None - IRADe

advertisement

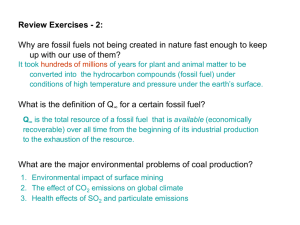

Implementing Integrated Energy Policy Expanding of Options for Power* 26,July 2006 Integrated Research and Action for Development New Delhi *connectedthinking PwC Contents Context Requirements & Key Issues Options for Expanding Power Context Defining Energy Security for India Current Energy Mix, Intensity & Security Development & Growth Requirements Role of Power in Energy Security “The country is energy Secure when we can supply lifeline energy to all our citizens as well as meet their effective demand for their safe and convenient energy to satisfy various needs at affordable costs at all times with a prescribed confidence level considering shocks and disruptions that can be reasonably expected” - Expert Committee on Integrated Energy Policy India Energy Needs: Energy Development Index • IEA has developed a simple composite measure of a country’s progress in transition to modern fuels & the degree of maturity of energy end-use • It has been calculated for 75 developing countries only. • It is a simple average of the following three sub-indicators 1. Per capita commercial energy consumption. 2. Share of commercial energy in total final energy use. 3. Share of population with access to electricity. India ranks a poor 53rd and fares very poorly in all three sub-indicators EDI and components for select countries EDI and components for select countries 1 Brazil China Indonesia India 0.75 0.5 0.25 0 EDI Expanding Power PricewaterhouseCoopers Commercial energy Commercial energy use per capita to total energy Electrification Index July 2006 Slide 4 Fuel Diversity and Energy Position Fuel Diversification Index Oil Natural Gas Coal Nuclear Energy Hydro electric Fuel Diversification Index USA 40% 24% 25% 8% 3% 0.291 China 21% 3% 70% 1% 6% 0.533 Russia 19% 54% 16% 5% 6% 0.357 Japan 47% 14% 23% 13% 4% 0.307 India 30% 9% 55% 1% 6% 0.402 Germany 38% 24% 25% 11% 2% 0.275 Canada 32% 26% 10% 7% 26% 0.248 Country India is the fifth largest energy consumer and will become the third largest in the next two decades India, exhibit high index indicating less diversification, shows a higher degree of reliance on oil and coal and lower development of other forms of energy. Fuel Diversification Index measures the diversification among various energy sources Expanding Power PricewaterhouseCoopers July 2006 Slide 5 • India, despite the improvement, is three times more energy intense when compared to developed nations making the economic growth energy dependent •India because of higher import dependence relative to the exports remains vulnerable Energy Imports as % of Exports Energy Security Strategy Vulnerability to external shocks 30% India, 39 25% 20% 15% 10% Japan, 112 Germany, 59France, 46 which is high dependence and vulnerability China, 52 Brazil, 11 5% UK, 30 Canada, 23 Com petitive - Low Dependence & Vulnerability 0% •India has a lonely position in a quadrant High Risk - Vulnerable & Dependant USA, 246 0 0.2 0.4 0.6 0.8 1 1.2 Energy Intensity Bubble size indicates Oil Import Bill in 2003 USD •It is imperative that India chalks an energy security strategy to lessen the external shocks and sustain its economic growth Expanding Power PricewaterhouseCoopers July 2006 Slide 6 India’s Energy Security- Requirements & Key Issues Learning from other countries Diversification of Energy Supply Energy Security : Equity, efficiency, diversity & sustainability Need to alter the source of energy for households Equity component of energy security Total Final Consumption: By Source Coal 9% Gas 2% Quantum of Biomass & waste (Fuel wood, straw, charcoal, agricultural residue & cow dung) consumption at 54% is very high. Electricity 9% Petroleum 26% Combusti ble & Waste 