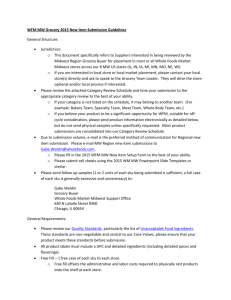

Category Review Schedule

advertisement

2015 Whole Foods Market Midwest Broker and Supplier Summit Welcome • Thanks for Coming! • We sincerely appreciate you committing the time to be together Midwest Grocery Support Team Mark Baron Coordinator Gabe Weldin Category Buyer Mark Tilton Promotions Buyer Heather Prach Associate Coordinator Will Wolf Associate Coordinator Daniel Pineda Associate Coordinator Rob Luscombe Drew Mara-McKay Category Buyer, Promotions Buyer, Canada Canada Selma Hudson Associate Buyer Mindy Hauge Category Analyst TBD IL Grocery Merchandiser/ Bakery Analyst Tyler Josh Coyle McCarthy Category Analyst Merchandizer Canada Canada Andrew Peterson TBD Merchandizer, Merchandizer, MN, MO, IA, NE IN, MI TBD Merchandizer, IL Our Core Values are Who we Are We Promote the Health of our Stakeholders Through Healthy Eating Education, while Practicing and Advancing Environmental Stewardship • • • • • WFM remains the leading Organic Retailer, with almost half of all MW Grocery sales certified Organic, and growing faster than Team sales overall with 12% year over year comps. Non-GMO is growing even faster at almost 17%, and has already captured almost a third of all MW Grocery sales dollars. A huge growth segment that is both a stepping stone from Conventional to Organic (for both customers and producers) as well as a desired attribute in its own right. Eating organic fruits and vegetables could increase your antioxidant intake by 20-40%. Organic strawberries have more nutrients and antioxidants than their conventional counterparts. Organic tomatoes are 50% higher in vitamin C content than conventional tomatoes **From a recent study by Dr. Jessica Shade. Dr. Shade is the Director of Science Programs for The Organic Center, a non-profit research and education organization focused on evidence-based science about the environmental and health benefits of organic food and farming. Organic Total Organic: Total Grocery: Non GMO Total NonGMO: Total Grocery: Unit $ Sales Prior $ Sales Unit Growth $ Share Share Growth Share Prior Unit Share 11.98% 47.36% 46.27% 8.33% 47.43% 46.72% 9.40% 100.00% 100.00% $ Sales $ Growth Share 6.72% 100.00% 100.00% Unit Prior $ Sales Unit Prior Unit Share Growth Share Share 16.76% 28.70% 26.89% 14.00% 28.66% 26.83% 9.40% 100.00 % 100.00% 6.72% 100.00% 100.00% We Serve and Support Our Local and Global Communities • Fair Trade is only 2% of all MW Grocery Sales, but that still represents Millions of sales dollars. • Note that growth is over 20%. Dollar Share is obviously much higher in categories that lend themselves to Fair Trade Certification – Sweeteners, Chocolate, Coffee, Tea, etc. • 2014 Supplier Supported Donation through the MW Scan Program totaled over $30K in support to the Whole Planet Foundation. • November B Fair Trade Weekender saw tremendous lift with over 700% unit growth! • We love working with Suppliers to support mission driven initiatives around this core value. • Our Team Members love it and our customers do too. Fair Trade $ Sales Prior $ $ Share Growth Share Total Fair Trade: 20.78% Total Subteams w/FT: 9.40% 1.94% 1.76% 100.00% 100.00% Unit Sales Growth 7.50% 6.72% Unit Share 1.98% Prior Unit Share 1.98% 100.00% 100.00% We Serve and Support Our Local and Global Communities • Midtown Detroit WFM Turned 1 in June of 2014 with great Success thanks to all of the support we received. • 1000’s of Midtown specific EDLPs from Global suppliers such as, but not limited to: Organic Valley, Annie’s Homegrown, Hain Celestial, Amy’s Kitchen, and many more. • All MDT specific EDLP scans resulted in Retail passdown to offer value to the customers • MDT zone specific pricing enables a greater value image with minimal margin compression • MDT WFM Detroit Exclusive skus from 16 Michigan producers to not only offer something original to customers but also be a platform for MI/Detroit based businesses to have a market to try new things with WFM. We Serve and Support Our Local and Global Communities We Serve and Support Our Local and Global Communities Local Producer Loan Program (or “LPLP”) • WFM has committed up to $25 million in small, low-interest loans for local suppliers • 190+ Loans totaling over 10M since 2007 • Average loan $53,000, 5.3% interest rate • Loan amounts between $1,000 and $100,000 WFM MW is seeking to express our Core Values by investing in our communities and creating win-win partnerships through both “What Makes Our State Great” marketing and LPLP investments. • “Local” as measured by LPLP-flagged Supplier sales is our fastest growing attribute in MW, with 115% growth. • LPLP is currently 1.14% of overall Grocery sales and more than doubling year over year, but future MW reporting will reveal even more “Local” sales dollars from suppliers that are not LPLP participants. Currently right under our nose but not yet flagged in data. • Customers are voting with dollars to express interest in carbon footprints, local economies, sustainability, diversity, and small-scale “craft” food and drink quality. Local Total LPLP: Total Grocery: Unit Prior $ Sales Unit $ Sales Growth $ Share Share Growth Share 115.76% 9.40% 1.14% 0.58% 105.70% 0.84% 100.00% 100.00% 6.72% Prior Unit Share 0.44% 100.00% 100.00% We Create Ongoing Win-Win Partnerships with our Suppliers The Scrumptious Pantry is a good example of many programs, key attributes, and product missions that WFM embraces. • “What Makes Our State Great” – Chicago-based IL company with sales in all Regions through a Global launch, but almost 30% of their sales in MW. • Midwest Region LPLP participant, with low-interest rate loan to invest in facilities to expand production for Global WFM launch. • WFM and Natural Channel Exclusives • Partnership with local farmers • Partnership with local producers on special subline launches • Non-GMO Heirloom Mission and ingredient sourcing – – – Scrumptious Pantry defines an heirloom as a crop variety that is open-pollinated and was introduced before 1945 Heirlooms are not cross-bred, but are improved by selection of the best specimens of one variety. (As opposed to hybrids, cross-bred from two genetically different parents in a process that could theoretically occur in nature. Or GMOs, genes spliced from unrelated species that could never cross-breed in nature.) We Support Team Member Excellence and Happiness + We Satisfy, Delight, and Nourish our Customers DSTM Role and Education Down the Aisles • We greww education down the aisles of Grocery by continuing to have over 80% participation in MJLC Global initiated new item video trainings. • We revolutionized the way that we classed our Supervisors to create “Development