Syllabus 207 - Professor Dohan's Website, Queens College, New

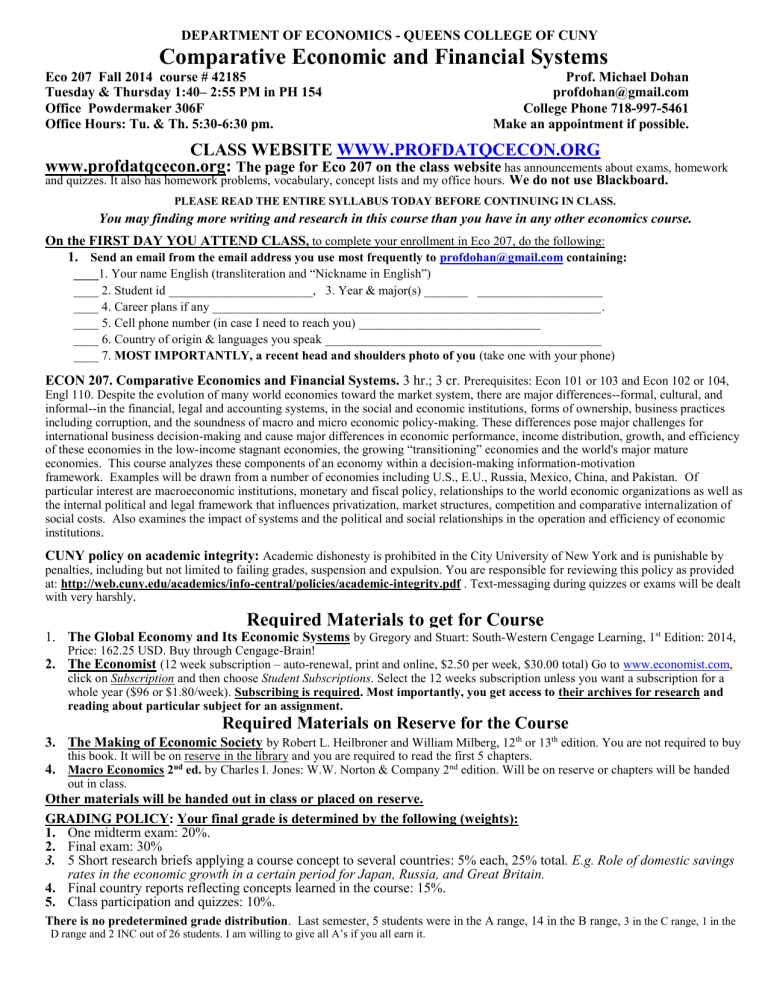

DEPARTMENT OF ECONOMICS - QUEENS COLLEGE OF CUNY

Comparative Economic and Financial Systems

Eco 207 Fall 2014 course # 42185

Tuesday & Thursday 1:40– 2:55 PM in PH 154

Office Powdermaker 306F

Office Hours: Tu. & Th. 5:30-6:30 pm.

Prof. Michael Dohan profdohan@gmail.com

College Phone 718-997-5461

Make an appointment if possible.

CLASS WEBSITE WWW.PROFDATQCECON.ORG

www.profdatqcecon.org:

The page for Eco 207 on the class website

has announcements about exams, homework and quizzes. It also has homework problems, vocabulary, concept lists and my office hours.

We do not use Blackboard.

PLEASE READ THE ENTIRE SYLLABUS TODAY BEFORE CONTINUING IN CLASS.

You may finding more writing and research in this course than you have in any other economics course.

On the FIRST DAY YOU ATTEND CLASS

, to complete your enrollment in Eco 207, do the following:

1.

Send an email from the email address you use most frequently to profdohan@gmail.com

containing:

____ 1. Your name English (transliteration and “Nickname in English”)

____ 2. Student id _______________________, 3. Year & major(s) _______ ____________________

____ 4. Career plans if any ______________________________________________________________.

____ 5. Cell phone number (in case I need to reach you) _____________________________

____ 6. Country of origin & languages you speak ____________________________________________

____ 7.

MOST IMPORTANTLY, a recent head and shoulders photo of you (take one with your phone)

ECON 207. Comparative Economics and Financial Systems.

3 hr.; 3 cr.

