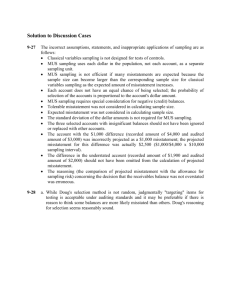

Statistical Tests of Balances

advertisement

Section 2a The Use of Audit Sampling Test of Balances Statistical Tests of Balances • Monetary Unit Sampling (MUS) or (PPS) • Involves the same previously seen 14 steps Athens Corporation Case An auditor has been assigned the responsibility of auditing the trade accounts receivable of Athens Corporation as of December 31, 200X. The total amounts to $2,400,000 and consists of 800 accounts. The auditor tested controls that relate to the existence of Athens Corporation’s trade accounts receivable during November 200X. After reviewing the work, the audit manager agreed with the auditor’s assessment that assessing control risk at 80 percent was appropriate. The manager indicated that the planned audit risk should be limited to 5 percent, inherent risk should be assessed to be 100 percent, and the risk that analytical procedures will not detect material misstatements should be assessed to be 60 percent. The manager also decided that $100,000 should be used as tolerable misstatement for purposes of confirming trade accounts receivable. During last year’s audit, the auditors found misstatements amounting to only $10,000, which the manager suggests should be used this year as an estimate of the misstatement for the purposes of determining sample size. A review of the listing of accounts indicates that it includes no accounts that have credit balances or zero balances. 1. Determine the Objective of MUS Sampling • Must relate to the audit procedure • What would be the assertion in this example? 2. Decide if audit sampling applies • Why would sampling apply here? 3. Define attributes and error conditions – What is the attribute here? – Error condition? 4. Define the population • What is the population in this case? 5. Define the sampling unit • The sampling unit is ? • Logical sampling unit Summary: For Athens Corporation, the population is all 800 customer accounts with debit balances, and the recorded book value of the accounts is $2,400,000. The audit manager decided that customers' accounts rather than individual invoices are to be confirmed. Accounts receivable has 2,400,000 sampling units and 800 logical sampling units. 6. Specify Tolerable Misstatement (TM) • The auditor’s planned level of materiality for the account • Thus TM is 7. Specify the reliability factor (RF) for acceptable risk of incorrect acceptance (ARIA) • Can eliminate the acceptable risk of incorrect acceptance by auditing the entire population • Recall the audit risk model • AR = IR x CR x AP x ARIA DR • ARIA = Reliability Factors for Misstatements of Overstatements RF Number of Overstatement Misstatements Always used Acceptable Risk of Incorrect Acceptance (ARIA) 1% 5% 10% 15% 20% 25% 30% 37% 50% 0 4.61 3.00 2.31 1.90 1.61 1.39 1.21 1.00 0.70 1 6.64 4.75 3.89 3.38 3.00 2.70 2.44 2.14 1.68 2 8.41 6.30 5.33 4.72 4.28 3.93 3.62 3.25 2.68 3 10.05 7.76 6.69 6.02 5.52 5.11 4.77 4.34 3.68 4 11.61 9.16 8.00 7.27 6.73 6.28 5.90 5.43 4.68 5 13.11 10.52 9.28 8.50 7.91 7.43 7.01 6.49 5.68 6 14.57 11.85 10.54 9.71 9.08 8.56 8.12 7.56 6.67 7 16.00 13.15 11.78 10.90 10.24 9.69 9.21 8.63 7.67 8 17.41 14.44 13.00 12.08 11.38 10.81 10.31 9.68 8.67 9 18.79 15.71 14.21 13.25 12.52 11.92 11.39 10.74 9.67 10 20.15 16.97 15.41 14.42 13.66 13.02 12.47 11.79 10.67 8. Specify Anticipated Misstatement (AM) and Expansion Factor (EF) • Anticipated misstatement • For Athens Corporation? • The expansion factor (EF) Acceptable Risk of Incorrect Acceptance (ARIA) Expansion factor • 1% 5% 10% 15% 20% 25% 30% 37% 50% 1.9 1.6 1.5 1.4 1.3 1.25 1.2 1.15 1.0 What is the expansion factor for anticipated misstatement and why? 9. Determine the sample size • Auditors can use the following formula: Book value (BV) Sample size (n) = Tolerable misstatement (TM) x - Anticipated Misstatement (AM) x n= - n= Reliability