Supervisors” that are focused on operations and training down the aisles • All Grocery teams hired this position • We hosted a Development Supervisor summit and taught our Supervisors how to train and educate the grocery teams on products, operations, and how to use the My Journey Learning Connection System • We have a bi weekly call to support the role and create trainings that are launched regionally • Global Trainings have been a focus and we have on boarded more MJLC hours and classes than any other region. Video Farm June Top 5 We Create Wealth Through Profits and Growth South Bend Midtown Detroit Maple Grove Minneapolis Park Ridge Lincoln, NE Younge and Sheppard * 4230 Grape Road Mishawaka, IN 46545 115 Mack Avenue Detroit, MI 48201 12201 Elm Creek Blvd N Maple Grove, MN 55369 222 Hennepin Avenue Minneapolis, MN 55401 225 W. Touhy Avenue Park Ridge, IL 60068 O Street and Lyncrest Lincoln, NB 68505 4777 Yonge Street Toronto, ON, Canada M2N5M5 SBN MDT MGV MIN PKR LIN YNG • We’ve been busy over the last 2 Years. • We’re looking forward to the upcoming locations and projects. • On top of the Rigorous store opening schedules we completely remodeled our IDY Store (RE-Model Grand Opening occurred last month) and relocated our Palatine Location successfully. • Plans for GAL, ARB, and KBS to come this year. • YNG opened yesterday with the highest total Grand Opening Sales $$ in Ontario history! We Create Wealth Through Profits and Growth Alpha Project 2014 46 YNG Yonge and Sheppard * 2015 47 LDP Lansdowne Park * 48 STV Chicago (Streeterville) 49 DPL Chicago (DePaul) 50 WLP Chicago (West Loop) 51 EWR Chicago (Edgewater) 52 ELM Elmhurst 53 ELN East Lansing, MI 54 GBR Evanston RE WBR Willowbrook 55 LEA Leaside * Address 4771 Yonge Street North York, ON Canada GL M2N 5M5 Bank and Holmwood Street Ottawa, ON Canada K1S 255 E Grand Ave Chicago, Il 959 W Fullerton Chicago, IL 1 N Halsted St Chicago, IL 6009 N Broadway Chicago, IL 215 S Il Rte 83 Elmhurst, IL 2778 E Grand River Avenue Meridian, MI 48823 2748 Green Bay Rd Evanston, IL 6300 Kingery Hwy (Rte. 83) Willowbrook, IL 1860 Bayview Avenue Toronto, ON Canada M4G 3C6 County Region Opening date York Tuesday, September 23, 2014 Ottawa Valley Wednesday, November 19, 2014 Cook Wednesday, January 28, 2015 Cook Wednesday, February 25, 2015 Cook Wednesday, March 25, 2015 Cook Wednesday, April 29, 2015 DuPage Wednesday, May 27, 2015 Ingham Wednesday, June 24, 2015 Cook Wednesday, July 29, 2015 DuPage Wednesday, August 26, 2015 York Wednesday, September 30, 2015 Why are we Here? We sell the Highest Quality Natural and Organic Product available…Because of You. Thank You!!!! 2015 Midwest Marketing business objectives Drive incremental traffic: • • Drive new customers to Whole Foods Market for new and existing stores Maintain existing customer base while growing frequency among core segments Increase basket: • Increase share with WFM cross-shoppers Reinforce the WFM brand: • • Support WFM leadership position as the natural foods authority Increase brand insistence for WFM as the grocer of choice in the trade areas where we do business strategy Drive awareness, trial and repeat visits through an “always on” front-loaded integrated media mix of: • • • • • Traditional paid media (print, outdoor, direct mail, broadcast) Digital media (display, social, mobile, email) Advanced targeting (credit card, consumer modeling, retargeting) Public relations Events and experiential marketing ADJUST ACCENTUATE EDUCATE the perception of price relative to value the dynamic in-store experience new and existing customers about WFM differentiators strategy In our always-on integrated mix each vehicle plays an important role using the strengths of each medium, working in concert to create a robust annual campaign. Print lays the foundation for citywide coverage. By providing a longer time-spent-viewing, readers are more engaged on a higher personal level. Digital efficiently and effectively provides additional citywide coverage with the opportunity for immediate user interaction with a brand message. It’s highly measureable and timely. Broadcast is an efficient reach builder that provides market-wide coverage. It’s ability to be close to the point-of-purchase is ideal for retail, especially in the suburban trade-areas. Advanced targeting lets us go after the customers that are most likely to be WFM customers, target our competitors shoppers and re-engage lapsed customers. Outdoor presents big impact/visibility opportunities and reaches customers in the specific trade-areas where we have stores. Events reinforce our ability to do the unexpected in memorable and personal ways. Public Relations gives us the ability to tell a deeper story with editorial credibility. In-store lets us focus customer attention to drive the perception of value that will build basket. Tactics at-a glance* Print Broadcast Events Chicago Tribune bi-weekly inserts Minneapolis Star Tribune holiday inserts Chicago Social Chicago Magazine Edible Magazine Total Traffic Network :15 sec NPR/CBC underwriting Clear Channel Radio CBS Radio Comcast Spotlight AT&T U-verse Local affiliate morning show OOS Differentiator events Holiday Truck Holiday Ordering Table Pop-Up Twitter Vending Machine Digital Chicago Tribune ROS Display Chicago Tribune Interstitials Xasis Network Display (HGTV, CNN, etc) Outbrain Pandora Digital Radio Outdoor Bulletins Trestles Bus shelters & CIPs 2-sheets Advanced Targeting Cardlytics WFM.com retargeting Conversant Media WFM Affinity Card Direct Mail NSO direct Mail At-work Network In-store Value Department Differentiators Our vs. Theirs Conscious Catering Made Right Here Public Relations NSO Differentiator Community WFM 2015 Opening Support Labor Strategy Store Opening Support • Line up support 6 weeks out • Look for a minimum of 5 TMS per week from surrounding stores – Some travel is included in satellite markets – Grocery Support drafts and communicates to teams and team members individually – Regional HR books travel and labor • Partner with other Regions – PNW for Canadian Openings for best practice sharing – NA Region on select openings as well. Set Order Breakdown – Appoint Aisle Captains – GOLD TEAM and POINT Oversees all – Daily Walks with task list at hand of duties based on GOLD Team Committee We have refined our process to a point of where one AC no longer fully plans and executes each store individually • Just as important as thorough planning is a solid support crew. • With a Gold Team in place and supervising all work, our structure has evolved to have experienced TLs/ ATLs support as “Gold TMs”. • Gold TMs assist in all store opening processes including • In store orders • Building sets • Supervising crew and delegating tasks • Organizing and maintaining equipment • Back room set up • New team training support • Sign requests 2015 WFM Support for the Program Requirements of Gold TM • Experienced in full MW Grocery program and proficient in all systems – Showing a solid relationship with the vendor community through successfully running resets at your current store. – Is able to consistently hit the parameters of the market special and category review programs. • Must be from a team performing well enough to support their absence – Strong TL or ATL counterpart is a must – Financial good standing • Must have the ability and desire to travel for full month during opening – Open availability needs to be met – Seeing the project from start to finish is a must while opening a store Purpose of the Merchandiser Role • Reset follow up- Ensure all agreed upon new items are cut into the sets. • Merchandising follow up- All agreed upon Off Shelf Requirements are fulfilled. Support Needed for 2015 and Beyond AC/Merchandiser Relationship • Will include weekly/ monthly focus areas dictated by AC group (task list for follow up in store) • Weekly check in call • discuss hot topics/ issues • review merchandisers schedule and adjust if needed • delegate clear and specific store follow up topics as needed Expectations for Resets and Store Openings • WFM has invested and plans to continue to invest in the program as it exists today Portion of the Labor Investment is Within Global Data Unification Process • All regions will view data the same causing some shifts product hierarchy within where it lives in our data. • No specifics around sku by sku. • Target Date is around WFM 3rd Quarter, but still TBD. • No Changes will come to effect products beyond how the data is viewed for WFM. • More info to come Whole Foods Market Midwest Grocery Vendor Broker Summit Promotion Discussion GRAND OPENING PROMOTIONS 2015 • Purpose of Illinois Market Grand Opening promotions – “Welcome to the IL” Market Approach – – – – • Illinois grand opening promotions + Market Special Program – – – – • The National and Regional Market Special Program will maintain placement in IL market stores IL grand opening promotions can enhance existing National/Regional Program Grand Opening promotions can be run in conjunction of Market Special program Good opportunity to display IL Grand Opening promotions with regular MS Program items What you’ll be getting from Illinois Grand Opening promotions – – – – – • Reduce cannibalization of sales in other IL stores Raise IL market above competition for 2015 This will work in conjunction with regional IL price investments Large portion of overall IL Market growth strategy. Local Tribune Flyer Opportunities “Best in Market” Promotions across the whole IL Market Expanded off-shelf placement possible Reduced cannibalization in other IL Market stores Opportunity to grow in IL market beyond normal market special program Illinois Market Grand Opening Promotion Strategy – – – Grand Opening deals will be run in all Illinois Market Stores Scan discounts will be billed back for IL only stores via National Scanback tool A Chicago Tribune Flyer will feature the best discounts available to our customers IL GRAND OPENING PROMOTIONS 2015 • • • Alpha STV DPL WLP EWR ELM ELN GBR WBR LEA Illinois Grand Opening Promo Submission Process – – – – We will be collecting a stable of promotions for all store openings Promo Submissions should be submitted in roster form, BY QUARTER One set of promotions should be submitted for use during any month during that quarter Promo submissions should be sent in based on Quarterly Deadlines – – – – Promotions will run for one month – an A and B cycle Promotions should be submitted as a OI/MCB or scan based promotion 35% minimum reduction in cost required (30% for Dairy) Scans will be billed back via National Scanback tool • • • Q2 December 1st Q3 March 16th Q4 June 15th Frequency of Promotion – – We will only use the submitted promotion one time within the quarter Selected promotions will be communicated in calendar form prior to the start of the quarter Placement of Promotions – – There is no guaranteed flyer/off-shelf placement or billing The discount and category will drive selection for flyer and off-shelf placement Store Chicago (Streeterville) Chicago (DePaul) Chicago (West Loop) Chicago (Edgewater) Elmhurst East Lansing, MI Evanston Willowbrook Leaside * Opening date Wednesday, January 28, 2015 Wednesday, February 25, 2015 Wednesday, March 25, 2015 Wednesday, April 29, 2015 Wednesday, May 27, 2015 Wednesday, June 24, 2015 Wednesday, July 29, 2015 Wednesday, August 26, 2015 Wednesday, September 30, 2015 Quarter Due Date Q2 Q2 Q2 Q3 Q3 Q3 Q4 Q4 Q4 Dec 1st Dec 1st Dec 1st March 16th March 16th March 16th June 15th June 15th June 15th Promotional Opportunities 2015 • 2015 Marketing Fees • • • • • • • Shelf Special • • • MW Region is growing more than it has in any year and we will be expanding our marketing expenses The cost of flyer printing and banner creation will rise with the influx of stores The flyers and banners will be reaching additional customers as well, increasing the exposure of this great promotional vehicle In 2015, we’ve decided to raise the flyer and banner fee by $500 apiece Flyer Fee $2,500 Banner Fee $3,500 15% minimum cost reduction required Runs for the A and B Period Market Special • • • 15% minimum reduction in cost required Sale runs the length of both the “A” and “B” promotional cycle $2,500 investment with flyer placement- picture of product and sale price goes into flyer that is distributed in all stores and via electronic communication Promotional Opportunities 2015 • Market Special Plus • • • • • • • 30% minimum reduction in cost required (25% for dairy items) Items featuring a scan must contain a UNFI discount (OI or MCB) Scan amount should be percentage based up to the requisite 30% Scans will be entered by the MW Grocery Team into the National Scanback Tool for invoicing Sale runs in either A promo or B promo period $2,500 investment with flyer placement- picture of product goes into flyer that is distributed in all stores and electronic communication Grocery Banner Promotion • • • • • 40% minimum reduction in cost required Items featuring a scan must contain a UNFI discount (OI or MCB) Scans will be entered by the MW Grocery Team into the National Scanback Tool for invoicing Promo will run in the A promo or B period, depending on the regional banner assignment $3,500 investment – covers actual banner AND flyer placement with product image, sale price and total savings over regular price Promotional Opportunities 