Prerequisites: Econ 101 or 103 and Econ 102 or 104,

Engl 110. Despite the evolution of many world economies toward the market system, there are major differences--formal, cultural, and informal--in the financial, legal and accounting systems, in the social and economic institutions, forms of ownership, business practices including corruption, and the soundness of macro and micro economic policy-making. These differences pose major challenges for international business decision-making and cause major differences in economic performance, income distribution, growth, and efficiency of these economies in the low-income stagnant economies, the growing “transitioning” economies and the world's major mature economies. This course analyzes these components of an economy within a decision-making information-motivation framework. Examples will be drawn from a number of economies including U.S., E.U., Russia, Mexico, China, and Pakistan. Of particular interest are macroeconomic institutions, monetary and fiscal policy, relationships to the world economic organizations as well as the internal political and legal framework that influences privatization, market structures, competition and comparative internalization of social costs. Also examines the impact of systems and the political and social relationships in the operation and efficiency of economic institutions

.

CUNY policy on academic integrity:

Academic dishonesty is prohibited in the City University of New York and is punishable by penalties, including but not limited to failing grades, suspension and expulsion. You are responsible for reviewing this policy as provided at: http://web.cuny.edu/academics/info-central/policies/academic-integrity.pdf

. Text-messaging during quizzes or exams will be dealt with very harshly

.

Required Materials to get for Course

1.

The Global Economy and Its Economic Systems

by Gregory and Stuart: South-Western Cengage Learning, 1 st Edition: 2014,

Price: 162.25 USD. Buy through Cengage-Brain!

2.

The Economist

(12 week subscription – auto-renewal, print and online, $2.50 per week, $30.00 total) Go to www.economist.com

, click on Subscription and then choose Student Subscriptions . Select the 12 weeks subscription unless you want a subscription for a whole year ($96 or $1.80/week). Subscribing is required. Most importantly, you get access to their archives for research and reading about particular subject for an assignment.

Required Materials on Reserve for the Course

3.

The Making of Economic Society

by Robert L. Heilbroner and William Milberg, 12 th or 13 th edition. You are not required to buy this book. It will be on reserve in the library and you are required to read the first 5 chapters.

4.

Macro Economics 2 nd ed. by Charles I. Jones: W.W. Norton & Company 2 nd edition. Will be on reserve or chapters will be handed out in class.

Other materials will be handed out in class or placed on reserve.

GRADING POLICY: Your final grade is determined by the following (weights):

1.

One midterm exam: 20%.

2.

Final exam: 30%

3.

5 Short research briefs applying a course concept to several countries: 5% each, 25% total . E.g. Role of domestic savings rates in the economic growth in a certain period for Japan, Russia, and Great Britain.

4.

Final country reports reflecting concepts learned in the course: 15%.

5.

Class participation and quizzes: 10%.

There is no predetermined grade distribution . Last semester, 5 students were in the A range, 14 in the B range, 3 in the C range, 1 in the

D range and 2 INC out of 26 students. I am willing to give all A’s if you all earn it.

Prof. Dohan Eco 207, Spring 2014 2

This 207 course differs dramatically from the first two ECO 207 I taught last year, by reducing the time required for doing the assignments and reading and by making the assignments clearer and shorter. the normal amount of work for course will be quite adequate to earn an A, provided you have a good grasp of English and knowing Excel. If your English is weak or you don’t know

Excel at all you will have to put in a bit more time. The course is structured in more logical order to be sure that you are taught the skills before you are required to do the assignment.

Mid-terms and Final (50%):

There will be one midterm exam (tentatively scheduled on the syllabus) and a cumulative final exam.

The mid-term and final are multiple-choice, concept-identification (vocabulary), analytical and short answer questions. The midterm is based on lectures, textbook material, and homeworks. The final has one major essay about your country, 2 shorter essays and multiple choice and concept identification. Old exams with answers will be posted at www.profdatqcecon.org before the exam.

No make-up exams will be given except in the case of illness confirmed in writing by a physician.

Research reports (25%):

There are 5 written research reports or briefs that require you to gather data and to analyze this data critically. At the beginning of the semester you will be assigned a country. You will be asked to collect data generally using the

World Bank and other institutions, and read relevant articles from Wikipedia, The Economist, New York Times and Wall Street

Journal. You will present this data in a professional format following the “Sample Report” format. Each report focuses on a series of questions which will require you to collect and critically analyze the data you have gathered.