factor (RF) for risk of overstatement x x Expansion factor for anticipated misstatement (EF) • Change in a component of sample size Component of Sample Size Equation Relationship to Sample Size Book value Direct Risk of incorrect acceptance Inverse Tolerable misstatement Inverse Anticipated misstatement Direct Expansion factor for anticipated misstatement Direct 10.Select Sample • Sampling interval • Systematic sampling Sampling Interval = Book value of the population (BV) Sample size (n) • The auditor decides to use systematic sampling • What is the sampling interval? • BV/n = • Must now identify customer account numbers •Also called logical sampling units Customer Recorded Account Number Account Balance Cumulative Dollar Total 1001 $521 521 1012 $8,484 9,005 1030 $793 9,798 1041 $8,309 18,107 1052 $547 18,654 1056 $28,838 47,492 1075 $356 47,848 1080 $74,358 122,206 1091 $40 122,246 2089 $2,498 2,396,787 2894 $3,213 2,400,000 • Assume auditor selects 9832 with a random stab – From where? • Which account balance should we select? • What is the sampling interval? • Thus what is the next account? Customer Recorded Account Number Account Balance Cumulative Dollar Total 1001 $521 521 1012 $8,484 9,005 1030 $793 9,798 1041 $8,309 18,107 1052 $547 18,654 1056 $28,838 47,492 1075 $356 47,848 1080 $74,358 1091 $40 122,246 2089 $2,498 2,396,787 2894 $3,213 2,400,000 Dollar Selected $9,832 $46,755 122,206 $83,768 and $120,601 11. Perform the audit procedures • Appropriate procedures that are appropriate for the circumstances • What is the appropriate procedure? 12. Generalize from the sample to the population • Upper misstatement limit Allowance for sampling risk Upper = misstatement limit Projected + misstatement Basic + precision Incremental allowance (a) Computing Projected Misstatements • What is projected misstatement? • The tainting percentage • For logical sampling units less than the sampling interval Tainting percentage Book value – Audited value Book value x Sampling interval = Project misstatement for each audited item • For logical sampling units greater than or equal to the sampling interval Book value – Audited value = Projected misstatement for each audited item • Assume that for Athens Corporation three errors were found. Customer accounts 1491 and 1794 have book values less than the sampling interval, and customer account 1225 is larger than the sampling unit (a) (b) Account Number Book Value (c) (d) Audited Difference Value (b) – (c) (e) (f) (g) Tainting Percentage (d)/(b) Sampling Interval Projected Misstatement (e) x (f) Logical sampling units less than sampling interval: 1491 $40 $36 $4 10% $36,923 $3,692 1794 $4,000 $3,800 $200 5% $36,923 $1,846 $5,538 Logical sampling units greater than or equal to sampling interval: 1225 $37,858 Projected misstatement $37,465 $393 $393 $5,931 (b) Computing Allowance for Sampling Risk • What is this allowance? • Two components 1. Basic precision BP = RF x SI 2. Incremental allowance for sampling risk • Auditor must use reliability factors Number of Overstatements Acceptable Risk of Incorrect Acceptance(ARIA) 1% 5% 10% 15% 20% 25% 30% 37% 50% 0 4.61 3.00 2.31 1.90 1.61 1.39 1.21 1.00 0.70 1 6.64 4.75 3.89 3.38 3.00 2.70 2.44 2.14 1.68 2 8.41 6.30 5.33 4.72 4.28 3.93 3.62 3.25 2.68 3 10.05 7.76 6.69 6.02 5.52 5.11 4.77 4.34 3.68 4 11.61 9.16 8.00 7.27 6.73 6.28 5.90 5.43 4.68 • For Athens Corporation accounts 1491 and 1794 were identified as including misstatements less than the sampling interval. (a) (b) (c) (d) (e) (f) Tainting Percentage (ranked) Account Number Projected Misstatement Reliability Factor Increase in Reliability Factor Incremental Allowance (c) x (e) 2.31 10 1491 $3,692 3.89 1.58 $5,833 5 1794 1,846 5.33 1.44 2,658 $8,491 Less: Projected misstatement for sampling units less than sampling interval Incremental allowance for sampling risk 5,538 $2,953 