2015 • Grocery Banner Promotion • • • • • • 40% minimum reduction in cost required Items featuring a scan must contain a UNFI discount (OI or MCB) Scans will be entered by the MW Grocery Team into the National Scanback Tool for invoicing Promo will run in the A promo or B period, depending on the regional banner assignment $3,500 investment – covers actual banner AND flyer placement with product image, sale price and total savings over regular price Sales Contest Program • • • • • 30% minimum reduction in cost required Limited to dry grocery items (no dairy or frozen without prior approval) Sale runs in BOTH A promo and B promo period $2500 investment with flyer placement A $2,000 investment in prizes for the winning Teams is required. Promotional Opportunities 2015 • 3-Day/Weekend Event •3-Day/Weekender Promotion ( Limited Time Off-shelf Promotion) •35% minimum reduction in cost required (30% for dairy items) •30% discount can be structured different ways; we offer the opportunity for Regional scan discounts in the MW. •Scan amount should be percentage based up to the requisite 30% •Scans will be entered by the MW Grocery Team into the National Scanback Tool for invoicing •Sale runs for a select 3-day timeframe • Midwest has run two regional weekenders • • We would like to begin scheduling weekenders to fill in the gaps from the National Program Weekenders can be submitted in an open format. We would like to be able to plug and play were able MW Promotion Forms 2015 • Promotions Calendar: Promo Submission Forms Published to Vendors Month Proposals (UPC level) from Final Promos MW Promotions Due to Vendors Due to Central (no Published MW Grocery Team later than) National Preorders Due to Global Grocery All National/Regional Promos Due to UNFI (incl. quantity projections & allocations) 11/02/2014 11/26/2014 Promo Year FY2015 FEB • 8/18/2014 09/03/2014 10/22/2014 10/1/2014 Deadlines are important • • They keep us organized and avoid issues created by backtracking In 2015, strict deadlines will need to be met. We will not accept any regional promotions submitted after the deadlines • We may reach out to fulfill merchandising needs, but these requests made by us will be limited MW Promotion Forms 2015 Promo Submission Form: • • • • • Promo forms need to be entirely filled • Merchandiser creating is a fairly manual process • No Missing UPCs • No incorrect UPCs • Typed in “proper” text” – not all uppercase • Size and UOM should be accurate, not rounded • Category information should be selected to the best of your ability, no blank cells • The category information provides us a snapshot of potential merchandising opportunities • Suppliers/brokers should also look at this information to make sure they are presenting promos in all categories • Submission contact info should also be included – this provides us quick access to brand contact info Products that have incomplete or incorrect information will be removed from that month Nutrition Bars need to have BOTH the single and the sleeve UPC If a Promotion is submitted as a Market Special or Market Special Plus we need to have a high resolution image submitted as well • We will keep these images on file, regardless of Market Special Acceptance Promos that are submitted incorrectly, require us to scrub data • When product information is submitted correctly, we spend less time creating the merchandisers and can focus on proper merchandising execution and communication MW Grocery Partnerships • The MW Grocery Team + • • • The MW Grocery Team has collaborated with other MW teams this past year to create some amazing programs. The Programs are created to drive sales and create theatre. The program may be driven by: • Specific times of the year i.e. Holiday, Season, Special Diet • Organizational or Mission i.e. Whole Planet Foundation , Share the Buzz, Whole Kids Foundation • Team Specific Decisions on exciting ideas A few programs we ran this year include: • “Ask Me” Program – Customer Service Partnership • Whole Planet Brochure and Scan Program – Marketing Partnership • Feature Ingredient Program – Partnership with Prepared Foods MW Grocery Partnerships • “Ask Me” Program – Partnership with Customer Service • • • • • • Customer Service and Grocery work together to order product and run Demos. Product is displayed throughout the store and at the POS We run the program in 2 week increments, A and B. This program alternates between Grocery and Whole Body The MW Support team selects the item for the first 2 weeks and the CS team selects the item for the second 2 weeks We saw lift over 1000% during the initial launch MW Grocery Partnerships • Whole Planet Foundation Brochure and Scan Program – Partnership with Marketing • • • • • • This past March, we put together our most successful Whole Planet Driver yet With the amazing support of our suppliers, we were able to raise over $30K in donations (100% more than the previous year) We launched a new brochure, the charge was $500 per spot and brochures went to all stores In 2015, we will look to continue our successful program • Brochure Participation • Month-long contributions In 2014, the MW had the largest amount from a regional scan program since inception of WPF Our Marketing team collaborated with us on materials design and creation MW Grocery Partnerships • Featured Ingredient Program – Partnership with Prepared Foods • • • • Grocery and Prepared Foods choose a brand or item to feature in recipes, Off-shelf displays and Pop-ups The idea is to drive sales, inspire innovation and tap into culinary trends • PFDS creates recipes and sells products at Pop-up displays • All Pop-up displays feature the product • Featured ingredient is on sale at retail • Promotion runs month long Sriracha Burning Love: • We saw Unit Lift of 414% over the prior year on the featured ingredient I (heart) Maple Syrup Program: • We saw Unit lift of 125% over prior months sales MW EDLP Program • MW will be rolling out an official EDLP program in 2015 • • • • • • • There has been an overwhelming amount of interest in doing region specific EDLP programs Two types of EDLP Programs: • All-in • This will take the retail price as low as possible, but promotions will not be an option • Suppliers can still participate in the marketing part of our program, but there will be no retail adjustments • Hybrid • This will be a small reduction in retail to hit a specific price point • We will still require quarterly promotions and participation in out marketing programs Discount Structure: • We are requesting to have all the EDLC discounts structured as a scan rebate Promos: • All suppliers participating in the EDLP program will need to supply