54% Dependence on Petroleum is significantly high Total Final Consumption: By sector Other Agriculture 2% Non energy 2% 3% The changes in energy mix in residential use will help to address equity issues Transport 9% Industry 27% Source: IEA Expanding Power PricewaterhouseCoopers Residential 57% There is huge potential to improve overall energy efficiency in industrial and transport sector The Challenge is related to governance of the large dispersed rural system July 2006 Slide 8 Improving energy efficiency & reducing oil dependency Opportunity for expanding power End-Use Oil (2004Keros Furnac 05) LPG ene Naphta Diesel LDO e Oil Total Consumed (MMT) 9.9 9.4 14.0 39.7 1.5 9.4 Domestic 95.4% 98.9% 0.0% 0.0% 0.0% 0.0% Transport 0.0% 0.0% 0.0% 56.8% 3.3% 2.7% Power Gen 0.0% 0.0% 6.9% 7.0% 5.9% 3.3% Agri 0.0% 0.0% 0.0% 18.9% 2.5% 0.0% Industrial/Comm 4.6% 1.1% 93.1% 17.4% 88.3% 94.0% LSHS MS 4.4 8.3 0.0% 0.0% 0.0% 100.0% 28.1% 0.0% 0.0% 0.0% 71.9% 0.0% Source: MoPNG Improved Access to Electricity could significantly reduce Kerosene for domestic use Appropriate Supply of Power for Irrigation will reduce Diesel in Agriculture Improved Mass Transportation based on Electricity can arrest rapid growth of the Motor Spirits Expanding Power PricewaterhouseCoopers July 2006 Slide 9 Expanding Power in Transportation A case of INDIAN RAILWAYS • • Total energy consumption of transport sector only 1.5% met through electricity and remaining about 98.5 % through petroleum products IR consumes about 5.1% of total energy consumed by transport sector (and 1.1% of total energy consumption) Within Railways energy consumption - 77.5% consumed in the form of diesel (HSD) - 22.5% consumed in the form of electricity As a proportion to the total energy consumption by the Nation: - 1.8% of total electric energy - 4.4% of total diesel consumption • • Had there been no electrification IR would have been using additional 2.25 million tonnes of diesel oil per annum - This would have raised consumption of oil in Rail sector from 4% to 9% If entire IR was electrified there would have been saving of 1.7 million tonnes of diesel oil per annum - This would have reduced the nation’s requirement of diesel oil by 4% Expanding Power PricewaterhouseCoopers July 2006 Slide 10 Urban Mass Transport Enhancing energy efficiency & Expanding power Increase Mass Urban Transport • Savings in fuel costs is potentially high with introduction of electrified Metro (EIA study for Bangalore estimates savings of Rs.876 cr./yr on a price of Rs.35/ltr of petrol for just 2 & 3 wheelers for just 32 km of metro length) Category of Vehicles Expected reduction of fuel consumption in 2011 No of No of vehicles Fuel consumption Fuel consumption vehicles with without Metro without Metro (litres) with Metro (litres) Metro Two Wheelers Three Wheelers • • 2,394,075 157,224 1,676,137 1,795,556 125,829 786,120 Total Saving in Fuel, litres per day Fuel Saved (litres) 1,257,102 538,454 629,145 156,975 695,429 In the Delhi Metro project phase-II, the estimated foreign exchange savings due to reduced consumption of 7 Mn lts of Diesel, 31.5 Mn lts of Petrol and 18.6 Mn kg of CNG is Rs. 1.722 Bn, in addition to reduced CO2, travel time and decongestion of roads With a fully integrated Metro, Bus and Rail network, only 13% use personal motorised transport to travel into central London Expanding Power PricewaterhouseCoopers July 2006 Slide 11 Indian Energy Mix: Need for Diversification Lessen the impact of market risks India Energy Mix Coal has not kept pace with India’s growing energy needs Hydro Power development has also not addressed the energy needs as required and both energy forms have declined despite an abundance of both these resources Natural Gas has rescued a perilous situation