Thus upper misstatement limit (UML) is Allowance for sampling risk Upper = misstatement limit UML = Projected + misstatement Basic + precision Incremental allowance 13. Evaluating results • To evaluate results the auditor compares the estimate of upper misstatement limit with the tolerable misstatement • From the results, the auditor for Athens Corporation may conclude with a 5% risk that the $2,400,000 book value is not overstated by more than $94,176. • What was the tolerable misstatement? • What is the final evaluation? • When upper misstatement limit exceeds the tolerable misstatement • What does this mean to valuation? • If the sample has no misstatements • UML = PM + BP + IA 14. Decide the acceptability of the population • Reaching a conclusion • Have to also look at qualitative aspects • Must evaluate whether misstatements are errors or irregularities • If upper misstatement limit exceeds the tolerable misstatement Population is not acceptable • Some possible courses of action 1. Consider whether the projected amount of misstatement in the population based on the audit is greater than the amount anticipated when sample size was determined. 2. Consider whether the sample is representative of the population. 3. Ask the client to perform additional work or to adjust the accounts Advantages and Disadvantages of MUS Sampling Advantages 1. Increases likelihood of including highdollar value items 2. Easy to use 3. Enables auditor to state a conclusion Disadvantages 1. Assumption is that the audited value of a sampling unit is neither less than zero nor greater then book value. 2. Upper misstatement limit. Problem 16. MUS Sampling. Edwards has decided to use MUS sampling in the audit of a client’s accounts receivable balance. Few, if any, overstatements of account balance are expected. Edwards plans to use the following MUS sampling table: Reliability Factors for Overstatement Number of Overstatements Risk of Incorrect Acceptance (ARIA) 1% 5% 10% 15% 20% 25% 30% 37% 50% 0 4.61 3.00 2.31 1.90 1.61 1.39 1.21 1.00 0.70 1 6.64 4.75 3.89 3.38 3.00 2.70 2.44 2.14 1.68 2 8.41 6.30 5.33 4.72 4.28 3.93 3.62 3.25 2.68 3 10.05 7.76 6.69 6.02 5.52 5.11 4.77 4.34 3.68 4 11.61 9.16 8.00 7.27 6.73 6.28 5.90 5.43 4.68 Required: a. Calculate the sampling interval and the sampling size Edwards should use, given the following information: i. Tolerable misstatement $15,000 ii. Risk of incorrect acceptance 5% iii. Number of misstatements allowed 0 iv. Recorded amount of accounts receivable $300,000 b. Calculate the total projected misstatement if the following three misstatements were discovered in a MUS sample: Recorded Amount ($) c. Audited Amount ($) Sampling Interval ($) 400 320 1,000 500 0 1,000 3,000 2,500 1,000 Does the book value present fairly? Problem 2. MUS Sampling. Tim Dolan plans to use MUS sampling in auditing the Repairs and Maintenance account for Daco International to determine whether the accounts includes items that should be capitalized rather than expensed. Daco has recorded 2,000 invoices in arriving at the $800,000 expense for the year. Tim has decided to use $4,000 as the anticipated misstatement, and $50,000 as tolerable misstatement. After reviewing Tim’s work, the audit manager agreed with him that assessing control risk at 80 percent was appropriate. The manager indicated that the planned audit risk should be limited to 2 percent, inherent risk should be assessed to be 100 percent, and the risk that analytical procedures will not detect material misstatements should be assessed to be 50 percent. Required: 1. Determine the required sample size and sampling interval. 2. Calculate the upper misstatement limit, assuming that the auditor tested the sample and discovered the following misstatements. Voucher Number Book Value Audited Value 0220-01 $ 2,400 0615-31 50 48 0714-09 3,600 2,400 1119-22 15,000 14,000 $ 0