a promotional calendar that spans the length of the EDLP • We will need this up front as proof of commitment to the program Review Process: • EDLPs will be reviewed quarterly. This will give everyone a chance to evaluate the strategy and impact MW will track and bill EDLCs through the national scanback tool 2015 EDLCs will start in Q2 (1/19/2015) and run Quarterly. Review periods will be by quarter: • Q2 starts 1/19/2015 – Q3 starts 4/13/2015 – Q4 starts 7/6/2015 • EDLC Review sessions should be booked near the end of each Quarter - in conjunction with your Category Review Meetings Q&A • • • • Ideation What programs are working for MW promotions? Where are there areas of opportunity for the MW Market Special Program? What should we consider adding to the program? What should we consider removing from the program? Category Review Schedule Overview • All categories to be reviewed on a yearly basis – MW Calendar follows Global Calendar, included in Summit materials and available upon request. – Higher volume categories to be reviewed multiple times (Primary, Secondary) – Please ask questions about when specific items should be reviewed if necessary Meetings • • • Meetings to review categories, lines, and new items should be requested within review schedule – Meetings are generally held in a Wednesday/Thursday/Friday block at the end of a calendar month. – Exact dates of the meeting block are fluid due to internal WFM scheduling conflicts, but are nailed down one month out. – MW Buyers cannot meet with every Broker and Supplier that requests a meeting – will prioritize as necessary based on agenda topics. Supplier meetings as part of Broker Meetings must be approved in writing by MW Grocery. – MW Buyers cannot meet with every Supplier that requests a meeting – will prioritize as necessary based on agenda topics. – Supplier meetings within Broker meetings will be limited to 15 minutes – Number of Supplier meetings per Broker meeting will be limited based on length of meeting, agenda topics, etc. Generally speaking, 0 to 2 Suppliers per 1 hour Broker meeting, or 0 to 4 Suppliers per 2 hour Broker Meeting. Off-schedule meetings with Suppliers will be accepted on a case-by-case basis and must be approved ahead of time. Try to get Suppliers into meetings on schedule – Category Reviews are the appropriate time to meet with Suppliers with interests in reviewed categories Category Review Schedule Timeline • • • • • • • • 5 months out – Broker Meetings are scheduled for following month. (End of July for Round 1) 4 months out – Broker Meetings are held. (End of August for Round 1) 3.5 months out – Submission deadline. (9/19 for Round 1) 10 to 12 weeks out - New items are submitted to UNFI, KEHE, and other distributors. (10/13 for Round 1) – – – Buyer will send new item confirmations to Brokers/Suppliers at this time. Product denials will not necessarily receive confirmation but are available upon request. A-B set matrix will also be available at this time – – Planograms are large files and will be distributed via Hightail.com All materials will be consolidated and resent at this point. 8 weeks out - Discos communicated to Distributors. (11/1 for Round 1) 6 weeks out - Category reset schedule, including reset and auto ship dates, will be provided to broker support team (11/24 for Round 1) 4 weeks out – Discos communicated to stores and Brokers. (12/1 for Round 1) 3 to 4 weeks out - Planograms & previous reset voids will be provided to support team Notes • In-store date (auto ships) vary by store based on schedule. This is a rotating schedule where new items and opportunity gaps will be auto shipped on Fridays and Mondays for resets taking place that upcoming week. • New items are expected to be presented for the category review meetings, and ready to launch by the launch date • Approved items will be auto-shipped according to that schedule • • • – High-volume SKU voids will also be auto-shipped; called ‘opportunity gaps’ Only select, urgent item launches will be shipped outside of the schedule – Off-schedule items should be shown in accordance with launch dates on Review calendar – pick the Round appropriate to item availability date Voids for a reset will be sent to stores in advance of reset two months after launch date – ex. January new item voids to be sent with March resets – the goal is 100% of new items on all intended shelves Questions about terminology or schedule please ask • Bulk has been folded into our standard Category Review and Promotions programs. – Store Optional and Local matters will still be handled by store level Bulk Buyers and that store’s Point AC. – Region-wide Category Review (New Items, Discos, Core Lists, and Voids) will be included in our regular Category Review program on the Global Schedule, with additional off-cycle opportunities as appropriate. – Planograms to come further down the road. – Region-wide Promotions will be included in our regular Market Special program, please submit according to standard Market Special deadlines. • • Regional and Global Bulk Bin launches from key suppliers have been the first step in this process over the last two years. MW Region Core Lists and Opportnities (Voids) are the next step. The first Core List (in recent memory) was published for October 2014, with accompanying “Opportunities” (Voids). – As in Grocery, Dairy, and Frozen, Bulk Core lists will be made up of proven top sellers from across the Region, as well as key initiatives. – In Bulk, Core Lists will provide the added benefit of cleaning up excess (but not all) variation in PLUs across stores. • Global Bulk PLU Alignment is a new and ongoing project, spearheaded by the WFM Global Data Team, to align all PLUs across all WFM Regions. – This is understandably complex and time-consuming. – Completion of the project will result in more accurate reporting and more effective category review, promotions, etc. – New Item Launches and major product mix changes may be limited until the project is completed. 