where otherwise Oil would have filled the strategic void 100% 80% 60% 40% 20% 0% Nuclear Hydro Coal Gas Oil 1965 1970 1975 1980 1985 1990 1995 2000 2005 Despite abundant reserves Coal production continues to be a limiting factor for the rapid growth in the power sector Natural gas supply will also be in short supply Eastern Region will by able to supply only half the Expanding Power PricewaterhouseCoopers potential planned due to coal supply limitations July 2006 Slide 12 Energy Security Strategies: Learning from other countries Brazil Energy Mix UK Energy Mix 100% Nuclear 80% Nuclear 60% Hydro 40% Coal 20% Gas 0% 1965 1970 1975 1980 1985 1990 1995 2000 2005 100% 80% 60% 40% 20% 0% Oil Hydro Coal Gas Oil 1965 1970 1975 1980 1985 1990 1995 2000 2005 Hydro & Regional Gas Dash for Gas Japan Energy Mix France Energy Mix 100% Nuclear 80% Nuclear 60% Hydro 40% Coal 20% Gas 0% Oil 1965 1970 1975 1980 1985 1990 1995 2000 2005 Conserve, Replace Oil-LNG & Nuclear Expanding Power PricewaterhouseCoopers 100% 80% 60% 40% 20% 0% Hydro Coal Gas Oil 1965 1970 1975 1980 1985 1990 1995 2000 2005 Go Nuclear July 2006 Slide 13 Diversification - International lessons Comparison of Total Final Consumption Total Final Consumption: by sector Total Final Consumption - by source MTOE 1571 USA 418 Russia 162 Brazil 885 China 116 Indonesia 394 India Combustible & wastes Petroleum Products Electricity Coal Gas 0% 20% 40% 60% 80% 100% Others Residential USA Russia Industry sector Brazil Transportation sector Agriculture China Indonesia Other sectors India 0% 20% 40% 60% 80% 100% Non-Energy Use Source : IEA 2003 Local/Regional resources play a critical role in meeting the energy needs (E.g. USA– Coal & Oil, China– Coal, Russia– Nat. Gas) For Developed Economies, reliance on Combustibles, renewables and wastes decreases, almost disappears – India would need to find commercial energy for all Transportation and Industrial Sector increases its share in sectoral mix vis-à-vis residential sector requiring a multiplier to the energy needs. The next decade will require India to review its transportation growth options in view of the energy needs Expanding Power PricewaterhouseCoopers July 2006 Slide 14 Options for Expanding Power Expanding of Regional Markets Expanding Internal Resources Options for Expanding Power Expanding Regional Markets Energy Resources of the Regions Development of Regional Power Markets Bilateral and Regional Energy Market Development Why Regional Resources for power? Generation Based on Imported Fuel • Imported fuel poses significant cost implication for power generation • Light area shows price at which gas is competitive vis-à-vis coal, while dark area coal is competitive • Spot prices and freight rates indicate $ 45/ton of delivered cost of coal and gas prices is considered at $6.2 MMBTU – bus-bar cost of generation at these levels is Rs. 3.0/kwh and Rs. 3.39 per kwh respectively • Current levels are however ruling at their highs and recent long term deals are showing signs of softening prices Expanding Power PricewaterhouseCoopers July 2006 Slide 17 Energy Resources of the Region Nepal Nepal’s topography and hydro sources emanating from snows and glaciers provides scope for hydroelectric development India has assisted in a limited way Nepal to develop its hydro resources: • HE schemes: Pokhra (1 MW), Trisuli (21 MW), Western Gandak (15 MW) and Devighat (14.1 MW) • Projects under consideration: - • • Karnali (10,800 MW) Pancheshwar (5,600 MW) Sapta Koshi (3,300 MW) NHPC considering Upper Karnali Project (300 MW) as an IPP DPR of Burhi Gandaki (600 MW) by WAPCOS under consideration Expanding Power PricewaterhouseCoopers Total Hydro Potential of Nepal River Basin Major (MW) Small (MW) Total (MW) Kosi 18,750 360 22,530 