Country report (15%):

In your country report you will describe the economic and financial system, institutions, organizations, etc. for your country. We will discuss more about the country report later in the semester. This will be due on the last day of finals week.

Class participation, attendance and quizzes (10%):

You can get or lose points when I ask you a question in class. Written attendance is taken every day, but attendance is not required. From experience, to pass the class you need to attend the lectures to get material only available from the lecture. Absence is no excuse for missing short quizzes from The Economist, vocabulary, or key concepts.

Reading Assignments:

Reading assignments are from the textbook, should be completed before or on the day they are covered in lecture. Even though I don’t cover part of the assigned text in class, you are still responsible for the assigned material in the text.

In the lectures:

Take good lecture notes. The lectures are a very important part of the course and often cover and explain materials and topics not in the text

.

You may record my lectures.

Eco 207: Syllabus Comparative Economic & Financial Systems

Spring 2014

I Basic Concepts for the study of comparative economic and financial systems

NIB = lecture material not in book.

Tues

Jan 28

1.Why study economic financial systems?

A . To understand how different economic systems work and accumulate and allocate capital.

Order Gregory &

Stuart from

Cengage.com

B.

Explain the large differences in per capita income, growth rate of GDP and socio-economic indicators among countries

Thurs

Jan 30

Tues

Feb 4

C.

How the interaction between economic institutions and non-economic institutions affect GDP

D. Explain the large differences of the productivity of resources in different economic systems

2.Working with economic time series:

A.

Measuring output over time

B.

Comparing output between countries

C.

Understanding the underlying data (meta-data)

D.

Do the numbers in the time series make logical sense?

Can you explain trends?

3.Definition of socio-economic concepts: infrastructure, institutions, belief systems, etc.

Thurs

Feb 6

Tues

Feb 11

4.Describing economic systems - what type of goods and services are produced : resources, types of goods and services produced, ownership structures, use of market forces, etc.

5.Sources of economic growth: capital accumulation, growth of human capital, labor, technological progress, economies of scale.

Jones Chap. 2

Look at sample

“Report” on website.

Gregory & Stuart chap. 2

Heilbroner chap.

1

Jones chaps.

3, 4, 5 and 6

Thurs Feb 13 Out Due to Weather

II. Types of Economic Systems

Tues

Feb 18

6.Various Models of growth. Cobb-Douglas production function, Solow-Romer model, total factor productivity model, and Malthusian population theory.

Thurs

Feb 20

Tues

Feb 25

Classes follow a Monday schedule

7.Understanding the concept of efficiency: Pareto Efficiency for Private Goods

The marginal analysis approach to static efficiency, eg. MPP la x

=

MPP lb x to produce one product, MPP la x / MPP la y = P x /P y and MC x /MC y = MU x /MU y etc. dynamic efficiency over time.

Jones handout

Read Prof. Dohan’s essay on “Efficiency &

Solitary of the Peasant”

Prof. Dohan Eco 207, Spring 2014

Thurs. 8.Strength and Weaknesses of the Market System: Markets work best for private type goods and

Feb 27 services and provide information on the quantity and prices that people are willing to pay for each commodity or service. The economy needs non-market guidance (king, parliament, legislature, etc.) on how to allocate resources between private type goods & services & public types goods & services

3

G&S pp. 35-41;

54-65 & chap. 6

Tues

Mar 4

Thurs

Mar 6

9.Ancient and traditional economies: primarily rural economies not producing for the market but rather according to tradition or command, worked by slaves or peasants tied to the land & was not monetized. Urban centers were markets for international & domestic trade and used money. Belief systems discouraged working for profit making, trading and lending money. By end of 4 th C. the western Roman Empire had nearly collapsed, was replaced by many small states creating a system called Feudalism & widespread manorial organization of society & towns, guilds, & concepts of medieval economics, disrepute of economic gain & profit as a method of distributing income.

10.Manorial economies from 5 th C. to the 17 th C. centered around self-sustaining fortified selfsufficient manors with few monetary transactions even in cities and where economic activity was guided by tradition. Urban centers had markets often regulated by guilds (goldsmiths, weavers, etc.) not for profit but stability. Dominated by the Catholic Church which was opposed to making money, charging interest.