2015 Category Review Expectations • • • What’s expected of the presenter? – – – – – – New item presentation with live samples, if possible New item form updated for 2015 (see attached) New Item Submission Power Point slides on presented items (see example) Promotions plan with minimum 15% TPR quarterly, more encouraged Broker Principal list using WFM MW Excel template Notice of product launch issues and delays What’s expected upon product approval? – – – – – – Dimensions and/or final packaging sent to Global Spaceplanning team 1 free case of goods per store unless otherwise negotiated First minimum 15% TPR scheduled for month after launch Reset support for product launch resets if not already covered by Broker’s regular presence New Item Product Knowledge Power Point slides on accepted items (see example) DSTM Training Info Submission on accepted items (see example) What’s expected of the reviewer? – – – – – Timely approvals Timely information to distributors Communication on changes and adjustments Advance notice for scheduling Reviewing all lines in order to make informed decisions Discos Death is a natural part of Life, Discos are a natural part of New Items. • Discos are selected specifically to create physical space for the new items. • Discos are selected through detailed analysis to ensure: – – – • Low “SPSS” (Sales Per Store Selling) – bottom movers in apples-to-apples sales ranking. High percentage of stores selling – ensures that most stores carry the disco, so real new item space will be created across the Region. Discos are not Exclusive Brands, Global Priorities, or Regional Priorities. Discos are also often the inverse of New Items in one or more ways: – New Item Priority is generally given to potential new items that are: • • • – • Disco Priority is generally given to potential discos that do not hit those desirably attributes detailed above. Generally speaking, by the time Discos are selected and communicated, “the train has left the station.” – – • Higher quality or better ingredients than what we have on the shelf now Socially Responsible, Mission-Driven, Non-GMO, Organic, GAP-rated, MSC-certified, etc. Clear channel strategy, including Natural Channel Exclusive or WFM-Exclusive The way to prevent discontinuation is to proactively drive sales with strong demos, promotions, and pricing. The time to prevent discontinuation is all day, every day, right now. Category Review is too late. Unless otherwise mandated by specific Regional or Global strategy, Discos can be Undisco’d by store level request if: – – – There is enough physical space after the Category Reset is complete There is enough customer demand after the Category Reset is complete That store’s Point Associate Coordinator agrees and approves the undisco Transition Map Template • • • • • • All Transitions need to be submitted on WFM MW’s Transition Map Template in order to be handled properly. This gives us a functional, verifiable, trackable set of detailed information to work with in coordinating with Distributors, our internal Data Team, and Brokers/Suppliers. This template also serves as a clean and clear communication piece for our own teams. This information can be presented early and often, but please don’t “set it and forget it.” Put it back in front of us in a timely fashion. Too often the information is presented six months out and then never again, even if timing and transition details evolve. (Alternately, once every few weeks for six months is excessive and unnecessary.) Often there is a disconnect between Transition information communicated by the Supplier through the Broker, and the realities of Distributor stock levels and timing. Our actions will always be dictated by the realities of product in a warehouse. Please work with Suppliers to align Communication with Reality to avoid frustration all around. A hard cutoff is always encouraged for clean execution. OLD ITEMS UPC DISTRIBUTOR VIN CASE COST BRAND NEW ITEMS PRODUCT NAME CASEPACK SIZE UOM UPC (No check digit) 0-12345-67890 DISTRIBUTOR VIN UNFI 12345-7 CASE COST BRAND PRODUCT NAME CASEPACK SIZE UOM TIMING NOTES Olde Time New Creamed Corn 12 14 oz Hard cutoff 1/1/2013 (No Check Digit UNFI 12345-6 $ 11.96 Olde Time Creamed Corn 12 15 oz ----> ----> ----> ----> ----> 0-12345-67891 $ 14.96 Broker Principal List • Please submit your Broker Principal List electronically, once a month via e-mail, timed to the Category Review Meetings. • Going forward this will be required before booking the following round’s meeting. This quid pro quo is an easy hoop to jump through, but a meaningful carrot to keep us all on track. • This list is used internally as a contact list for promotions, storelevel communication, and urgent matters including product quality issues. • Adherence to the template ensures ease of use and accuracy of contact information. • Please fill out all fields on all rows (see example below). Supplier General Motors General Motors General Motors General Motors Brands Chevrolet Buick GMC Cadillac Broker Broker Pros Broker Pros Broker Pros Broker Pros Contact John Smith John Smith John Smith John Smith Email johnsmith@brokerpros.com johnsmith@brokerpros.com johnsmith@brokerpros.com johnsmith@brokerpros.com Phone 888-476-2767 888-476-2767 888-476-2767 888-476-2767 Notes <-- Examples <-- Examples <-- Examples <-- Examples • DSTM stands for “Development Supervisor Team Member.” Essentially “Team Trainer.” • There is one DSTM for every 10 team members on a given store-level Grocery Team • Their job is to create trainings vetted by the Regional Grocery team for use across the entire Region • They also conduct those trainings for their store team and track completion. • One important area of training is Product Knowledge. This submission form is your mechanism for spoon-feeding your brand’s product knowledge and attributes into our internal Training structure – turning our Team Members into your trained sales force. • Please fill out the attached “Grocery DSTM Team Training Product Info Submission” form for each item accepted. • This information will be used directly to generate a store-level product knowledge training. • Please also use the info you enter on the “Grocery DSTM Team Training Product Info Submission” form as a guide to modify your WFM New Item Submission DSTM Training Info Submission • • UPC Powerpoint Slide, as detailed in the attached 2015 WFM MW Slide Templates. – These new slides will focus less on financials and industry shorthand, and more on product attributes and training so that our store-level Team Members may speak more effectively about your products to our customers. – These slides are not meant to replace the standard new item submission slide, but they are a mutually beneficial additional element of the launch now that your product is accepted in the MW. – These slides are presented to our Grocery Team Leaders every month as a preview of the new items coming for their next reset, and are printed out for all Grocery Team Members to review in their log books or communication stations. Supplier Swag Contest Incentives – exact structure to come, but to be built around pertinent brands – We are seeking to develop a lottery-style contest among DSTMs to incentivize effective and plentiful trainings. This is an already-eager pool of participants and incentives should be particularly effective. Please