-12

Chapter

7-13

Chapter

7-14

Chapter

7-15

Fraud and Internal Control

Limitations of Internal Control

Costs should not exceed benefit.

Human element.

Size of the business.

Chapter

7-16

SO 2 Identify the principles of internal control activities.

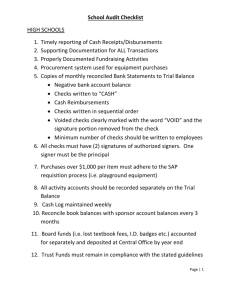

Cash Controls

Cash Receipts Controls

Establishment of

Responsibility

Only designated personnel are authorized to handle cash receipts

(cashiers)

Documentation

Procedures

Use remittance advice (mail receipts), cash register tapes, and deposit slips

Illustration 7-4

Independent Internal

Verification

Supervisors count cash receipts daily; treasurer compares total receipts to bank deposits daily

Segregation of Duties

Chapter

7-17

Different individuals receive cash, record cash receipts, and hold the cash

Physical,

Mechanical, and

Electronic Controls

Store cash in safes and bank vaults; limit access to storage areas; use cash registers

Human Resource

Controls

Bond personnel who handle cash; require employees to take vacations; conduct background checks

SO 3 Explain the applications of internal control principles to cash receipts.

Over-the-Counter

Receipts

Important internal control principle— segregation of record-keeping from physical custody.

Illustration 7-5

Chapter

7-18

SO 3 Explain the applications of internal control principles to cash receipts.

Mail Receipts

Control Procedures:

Mail receipts should be opened by two people, a list prepared, and each check endorsed.

Each mail clerk signs the list to establish responsibility for the data.

Original copy of the list, along with the checks, is sent to the cashier’s department.

A copy of the list is sent to the accounting department for recording. The clerks also keep a copy.

Chapter

7-19

SO 3 Explain the applications of internal control principles to cash receipts.

Cash Controls

Review Question

Permitting only designated personnel to handle cash receipts is an application of the principle of:

a. segregation of duties.

b. establishment of responsibility.

c. independent check.

d. other controls.

Chapter

7-20

SO 3 Explain the applications of internal control principles to cash receipts.

Cash Controls

Cash Disbursements Controls

Generally, internal control over cash disbursements is more effective when companies pay by check, rather than by cash.

Applications:

Voucher system

Petty cash fund

Chapter

7-21

SO 4 Explain the applications of internal control principles to cash disbursements.

Cash Controls

Cash Disbursements Controls

Independent Internal

Verification

Compare checks to invoices; reconcile bank statement monthly

Physical, Mechanical, and Electronic

Controls

Store blank checks in safes, with limited access; print check amounts by machine in indelible ink

Documentation

Procedures

Use prenumbered checks and account for them in sequence; each check must have an approved invoice; require employees to use corporate credit cards for reimbursable expenses; stamp invoices "paid."

Illustration 7-6

Chapter

7-22

SO 4 Explain the applications of internal control principles to cash disbursements.

Establishment of

Responsibility

Only designated personnel are authorized to sign checks (treasurer)

Segregation of Duties

Different individuals approve and make payments; check signers do not record disbursements

Human Resource

Controls

Bond personnel who handle cash; require employees to take vacations; conduct background checks

Chapter

7-23

Cash Controls

Review Question

The use of prenumbered checks in disbursing cash is an application of the principle of:

a. establishment of responsibility.

b. segregation of duties.

c. physical, mechanical, and electronic controls.

d. documentation procedures.

Chapter

7-24

SO 4 Explain the applications of internal control principles to cash disbursements.

Cash Controls

Cash Disbursements Controls

Voucher System

Network of approvals, by authorized individuals, to ensure all disbursements by check are proper.

A voucher is an authorization form prepared for each expenditure.

Chapter

7-25

SO 4 Explain the applications of internal control principles to cash disbursements.

Cash Controls

Cash Disbursements Controls

Petty Cash Fund - U

sed to pay small amounts.

Involves:

1.

establishing the fund,

2.

3.

making payments from the fund, and replenishing the fund.

Chapter

7-26

SO 4 Explain the applications of internal control principles to cash disbursements.

Control Features: Use of a Bank

Contributes to good internal control over cash.

Minimizes the amount of currency on hand.

Creates a double record of bank transactions.

Bank reconciliation.

Chapter

7-27

Control Features: Use of a Bank

Bank Statements

Debit Memorandum

Bank service charge

NSF (not sufficient funds)

Credit Memorandum

Collect notes receivable.

Interest earned.

Chapter

7-28

Illustration 7-7

Control Features: Use of a Bank

Review Question

The control features of a bank account do not include: a. having bank auditors verify the correctness of the bank balance per books. b. minimizing the amount of cash that must be kept on hand.

c. providing a double record of all bank transactions.

d. safeguarding cash by using a bank as a depository.

Chapter

7-29

Control Features: Use of a Bank

Reconciling the Bank Account

Reconcile balance per books and balance per bank to their adjusted (corrected) cash balances.

Reconciling Items:

1.

Deposits in transit.

2.

3.

Outstanding checks.

Bank memoranda.

Time Lags

4.

Errors.

Chapter

7-30

SO 5 Prepare a bank reconciliation.

Control Features: Use of a Bank

Reconciliation Procedures

Illustration 7-8

+ Deposit in Transit

Outstanding Checks

+/- Bank Errors

Chapter

7-31

CORRECT BALANCE

+ Notes collected by bank

NSF (bounced) checks

Check printing or other service charges

+/- Book Errors

CORRECT BALANCE

SO 5 Prepare a bank reconciliation.

Control Features: Use of a Bank

Chapter

7-32

Advertising expense

SO 5 Prepare a bank reconciliation.

Control Features: Use of a Bank

Illustration: Prepare a bank reconciliation at April 30.

Cash balance per bank statement $15,907.45

Adjusted cash balance per bank

Cash balance per books $11,589.45

Chapter

7-33

Adjusted cash balance per books

SO 5 Prepare a bank reconciliation.

Control Features: Use of a Bank

Illustration: Journalize the adjusting entries at April 30 on the books of Laird Company.

Dr.

Cr.

Apr. 30

Chapter

7-34

SO 5 Prepare a bank reconciliation.

Control Features: Use of a Bank

Review Question

The reconciling item in a bank reconciliation that will result in an adjusting entry by the depositor is:

a. outstanding checks.

b. deposit in transit.

c. a bank error.

d. bank service charges.

Chapter

7-35

SO 5 Prepare a bank reconciliation.

Control Features: Use of a Bank

Electronic Funds Transfers (EFT)

Disbursement systems that uses wire, telephone, or computers to transfer cash balances between locations.

Chapter

7-36

SO 5 Prepare a bank reconciliation.

Reporting Cash

Most liquid asset, listed first.

Illustration 7-11

Chapter

7-37

Cash equivalents Restricted cash

SO 6 Explain the reporting of cash.

Reporting Cash

Review Question

Which of the following statements correctly describes the reporting of cash?

a. Cash cannot be combined with cash equivalents.

b. Restricted cash funds may be combined with

Cash.

c. Cash is listed first in the current assets section.

d. Restricted cash funds cannot be reported as a current asset.

Chapter

7-38

SO 6 Explain the reporting of cash.

Managing and Monitoring Cash

Basic Principles of Cash Management

1. Increase the speed of receivables collection.

2. Keep inventory levels low.

3. Delay payment of liabilities.

4. Plan the timing of major expenditures.

5. Invest idle cash.

Chapter

7-39

SO 7 Discuss the basic principles of cash management.

Chapter

7-40

Copyright

“Copyright © 2009 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.”