Gandak 17,950 270 20,650 Karnali (Ghaghra) 28,840 3,170 32,010 Mahakali 3,840 320 4,160 Southern Rivers 3,070 1,040 4,110 Total Improving political 72,450 situation 10,830 in83,280 Nepal could facilitate development of some of the above potential. July 2006 Slide 18 Nepal – Interconnections with India India Nepal Voltage Anand Nagar Bhairahawa 33 kV Itawa Krishna Nagar 33 kV Nanpara Nepalganj 33 kV Pallia Dhangadhi 33 kV Tulsipur Koliabas 11 kV Lohiahead Mahendranagar 33 kV Pithoragarh Baitadi 11 kV Dharchula Jaljibe 11 kV Dharchula Pipale 11 kV Gandak East Surajpura 132 kV Raxaul Birganj 33 kV Jogbani Biratnagar 11 kV Thakurganj Bhadrapur 33 kV Balmikinagar Surajpura 11 kV Kataiya Duhabi 132 kV Kataiya Biratnagar 33 kV Kataiya Rajbiraj 33 kV Bargania Gaur 11 kV Sitamarhi Jaleswar 33 kV Expanding Power PricewaterhouseCoopers Transmission links at 132 kV, 33 kV and 11 kV – Low capacity for energy exchange July 2006 Slide 19 Energy Resources of the Region Bhutan Tala Transmission System Developed by Powerlinks, a JV between Tata Power & PGCIL (51:49) provides a secure infrastructure for Bhutan power to reach more power deficit Northern Indian States. Indirectly it provides also access to western Indian market Bhutan’s hydro power potential is assessed to be 30,000 MW, of which 23,500 MW is considered technoeconomically feasible. Developed hydro capacity of 469 MW constitutes ~2% of the potential The upcoming Tala Project will add 1020 MW of new capacity on commencement (July 06) and increase the capacity threefold Tala is expected to produce 4865 MU Hydro Projects to be taken up on Priority basis have been identified 3000 MW Capacity, 1200 km length (2384 Ckt Km) BOOT project is integrated into Eastern Transmission system. Expanding Power PricewaterhouseCoopers July 2006 Slide 20 Regional Energy Cooperation There is a need and potential for higher level of energy cooperation within the region to promote energy security •SAARC Initiatives •BIMSTEC Initiatives • • • • Strengthen bi-lateral agreements Allow of more access to Indian market segments Integration & Strengthening of transmission network Developing commercial framework for trading: framework trading agreements, model power purchase agreements Cross-border energy exchanges through trans-national oil & gas pipelines and transnational grids for transmission of power. Expanding Power PricewaterhouseCoopers July 2006 Slide 21 Options for Expanding Power Expanding Internal Resources Energy Resources & Demand Transmission Infrastructure Power Trading Arrangements Technology Improvements Energy Resources & Demand • Energy resources are concentrated in Eastern region • North East India ranked highest in unexploited hydro potential • The Northern, Western and Southern are expected face the maximum shortages in energy, while the eastern region is expected remain surplus and export power Energy & Power Requirement MU 157107 150000 115705 100000 78037 50000 50700 81492 54500 97500 71900 0 FY 01 FY 03 Peak Requirement (MW) Expanding Power PricewaterhouseCoopers FY 07 FY 12 Energy Requirement (MU) July 2006 Slide 23 Hydro Power Potential in India • India itself has significant hydro- power capability undeveloped and has targeted 50 GW for development • Significant potential for development in N-E and North India. • These states see hydro power as the main strategy for development of their economies • South India and Western India has diminishing HEP opportunity. These states are facing energy and peak power shortages Uttaranchal & HP have focused plans for Hydro power development through involvement of private sector. Expanding Power PricewaterhouseCoopers State Assessed (MW) In Operation Under Construction Balance (MW) Arunchal Pradesh Uttaranchal 50,328 11 