brainstorm. Nothing as formal or expensive as a Sales Contest. Subteam Brand Description SIZE UOM Palate Descriptors Pairs Well With… Benefits/ Attributes 1 Benefits/ Attributes 2 Benefits/ Attributes 3 7831422105 Grocery Madhava Mmm…Super Yummy Chocolate Cake Mix 15.3 oz Organic cake mix made of all-natural ingredients including delicious, sustainably grown and Friends, family, good times, celebrations, any given Tuesday, harvested Madhava Organic Coconut Sugar and nutritious ancient whole grains farro, spelt milk, ice cream, frosting, fruit and KAMUT® Organic & Non-GMO Made with ancient grains Sweetened with blend of including farro, Kamut, and organic coconut sugar/cane spelt sugar 7831423105 Grocery Madhava Mmm…Super Yummy Yellow cake Mix 15.3 oz Organic cake mix made of all-natural ingredients including delicious, sustainably grown and Friends, family, good times, celebrations, any given Tuesday, harvested Madhava Organic Coconut Sugar and nutritious ancient whole grains farro, spelt milk, ice cream, frosting, fruit and KAMUT® Organic & Non-GMO Made with ancient grains Sweetened with blend of including farro, Kamut, and organic coconut sugar/cane spelt sugar 7831424105 Grocery Madhava Ooey-gooey Chocolate Brownie Mix 17.5 oz Like brownies made from scratch without all the work! Pure delicious ancient whole grains Friends, family, good times, celebrations, any given Tuesday, and natural sweeteners make this ooey-gooey, rich chocolate brownie the best treat. milk, ice cream, frosting, fruit Sweet! Organic & Non-GMO Made with ancient grains Sweetened with blend of including farro, Kamut, and organic coconut sugar/cane spelt sugar 7831425105 Grocery Madhava Mmm…Chocolate Chip Cookie Mix 13.8 oz Like cookies made from scratch without all the work! Pure delicious ancient whole grains and natural sweeteners make these cookies the best treat. Sweet! Organic & Non-GMO Made with ancient grains Sweetened with blend of including farro, Kamut, and organic coconut sugar/cane spelt sugar Friends, family, good times, celebrations, any given Tuesday, milk, ice cream, frosting, marshmallows Completed DSTM Training Example The next two slides are examples of Global/Regional WFM Submission Slides • Note the focus on financials, programs, and industry shorthand. (Template) Insert Title Product Type (Grocery, Dairy, Frozen, Bulk) Maximum Unit Cost to WFM (maximum delivered unit cost from distributor + 8% Markup) Suggested Retail Price Gross Margin % Promotional Support Program (Total allowance in form of % and frequency of support) Demo Support Program (# of Stores / Frequency) Exclusivity (None, 60, 90, Control Label) Channel Strategy of Item (Conventional, Natural, Big Box Formats) Manufacturer Launch Date (Month/Year) Selling Points of the products Unique call-outs of the product Key Facts of interest about your company Sustainability / Efficacy/ Packaging / Facts Other attributes Vendor Contact Information (Manufacturer Company, Name, Email, Phone) Insert Picture(s)/Charts here 500K Limit Scannable Bar Code Method’s WFM Exclusive Line Extension Grocery $2.85 (Cost +8%) $4.79 (SRP) 40.50% GM 20% Allowance / Quarterly 75 Demo’s / Quarterly (300 Demo’s Total) 90 Day Exclusive 90 Day Exclusive to WFM, followed by one year in Natural Channel, and then open to all channels. January 2013 Multi Surface Cleaner and Dish Soap Exclusive Ginger Yuzu Scent Natural Colors – No Synthetic Dyes Biodegradable Bottles produced from 100% recycled plastic Method : John Doe : john.doe@email.com : 555.555.555 The next two slides are examples of Product Knowledge Slides aimed at WFM MW Store-Level Team Members once an item has been accepted Regionally. • Note that there is less of a focus on financials and industry shorthand, and more of a focus on product training and attributes. Please submit these slides upon acceptance to the MW Region. (Template) Insert Title Product Type (Grocery, Dairy, Frozen, Bulk) Promotional Support Program (Total allowance in form of % and frequency of support) Demo Support Program (# of Stores / Frequency) Exclusivity (None, 60, 90, Control Label) Channel Strategy of Item (Conventional, Natural, Big Box Formats) Specific Skus Selling Points of the products Unique call-outs of the product Palate Descriptors Key Facts of interest about your company Sustainability / Efficacy/ Packaging / Facts Other attributes – Don’t Skimp! This version of the slide will be put in front of WFM MW StoreLevel Team Members as product knowledge training for your product. Educated and excited team members will sell your product for you. Vendor Contact Information (Manufacturer Company, Name, Email, Phone) Insert Picture(s)/Charts here 500K Limit Acme’s Biodynamic Cold Pressed Hot Tomato Soup Grocery Quarterly 30% Market Special Plus Quarterly Demos at All MW US Stores 6 Month Exclusive Natural Channel Only 3 skus – 33.8oz – Tomato, Tomato Basil, Tomato Basil w/Cracked Pepper Delicious - heirloom tomatoes are sun-dried, heavy cream is grass-fed, basil is fresh-picked, black pepper is hand-cracked, personally cooked in small-batch 2-gallon crock pot by CEO's grandmother. Creamy, bright, balanced acidity, slightly sweet, subtle onion, pronounced basil, rich cream, deep savory chicken. Pairs well with crackers, parmesan. Biodynamic, Organic, Non-GMO Project Verified, identitypreserved Heirloom Tomatoes, and low sodium. Cold-pressing preserves high levels of highly beneficial nutrient lycopene. Packaged in glass, so BPA-free and infinitely recyclable. Chicken Stock used as soup base is sourced from Step-5 GAP Rated Chickens. Acme: Joe Joseph, joe.joseph@acme.com, 888-555-1212 9-12345-67890 9-12345-67891 9-12345-67892 Our Favorite New Items E-Blast • • • • • WFM MW Marketing is now highlighting “Our Favorite New Items” from Grocery and Whole Body in a monthly E-Blast via e-mail and website. (http://www.wholefoodsmarket.com/service/new-products-midwest) E-mails come from WholeFoodsMarket@communications.wholefoodsmarket.com and subscriptions can be managed through standard marketing subscription list preferences on our website. Program is currently free to Suppliers, with products chosen by MW Grocery Support. Emphasis is on innovation, Exclusives, Control Labels, differentiators, Mission/Attribute-driven launches, etc. MW Grocery Support will reach out for high-resolution images as needed for featured products. Category Reset Schedule • Reset schedule follows category review • Schedule for support labor – broker team will be in stores to execute decisions made during category review • All Midwest stores receive one reset date per category review • New item and SKU void auto ships occur based on reset schedule – product