Heilbroner chap.

2, pp. 15-23

Heilbroner chap.

2, pp. 24-35

Tues

Mar 11

11.Changes in Economic Institutions throughout Europe and England:

Changes leading up to the industrial revolution: the itinerant merchant, urbanization, the crusades, the growth of national power uniting manors, exploration to the far east and new world, a change

Heilbroner chap.

3

G&S in religious climate, breakdown of the manorial system, and the rise of the cash economy. chap. 10

Thurs

Mar 13

12.Leading up to the Industrial revolution in England: Gradual appearance of economic activity in the 16 th

& 17 th C. with the spread of monetization , the development of markets for labor, land and capital, the “enclosures” (for sheep raising) forcing labor off of their traditional manorial land which led to the emergence of a landless proletariat working for wages.

Calvinism, the profit motif, the protestant ethic, invention of economics, emergence of market systems.

Tues

Mar 18

13.Industrial Revolution in England: 1750-1870 New industrial technologies: steam engine, improved iron and steel, power loom, spinning Jenny, building of canals, emergence of railroads, etc. Falling costs from economies of scale leading to large profits and savings by the entrepreneur most of which was reinvested. Great interest in technology by all strata of society, introduction of the patent system, large domestic market, emergence of the factory in cities.

( VIP: See Prof. Dohan’s essay outlining the principal components of the Industrial Revolution in England.)

Thurs

Mar 20

First Midterm:

covers chapters 1-8 from Gregory & Stuart & 1-4 from Heilbroner & 2 from

Jones.

Heilbroner chap.

3

Heilbroner chap.

4

III. Development of Modern Economies

Tues

Mar 25

14.Development of modern capitalism: using US as an example. 1830-1920: vast amount of agricultural land raised the productivity of labor & raised wages for industry as well.

Constitution guaranteed a large market without borders. Stable government, rich resources of oil, iron ore, wood supported the development of industry. The development of a financial system as well as government land grants to railroads helped finance economic growth. The invention of

Tues

April 1

16.The European model. The European union is now a market larger than the US. Euro financial system with a unified currency for members. Different systems of corporate governance.

Independent fiscal polities. Some economies have strong social safety nets.

Heilbroner chap. 5 the internal combustion engine formed the basis of the rapid growth of the auto industry which changed the face of America. Economies of large scale production changed the market structure of many industries. Giving rise to anti-trust regulations. Captains of industry.

Thurs

Mar 27

15.US mixed market economy. The basics: private ownership of the means of production with

G&S Ch. 11 public regulation of the behavior of enterprises. Private financing of the economy (some pp. 239-279 exceptions). The importance of not-for-profit organizations: colleges, charities, churches. The see vocab. wide spread presence of non-private enterprises managed by board of trustees providing government services (MTA, post office, Queens College, etc.). The importance of regulation in sheet on Ch. 11. the US economy. Corporate governance and US financial markets.

G&S Chap. 12

Thurs

April 3

17.Problems facing the European Union : High taxes cause high labor costs reducing competitiveness in world markets. Problems paying for the welfare state with a declining work force and an aging population. Uneven fiscal policy and deficits among its members (Greece,

G&S Chap. 12 continued

Tues

Apr 8

Italy, Spain, Portugal) are causing major stresses. Whatever happened to Keynes?

18.The Asian Model: Japan and the 4 Tigers. Plus India a.

Gershchenkron’s theory of relative backwardness inspired countries to take steps to accelerate economic growth. b.

Rapid economic growth based on high rates of investment and national saving, closing the technology gap through import and imitation, shifting excess agricultural labor from agriculture to industry, and a focus on expanding exports. Technological borrowing does not substitute for technological innovation. c.

Export lead growth strategy was the basis for rapid economic growth of the four Tigers listed

G&S Chap. 13

Read Wikipedia on economy of

India

Prof. Dohan Eco 207, Spring 2014 plus Japan: Hong Kong, Korea, Singapore, & Taiwan. d.

Income security will become a major problem for Asian economies most of which have a young labor force. They currently rely on the young supporting the old. Or relying on a high rate of savings during population’s working years. e.

India: A success story threatened by corruption.