405 49,913 18,898 1,610 3,453 13,835 Himachal Pradesh Jammu & Kashmir Sikkim 18,820 3,823 1,926 13,071 14,146 1,394 469 12,283 4,286 84 519 3,683 Karnataka 6,602 2,789 222 3,591 Meghalaya 2,394 185 - 2,209 Mizoram 2,196 - 60 2,136 MP/ Chattisgart h Kerala 4,485 899 30 1,684 3,514 1,800 30 1,684 West Bengal Manipur 2,841 301 936 1,605 1,784 105 90 1,589 Nagaland 1,574 75 24 1,475 Orissa 2,999 1,838 66 1,096 134,867 14,912 8,231 Total CEA Ranking Study on River Basins 109,852 July 2006 Slide 24 Requirements for meeting demand Transmission system • To facilitate evacuation of power from eastern region to rest of India • The capacity of the transmission system needs multi fold increase • JVs similar to Tala system would help to speed up Development of Power Market •Incentives for eastern region states to attract investments in Generation • Country wide consistent Open Access regime to provide choice and competition •Third party supplies with credible open access is essential prerequisite as payment security mechanism •Need to remove both tariff and non-tariff barriers Expanding Power PricewaterhouseCoopers Year 2002 2007 ERERERERNRWR-SR NER- Total SR NR WR NER WR NR 600 100 400 1,250 1,000 1,700 0 5,050 3,600 5,000 2,800 1,250 2,100 1,700 0 16,450 2012 3,600 8,500 8,500 2,250 7,600 2,700 4,000 37,150 July 2006 Slide 25 Potential capacity addition through Open Access A successful Open Access regime would • Bring in investment in generation, and • Innovation and Efficiency in choice of size, fuel, etc.. • ..without the need for contingent liabilities through long term contracts with the State Maharashtra 2007 Supply Situation (MW) 14,000 3 The Eligible Customer market could conceivably contract for as much as 3,175 MW from other sources, alleviating all or part of the expected supply shortfall 12,000 10,000 2 The Discom plans another 2,997 MW of contracts for 2007. This leaves an expected 13% shortage on peak 8,000 6,000 1 4,000 Currently Contracted Generation to Maha Discom is about 9,000 MW 2,000 Source: PwC Research for a World Bank sponsored study 0 Demand Supply Size of Open Access market estimated at US$ 3-5 billion Expanding Power PricewaterhouseCoopers July 2006 Slide 26 The Big Leap: PwC Utilities Survey 2006 - Inside the boardroom The change challenge Nearly 60% of respondents thought the industry needed to have a strong 10-year focus on reducing environmental damage, developing new technologies and improving customer service relationships. The importance of technology is highlighted by utility companies’ identification of coal, alongside piped gas, as the key fuel in meeting much of future demand growth. Nuclear has grown in favour and finds fifth rank. Hydro-Carbons (LNG and Oil) are low on the rankings of CEOs Expanding Power PricewaterhouseCoopers July 2006 Slide 27 Big Leap – Where would technology Investment yield results Expanding Power PricewaterhouseCoopers July 2006 Slide 28 Expanding options for Power Summary • • • • • • Energy Security challenges are Global in nature but we need to develop India specific strategy and action plans Oil intensity of our economy has to be reduced in favour of Electricity Coal & Hydro potential of the nation and the region could help alter the energy balance Energy Security Plans have to be developed at the State level progressing further from Expert Committee Recommendations Indian supply resources have to be augmented through national transmission network development & connectivity Regional Power resources could be developed through appropriate development of regional power markets and Framework Agreements on trade & energy cooperation Expanding Power PricewaterhouseCoopers July 2006 Slide 29 Thank You Expanding Power PricewaterhouseCoopers July 2006 Slide 30