hits the stores when the help will be there • Disco decisions hit stores in weeks prior to resets (4 weeks) • Reset teams led by MW Associate Coordinators, Merchandisers & GTLs • Planograms and updated core lists to be provided to broker teams in the week prior to resets. • Planograms will be executed to detail and core list distribution will be filled out • Not every category will be reset each month – situational resets will occur based on category needs – Reset categories to be noted as focus categories on the schedule Category Reset Performance Expectations • • • • • • • • • • • • • For all resets, 5-7 support bodies are expected at each reset according to category share; this means the possibility of 10-14/day in IL & WI We would like all fair share resets to include all supplier and broker partners involved. – Labor supporting products is a vital part of product success, from meeting to discuss opportunities to physically launching product on the shelf. – Products that have been reviewed for each category should benefit from accompanying labor at resets to ensure this important aspect of the product’s success. – WFM has invested labor to help see this aspect through at our stores, as we recognize how important this is for all stakeholders, and we expect all stakeholders to join us and each other in this shared fate. Some vendors that have broker support employ additional merchandisers to connect at store level – these people should also attend resets based on interest in categories being worked on One associate coordinator, Merchandiser, or Grocery TL will also be present at every reset. Store teams are not expected to provide help without advance notice Support labor is expected to show up on time and stay for the duration of the reset Reset schedule will be available at least a month ahead of time. It will avoid holidays and inventories, as well. – Travel needs to be scheduled outside of the full reset time committed – Other work (ie Conf Calls, training, audits) needs to be scheduled outside of the full reset time committed Some metro markets will overlap to avoid significant dates and events Action items will be provided each month for reset and will include: – Planograms for categories and list of resets to be performed – New Item Update which lists auto shipped new items and SKU voids to hit stores with disco lists – Core lists that need to be checked for distribution and placement Resets are completed when store conditions are up to MW standards: all items are tagged, all back stock/discos are cleared, floor is clean, product is faced, and Associate Coordinator/Merchandiser/TL overseeing the reset provides the ok for completion Professional behavior is expected from the broker community We should not receive pushback from brokers/vendors about using planograms. Alterations to planograms will be made only with the consent of AC/Merchandiser/TL Items not currently carried by the store should only be slotted in with the express verbal consent of AC/Merchandiser/TL. Expectations for store openings are the same as Category Resets. What it means • Benefits – Ensured representation in WFM sets – General uniformity to top line Midwest product mix – Ability to present new lines and have them executed in all MW stores – Fulfillment of top SKU voids in stores – Greater effectiveness of brand growth and promotion – Ability to tailor product launches to footage differences • Expectations – All vendors with investment in a category will provide labor for category maintenance – Execution will be up to Midwest Regional standards – Labor provided in all stores, all markets – Issues with management will be taken up with MW Regional support team – Brands without broker affiliation will provide some level of support – Support for stores means support for brands Planograms: • provided at resets and store openings for all grocery, dairy and frozen categories • dictate product placement and flow within a category How planograms are made: • Data: – A report is generated that shows 52 week movement along with many other metrics for all items in a given category • This report is used to determine what products belong in a set. – Many factors are considered when choosing product mix: • • • • Movement Product status (is it available from the supplier and is it active in our system?) # of stores selling (space is left for local and store choice items, but they aren’t planogrammed) All globally/regionally launched new items are included. If images aren’t available in our spaceplanning software, a text box indicating placement is put on the planogram. • Set size—a larger number of items are launched into our “A” stores (determined by set size), and therefore have a larger sku count than our smaller sets. • We also seek out differentiators and unique items that cover our customers needs—such as ensuring we have a gluten free option or options in each subcategory. – Store optional and local items: • Not every single item available to a store is planogrammed. • It is the store’s choice whether or not to bring in additional items (some items also require authorization from the regional team). • Non-planogrammed items can be worked into the set, but brand placement and overall merchandizing strategy must be maintained. How planograms are made, pt 2: • Merchandizing and brand placement: – No two categories are merchandized exactly alike, many factors are taken into consideration. • Most often a set is merchandized based on shopping occasion and subcategory. For example, in the baking set all the flours are grouped together, as are mixes and so on. • Other factors like price point, OG status, gluten free and non gmo play a role. – Brand placement is deliberate and based on many factors. • Placement is determined by the message we are trying to convey with the set. – Do we want to showcase our private label brand? Or are we trying to show a differentiator like non-gmo or fair trade? • Exclusive brands, valued partners, proven bestsellers and promising newcomers dominate the coveted eye level real estate – Non-eye level placement is NOT a bad thing. There are many brands and items so popular that customers will seek them out wherever they’re placed. • COMING SOON!!!! Midwest Grocery Supplier Facing Website • Once complete, the link and password will be found in the email signatures of the MW Grocery Purchasing Team • Will be a one stop shop for all of your MW Grocery program informational needs and forms • Site contents – – – – – MW Regional Grocery Contacts MW Grocery Promotional info and documents MW Grocery Category Review info and documents MW Grocery Quality Standards MW Grocery Supplier Guidelines Q&A