Thurs

Apr 10

19.Origins of Soviet command economy: Marx left no outline for economic growth. Near economic collapse in Russia in 1920 led Lenin to initiate the New Economic Policy=NEP, a mixed market economy relying heavily on the sale of grain for export. Stalin, after eliminating his rivals initiated the first 5 year plan to accelerate industrialization through the development of heavy industry. The imbalance between industry and agriculture led to a drastic drop in grain collections needed for export and industrialization and led Stalin to his disastrous policy of collectivization forcing all peasants into collectivized farms where they had no ownership of the means of production.

Apr

14-22

Spring Recess. No classes

(Lots of reading and writing to do).

Passover April 14

th

Easter April 20th Last day of Passover April 22

4

G&S Chap. 14 to p. 391

Thurs

Apr 24

20.Institutions of the Soviet economy: given the priorities of the political leaders, Gosplan and the State Ministries worked out the targets for all sectors of the economy down to the individual enterprises and farms relying on information of capacity, resources, etc. provided by directors and managers of the enterprises and farms. It used a system called “material balances” to try to equate the supply and demand for individual inputs and outputs while meeting the targets of the political leadership. The market system and shortages were not used for these production decisions. Managers were rewarded based on planned fulfillment, not on profit. Markets, however, were used to allocate labor & consumer goods. Gosplan used the value added tax to try to keep the macro-economy in balance & reduce consumer demand.

Tues

Apr 29

21.Why the Soviet planning process didn’t work. a.

Growing inefficiency because of the inability to equal marginal products in production b.

Asymmetrical information provided by managers to get less demanding plan targets and high productive capacity led to underutilized resources. The material balance system (input output table) 1) didn’t adapt for technological change, 2) rarely balanced leading to shortages

& was late.

c.

The principal agent problem favored the manager in finding the easiest way to fulfill his plan rather than producing what was really needed in the economy.

d.

A poor system of incentives did not reward managers for production of spare parts or the introduction of new products and technology. e.

Failure to use interest rates along with a price system based on labor costs led to growing inefficiency in the productivity of added capital.

G&S

Chap. 14

pp. 392- 413

G&S

Chap. 14

pp. 414-

424 and

Chap. 16

And

Chap 18 pp. 531-

539

Thurs

May 1

Thurs

22.Growing failure of the Soviet system: initial rapid growth from 1928 through 1970 based on high rates of investment and shift of labor from agriculture into industry. Declining static efficiency and poor performance for reasons discussed above, little economic change in the economy took place between 1970 and 2000 after which the system collapsed. Extensive second economy between firms trading scare inputs and black markets for consumers.

Transitioning to a modern mixed market economy: Soviet experience with privatization, privatizing the land in agriculture, shifts in income distribution, corruption, unreliable court system and political agendas of Putin.

26.Political, institutional and social problems as a major cause of Africa’s poor

May 15 economic performance in many economies, even those with rich natural resources.

Note

: the six African countries you are to read about will be given in “The African

Assignment”

G&S

Chap. 15 pp. 425-442

Tues

May 6

Thurs

May 8

23.The surprising success of Chinese economy since 1970s: abandonment of Soviet type policies, introduction of market type incentives in agriculture and in small businesses, retain state ownership of the “commanding heights,” in SEOs (State owned enterprises) development of foreign trade, and decentralization of authoritarian regime.

24.Problems emerging in the Chinese economy from the years 2000-2013 excessive reliance on exports, growing shortage of labor, deteriorating environment, pervasive corruption and poor macro policy leading to inflation.

: ineffective corporate governance of large state owned enterprises, lack of an internal market and

G&S

Chap. 15 pp. 443 - 465

Read articles on

China in Archive of The Economist

Jan 2000 – Jan

2014

Tues

May 13

25.Islamic economic theory: Three religious tenets: no interest rate to allocate investment, zakat (10% of profit goes to the poor) and “the practice of “fair and honest business”. Yet corruption and politics are a major factor in Islamic economic performance. Many are single resource economies (oil). What will happen if the market for oil collapses ? Others are very poor & overpopulated: Pakistan, Bangladesh. Why?

G&S Chap. 22 pp. 607-609, plus written assignment using World Bank info.

Articles on the 6 African countries in Archive of

The Economist

Jan 2000 –2014